Paper Currency Deposit Fees as Unrealized Interest Equivalents

Note: for background to this post, see "How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide."

The Fed is allowed to charge fees for transactions at the cash window, but these fees must be reasonably closely related to actual expenses the Fed incurs. In negative interest periods, the Fed would incur an expense when banks with access to the Fed's cash window withdraw paper currency and then redeposit it after an intervening period of negative interest rates for marginal reserves and negative interest rates for the Treasury bills the Fed holds in its portfolio.

Negative interest rates simply mean that the lender pays the borrower rather than the borrower paying the lender. When banks withdraw paper currency, in an immediate sense they are reducing their balances in reserves, and therefore depriving the Fed of the payments it would otherwise receive as the borrower given negative interest on reserves--or in the Fed's reverse repo program acting as a substitute for reserves. (See "How the Fed Could Use Capped Reserves and a Negative Reverse Repo Rate Instead of Negative Interest on Reserves.")

On a rainy November afternoon after our two presentations at the Swiss National Bank, Ruchir Agarwal (my coauthor for "Breaking Through the Zero Lower Bound") and I wandered the streets of Zurich, and finally sought refuge in a coffee shop. There we pursued Ruchir's intuition that ultimately led to the insight that the paper currency deposit fee can be considered a way of making up for the negative interest that (aside from that) doesn't happen for paper currency, in an accounting sense.

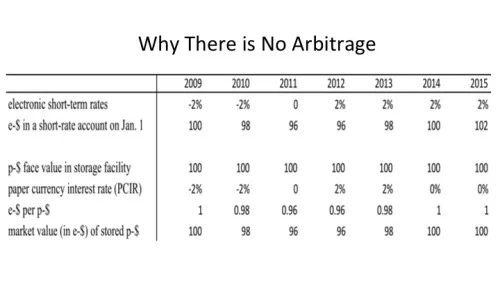

For cash taken out right at the beginning of a negative-interest-rate period, the equivalence between the paper currency deposit fee and unrealized interest is easiest to see. Consider the table above, from the Powerpoint file "21 Misconceptions about Eliminating the Zero Lower Bound (or Any Effective Lower Bound on Interest Rates)." If electronic, safe, short rates (such as the rates on reserves or Treasury Bills) are running at -2%, the same rate of return for paper currency can be engineered by having the electronic equivalent value of $100 face value of paper currency decline by 2% per year, until the level of electronic, safe, short rates changes. But from the legal perspective taken here, instead of thinking of the value of paper currency departing from par, each banknote (that is, each piece of paper currency) is thought of as having attached to it by an invisible umbilical cord a liability called an unrealized interest equivalent (UEI). The unrealized interest liability is owed to the central bank by the bearer of that banknote.

The image I have of the UEI is like a daemon in the book and movie The Golden Compass—a daimon standing beside, perched upon, or hovering in the air above the person whose daemon it is. There is a Wikipedia page for "Daemon," which describes them this way:

A dæmon /ˈdiːmən/ is a type of fictional being in the Philip Pullman fantasy trilogy His Dark Materials. Dæmons are the external physical manifestation of a person's 'inner-self' that takes the form of an animal. Dæmons have human intelligence, are capable of human speech—regardless of the form they take—and usually behave as though they are independent of their humans.

image source

In the Golden Compass, the daemon cannot be separated very far from the person it belongs to without great trauma to both the person and the daimon itself.

In the case of negative interest rates, the paper currency deposit fee weighing on the banknote (e.g. about 2% at the beginning of 2010 and about 4% at the beginning of 2011 in the example above) is exactly equal to the interest that would have been owed to the central bank as borrower if the banknote had been held since the beginning of the negative interest rate period. (The analogy to a daemon perched on a banknote is inexact: the UEI would not be the "inner-self" of the banknote.)

But what if a bank withdraws paper currency some time into the negative interest rate period, or even after interest rates have turned positive but cumulative interest since the beginning of the negative interest rate period is still in the hole? Then that bank does not owe the negative interest from before it withdrew the cash. A good way to avoid charging a private bank negative interest on paper currency that it doesn't owe—while making it easy to keep track of things—is for the central bank to have the banknote owe that interest but provide a preemptive refund to the private bank of the interest it didn't accrue. This is a nice way of looking at why it is appropriate for the amount a private bank is charged in its reserve account for cash withdrawals to be reduced by the amount of the paper currency deposit fee; the deposit fee at that point represents a UIE the bank doesn't owe since it hasn't had the paper currency out up to that point.

By giving the private bank a preemptive refund, the private bank then does owe the full UIE for the banknote accumulated since the beginning of the negative interest rate period. This full UIE from the beginning of the negative interest episode depends only on the date and not on when the bank withdrew it, avoiding the need for complex record keeping.

By the way, one thing I like about the legal argument here using the concept of unrealized interest equivalents is that it cannot justify an engineered rate of return on paper currency any lower than the interest rate on marginal reserves. Therefore, using this as a legal basis for a time-varying paper currency deposit fee provides protection against confiscatory reduction in the value of paper currency; paper currency can have a negative rate of return, but no more negative than the last dollar of reserves. That is enough to keep paper currency out of the way of a robust negative interest rate policy, but does not disadvantage paper currency in its rate of return relative to money in the bank.