João Marcus Marinho Nunes on Japan's Monetary Policy Experiment

There have been many disputes about the effectiveness of the large scale purchases of long-term and risky assets by a central bank that we have all fallen into calling QE. In June 2012, I wrote in “Future Heroes of Humanity and Heroes of Japan”:

Noah [Smith] points out that macroeconomists have been arguing over the same things for a long time with no resolution; only decisive central bank actions have provided “experimental” evidence strong enough to convince most macroeconomists of something they didn’t already believe. Just so, massive balance sheet monetary policy on the part of the Bank of Japan could put to rest the idea that balance sheet monetary policy doesn’t work. The Bank of Japan has amazing legal authority to print money and buy a wide range of assets, and has the rest of the government actually pushing for easier monetary policy. So they could do it. They just need to buy assets chosen to have nominal interest rates as far as possible above zero in quantities something like 30% or more of annual Japanese GDP. Japan needs monetary expansion, particularly if it is going to raise its consumption tax, and would be doing the world a huge service by settling the scientific question of whether Wallace neutrality applies to the real world.

… the value of experimentation in economic policy is vastly underrated: trying a policy of “print money and buy assets” on a massive scale such as 30% or more of the value of annual GDP is the way to find out. And there is no country in the world for which the possible side effect of permanently higher inflation would be more harmless. The Bank of Japan has officially set an inflation target at 1%, which is 1% higher than where Japan is at, and there would be nothing terrible about having a 2% inflation target, like the inflation targets for the Fed and the European Central Bank. So the Bank of Japan should do it. If the Bank of Japan shifts to such a decisive policy, those pushing for this approach on its monetary policy committee will ultimately go down in history as heroes of humanity as well as heroes of Japan.

After having seen decades of feckless Japanese monetary policy, I was as surprised as anyone when now Prime Minister Shinzo Abe ran an election campaign centering on monetary policy, and with his election victory in December 2012 and the appointment of Haruhiko Kuroda to the Bank of Japan turned Japanese monetary policy around.

João Marcus Marinho Nunes provides an early read on the results of the Japanese monetary policy experiment in his post “‘Abenomics’ one year on.” What Marcus finds is impressive. I am grateful to him for permission to mirror his blog post in full here.

Shinzo Abe was elected in December 2012 on a promise to revive growth and put an end to deflation. How have his promises ‘performed’ one year after taking power?

The ‘performance’ will be illustrated by a set of charts.

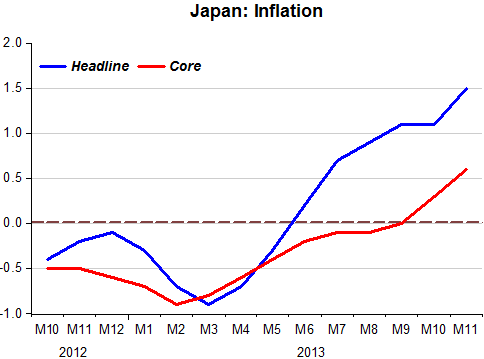

The first chart shows the behavior of inflation, both headline and core.

It appears to be gaining ‘positive traction’ after years of languishing in deflationary territory.

The next chart shows the bounce in aggregate demand (NGDP) and real output (RGDP).

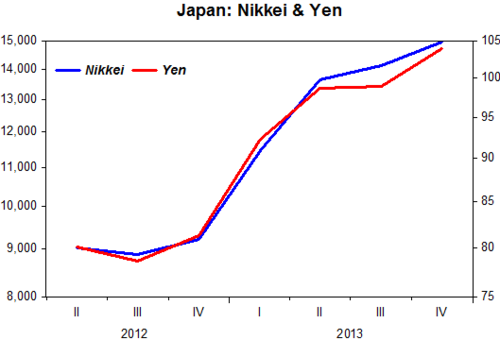

The next chart depicts what happened with the Nikkei stock index and the exchange rate (yen/USD).

The strong rise in the stock market is indicative of positive expectations about the effects of the plan. The depreciation of the yen is an important transmission mechanism of the expansionary monetary policy. In this case, the initial negative reaction of competitors, who accused Japan of engaging in ‘beggar-thy-neighbor’ policies, was misplaced. As the next chart shows, imports rose by more than exports, with Japan incurring a trade balance deficit.

This is indicative that the income effect of the expansionary policy was stronger than the terms of trade effect of the exchange devaluation. In other words, it reflects an increase in domestic demand.

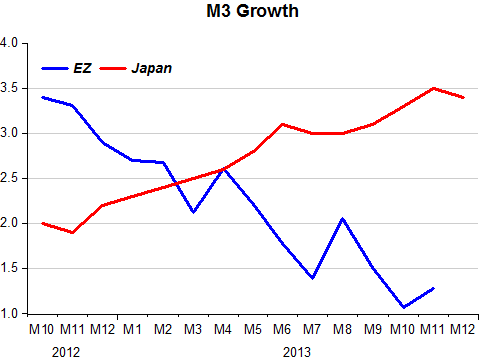

It is also interesting to compare Japan since ‘Abenomics’ with what´s happening in the Eurozone.

The chart shows the growth of broad money (M3). While in Japan, according to the plan, monetary policy is expansionary; in the Eurozone the BCE is tightening monetary policy.

It is, therefore, not surprising to observe the contrasting behavior of inflation in the two cases. While in Japan inflation is climbing towards the 2% target, in the EZ it is way below target and falling, with several countries in the group experiencing deflation.

The difference in the behavior of the BoJ and BCE is summarized in the chart below which shows the growth of real output in the two ‘countries’.

So it seems that ‘Abenomics’ is delivering on its promise. Hopefully it will continue to do so. We may also conclude that the EZ is travelling to “where Japan is coming from”!