Border Adjustment vs. Dollar Depreciation

According to the recent reports, the Republicans in Congress want to cut the corporate tax rate to 20% and have it be "border adjustable, while soon-to-be President Donald Trump wants to cut the corporate tax rate to 15% and have the dollar depreciate. Let me leave aside the effects of cutting the corporate tax rate to focus on the effects of "border-adjustability" and dollar depreciation.

First, border adjustability. In the eurozone, where there is a fixed exchange rate of 1 between the member countries, relying more heavily on a value-added tax—for which international rules allow taxing imports while exempting exports from the tax—and less on other taxes, is understood as a way to get the same effect as devaluing to an exchange rate that makes foreign goods more expensive to people in a country and domestic goods cheaper to foreigners.

But in a floating exchange rate setup as the US has, most of the effects of border adjustment can be canceled out by an explicit appreciation in the dollar that cancels out the implicit devaluation from the tax shift. And indeed, such an appreciation of the dollar is exactly what one should expect. The reason is that the supply of US dollars available for the rest of the world to pay for net exports from the US is determined by the eagerness of those in the US to own more foreign assets minus the eagerness of those abroad to own more US assets. I explain this kind of reasoning in International Finance: A Primer. There is no reason to think that border adjustment dramatically changes the balance of those portfolio decisions. So the supply and demand for US dollars makes the price of the US dollar adjust to where the same amount of net exports will take place.

For a moment, suppose that border adjustment (or the other details of the tax change) instead of having little effect on the desire to hold US assets versus foreign assets made companies want to do more physical investment in the US and thereby hold more US assets as some hope. This would reduce the supply of dollars available to the rest of the world to pay for net exports to the US, and so would push the US dollar up to an even higher price than what would leave net exports fixed.

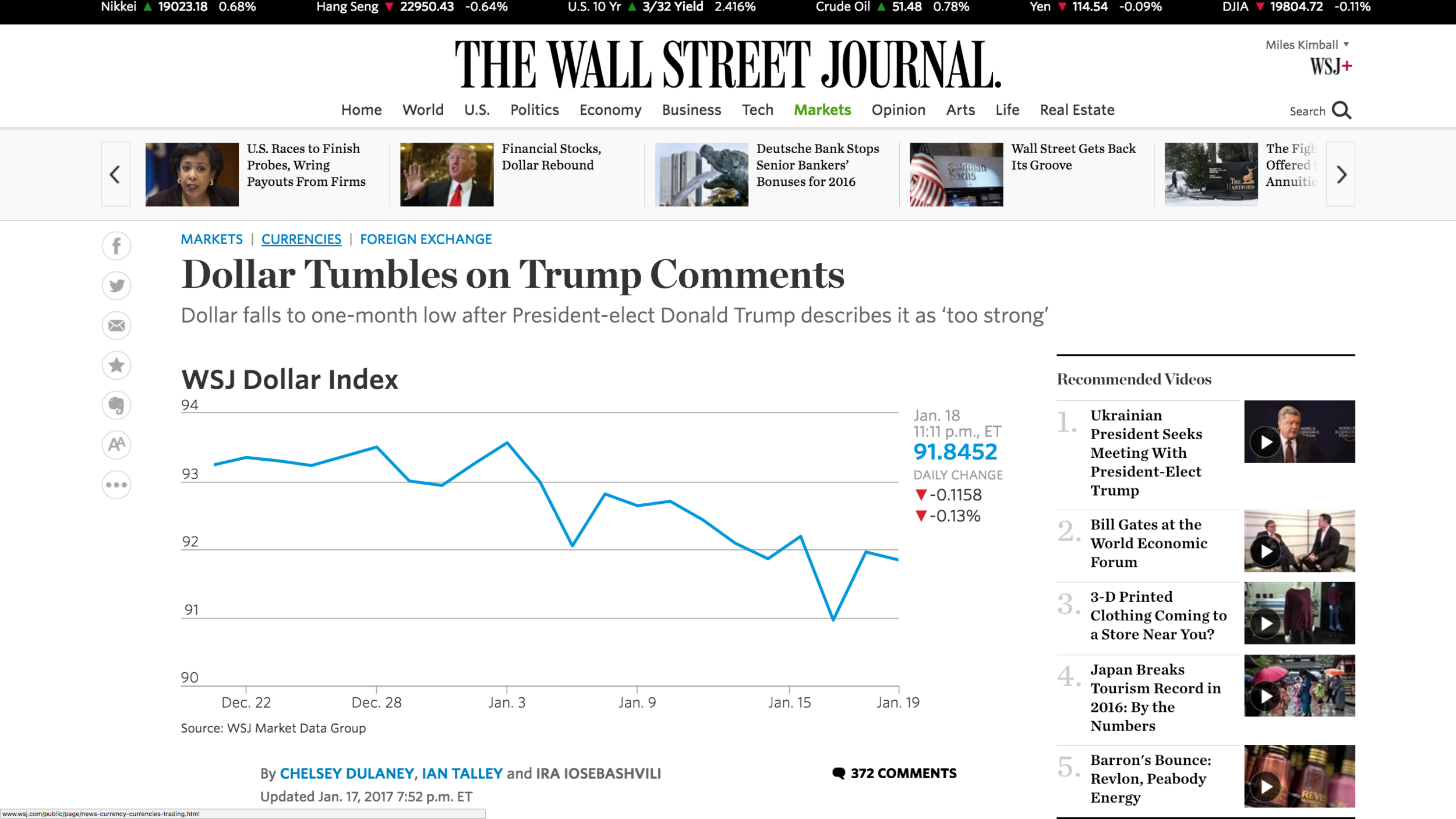

By contrast to border adjustment, which would tend to push the dollar up enough to cancel its effects, Donald Trump's wish for a lower price of the US dollar, if it happened, would stimulate net exports. Remarkably, just his talking about wanting a lower dollar seems to do a lot to make the dollar go down as he wants. Currency traders think that some kind of future policy supporting that decline in the dollar will come about. They may be wrong, in which case the dollar will return to a higher value in the future. This makes them want to get out of US assets, which pushes the dollar down now as a result of those traders thinking something will push the value of the dollar down in the future.

But if the future policy to justify a lower dollar price is not forthcoming, flows of portfolio investment will shift and the dollar will rise again. What could those future policies be? One possible way to push down the dollar for a few years time is loose monetary policy that lowers rates of return in the US, making foreign assets more attractive. When people in the US flee the low interest rates to buy foreign assets, they are providing extra US dollars to the rest of the world, which pushes down the price of the US dollar and raises net exports. However, too much loose monetary policy would eventually cause unwanted inflation.

A way to push down the value of the dollar and stimulate net exports for a much longer time is to increase saving rates in the US. This is easier than you might think. As I explained in my May 14, 2015 column "How Increasing Retirement Saving Could Give America More Balanced Trade":

I talked to Madrian and David Laibson, the incoming chair of Harvard’s Economics Department (who has worked with her on studying the effects of automatic enrollment) on the sidelines of a Consumer Financial Protection Bureau research conference last week. Using back-of-the-envelope calculations based on the effects estimated in this research, they agreed that requiring all firms to automatically enroll all employees in a 401(k) with a default contribution rate of 8% could increase the national saving rate on the order of 2 or 3 percent of GDP.

Under such a policy, people would not have to save more. But it would be the easy, lazy thing to do to save more. As greater saving pushed down US rates of return, some of that extra saving would wind up in foreign assets, putting extra US dollars in the hands of folks abroad, so they would have US dollars to buy US goods. This effect can be enhanced if the regulations for automatic enrollment are favorable to a substantial portion (say 30%) of the default investment option being in foreign assets.

Note that an increase in US saving would tend to push down the natural interest rate, and so needs to be accompanied by the elimination of the zero lower bound in order to avoid making it hard for monetary policy to respond to recessions. Fortunately, tools are readily available to eliminate the zero lower bound. See "How and Why to Eliminate the Zero Lower Bound: A Reader's Guide."

It is worth noting one other difference between a policy of encouraging saving in this way and "border adjustment" for corporate taxation (besides the fact that encouraging saving will do the trick while border adjustment is unlikely to work). Border adjustment, by likely causing the dollar to look more expensive and other currencies to look cheaper, would tend to lower the dollar net worth of those who have substantial assets in other countries. By contrast, increasing US saving, by likely causing the dollar to look less expensive and other currencies to look more expensive, would tend to increase the dollar net worth of those who have substantial assets in other countries. So the policy that will actually work is also more in Donald Trump's pecuniary self-interest.

Addendum: Of course the US government could have a program of regularly buying large quantities of foreign assets assets directly. But such a blatant move would raise a much bigger storm of international protest than encouraging Americans to save more in an internationally diversified way. The governments of much smaller economies, such as Switzerland, Sweden, Denmark and Israel frequently do this--often through their central banks as a part of monetary policy. But China has come under a lot of criticism for this as "currency manipulation" even when it was trying to keep the yuan from rising rather than trying to make the yuan fall. Now that economic forces would make the yuan fall without government intervention, the Chinese government is afraid enough of international criticism and retaliation if the yuan falls that it is selling foreign assets rather than buying. It is possible that Donald Trump would be willing, perhaps even relish, the international criticism as a currency manipulator and so be willing to do it. But why take such a fraught route when it is so easy to change international capital flows and help Americans prepare for retirement at the same time? This, too, would occasion some international criticism as currency manipulation, but it helps a lot that it has another purpose as well. I predict that criticism would die down to a modest level relatively quickly--except from those who take the lower bound on interest rates as given and so view a further decline in the natural interest rate as a threat to the power of monetary policy.

One other minor problem with a regular US government program of buying foreign assets is that it requires either a budget surplus (as the Chinese government has had) or further borrowing. Further borrowing to raise funds to buy foreign assets is certainly possible, but allows the program to be challenged when the debt limit is reached (unless the debt is calculated on a net basis rather than simply in terms of outstanding liabilities).

Note: David Zervos points out that border adjustment raises revenue to offset revenue lost by the reduction in the corporate tax rate and by shifting away from taxing foreign corporate income directly. This is true as long as imports exceed exports so that the extra taxes due to imports exceed the cost of the tax break for exports. And precisely because border adjustment is likely to be ineffective at reducing the trade deficit, the excess of imports over exports would be likely to continue, and so would the net revenue produced by border adjustment.

Coda and Chorus: In October 2012, I wrote this in "International Finance: A Primer":

An Easy Policy to Restore America’s Industrial Heartland (Including Key Swing States). It is not likely that many people will actually be persuaded by my portfolio advice, so let’s think of a policy that really would increase the amount of foreign assets that Americans buy and so increase our exports and reduce our imports. David Laibson and his coauthors have found that in retirement accounts, people often stay with the default contribution level and allocation to different assets, even if they are allowed to change the contribution level and allocations of contributions to different assets by going through a little paperwork. There are at least two reasons for this. One is that people are sometimes a little lazy–or to be more charitable, perhaps scared of financial decisions. That makes them want to do nothing. The other reason people often stick with the default settings for their retirement accounts is that they think (unfortunately wrongly for the most part right now), that their company, or maybe the government has carefully thought through how much they should be putting aside and what they should be financially investing it in.

So imagine that the government establishes a regulation that employers all need to have a retirement saving account and have a relatively high default contribution level. The employers are not required to match it. And employees can get out of making any contributions just by doing a little paperwork. But many, many employees won’t change the default contribution. So this simple regulation could dramatically raise the household saving rate in America. Assuming the government keeps its budget deficits on the same path as it otherwise would, that would also raise the national saving rate. A higher national saving rate would make loanable funds more plentiful at any real interest rate, making a surplus of loanable funds at a high real interest rate and so drive down the real interest rate. With real interest rates low in the United States, Americans would start thinking of buying more foreign assets that earn higher interest rates, and foreigners would be less likely to buy low-interest-rate American assets. (How much people want foreign assets is only somewhat independent of rates of return, not totally independent. A big enough interest rate differential will lead people in both countries to shift.) With Americans buying more foreign assets and foreigners buying fewer American assets, the flow of dollars has shifted outwards. Something has to happen to recycle those dollars. That something is a change in the exchange rate that increases net exports. And it has to increase net exports by the same amount as the change in the flow of dollars for asset purchases.

Indeed, following the tradition of calling the flow of dollars for intentional asset purchases net capital outflow, we can say that net exports would have to equal net capital outflow. More precisely, the net flow of dollars for anything other than buying goods and services has to be exactly balanced by a countervailing net flow of dollars that is about buying goods and services. And except for short periods of time, the net flow of dollars for purposes other than buying goods and services has to be intentional; it won’t take long before unintentional movements get undone by recycling.

Now suppose that the government wants to increase net exports even more than was accomplished by mandating that all employers provide retirement savings accounts and setting a high default contribution level for retirement savings accounts. The government could simply add the regulation that the default asset allocation would be, say, 40% in foreign assets. That would dramatically increase the buying of foreign assets relative to what would be likely to happen otherwise (at least in the United States with current attitudes toward foreign assets). That would further increase net financial capital outflow from the United States, and lead to exchange rate adjustments that would further raise net exports to recycle those dollars back to the United States.

Paper Currency Deposit Fees as Unrealized Interest Equivalents

Note: for background to this post, see "How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide."

The Fed is allowed to charge fees for transactions at the cash window, but these fees must be reasonably closely related to actual expenses the Fed incurs. In negative interest periods, the Fed would incur an expense when banks with access to the Fed's cash window withdraw paper currency and then redeposit it after an intervening period of negative interest rates for marginal reserves and negative interest rates for the Treasury bills the Fed holds in its portfolio.

Negative interest rates simply mean that the lender pays the borrower rather than the borrower paying the lender. When banks withdraw paper currency, in an immediate sense they are reducing their balances in reserves, and therefore depriving the Fed of the payments it would otherwise receive as the borrower given negative interest on reserves--or in the Fed's reverse repo program acting as a substitute for reserves. (See "How the Fed Could Use Capped Reserves and a Negative Reverse Repo Rate Instead of Negative Interest on Reserves.")

On a rainy November afternoon after our two presentations at the Swiss National Bank, Ruchir Agarwal (my coauthor for "Breaking Through the Zero Lower Bound") and I wandered the streets of Zurich, and finally sought refuge in a coffee shop. There we pursued Ruchir's intuition that ultimately led to the insight that the paper currency deposit fee can be considered a way of making up for the negative interest that (aside from that) doesn't happen for paper currency, in an accounting sense.

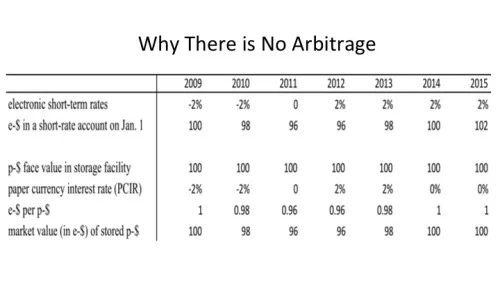

For cash taken out right at the beginning of a negative-interest-rate period, the equivalence between the paper currency deposit fee and unrealized interest is easiest to see. Consider the table above, from the Powerpoint file "21 Misconceptions about Eliminating the Zero Lower Bound (or Any Effective Lower Bound on Interest Rates)." If electronic, safe, short rates (such as the rates on reserves or Treasury Bills) are running at -2%, the same rate of return for paper currency can be engineered by having the electronic equivalent value of $100 face value of paper currency decline by 2% per year, until the level of electronic, safe, short rates changes. But from the legal perspective taken here, instead of thinking of the value of paper currency departing from par, each banknote (that is, each piece of paper currency) is thought of as having attached to it by an invisible umbilical cord a liability called an unrealized interest equivalent (UEI). The unrealized interest liability is owed to the central bank by the bearer of that banknote.

The image I have of the UEI is like a daemon in the book and movie The Golden Compass—a daimon standing beside, perched upon, or hovering in the air above the person whose daemon it is. There is a Wikipedia page for "Daemon," which describes them this way:

A dæmon /ˈdiːmən/ is a type of fictional being in the Philip Pullman fantasy trilogy His Dark Materials. Dæmons are the external physical manifestation of a person's 'inner-self' that takes the form of an animal. Dæmons have human intelligence, are capable of human speech—regardless of the form they take—and usually behave as though they are independent of their humans.

image source

In the Golden Compass, the daemon cannot be separated very far from the person it belongs to without great trauma to both the person and the daimon itself.

In the case of negative interest rates, the paper currency deposit fee weighing on the banknote (e.g. about 2% at the beginning of 2010 and about 4% at the beginning of 2011 in the example above) is exactly equal to the interest that would have been owed to the central bank as borrower if the banknote had been held since the beginning of the negative interest rate period. (The analogy to a daemon perched on a banknote is inexact: the UEI would not be the "inner-self" of the banknote.)

But what if a bank withdraws paper currency some time into the negative interest rate period, or even after interest rates have turned positive but cumulative interest since the beginning of the negative interest rate period is still in the hole? Then that bank does not owe the negative interest from before it withdrew the cash. A good way to avoid charging a private bank negative interest on paper currency that it doesn't owe—while making it easy to keep track of things—is for the central bank to have the banknote owe that interest but provide a preemptive refund to the private bank of the interest it didn't accrue. This is a nice way of looking at why it is appropriate for the amount a private bank is charged in its reserve account for cash withdrawals to be reduced by the amount of the paper currency deposit fee; the deposit fee at that point represents a UIE the bank doesn't owe since it hasn't had the paper currency out up to that point.

By giving the private bank a preemptive refund, the private bank then does owe the full UIE for the banknote accumulated since the beginning of the negative interest rate period. This full UIE from the beginning of the negative interest episode depends only on the date and not on when the bank withdrew it, avoiding the need for complex record keeping.

By the way, one thing I like about the legal argument here using the concept of unrealized interest equivalents is that it cannot justify an engineered rate of return on paper currency any lower than the interest rate on marginal reserves. Therefore, using this as a legal basis for a time-varying paper currency deposit fee provides protection against confiscatory reduction in the value of paper currency; paper currency can have a negative rate of return, but no more negative than the last dollar of reserves. That is enough to keep paper currency out of the way of a robust negative interest rate policy, but does not disadvantage paper currency in its rate of return relative to money in the bank.

Reparation and Deterrence

In section 10 of his 2d Treatise on Government: On Civil Government," John Locke distinguishes between deterrence and reparation:

Besides the crime which consists in violating the law, and varying from the right rule of reason, whereby a man so far becomes degenerate, and declares himself to quit the principles of human nature, and to be a noxious creature, there is commonly injury done to some person or other, and some other man receives damage by his transgression; in which case he who hath received any damage, has, besides the right of punishment common to him with other men, a particular right to seek reparation from him that has done it: and any other person, who finds it just, may also join with him that is injured, and assist him in recovering from the offender so much as may make satisfaction for the harm he has suffered.

However, if one takes a stochastic perspective, what is needed for proper reparation can do most of the work of deterrence. The key idea is that since the perpetrator of a particular harm—say a theft—is not always detected, the perpetrator who does get caught should make restitution for all of the other chances shehe had to get away with it as well as restitution for the (realized) case of getting caught. In other words, the starting point should be reparations equal to (1/p) * (harm of offense), where p is the probability of getting caught. This makes the expected gain for a criminal and the expected loss for a victim zero.

This starting point raises many issues:

First, it is not fair for bumbling criminals who often get caught to be paying the freight for clever criminals who seldom get caught. Thus, the multiple damages factor (1/p) needs to be based on a probability specific to a type of crime and to a type of criminal. In other words, by this logic, types of criminals known to be more clever and therefore to be caught less often should pay a higher multiple of the damages.

Second, if the probability of detection is too low, many perpetrators will be partially judgment-proof: genuinely unable to pay the full amount of (1/p) * (harm of offense). Also low detection probabilities create unfairness between individual perpetrators within the same type: some get lucky and get away with it, while others get caught. So higher detection probabilities are better. Given the value of a higher detection probability, perpetrators can legitimately be required to pay their share (multiplied by 1/p) of the costs of better detection as well as of other costs of enforcement. Note that charging perpetrators for the costs of detection and enforcement enhances deterrence.

Third, the deadweight loss to society of detection and other aspects of enforcement is greater if people do not take reasonable crime-prevention precautions, such as locking their doors. Thus, there should be some incentive for people to take basic crime-prevention precautions. Insurance is a great way to organize compensation for victims that both reduces risk for victims and provides appropriate incentives for crime prevention. People get compensated immediately for their loss—whether or not the perpetrator is caught—if they have been making basic efforts toward crime-prevention. Then when multiplied recovery is made from a perpetrator, the agency providing insurance gets the part of that money that was not needed to pay for detection and other aspects of enforcement. (The insurance agency's taking over the right of recovery is called "subrogation.") If someone has failed to make basic efforts toward crime prevention, they retain the right of recovery, but get nothing if no perpetrator is caught in that instance.

Finally, as discussed at some length in Robert Nozick's Anarchy, State and Utopia, the problem of people being partially judgment-proof can justify some penalties for taking risky actions that may harm others. That is, in many cases it can be reasonable to take as the starting point not (1/probability of detection) *(harm of offense), but (probability of harm given the risky action/probability of detection) *(magnitude of harm if it occurs). This modification also makes sense from a stochastic perspective.

Spencer Levan Kimball on How the Federal Government Can Support and Direct Rather than Undermine State Regulation

The Republicans have promised to repeal and replace Obamacare. I continue to think the proposal I made in "Evan Soltas on Medical Reform Federalism—in Canada" is a good way to go:

Let’s abolish the tax exemption for employer-provided health insurance, with all of the money that would have been spent on this tax exemption going instead to block grants for each state to use for its own plan to provide universal access to medical care for its residents.

On another set of policy issues that I discussed in "Against Anticompetitive Regulation," I am very concerned at the way state and local governments are harming economic growth by overregulating land use and licensing more and more occupations. To me, it is a legitimate and appropriate use of the interstate commerce clause in the US Constitution to require states to respect the benefits greater economic freedom in certain key areas can have for enhancing economic growth.

In both cases, the approach is for the Federal government to lay down general rules of the road while the states do the driving.

I was delighted to discover from reading my uncle Spencer Levan Kimball's autobiography that he recommended a similar approach in his area of expertise: insurance law. His approach to Federalism in auto insurance law is described well in this passage from A Tale That is Told: The Autobiography of Spencer L. Kimball, pp. 314-317. In this passage he also expresses a clear-eyed view of the nature of government.

In 1967 a proposal was made in Congress for a study of automobile accident compensation by The Department of Transportation ("DOT"); in May 1968 Congress "authorized and directed" it by Joint Resolution and I spent a day in Washington consulting about planning the study. ...

The principal non-quantitative study was of mass marketing in liability insurance. It was the only one in which the authors' conclusions on policy questions were forthrightly stated as part of the study. Herb Denenberg and I stated them; we were the contracting parties. We drew on our combined knowledge of the property and liability lines of the insurance business to write Mass Marketing in Property and Liability Insurance, a small book making the case for freedom to try marketing methods that had the potential to reduce the cost of putting business on the books of the company. ...

In September 1968 the Secretary of Transportation invited me to serve on the Economic Regulation Advisory Committee for the project. I accepted promptly, despite being in the middle of the Wisconsin Insurance Laws Revision project and also working on the mass marketing study for the same [DOT] project. This committee assignment was a major undertaking, involving at least a dozen full day meetings, most in Washington. I had two reasons for agreeing, despite heavy commitments: (1) the participation was recognition I felt was important to my further work in the insurance field, and (2) I was becoming suspicious about the political motivations lying behind many actions emanating from Washington, both from Congress, which had ordered the study and from the administrative agency planning and executing it. My ready acceptance and advocacy of big government as a young man was fading fast. ...

On January 16, 1969 we were sworn in. I was named Chairman of our committee. At that meeting an agenda was supplied for our next meeting on February 7. As Chairman I had a role in preparing agendas, but the basic planning was done by full-time staff, which apparently had the duty of keeping a tight rein on us, for while Department rules required at least one staff member to be present at each meeting, in fact several did attend each of our meetings. Perhaps they found our discussions particularly informative and useful. They did not find us malleable. As a group, we were well-informed and most of us were opinionated; our opinions ran approximately in parallel, so that we presented a united front to the bureaucrats.

Comments on staff plans for studies tended to fill the agendas. Whether our discussions were used is doubtful ...

I wrote on February 19 to one of the responsible members of the staff, saying in part:

... I should like to reemphasize a point made by Dick Roddis at the meeting which has seemed of even more importance since the meeting than then. At the very heart of the whole study, it seems to me as to him, is the economic profitability of the automobile insurance enterprise. ...

[I]t is not appropriate to omit cost-efficiency or a good cost-benefit ratio as a criterion for judging regimes of compensation. If you need to regard this as a mere fact finding study, then no criteria should be stated and those already stated should be expunged ...

If I understand the statement that you made in Chicago, the omission of the criterion was essentially a political omissions. ... I would appreciate it if you would give me your reflections upon these points at as early a date as possible, after having consulted on the matter with the necessary people up the line of command.

On June 2, 1969, Richard F. Walsh, Director of Operations of the overall study, asked the Advisory Committee for its comments on an administration bill, S. 2236, which would create a national insolvency fund supported by levies on all policy-holders. All Committee members except Governor Ellington met with five members of the staff on July 8 and prepared a statement of position under severe time pressure. The excellent minutes say that:

The Committee also agreed that S. 2236 is an undesirable bill—badly drafted and difficult to administer (e.g., the primary emphasis is on examination, the receivership process is lengthy and cumbersome and not in accordance with modern practices, etc.). The members felt that the bill would simply be a `back door' approach to achieving Federal regulation, eventually replacing regulation by the States. In fact, it was suggested that this may be a major purpose of the bill's framers.

Our statement of position said that we agreed with the objective of the bill, but that we all thought the bill was unsound:

S. 2236 creates a basic dilemma, then seeks to resolve it by an impossible compromise. It would create a Federal Guaranty Fund by levying a tax on all policyholders throughout the country. It then provides for Federal administration of the insolvency fund and Federal participation with state insurance supervisors in the financial supervision of insurers and in the administration of insolvent insurers. It evidences a purpose to preserve the pattern of existing state regulation, yet at the same time recognizes that the administrators of the Federal fund cannot rely entirely upon state regulation.

Actually, the bill would create a dramatic counter-incentive to the fulfillment of the objective of sound financial supervision of insurers. States which have not in the past shown great motivation to establish legal standards and administrative controls adequate to minimize insurer insolvencies would further lose incentive to do so. This is true because insolvency losses in those states would be paid for from the Federal fund derived largely from the people of other states. The only control offsetting this economic counter-incentive would be the aggressive utilization by the Federal agency of the direct powers conferred upon it by the bill. This, however, automatically results in the superimposition of a system of Federal supervision on the existing pattern of state regulation. ... Comprehensive Federal control will, indeed must, follow Federal financial responsibility. ... What is needed is a Federal law requiring all states to adopt insolvency guaranty laws, establishing minimum standards for such laws, and creating forceful incentives for the states to comply, but which avoids Federal administrative involvement.

We suggest that these objectives can be met by the enactment by the Congress of a law which would provide for the imposition of a substantial Federal general revenue tax on insurance premiums ... [with] the tax [to] be forgiven in full for all states which have in effect an insolvency guaranty law meeting certain criteria specified in the Federal law. ...

The two methods most likely to be adopted would be either an insolvency fund law such as has long existed in New York, or a post-insolvency assessment law such as that proposed by the Wisconsin Insurance Laws Revision Committee. ...

[T]he proposed approach ... would result in maximum pressure on state legislatures and regulators to have adequate administrative supervision of insurers. It would permit a minimum of administration at the Federal level and would avoid the need for accumulation of substantial funds under the control of a Federal agency. ... The proposed law has the virtue of largely being self-executing. ...

In June, 1970, the research studies were presented by their authors (or a staff member) to the combined Committees. Authors of the quantitative fact-finding studies placed their views on the policy implications of the research on the record separately. Herb's and my views were in the study itself, which was a brief for mass marketing. ...

Despite our general opposition to federal regulation, in Mass Marketing we advocated a narrow federal statute to remove the barriers to the freedom of insurers to use mass marketing. We wrote to all insurance commissioners, urging state action to eliminate the barriers and remove the need for federal legislation with its inevitable threat of greater federal intervention. We said the report

... describes the many unreasonable barriers to the free development of mass marketing now on the statute books or in regulations. ... The [National Association of Insurance Commissioners] will have to provide more vigorous leadership in protecting the consumer interest if it is to prevent the regulatory center of gravity from continuing to shift to Washington.

A Beautiful Example of Evolution Right Before Our Eyes

Sometimes people claim that there is little evidence of evolution that we can actually see, or that the examples are of only trivial importance. I thought the article above on the research of Regina Baucom and coauthors was a wonderful example of evolution before our eyes.

When Roundup (containing the active herbicide glyphosate) is used to kill the pretty weed morning glory, some morning glory plants have genes that help protect them and therefore survive better.

But there is more. Morning glory plants have both male and female parts: pollen-producing anthers and the pollen-receiving stigma. Some of the Roundup-resistant morning glories have anther and stigma close together so they frequently self-fertilize, while other Roundup-resistant morning glories have anther and stigma far apart, so they are less likely to self-fertilize and more likely to be fertilized by another morning glory that might not be Roundup-resistant. Because the descendants of the Roundup-resistant morning glories with anther and stigma close together are more likely to inherit the Roundup-resistant genes, they will be more common in the next generation. Because these increasingly common descendants from self-fertilization of Roundup-resistant morning glories are also likely to have genes for anther and stigma close together, the population of morning glories shifts to a higher frequency of anther and stigma close together. Thus, Roundup causes the population of morning glories to evolve toward having anther and stigma close together—a different reproductive strategy—as well as causing the population of morning glories to evolve toward Roundup-resistance.

Not Perfect: Spencer Levan Kimball on Spencer Woolley Kimball's Transgression Against Freedom of Thought

"[As a Mormon missionary in 1937] One of the activities I mentioned in a letter to Kathryn was 'library work,' by which I meant 'putting Books of Mormon in libraries and trying to remove anti-Mormon literature.' It is apparent that I had not acquired from my early training the belief that the best test of truth is in the marketplace of ideas (an idea forcefully expressed in those terms by one of my later heroes, Oliver Wendell Holmes, Jr., and by John Stuart Mill before him). Indeed, my father had inadvertently given me a lesson in the contrary position that I would later reject. In Montreal we visited a branch library together. While I prepared a sermon, he thumbed through current magazines and came across an article uncomplimentary to Mormonism. He tore it out. HIs conduct startled me, at the time mainly because he was destroying someone else's property. Not long after my mission was over, I would regard such an attempt at 'censorship,' coupled with damage to another's property, as seriously wrong. I do not know whether with my father's unquestioning faith in his Church's doctrine's he ever overcame that inclination to suppress contrary views when he could. It was a flaw--one I would later regard as serious--in the otherwise sterling character of a great and good man."

--Spencer LeVan Kimball (son of Spencer Woolley Kimball, oldest brother of Edward Lawrence Kimball and uncle of Miles Spencer Kimball) in his autobiography A Tale That is Told, pp. 77-78.

David K. Evans and Anna Popova: Cash Transfers and Temptation Goods →

Abstract: Cash transfers have been demonstrated to improve education and health outcomes and alleviate poverty in various contexts. However, policy makers and others often express concern that poor households will use transfers to buy alcohol, tobacco, or other “temptation goods.” The income effect of transfers will increase expenditures if alcohol and tobacco are normal goods, but this may be offset by other effects, including the substitution effect and the effect of social messaging about the appropriate use of transfers. The net effect is ambiguous. This article reviews 19 studies with quantitative evidence on the impact of cash transfers on temptation good expenditure, as well as 11 studies that surveyed whether respondents reported they used transfers to purchase temptation goods. We conduct a meta-analysis to gauge the average impact of transfers on temptation goods. Results show that on average cash transfers have a significant negative effect on total expenditures on temptation goods, equal to −0.18 standard deviations. This negative result is supported by data from Latin America, Africa, and Asia, for both conditional and unconditional cash transfer programs. A growing number of studies therefore indicate that concerns about the use of cash transfers for alcohol and tobacco are unfounded.

Spencer Levan Kimball Fighting the TIAA/CREF Monopoly at the University of Chicago in 1980

In his time, my Uncle Spencer Levan Kimball was arguably the world's leading expert on insurance law. After serving as Japanese interpreter in World War II and a Rhodes scholarship, he was a young Law School Dean at the University of Utah, an older Law School Dean at the University of Wisconsin (where my father was also on the faculty), and between those two deanships a professor at the University of Michigan Law school for a long time. He lead a revision of the insurance code for the state of Wisconsin and had a hand in a revision of the insurance code for the State of Utah. Spencer finished his academic career in Chicago, as Executive Director of the American Bar Foundation and Seymour Logan Professor of Law at the University of Chicago. He had no formal economic training, but learned some economics from his work on insurance law. And he wrote in his autobiography that rubbing shoulders with others on the Chicago law faculty provided him with some additional education in economics. Below, is Uncle Spence's account of how the University of Chicago decided to allow faculty to invest their required retirement contributions in Vanguard (from A Tale That is Told: The Autobiography of Spencer L. Kimball, pp. 369-370).

The most important Committee on which l served at Chicago was a University ad hoc faculty-administrative committee on faculty retirement annuities. The University was systematically considering all fringe benefits. In that context, Provost Ken Dam, who was also my law school colleague, asked me to chair the committee on December 2, 1980, "to determine whether contributors should be able to invest their contributions, and those made on their behalf by the University, with organizations other than TIAA and CREF." Such a broadening had taken place with regard to supplemental contributions, as a result of a report of a similar committee chaired by Eugene Fama of the Economics Department, one of the developers of the "efficient market" theory justifying index funds. I had taken advantage of the options allowed and had put my own supplemental retirement funds in Vanguard.

The personnel of the committee was excellent, motivated and regular in attending our frequent meetings. On February 24, I wrote a memorandum outlining the questions I thought we needed to discuss, including how far the University should continue its "paternalistic" posture. We heard presentation from TIAA/CREF, which would like us to make no changes, from Vanguard which would like to be cut in on the act, and from Variable Annuity Life Insurance Company. VALIC made such a poor presentation that we dropped it at once. That left us with the addition of Vanguard or the status quo as our two realistic options, for the University administration balked at having a wide range of choices because of administrative costs. Vanguard made an impressive presentation. TIAA/CREF's attitude was the natural one of a monopolist: any change would be for the worse and, in fact, would violate their rights. TIAA tried to use the principles of the American Association of University Professors and American Association of Colleges about retirement benefits to strengthen their position, but that made little impression on us. A few other schools were beginning to break loose from the hegemony of TIAA, Stanford among them. On March 26 I sent the members an initial draft of a report, done "off the top of my head" in order to get something to discuss. On April 21 I sent the committee members a draft into which I had been able to work the numerous suggestions of the others. A week later I sent a draft to the Provost. After minor corrections our final report went to him May 6, 1981, only three months after our appointment, almost a record for University committees dealing with complex and important questions. The report was compressed into 19 double-spaced pages plus appendices. It recommended enlarging the options of the faculty to include some but not all of Vanguard's funds; it retained the restrictions that compelled annuitization or its equivalent. I made appearances to support the proposal, which finally got approval on October 13 and was quickly implemented. TIAA fought a rear guard action against additional alternatives for retirement funds in various universities and colleges but liberalization of retirement fund accumulation methods was spreading in the academic world, with Chicago leading.

Top 150 Posts and All Columns on supplysideliberal.com, Ranked by Popularity, as of December, 2016

This page is intended to provide ready access to all of my most important posts. To begin with, I list all of my columns and the top 150 other posts based on May 28, 2012 through July 31, 2016 data, when this blog was on Tumblr. Then I give links to other posts in categories. For more recents posts, don't miss:

Even more recent posts can be seen at the Archive link above, and my most popular storified Twitter discussions are here.

Recent Bloomberg and Quartz Columns: (no pageview data available to enable ranking):

Quartz Columns Through 2017, in Order of Popularity:

There’s One Key Difference Between Kids Who Excel at Math and Those Who Don’t

The Coming Transformation of Education: Degrees Won’t Matter Anymore, Skills Will

The Case for Gay Marriage is Made in the Freedom of Religion

After Crunching Reinhart and Rogoff’s Data, We Find No Evidence That High Debt Slows Growth

The Swiss National Bank Means Business with Its Negative Rates

The National Security Case for Raising the Gasoline Tax Right Now

Will Narendra Modi’s Economic Reforms Put India on the Road to Being a Superpower?

The Shakeup at the Minneapolis Fed and the Battle for the Soul of Macroeconomics

How Increasing Retirement Saving Could Give America More Balanced Trade

Human Grace: Gratitude is Not Simple Sentiment; It is the Motivation that Can Save the World

Larry Summers Just Confirmed That He is Still a Heavyweight on Economic Policy

How to Avoid Another NASDAQ Meltdown: Slow Down Trading (to Only 20 Times Per Second)

Benjamin Franklin’s Strategy to Make the US a Superpower Worked Once, Why Not Try It Again?

Gather ‘round, Children, and Hear How to Heal a Wounded Economy

QE or Not QE: Even Economists Needs Lessons In Quantitative Easing, Bernanke Style

Don’t Believe Anyone Who Claims to Understand the Economics of Obamacare

Swiss Pioneers! The Swiss as the Vanguard for Negative Interest Rates

Radical Banking: The World Needs New Tools to Fight the Next Recession

How Italy and the UK Can Stimulate Their Economies Without Further Damaging Their Credit Ratings

Janet Yellen is Hardly a Dove: She Knows the US Economy Needs Some Unemployment

Four More Years! The US Economy Needs a Third Term of Ben Bernanke

Japan Should Be Trying Out a Next Generation Monetary Policy

One of the Biggest Threats to America’s Future Has the Easiest Fix

Could the UK be the First Country to Adopt Electronic Money?

Optimal Monetary Policy: Could the Next Big Idea Come from the Blogosphere?

Why You Should Care about Other People’s Children as Much as Your Own

Get Real: Bob Shiller’s Nobel Should Help the World Improve Imperfect Financial Markets

Read His Lips: Why Ben Bernanke Had to Set Firm Targets for the Economy

How Subordinating Paper Money to Electronic Money Can End Recessions and End Inflation

That Baby Born in Bethlehem Should Inspire Society to Keep Redeeming Itself

Three Big Questions for Larry Summers, Janet Yellen, and Anyone Else Who Wants to Head the Fed

The Man in the Tank: It’s Time to Honor the Unsung Hero of Tiananmen Square

Yes, There is an Alternative to Austerity Versus Spending: Reinvigorate America’s Nonprofits

John Taylor is Wrong: The Fed is Not Causing Another Recession

However Low Interest Rates Might Go, the IRS Will Never Act Like a Bank

Make No Mistake about the Taper—the Fed Wishes It Could Stimulate the Economy More

Nationalists vs. Cosmopolitans: Social Scientists Need to Learn from Their Brexit Blunder

Off the Rails: What the Heck is Happening to the US Economy? How to Get the Recovery Back on Track

VAT: Help the Poor and Strengthen the Economy by Changing the Way the US Collects Tax

Talk Ain’t Cheap: You Should Expect Overreaction When the Fed Makes a Mess of Explaining Its Plans

Economics Is Unemotional—And That's Why It Could Help Bridge America's Partisan Divide

Obama Could Really Help the US Economy by Pushing for More Legal Immigration

Does Ben Bernanke Want to Replace GDP with a Happiness Index?

How to Stabilize the Financial System and Make Money for US Taxpayers

Al Roth’s Nobel Prize is in Economics, but Doctors Can Thank Him, Too

Italy Should Look to Ancient Rome to Reform Its Ineffective Senate

Symbol Wanted: Maybe Europe’s Unity Doesn’t Rest on Its Currency. Joint Mission to Mars, Anyone?

Bloomberg Columns (in Chronological Order)

Major Pieces First Appearing in Other Outlets (in Arbitrary Order)

Slate: Governments Can and Should Beat Bitcoin at Its Own Game

The Independent: Why George Osborne Should Give Everyone in Britain a New Credit Card

Columns Rejected by Quartz Because of Their Topics

Top 150 Posts on supplysideliberal.com:

How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide 11,386

The Medium-Run Natural Interest Rate and the Long-Run Natural Interest Rate 10,375

The Logarithmic Harmony of Percent Changes and Growth Rates 8,894

Sticky Prices vs. Sticky Wages: A Debate Between Miles Kimball and Matthew Rognlie 7,126

Monetary vs. Fiscal Policy: Expansionary Monetary Policy Does Not Raise the Budget Deficit 6,256

Isaac Sorkin: Don’t Be Too Reassured by Small Short-Run Effects of the Minimum Wage 4,669

The Message of Mormonism for Atheists Who Want to Stay Atheists 4,485

Noah Smith Joins My Debate with Paul Krugman: Debt, National Lines of Credit, and Politics 3,819

The Deep Magic of Money and the Deeper Magic of the Supply Side 3,717

Silvio Gesell’s Plan for Negative Nominal Interest Rates 2,985

Trillions and Trillions: Getting Used to Balance Sheet Monetary Policy 2,788

How Conservative Mormon America Avoided the Fate of Conservative White America 2,574

The Shape of Production: Charles Cobb’s and Paul Douglas’s Boon to Economics 2,519

Getting the Biggest Bang for the Buck in Fiscal Policy 2,285

A Note for Graduate Students in Economics Looking for Ph.D. Dissertation Topics 2,108

Why I am a Macroeconomist: Increasing Returns and Unemployment 2,093

Ben Bernanke on Why the Fed Has an Inflation Target of 2% 1,978

Milton Friedman: Celebrating His 100th Birthday with Videos of Milton 1,901

Let the Wrong Come to Me, For They Will Make Me More Right 1,821

Is Monetary Policy Thinking in Thrall to Wallace Neutrality? 1,702

Leveling Up: Making the Transition from Poor Country to Rich Country 1,614

Henrik Jensen: Willem and the Negative Nominal Interest Rate 1,557

Jonathan Meer and Jeremy West: Effects of the Minimum Wage on Employment Dynamics 1,552

Bruce Greenwald: The Death of Manufacturing & the Global Deflation 1,198

18 Misconceptions about Eliminating the Zero Lower Bound 1,176

The Flat Tax, The Head Tax and the Size of Government: A Tax Parable 1,146

Anat Admati, Martin Hellwig and John Cochrane on Bank Capital Requirements 1,118

John Stuart Mill on Being Offended at Other People’s Opinions or Private Conduct 1,074

The Wrong Side of Cobb-Douglas: Matt Rognlie’s Smackdown of Thomas Piketty Gains Traction 1,071

Larry Summers: The Fed Looks Set to Make a Dangerous Mistake by Raising Rates this Year 1,051

Why My Retirement Savings Accounts are Currently 100% in the Stock Market 1,029

Noah Smith: Why Do Americans Like Jews and Dislike Mormons? 1,029

Robert Graboyes on Enabling Supply-Side Innovation in Health Care 999

Greg Shill: Does the Fed Have the Legal Authority to Buy Equities? 957

Preventing Recession-Fighting from Becoming a Political Football 947

What to Do When the World Desperately Wants to Lend Us Money 934

Miles’s April 9, 2006 Unitarian Universalist Sermon: “UU Visions” 929

Friends and Sparring Partners: The Skyline from My Corner of the Blogosphere 889

Jeff Smith: More on Getting into an Economics PhD Program 862

John Stuart Mill’s Argument Against Political Correctness 812

Bruce Bartlett on Careers in Economics and Related Fields 810

John Stuart Mill: A Remedy for the One-Sidedness of the Human Mind 795

John Stuart Mill’s Vigorous Advocacy of Education Vouchers 780

Principles of Macroeconomics Posts through September 3, 2012 728

Miles’s Best 7 “Save-the-World” Posts, as of July 7, 2012 708

Responding to Joseph Stiglitz on Negative Interest Rates 685

Glenn Ellison’s New Book: Hard Math for Elementary School 685

Most Important Aggregator Posts

How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide

How and Why to Expand the Nonprofit Sector as a Partial Alternative to Government: A Reader’s Guide

Gabriela D'Souza on Failure in Learning Math (with links to posts on math learning)

Helicopter Drops of Money Are Not the Answer (with links at the bottom to posts on federal lines of credit, national rainy day accounts and related ideas)

Live: The Egocentric Illusion (with links to other UU sermons)

Live: Teleotheism and the Purpose of Life (with links to other key religion posts)

Noah Smith: Sunni Islam is Failing (with links to other religion posts by Noah Smith)

Happiness and Satisfaction Are Not Everything: Toward Well Being Indices Based on Stated Preferences

Math Learning for Kids Who Have a Tough Time (with links on math education and math learning)

Other Aggregator Posts

Making a Difference: Save-the-World Posts as of December 3, 2013

Principles of Macroeconomics Posts through September 3, 2012

A Guided Tour through Meta-posts at the End of the Second Cycle

Posts on Politics and Political Economy through September 1, 2012

Posts on Religion, Philosophy, Science, Literature and Culture through August 27, 2012

Monetary Policy Other Than Negative Interest Rates (most recent first)

Peter Conti-Brown on Marriner Eccles and the Refounding of the Fed

Gauti Eggertsson and Miles Kimball: Quantitative Easing vs. Forward Guidance

Luke Kawa: How Central Banks Gained More Control Over the World’s Major Currencies

Why a Weaker Effect of Exchange Rates on Net Exports Doesn’t Weaken the Power of Monetary Policy

Alex Rosenberg Interviews Miles Kimball on the Responsiveness of Monetary Policy to New Information

Owen Nie: Monetary Policy in Colonial New York, New Jersey and Delaware

Paul Krugman Deconstructs Martin Feldstein's Critique of Quantitative Easing

Jo Craven McGinty: Easy to Lose and Expensive to Produce: Is the Penny Worth It?

Allan H. Meltzer: Don't Be Distracted by the Last 5+ Years--Massive Inflation is Coming

João Marcus Marinho Nunes on Japan’s Monetary Policy Experiment

Wallace Neutrality Roundup: QE May Work in Practice, But Can It Work in Theory?

Reaching for Yield: The Effects of Interest Rates on Risk-Taking

Ryan Avent on the Fed's Plans to Keep Rates Low Even After Recovery is Underway

Michael Woodford Endorses Monetary Policy that Targets the Level of Nominal GDP

Should the Fed Promise to Do the Wrong Thing in the Future to Have the Right Effect Now?

Mike Konczal: What Constrains the Federal Reserve? An Interview with Joseph Gagnon

The supplysideliberal Review of the FOMC Monetary Policy Statement: June 20th, 2012

Is Monetary Policy Thinking in Thrall to Wallace Neutrality?

Miscellaneous Religion Posts (most recent first)

Christian Kimball: Anger [1], Marriage [2], and the Mormon Church [3]

The Mormon Church Decides to Treat Gay Marriage as Rebellion on a Par with Polygamy

Slavoj Zizek on the Psychological Insecurities of Terrorists

What If Jesus Was Really Resurrected? Musings of a Non-Supernaturalist

John Erdevig and Kenji Yano: A Personal East/West Convergence and “The Nature God”

Christian Kimball on the Fallibility of Mormon Leaders and on Gay Marriage

Marcelo Gleiser: "Astrotheology: Do Gods Need to Be Supernatural?"

Rodney Stark, the Rig Veda Hymn of Creation and the Cult of Bacchus

Inspirational Posts (most recent first)

The Importance of the Next Generation: Thomas Jefferson Grokked It

May the Best in the Human Spirit Vanquish the Worst in the Human Spirit

So What If We Don’t Change at All … and Something Magical Just Happens?

Jessica Tozer: Boldly Going into a Future Where All Men and Women are Created Equal

As I Faced the Fiscal Cliff, I Failed to Find Comfort in the Words of Winston Churchill

Milan Kundera on the Contribution of Novels to the Liberal Imagination

The True Story of How Economics Got Its Nickname "The Dismal Science"

John Locke Posts (in chronological order)

John Locke: Revolutions are Always Motivated by Misrule as Well as Procedural Violations

John Locke Looks for a Better Way than Believing in the Divine Right of Kings or Power to the Strong

John Locke: The Right to Enforce the Law of Nature Does Not Depend on Any Social Contract

John Locke: Law Is Only Legitimate When It Is Founded on the Law of Nature

John Locke: Foreign Affairs Are Still in the State of Nature

Law, Regulation and Policy (most recent first)

Gwynn Guilford: The Epic Battle Between Clinton and Trump is a Modern Day Morality Play

Next Year’s Momentous Supreme Court Decision: Reining in Public Sector Unions?

The Wonderful, Now Suppressed, Republican Study Committee Brief on Copyright Law (direct link)

Uwe Reinhardt: Does Occupational Licensing Deserve Our Approval? A Review of Work by Morris Kleiner (direct link)

Tyler Cowen: Regulations Hinder Development of Driverless Cars

Tyler Cowen on How Much Easier It Is to Create Regulations Than to Get Rid of Them (direct link)

Amanda Foreman: When Justice Drowns in Law (direct link)

Drew Hinshaw: Nigeria Produces Half the Electricity of North Dakota-for 249 Times More People

Jeff Smith: Why I Won’t Sign a Petition to Raise the Minimum Wage

Josh Barro: We Need a New Supply Side Economics–Here Are 8 Things We Can Do

John Cochrane: What Free-Market Medical Care Would Look Like

An Experiment with Equality of Outcome: The Case of Jamestown

Neil Irwin: American Manufacturing is Coming Back. Manufacturing Jobs Aren’t

Holman Jenkins on the Role of Organized Labor in Blocking Policy Initiatives in the Democratic Party

Clay Christensen Posts (in chronological Order)

Clay Christensen, Jerome Grossman and Jason Hwang on Intuitive Medicine vs. Precision Medicine

Clay Christensen, Jerome Grossman and Jason Hwang on the Personal Computer Revolution

Clay Christensen, Jerome Grossman and Jason Hwang on the Three Basic Types of Business Models

Math, Statistics, Writing and Teaching (most recent first)

Effort vs. Innate Ability: What I Learned from Being in the Spelling Bee

Jethra Spector: Using Miles and Noah’s Math Column in the Classroom

My Advice to Qatar: Make Math Education a Research Grand Challenge

Jessica Lahey: Teaching Math to People Who Think They Hate It

Marjorie Drysdale: Even When You Can Do Math, You May Not Love It

Michael Bloomberg: A University Cannot Be Great If Its Faculty Is Politically Homogenous

Elizabeth Cleland: How I Get All My Students to be Good at Math (direct link)

Matt Waite: How I Faced My Fears and Learned to Be Good at Math

Jing Liu: Show Kids that Solving Math Problems is Like Being a Detective

Eric Hanushek on the Importance of Improving Teacher Quality

Humanities, Science, History and Culture (most recent first)

Bret Stephens and Paul Krugman: What Should a Correction Look Like in the Digital Era?

Tom Bowen’s Gift to Humanity: A Powerful Australian Technology

Recasting “The Hunger Games” as a Parable about Immigration Policy

David Byrne: The Power of Democratizing Making Music and Art

The “Wait But Why” Blog on Why Generation Y Yuppies are Unhappy

Population Distribution of the United States in Units of Canadas (direct link)

Steven Pinker on How Taboos on What We Let Ourselves Think and Say Can Steer Us Wrong

Tunku Varadarajan on the Backlash Against Winner-Take-All in Online Journalism

Other Posts I Want to Highlight Not Listed Above Nor in Aggregator Posts (most recent first)

John T. Harvey: Five Reasons You Should Blame The Economics Discipline For Today's Problems

Q&A: Why is Fiscal Policy So Close to Being Neutral in Many Modern Macro Models?

Sarah Sloat: What is Cognitive Economics? Understanding the World Through New Types of Data

Q&A: Evidence that Financial Flows Determine the Overall Balance of Trade, Not Tariffs

Answering Adam Ozimek’s Skepticism about a US Sovereign Wealth Fund

Stephanie Shimko Interviews Miles Kimball about His Earliest and Latest Research

Robin Green: Don’t Recognize Racist Externalities with a Pigou Tax

Richard V. Reeves, Isabel Sawhill and Kimberly Howard: The Parenting Gap

Edward Glaeser, Joshua Gottlieb and Oren Ziv: Maximizing Happiness Does Not Maximize Welfare

The Wall Street Journal Editorial Board Comes Out for a Straight 15% Equity Requirement

Jonathan Clements on Integrating Human Capital into Your Portfolio

Another Quality Control Failure on the Wall Street Journal Editorial Page?

Brad Delong: Mr. Piketty and the “Neoclassicists”: A Suggested Interpretation (direct link)

Robert Flood and Miles Kimball on the Status of the Efficient Markets Theory

Justin Wolfers, Matthew Adler and Ori Heffetz: Round Table on Happiness

John L. Davidson on the Decline of the Quality of Information Processing in Lending

What Would Economic Growth Look Like If We Properly Valued the Web?

John L. Davidson on Resolving the House Mystery: The Institutional Realities of House Construction

Allison Schrager: The Economic Case for the US to Legalize All Drugs

Niklas Blanchard Defends Me Against the Wrath of Paul Krugman, Despite My Lack of Nuance

Miles on HuffPost Live: The Wrong Debate and How to Change It

How a US Sovereign Wealth Fund Can Alleviate a Scarcity of Safe Assets

The Marginalization of Economists at the Consumer Financial Protection Bureau

Bonnie Kavoussi's List on Huffington Post of "26 Economists You Should Be Following on Twitter" (direct link)

Duncan Green: Lant Pritchett v. the Randomistas on the Nature of Evidence--Is a Wonkwar Brewing?

Steven Johnson: We're Living the Dream, We Just Don't Realize It

Noah Smith: The Well-Behaved Japanese Poor Call Into Question the Idea that Poverty Stems from Bad Behavior (direct link)

Joshua Hausman: More Historical Evidence for What Federal Lines of Credit Would Do

The supplysideliberal Style Guide for Referring to Public Figures

About Paul Krugman: Having the Right Diagnosis Does Not Mean He Has the Right Cure

Another Dimension of Health Care Reform: Discouraging Soft Drink Consumption

Isomorphismes: A Skew Economy & the Tacking Theory of Growth

Milton Friedman's Thermostat: An Econometric Cautionary Tale

Joshua Hausman on Historical Evidence for What Federal Lines of Credit Would Do

“It Isn’t Easy to Figure Out How the World Works” (Larry Summers, 1984)

Adam Ozimek: What “You Didn’t Build That” Tells Us About Immigration

Will the Health Insurance Mandate Lead People to Take Worse Care of Their Health?

Bill Greider on Federal Lines of Credit: “A New Way to Recharge the Economy”

Dissertation Topic 3: Public Savings Systems that Lift the No-Margin-Buying Constraint

Miles’s Presentation at the Federal Reserve Board on May 14, 2012 (pptx)

Henry George and the Carbon Tax: A Quick Response to Noah Smith

Clive Crook: "Supply-Side Liberals"

Note: Although the primary location of supplysideliberal.com is now on Squarespace, posts from 2016 and before still exist on Tumblr. The archive for these posts on Tumblr is here at http://supplysideliberal.tumblr.com/archive.

The Scope and Readership of supplysideliberal.com

I need a post like this first and foremost for myself--to see what I have done in general, and on particular topics. But I also hope it helps both those who want to look at a few top posts and those who want to do a deep dive into supplysideliberal.com.

This post is especially valuable in showing the range of topics covered on supplysideliberal.com beyond negative interest rate policy, since here those posts are mostly covered indirectly by the one aggregator post “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.”

I care a lot about current and future super-readers of this blog, who individually want to read many posts! Despite all of its flaws, Google Analytics is adequate for showing that there are indeed many super-readers. For example, taking the data in the graph below at face value, one can deduce using division and bounding that there are at least 73 readers with between 101 and 200 reading sessions each, and at least 193 readers with between 51 and 100 reading sessions each. At the other end of the spectrum, Google Analytics shows 364,219 distinct readers have been exposed to the website supplysideliberal.com itself exactly once.

It is interesting to see some of the demographic and geographical breakdown of readers. I wish I had more female readers, but I am happy with having readers of many different ages, though of course the young are more into blogs than the old:

I am especially pleased to have readers from around the world. Here are the top 50 cities shown by Google Analytics with the admittedly imperfect measure of sessions as follows giving some indication of relative weight:

City Sessions

New York 29,052

Ann Arbor 29,006

Washington 18,304

London 16,944

Chicago 10,034

Los Angeles 6,082

Sydney 5,663

Toronto 5,535

San Francisco 5,004

Boston 4,706

Seattle 4,424

Melbourne 4,231

Singapore 4,140

Cambridge, MA 4,077

Arlington 3,962

Philadelphia 3,871

Houston 3,460

Austin 3,176

Paris 3,118

Minneapolis 3,072

San Diego 2,747

Ottawa 2,494

Hong Kong 2,408

Madison 2,219

Dublin 2,199

Columbus 2,104

Canberra 2,069

Rome 2,063

Denver 2,044

Portland 2,026

Montreal 1,874

Atlanta 1,855

Berlin 1,848

New Delhi 1,793

Calgary 1,790

Brisbane 1,771

Bethesda 1,769

Cambridge, UK 1,738

Copenhagen 1,732

Berkeley 1,712

Durham 1,700

Bengaluru 1,696

Wellington 1,585

St. Louis 1,567

San Jose 1,557

Seoul 1,542

Evanston 1,480

Salt Lake City 1,451

Dallas 1,450

Mumbai 1,448

Explanation of the rankings:

The top 150 posts on supplysideliberal.com listed above are based on Google Analytics pageviews from June 3, 2012 through December 24, 2016. The number of pageviews is shown by each post. However, Google Analytics has been getting worse and worse in the job it is doing, both mechanically, and because more and more of the traffic has migrated to forms such as mobile access that Google Analytics is very bad at counting. Google Analytics counts 887,732 pageviews during this period but that is a big underestimate of the impact because of

that failure to count most readers on mobile devices

the failure to count those reading on Tumblr itself

not counting people reading the columns on Quartz

the mysterious dropoff to no more than a trickle of Google Analytics pageviews counted after the end of July, 2016 with no corresponding dropoff in any other measure of activity at that time.

Furthermore, of those 887,732 pageviews that are counted by Google Analytics, 221,260 are to the homepage, and so cannot be categorized by post.

(As I mentioned yesterday, in addition to greater confidence in the future of Squarespace than the future of Tumblr and increasingly greater functionality of Squarespace in creating and displaying posts compared to Tumblr, an important motivation for moving supplysideliberal.com to Squarespace is better analytics. For a long time now, I have felt I was flying blind with my blog given how little I could see through Google Analytics applied to a Tumblr blog.)

Nevertheless, the relative popularity of different posts for that limited subset of pageviews is informative. Indeed, with the passage of more time, the pageview ratings have come closer to my own judgment of the relative importance of posts as it becomes possible to see which posts have stood the test of time. And to be clear, if I think a post is more important, over time that adds to its pageviews because I link to it more often in subsequent posts and in tweets.

I have to handle my Quartz columns separately because that pageview data is proprietary. My very most popular pieces have been Quartz columns, so I list them first. I have listed them all plus a few columns in other outlets, with the ones with no data (yet) listed at the bottom. (To avoid duplication, I have disqualified companion posts to Quartz columns from the top 40 blog post list, since they eventually get recombined with the Quartz columns when I repatriate the columns. For these columns, the ranking is by pageviews at a point where things have settled down. For later posts, that is standardized to pageviews during the first 30 days when Quartz has an exclusive.)

Musings about the Top 10 Quartz columns:

The page view data I have for the Quartz columns is proprietary. But I can say that the top Quartz columns have dramatically more pageviews than are shown by Google Analytics for the top posts on my blog. So it is worth musing about the popularity of the top ten Quartz columns.

Five of the top ten Quartz columns–1, 2, 4, 7, 8–are about education. Somewhat to my surprise, this has emerged as an important theme on my blog, as Noah Smith identified when writing about this blog.

Four of the top ten columns are coauthored: 1 and 4 with Noah Smith, 8 with Anonymous and 9 with Yichuan Wang. It helps to have a top-notch coauthor.

Two of the top ten–3 and 6–are relatively recent columns with a strong religious or moral tone to them. I am glad to see that my efforts to articulate religious and moral themes find an audience as well as what I have to say about economics. I actually consider 5 to be in this category as well.

One of the top ten–9–is about Reinhart and Rogoff. Levels of interest for understanding Reinhart and Rogoff’s mistake was extraordinary.

One thing I pay attention to is how great a reach my most popular column on negative interest rates is. I am pleased to have one at 10.

Two of the top ten–3 and 5–touch on national security.