Higher Inflation Is Not the Answer

Because the Economist doesn’t appreciate the power of deep negative interest rates to revive an economy and return quickly to positive interest rates–in a way mild negative rates cannot guarantee–it has turned to many other questionable proposals instead in February 20, 2016 cover story “The World Economy: Out of ammo? Central bankers are running down their arsenal. But other options exist to stimulate the economy” and the related article “Fighting the next recession: Unfamiliar ways forward–Policymakers in rich economies need to consider some radical approaches to tackling the next downturn.” Yesterday, I argued that “Helicopter Drops of Money Are Not the Answer.” Today, let me argue that higher inflation is not the answer. I gave the long version of the argument in “The Costs and Benefits of Repealing the Zero Lower Bound … and Then Lowering the Long-Run Inflation Target.” Today, let me try to give the short version.

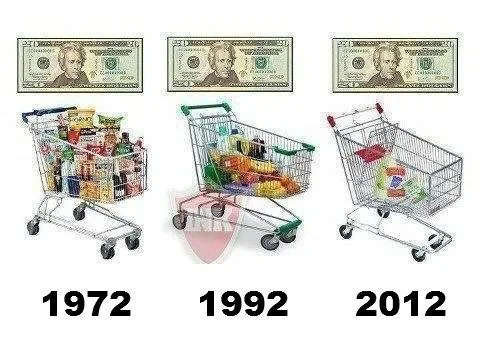

Inflation has many costs. Among those costs, some of the most important are messing up microeconomic price signals and confusing people. This is a cost of the unit of account that people use to think about prices changing its value. Unless we want to confuse people, we should avoid changes in the value of the unit of account. As Greg Mankiw points out in his textbooks, the idea that the unit of account should have a constant value–or as constant a value as we can reasonably make it have–is akin to the idea that we want a meter to stay the same length and a kilogram to stay the same weight from one year to the next. To alter our weights and measures every year would have many costs stemming from the confusion it would cause.

Similarly, having the unit of account change value has many costs stemming from the confusion it causes–not all of which are captured in the usual models of the costs of inflation. I worry, for example, that people saving for retirement will think they are on track to be better prepared for retirement than they really are because they are tempted to think in terms of asset returns that are unadjusted for inflation. I am sure this confusion doesn’t affect everyone, just as I am sure that it does affect some people–and I think, unfortunately many people. I know that inflation confuses the US Congress, since large parts of the tax code are unadjusted for inflation. Inflation even confuses aspects of the economic debate where one might have thought it wouldn’t matter. The income of the top 1% of the income distribution is a remarkably high fraction of the total however the calculation is made. But that fraction is somewhat overstated whenever the asset returns used in those income calculations are not adjusted for inflation–a mistake that is all too common. And as Thomas Piketty points out in Capital in the Twenty-First Century, inflation makes it hard for us to understand novels like those of Jane Austen, as monetary values that had a very clear meaning for people back then have no clear meaning for modern readers.

The bottom line is that we should avoid inflation in the unit of account. The interesting thing to realize is that those who are calling for higher inflation (Such as Paul Krugman, Larry Ball, Brad DeLong and the Economist) are not really calling for higher inflation in the unit of account. They are calling for higher inflation relative to paper currency. It is only if the paper dollar, or paper euro or paper yen is the unit of account that inflation relative to the unit of account and inflation relative to paper currency are the same thing. Once a central bank takes a nation off the paper standard, it is possible to have the good inflation relative to paper currency without any of the bad inflation. That is, it is possible to have “inflation” relative to paper currency without any inflation relative to an electronic unit of account. In other words, once the electronic dollar, or electronic euro or electronic yen is the unit of account, the value of that unit of account can be kept the same, while the value of a paper dollar, paper euro or paper yen is made to decline whenever necessary in order to allow negative interest rates. See “An Underappreciated Power of a Central Bank: Determining the Relative Prices between the Various Forms of Money Under Its Jurisdiction” for how this works.

Indeed, under the kind of electronic money system I recommend, even inflation relative to paper currency would normally be a temporary thing. Thus, whatever minor costs it had (minor because the paper dollar or euro or yen would not be the unit of account), would be borne only during economic emergencies and for a time thereafterward. By contrast, those who advocate a higher inflation target without realizing it is possible to go off the paper standard are advocating paying the costs of the much more serious inflation relative to the unit of account every year, on and on indefinitely.

With all of this in mind, consider how unpleasant the Economist’s recommendation is compared to brief periods of going off the paper standard coupled with deep negative interest rates. “The World Economy: Out of ammo? Central bankers are running down their arsenal. But other options exist to stimulate the economy” sets out this idea:

Another set of ideas seek to influence wage- and price-setting by using a government-mandated incomes policy to pull economies from the quicksand. The idea here is to generate across-the-board wage increases, perhaps by using tax incentives, to induce a wage-price spiral of the sort that, in the 1970s, policymakers struggled to escape.

Moreover, the economist doesn’t seem to realize that this is at cross-purposes with a much better set of proposals to improve the supply-side of the economy:

Deregulation is another priority—and no less potent for being familiar. The Council of Economic Advisors says that the share of America’s workforce covered by state-licensing laws has risen to 25%, from 5% in the 1950s. Much of this red tape is unnecessary. Zoning laws are a barrier to new infrastructure. Tax codes remain Byzantine and stuffed with carve-outs that shelter the income of the better-off, who tend to save more.

Wonderful areas for improvement! But they need to be coupled with negative interest rates. Here is why: most supply-side improvements tend to reduce prices. As long as one can use deep negative interest rates, a reduction in prices is no problem. But if a central bank insists on staying on the paper standard, a lower growth rate of prices makes it harder to stimulate the economy.

I would choose supply-side improvements coupled with negative interest rates to ensure enough aggregate demand for all of the extra output any day before I would choose a higher inflation target our unit of account as a ham-handed way to do the work that should be done by going off the paper standard.

See links to everything I have written on negative interest rate policy organized in my bibliographic post “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.”