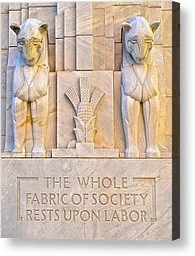

Does the Fabric of Our Society Depend on a Lie?

On a walk the day after Christmas, I was thinking about the interaction of inflation and loss aversion and about supernatural religions. Loss aversion is when someone, for example, treats something they code as a $10 loss as twice as painful as something they code as a $10 gain, and so have a substantial risk premium even for small risks. If gains and losses are coded in nominal terms, then for the same real return distribution, low inflation makes more of the returns into losses, and so can easily raise the risk premium. In my view, 98% of loss aversion is irrational, so in these cases, the higher effective risk premia are steering people wrong. Irrational loss aversion can thus create one of the few benefits of having higher inflation (something I need to add to my post “The Costs and Benefits of Repealing the Zero Lower Bound … and Then Lowering the Long-Run Inflation Target.”) But this benefit comes from the lie of inflation helping to partially counteract the bad effects of an irrationality.

Similarly, for many people, believing in some supernatural being helps counteract other irrationalities and sometimes even antisocial tendencies. And in the political realm, what Michael Huemer would call the illusion of political authority sometimes helps avoid anarchy and chaos that could cost many lives.

In this line of thought I thought

There is always the logical possibility that the fabric of our society depends on a lie. But I prefer not to think that way.

But should I be saying “I prefer not to think that way?” If I believe in facing the truth, then sholuldn’t I face the truth about the fact that our society is based on key lies, if it is the truth?

But besides hating the idea of a “noble lie” (see my post “John Stuart Mill on the Protection of ‘Noble Lies’ from Criticism”), I am not convinced that it is true that “noble lies” are needed. I have often encouraged myself with the thought "If I am clever enough, I can get away with telling the truth.“ And I believe the same is true for society as a whole:

If we are clever enough, we can get away with telling the truth.

This is a matter of faith for me, in the sense of "The Unavoidability of Faith.” In religion, my belief that if we are clever enough, we can get away with telling the truth is the theme of my sermon “Godless Religion.”

Technical Note: In addition to loss aversion, Kahneman and Tversky’s Prospect Theory is risk averse among gains and risk loving among losses. So while having the boundary between perceved gains and losses shift closer to the middle of the distribution of real returns can make for a bigger risk premium, pushing the bulk of the return distribution into the category of perceived losses can reduce the risk premium and even turn it negative. If the risk premium falls below the rational level, the resulting behavior is often called reaching for yield.

There is another possible source of “reaching for yield.” If an investor’s agent gets compensated out of “gains” or returns above some specific level, then there is a great incentive to try to encourage risk taking if necessary to have a good probability of getting above that level. The same can be said if there is a fixed reward for getting above some level.

In any case, if there is either an institutional or psychological reason to care about nominal “gains” versus “losses” or “above” versus “below” a given nominal level of returns, changing the level of inflation might make a difference for good or ill.