When Honest House Appraisers Tried to Save the World

Being a bond-rater may not seem like the kind of job that could save the world, but it was. In particular, the financial crisis that has cost us so dearly since 2008 could have been avoided if the bond-raters had refused to stamp undeserving mortgage-backed securities as AAA. But bond-raters are not the only ones who could have averted the crisis. It turns out that a large group of home appraisers not only tried to do the jobs we trust them to do, but blew the whistle on other home appraisers who weren’t worthy of that trust. Here is how Bill Black describes the events in his post “Two Sentences that Explain the Crisis and How Easy It Was to Avoid”

Here are the two sentences of Bill Black’s title, which appeared in the 2011 report of the Financial Crisis Inquiry Commission (FCIC):

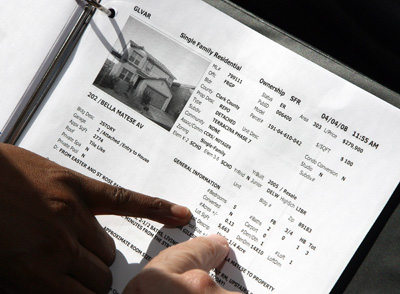

“From 2000 to 2007, [appraisers] ultimately delivered to Washington officials a petition; signed by 11,000 appraisers…it charged that lenders were pressuring appraisers to place artificially high prices on properties. According to the petition, lenders were ‘blacklisting honest appraisers’ and instead assigning business only to appraisers who would hit the desired price targets” (FCIC 2011: 18).

Bill argues that “This had to be done with the knowledge of the bank CEOs”:

One of the wonderful things about being a CEO is the ability to communicate to employees and agents without leaving an incriminating paper trail. Sophisticated CEOs running large accounting control frauds can use compensation and business and personnel decisions to send three key messages: (a) you will make a lot of money if you report exceptional results, (b) I don’t care whether the reports are true or the results of fraud, and © if you do not report exceptional results or if you block loans from being approved by insisting on effective underwriting and honest appraisals you will suffer and your efforts will be overruled. The appraisers’ petition was done over the course of seven years. Even if we assumed, contrary to fact, that the CEO did not originate the plan to inflate the appraisals the CEOs knew that they were making enormous numbers of fraudulent “liar’s” loans with fraudulent appraisals. It is easy for a CEO to stop pervasive fraudulent lending and appraisals. Where appraisal fraud was common it was done with the CEO’s support.

Here is how he sees this kind of fraud as contributing to, and in turn being propelled by the bubble in mortgage-backed securities:

the fraud “recipe” cause an enormous expansion in bad loans. This can hyper-inflate a financial bubble. As a bubble grows the fraud recipe becomes even more wealth-maximizing for unethical senior officers. The trade has a saying that explains why bubbles are so criminogenic – “a rolling loan gathers no loss.” The fraudulent lenders refinance their bad loans and report (fictional) profits.

Here is the dilemma the honest appraisers faced:

The Gresham’s dynamic that causes us the most wrenching pain as regulators is the one that the officers controlling the fraudulent lenders deliberately created among appraisers. They created the blacklist to extort the most honest appraisers. The fraudulent lenders, of course, do not have to successfully suborn every appraiser or even most appraisers in order to optimize their frauds. A fairly small minority of suborned appraisers can provide all the inflated appraisals required. The honest appraisers will lose a great deal of income and many will be driven out of the profession by the lost income or because the degradation of their profession disgusts them. These non-wealthy professionals, the ethical appraisers, were injured by the fraudulent CEOs because the appraisers knowingly chose honesty over maximizing their incomes. The CEOs of the lenders and the officers and agents they induced (by a combination of de facto bribery and extortion) to assist their frauds chose to maximize their incomes through fraud.

The government then failed in its duty to prevent fraud:

The U.S. government did nothing in response to the appraisers’ petition warning about the black list of honest appraisers. The federal banking agencies’ anti-regulatory leaders’ hatred of effective regulators caused them to do nothing in response to the appraisers’ petition. The anti-regulators did nothing for years, as the number of appraisers signing the petition grew by the thousands and surveys and investigations confirmed their warnings about lenders extorting appraisers to inflate appraisals. The appraisers put the anti-regulators on notice about the fraud epidemic for seven years beginning in 2000.

Bill’s explanation of why the government failed in its duty to prevent fraud: a confusion between regulations to prevent fraud–without which there can be no expectation of a good market outcome–from regulations limiting what a fully honest company can do. As I wrote in my Quartz column “US Government Spying is Straight Out of the Mob’s Playbook,"

The idea that the free market requires tolerance of corporate deception is itself a big lie.

Preventing fraud, like enforcing property rights and preventing blackmail and extortion, is a fundamental requirement for getting the good results that free markets can yield. Therefore, preventing fraud should never be lumped into the same category as other regulations that limit what a fully honest individual or company can do. If a regulation limits what a fully honest individual or company can do, that regulation requires very careful justification. But there should always be a strong presumption in favor of regulations insisting that individuals and companies tell the truth in commercial contexts–except perhaps in cases where tort law in fact induces truth-telling even without the help of regulations.