Against Anticompetitive Regulation

If several businesses got together and agreed to raise their prices, that would be an antitrust violation. But when people with something to sell get together and run to the government and successfully ask for a regulation that will raise their prices, people often see that as OK. That makes no sense. If a restraint of trade would be a bad thing done by private agreement, surely that restraint of trade is also a bad thing done by government at the point of a gun.

Of course, for most people, the big difference between a good and a bad restraint of trade is this:

Competition for thee; collusion for me.

That is, I hate competition that I have to face, but like competition for you that keeps prices down for me.

The standard argument against competition–when it is competition for me–is that (a) competition will lower quality because low-price, low-quality alternatives will be offered, and (b) these low quality offerings will have a bad spillover effect on people’s guesses about the quality of what I am selling. Notice that this is an all-purpose argument that can be used to justify almost any type of collusion.

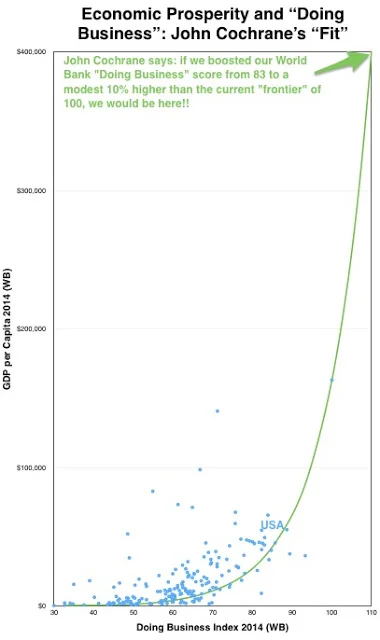

In his post “Dear John Cochrane, you are hurting the economists who care about you,” Matthew Martin distinguishes between reasonable and unreasonable arguments in favor of deregulation. Focusing narrowly on the “ease of doing business” rating for a cross-section of nations, Matthew contrasts John Cochrane’s rash extrapolation

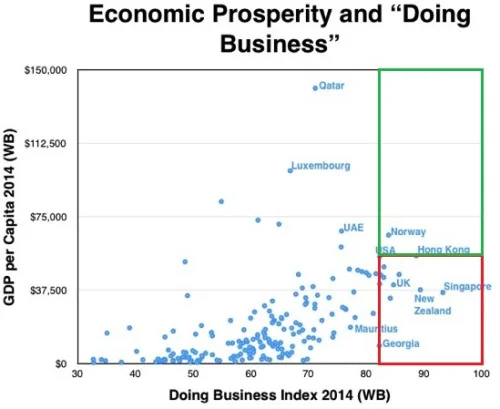

with the fact that those nations with a greater ease of business than the US do not do any better than the US in GDP per capita:

Evan Soltas, in “Is Pro-Business Reform Pro-Growth?” drives home the point by considering cases in which a country made a big leap up in ease of doing business, finding that there is very little growth dividend. My reaction to Evan’s post is to think that the “ease of doing business measure,” while correlated with things that make a difference, particularly among countries with lower scores than the US, but does not itself capture the key things. When countries raise their “ease of doing business scores” it might be like colleges gaming their rankings once they have figured out the US News and World Report formula for the college rankings. It is hard to genuinely make things better. It is much easier to raise a score by gaming it. And the “ease of doing business” rating is prestigious enough for many countries to see it as worth gaming it to raise it.

What if some of the key types of deregulation that are especially important for economic growth don’t show up in the “ease of doing business” rating? To the extent doing them well is correlated with the “ease of doing business rating,” the “ease of doing business” rating could be a good indicator, but it would be a less good indicator when a country is only doing the things tallied in the “ease of doing business” rating without also doing the things often correlated with a greater “ease of doing business.”

As an example of thinking about the benefits of deregulation more carefully than John Cochrane, Matthew Martin links to Salim Furth’s Heritage Foundation report “Costly Mistakes: How Bad Policies Raise the Cost of Living.” Let me list 11 areas Salim points to as areas of harmful regulation (I didn’t understand his least important example, “cement production regulation”) in the order of how big Salim thinks the annual cost to the average family is, without regard to what level of government is involved; many of the biggest are perpetrated by state and local governments. Indeed, I have often thought that instead the overly broad use of the “interstate commerce” clause of the US Constitution to meddle in things that are far removed from interstate commerce, the Federal government should use the interstate commerce clause to prevents states and localities from strangling their economies and thereby the US economy with harmful regulation. It is good to defer to states and localities when they lean in the direction of freedom, not always so good to defer to states and localities when they strangle freedom.

All estimates of annual cost to the average family are from Salim Furth

- Land use regulations–cost to average family: $1700. Property owners already within a locality colluding against everyone who might want to move to that locality.

- Occupational licensure–cost to average family: $1033. Those who already have a particular type of job colluding against everyone else who might want to do that job.

- Corporate Average Fuel Economy Standards–cost to average family: $448. Pretending to do something to help the environment and to reduce US dependence on oil from enemy nations instead of really helping the environment and reducing US dependence on oil from enemy nations by raising gasoline and other energy taxes.

- Auto Dealership Monopolies–cost to average family: $288.

- Ethanol Mandate–cost to average family: $255. A tax on drivers to fund a handout to corn farmers and agribusiness, enforced by the key role the Iowa caucuses have in winnowing out presidential candidates.

- Corporate Tax Complexity and Compliance Costs–cost to the average family: $230. Pretending that it is possible to avoid taxing people by taxing corporations, when at the end of the day, the only ultimate source for tax revenue is people. Or perhaps, pretending that taxing corporations only taxes rich people, when if one wishes to tax rich people, it is much better targeted to tax rich people by finding rich people directly.

- Crude Oil Export Restriction–thankfully now gone, but used to cost the average family $227.

- Renewable Energy Mandates–cost to the average family: $108. Those producing greenhouse gases using symbolism to distract everyone from the carbon taxes that would direct research and implementation of CO2 reduction in the most efficient directions.

- The Current Medical Tort System–cost to the average family: $82. Lawyers taking a big cut of the money flowing through the incentive system/insurance system surrounding medical mistakes.

- Sugar program–cost to the average family: $29. Sugar farmers colluding against sugar users. (Note that with a Pigou tax on sugar, the money would go to government uses instead of sugar growers.)

- Milk Marketing Orders–cost to the average family: $29. Dairy farmers and agribusiness colluding against milk users.

When faced with the politics of such schemes, it is easy to get discouraged. But a journey of a thousand miles must begin with a single step. One of the first steps toward getting rid of bad regulations is to call them out for the reflections of self-interest that they are, and refuse to let them hide behind prettified excuses. What is achievable in the medium-term is that whenever journalists write about any of these regulations, someone close to hand is ready and willing to be quoted about how selfish these regulations are.

Note: You might be interested in the related Storify story “Jonathan Portes, Brad DeLong and Noah Smith Set Me Straight When I Praise John Cochrane’s Shoddy OpEd.”