Joshua Hausman on Historical Evidence for What Federal Lines of Credit Would Do

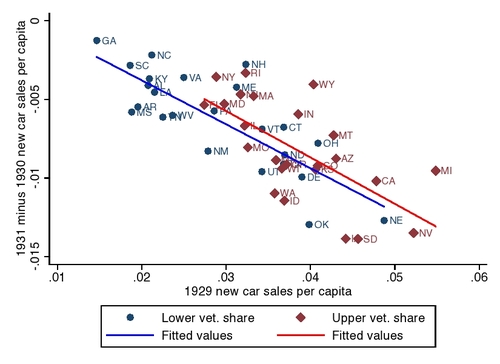

Guest blogger Joshua Hausman’s graph of the change in car sales in each state between 1930 and 1931, as a function of car sales in 1929, broken into those states with below-median fraction of veterans in the population (blue) and above-median fraction of veterans in the population (red). The fitted lines do not impose equal slopes.

The graph excludes the District of Columbia (DC), since it is a large outlier. Including DC strengthens the case for an effect of being allowed to borrow against the veteran’s bonus on auto sales: DC had a high share of veterans and was the only state to see auto sales actually increase from 1930 to 1931.

This is a guest post by Joshua Hausman. Joshua is a graduate student at Berkeley on the job market this Fall.

Perhaps the best historical analogies to Miles’s Federal Lines of Credit Proposal are 1931 and 1936 policy changes that gave World War I veterans early access to a promised 1945 bonus payment. In 1924, Congress passed a bill promising veterans large payments in 1945. When the depression came, veterans’ groups lobbied congress for immediate payment. Congress partially acquiesced in 1931, giving veterans the ability to borrow up to 50 percent of the value of their promised bonus beginning on February 27. (Prior to this, veterans could take loans of roughly 22.5 percent of their bonus.) For the typical veteran, this meant being able to borrow about $500. For comparison, in 1931 per capita personal income was $517. The loans carried an interest rate of 4.5 percent, but interest did not have to be paid annually. Rather, the amount of the loan plus interest would be deducted from what was due the veteran in 1945. In fact, the interest rate was lowered to 3.5 percent in 1932, and then forgiven entirely in 1936. But there is no reason to think that this was expected at the time.

Despite their ability to take loans, veterans continued to demand immediate cash payment of the entire, non-discounted, value of their bonus. Tens of thousands of veterans camped in Washington, DC from May to July 1932 to lobby for immediate payment. Finally, in 1936, congress granted their wish, giving veterans the choice of taking their bonus in cash or leaving it with the government where it would earn 3 percent interest until 1945. Whereas the 1931 policy change was a pure loan program, the 1936 policy had elements of both a loan and a transfer, since it gave veterans access to the same amount of cash in 1936 that they otherwise would have gotten in 1945, and since part of the 1936 bill forgave interest on earlier loans. A rough calculation suggests that of the typical bonus amount of $550 received in 1936, roughly half was an increase in veterans’ permanent income, while the other half was essentially a loan.

My ongoing work focuses on evaluating the 1936 bonus, both because it was quantitatively much larger than the 1931 loan payments, and because there is a household consumption survey and a survey of veterans themselves that makes it possible to evaluate the policy’s effects in detail. But the 1931 program is a better analogy for Miles’ Federal Line of Credit proposal. Thus in the rest of this blog post I consider what evidence there is on the 1931 program.

No single source of evidence is definitive, but several pieces of evidence suggest that loans to veterans boosted consumption in 1931. First, it is significant that veterans eagerly took advantage of the loan program. In the four months following the policy change (March to June 1931), veterans took 2.06 million loans worth an aggregate $796 million, or one percent of GDP. Since there were 3.7 million World War I veterans, these figures suggest that a majority quickly took advantage of the loan program (that is, unless many veterans took multiple loans). Given the 4.5 percent interest rate, and the lack of many attractive investment opportunities in the 1931 economy, it only made sense for veterans to take these loans to consume or to pay down high interest rate debt.

Other evidence points to veterans using some of the money on consumption rather than using it entirely to pay down debt. First, there is an uptick in department store sales amidst what is otherwise a steady downward trend. Seasonally adjusted sales rose 2.9 percent in April, the month when veterans took out the most loans. Since the proportion of veterans in the population varied significantly across states, it is also possible to relate changes in new car sales in a state to the number of veterans in the state, and thus measure the effect of the loan program. Uncovering whether or not there was such a relationship is tricky since the loan program was small compared to the other shocks hitting the economy. In particular, states with more veterans tended to be states in the west, and these states had higher car sales in 1929. In turn, states that had higher car sales in 1929 tended to see larger declines in sales during the Depression. A way to see both the relationship to 1929 sales, and the effect of veteran share is to graph the 1930-31 change in car sales per capita against the level of 1929 car sales. This is done in the figure at the top. The blue dots are states in the lower half of the veteran share distribution (i.e. states with fewer than 2.9 veterans per 100 people) and the red dots are states in the top half of the veteran share distribution. The lines are the fitted values for each set of points. The graphical evidence is hardly definitive, but it is at least consistent with the fact that conditional on pre-depression conditions, being in the top half of the veteran share distribution led to higher auto sales in 1931.

Finally, narrative sources provide some indication of what people at the time thought veterans were doing with the money. News stories are also consistent with veterans spending the money on cars. For example, the Los Angeles Times wrote on March 22, 1931: “The opinion has been ventured that the bonus readjustment would have a beneficial effect upon the motor trade and that a liberal amount of this money would find its way into the pockets of the automobile dealer. The prediction is becoming a fact to a greater extent than was at first anticipated."

Newspapers also reported veterans spending on other consumer items. The New York Times wrote on April 5, 1931: "That the payment of the soldiers’ bonus has definitely increase purchases of merchandise, particularly men’s wear, was the opinion yesterday of Julian Goldman, head of the Julian Goldman Stores, Inc., which sell goods on the instalment [sic] plan. Mr. Goldman recently returned from an extended trip through the country and reported that managers of his own stores and other merchants attributed a substantial increase in sales to the veterans spending their loan money.” The article goes on to also say that veterans were using their loans to pay back installment debt on previous clothing purchases.

2012 is not 1931 and a trial of Federal Lines of Credit today would provide much better evidence of its effects. But the 1931 experience is at least encouraging. The balance of evidence suggests that the loan program was popular and that it increased consumption relative to what it otherwise would have been. Of course, the economy still saw large absolute declines in consumption and output in 1931, since the loan program was tiny compared to the negative shocks hitting the economy.

Sources

Information on the the bonus legislation and the number and dollar amount of loans is taken from the 1931 Annual Report of the Administrator of Veterans’ Affairs, in particular, p. 42; data on seasonally adjusted department store sales are from

http://www.nber.org/databases/macrohistory/rectdata/06/m06002a.dat.

Data on veterans per capita in each state are from the 5% IPUMS sample from the 1930 Census; data on new car sales by state are from the industry trade publication Automotive Industries, data for 1929 sales is from the February 22, 1930 issue, p. 267, for 1930 from the February 28, 1931 issue p. 309, and for 1931 from the February 27, 1932 issue p. 294.