Border Adjustment vs. Dollar Depreciation

According to the recent reports, the Republicans in Congress want to cut the corporate tax rate to 20% and have it be "border adjustable, while soon-to-be President Donald Trump wants to cut the corporate tax rate to 15% and have the dollar depreciate. Let me leave aside the effects of cutting the corporate tax rate to focus on the effects of "border-adjustability" and dollar depreciation.

First, border adjustability. In the eurozone, where there is a fixed exchange rate of 1 between the member countries, relying more heavily on a value-added tax—for which international rules allow taxing imports while exempting exports from the tax—and less on other taxes, is understood as a way to get the same effect as devaluing to an exchange rate that makes foreign goods more expensive to people in a country and domestic goods cheaper to foreigners.

But in a floating exchange rate setup as the US has, most of the effects of border adjustment can be canceled out by an explicit appreciation in the dollar that cancels out the implicit devaluation from the tax shift. And indeed, such an appreciation of the dollar is exactly what one should expect. The reason is that the supply of US dollars available for the rest of the world to pay for net exports from the US is determined by the eagerness of those in the US to own more foreign assets minus the eagerness of those abroad to own more US assets. I explain this kind of reasoning in International Finance: A Primer. There is no reason to think that border adjustment dramatically changes the balance of those portfolio decisions. So the supply and demand for US dollars makes the price of the US dollar adjust to where the same amount of net exports will take place.

For a moment, suppose that border adjustment (or the other details of the tax change) instead of having little effect on the desire to hold US assets versus foreign assets made companies want to do more physical investment in the US and thereby hold more US assets as some hope. This would reduce the supply of dollars available to the rest of the world to pay for net exports to the US, and so would push the US dollar up to an even higher price than what would leave net exports fixed.

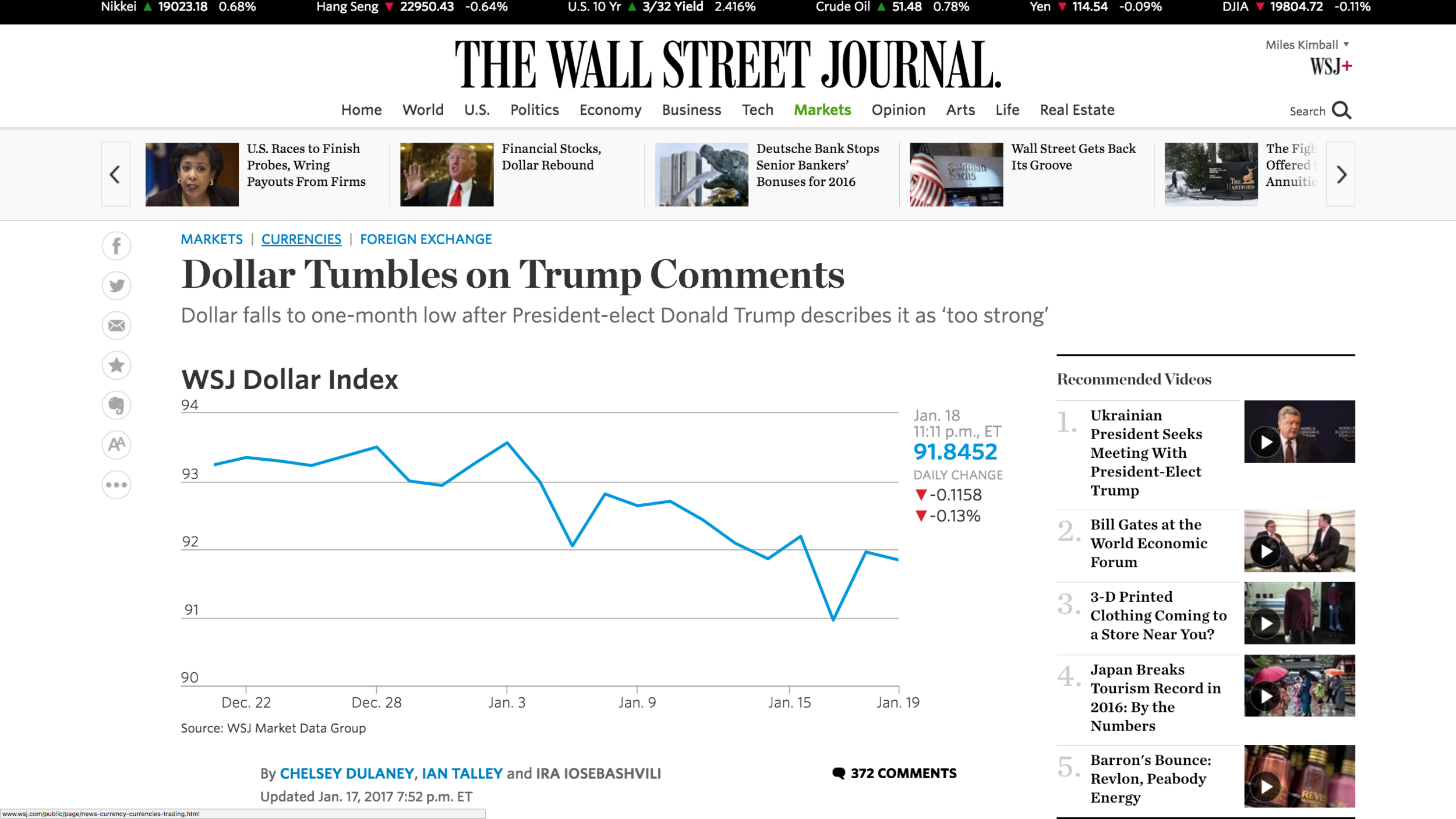

By contrast to border adjustment, which would tend to push the dollar up enough to cancel its effects, Donald Trump's wish for a lower price of the US dollar, if it happened, would stimulate net exports. Remarkably, just his talking about wanting a lower dollar seems to do a lot to make the dollar go down as he wants. Currency traders think that some kind of future policy supporting that decline in the dollar will come about. They may be wrong, in which case the dollar will return to a higher value in the future. This makes them want to get out of US assets, which pushes the dollar down now as a result of those traders thinking something will push the value of the dollar down in the future.

But if the future policy to justify a lower dollar price is not forthcoming, flows of portfolio investment will shift and the dollar will rise again. What could those future policies be? One possible way to push down the dollar for a few years time is loose monetary policy that lowers rates of return in the US, making foreign assets more attractive. When people in the US flee the low interest rates to buy foreign assets, they are providing extra US dollars to the rest of the world, which pushes down the price of the US dollar and raises net exports. However, too much loose monetary policy would eventually cause unwanted inflation.

A way to push down the value of the dollar and stimulate net exports for a much longer time is to increase saving rates in the US. This is easier than you might think. As I explained in my May 14, 2015 column "How Increasing Retirement Saving Could Give America More Balanced Trade":

I talked to Madrian and David Laibson, the incoming chair of Harvard’s Economics Department (who has worked with her on studying the effects of automatic enrollment) on the sidelines of a Consumer Financial Protection Bureau research conference last week. Using back-of-the-envelope calculations based on the effects estimated in this research, they agreed that requiring all firms to automatically enroll all employees in a 401(k) with a default contribution rate of 8% could increase the national saving rate on the order of 2 or 3 percent of GDP.

Under such a policy, people would not have to save more. But it would be the easy, lazy thing to do to save more. As greater saving pushed down US rates of return, some of that extra saving would wind up in foreign assets, putting extra US dollars in the hands of folks abroad, so they would have US dollars to buy US goods. This effect can be enhanced if the regulations for automatic enrollment are favorable to a substantial portion (say 30%) of the default investment option being in foreign assets.

Note that an increase in US saving would tend to push down the natural interest rate, and so needs to be accompanied by the elimination of the zero lower bound in order to avoid making it hard for monetary policy to respond to recessions. Fortunately, tools are readily available to eliminate the zero lower bound. See "How and Why to Eliminate the Zero Lower Bound: A Reader's Guide."

It is worth noting one other difference between a policy of encouraging saving in this way and "border adjustment" for corporate taxation (besides the fact that encouraging saving will do the trick while border adjustment is unlikely to work). Border adjustment, by likely causing the dollar to look more expensive and other currencies to look cheaper, would tend to lower the dollar net worth of those who have substantial assets in other countries. By contrast, increasing US saving, by likely causing the dollar to look less expensive and other currencies to look more expensive, would tend to increase the dollar net worth of those who have substantial assets in other countries. So the policy that will actually work is also more in Donald Trump's pecuniary self-interest.

Addendum: Of course the US government could have a program of regularly buying large quantities of foreign assets assets directly. But such a blatant move would raise a much bigger storm of international protest than encouraging Americans to save more in an internationally diversified way. The governments of much smaller economies, such as Switzerland, Sweden, Denmark and Israel frequently do this--often through their central banks as a part of monetary policy. But China has come under a lot of criticism for this as "currency manipulation" even when it was trying to keep the yuan from rising rather than trying to make the yuan fall. Now that economic forces would make the yuan fall without government intervention, the Chinese government is afraid enough of international criticism and retaliation if the yuan falls that it is selling foreign assets rather than buying. It is possible that Donald Trump would be willing, perhaps even relish, the international criticism as a currency manipulator and so be willing to do it. But why take such a fraught route when it is so easy to change international capital flows and help Americans prepare for retirement at the same time? This, too, would occasion some international criticism as currency manipulation, but it helps a lot that it has another purpose as well. I predict that criticism would die down to a modest level relatively quickly--except from those who take the lower bound on interest rates as given and so view a further decline in the natural interest rate as a threat to the power of monetary policy.

One other minor problem with a regular US government program of buying foreign assets is that it requires either a budget surplus (as the Chinese government has had) or further borrowing. Further borrowing to raise funds to buy foreign assets is certainly possible, but allows the program to be challenged when the debt limit is reached (unless the debt is calculated on a net basis rather than simply in terms of outstanding liabilities).

Note: David Zervos points out that border adjustment raises revenue to offset revenue lost by the reduction in the corporate tax rate and by shifting away from taxing foreign corporate income directly. This is true as long as imports exceed exports so that the extra taxes due to imports exceed the cost of the tax break for exports. And precisely because border adjustment is likely to be ineffective at reducing the trade deficit, the excess of imports over exports would be likely to continue, and so would the net revenue produced by border adjustment.

Coda and Chorus: In October 2012, I wrote this in "International Finance: A Primer":

An Easy Policy to Restore America’s Industrial Heartland (Including Key Swing States). It is not likely that many people will actually be persuaded by my portfolio advice, so let’s think of a policy that really would increase the amount of foreign assets that Americans buy and so increase our exports and reduce our imports. David Laibson and his coauthors have found that in retirement accounts, people often stay with the default contribution level and allocation to different assets, even if they are allowed to change the contribution level and allocations of contributions to different assets by going through a little paperwork. There are at least two reasons for this. One is that people are sometimes a little lazy–or to be more charitable, perhaps scared of financial decisions. That makes them want to do nothing. The other reason people often stick with the default settings for their retirement accounts is that they think (unfortunately wrongly for the most part right now), that their company, or maybe the government has carefully thought through how much they should be putting aside and what they should be financially investing it in.

So imagine that the government establishes a regulation that employers all need to have a retirement saving account and have a relatively high default contribution level. The employers are not required to match it. And employees can get out of making any contributions just by doing a little paperwork. But many, many employees won’t change the default contribution. So this simple regulation could dramatically raise the household saving rate in America. Assuming the government keeps its budget deficits on the same path as it otherwise would, that would also raise the national saving rate. A higher national saving rate would make loanable funds more plentiful at any real interest rate, making a surplus of loanable funds at a high real interest rate and so drive down the real interest rate. With real interest rates low in the United States, Americans would start thinking of buying more foreign assets that earn higher interest rates, and foreigners would be less likely to buy low-interest-rate American assets. (How much people want foreign assets is only somewhat independent of rates of return, not totally independent. A big enough interest rate differential will lead people in both countries to shift.) With Americans buying more foreign assets and foreigners buying fewer American assets, the flow of dollars has shifted outwards. Something has to happen to recycle those dollars. That something is a change in the exchange rate that increases net exports. And it has to increase net exports by the same amount as the change in the flow of dollars for asset purchases.

Indeed, following the tradition of calling the flow of dollars for intentional asset purchases net capital outflow, we can say that net exports would have to equal net capital outflow. More precisely, the net flow of dollars for anything other than buying goods and services has to be exactly balanced by a countervailing net flow of dollars that is about buying goods and services. And except for short periods of time, the net flow of dollars for purposes other than buying goods and services has to be intentional; it won’t take long before unintentional movements get undone by recycling.

Now suppose that the government wants to increase net exports even more than was accomplished by mandating that all employers provide retirement savings accounts and setting a high default contribution level for retirement savings accounts. The government could simply add the regulation that the default asset allocation would be, say, 40% in foreign assets. That would dramatically increase the buying of foreign assets relative to what would be likely to happen otherwise (at least in the United States with current attitudes toward foreign assets). That would further increase net financial capital outflow from the United States, and lead to exchange rate adjustments that would further raise net exports to recycle those dollars back to the United States.