The Storm and the Battle Ahead

Decades of stagnating wages didn’t help, and the swift cultural changes brought on by technical change and globalization have occasioned many tough adjustments, but the timing and intensity of the political storm we see all around us owes a great deal to the Great Recession. The Great Recession in turn owes its depth and duration to not just a failure of financial stability policy, but to a monumental failure of monetary policy.

Many of the central bankers at the helm during the Great Recession acted heroically to make things better than they might have been–notably Ben Bernanke at the Fed, Mervyn King at the Bank of England and Mark Carney at the Bank of Canada–but even those heroic efforts fell far short of what common women and men had a right to expect from central bankers. The fault lies with the economics profession as a whole, which first did too little to insist on the high equity requirements that could have easily blunted or avoided the financial crisis that sparked the Great Recession, and second had not laid the intellectual groundwork to break through the zero lower bound in 2009 to stop the Great Recession in its tracks once it had begun.

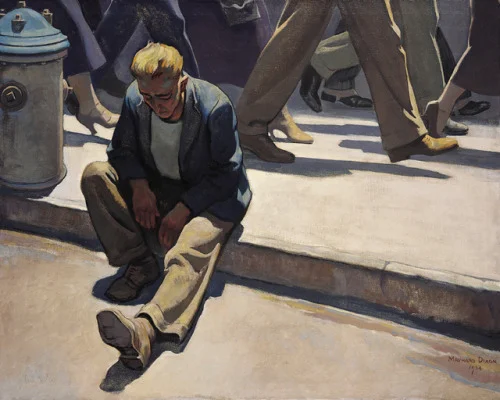

Many artists documented the suffering in the Great Depression of the 1930′s. Seeing several of Maynard Dixon’s painting at the BYU art museum, including the one you see above, made me think of how that suffering was caused by that era’s monumental failure of monetary policy. What you and I are doing now to add to the tools available to central banks to fight recessions and escape the need for inflation is the least that people should expect of us in doing our duty. The hundreds of millions of people who depend on us should not suffer during the next recession because of any lack of diligence or courage on our part.

The people of the world, by and large, do not know exactly what went wrong to make the Great Recession as bad as it was. They do not know, by and large, what it will take to avoid a rerun of the Great Recession or the secular stagnation that Japan has suffered for the last 20+ years. Many of the people of the world may curse us for tools they don’t understand are the key to avoiding such dire outcomes. But they will curse economists in general–and central bankers in particular–much more if we fail to do our job of keeping the world economy on an even keel. Let us not shrink from the task before us, but press forward.

Many of you are already participants, in large and small ways, in the battle against the zero lower bound. This post is written in the first instance to honor you, to encourage you and to thank you for your efforts. For those readers newer to the idea that monetary policy can be reinvigorated by modifying traditional paper currency policy, take a look at “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.”