Mike Konczal has a recent post “Four Issues with Miles Kimball’s ‘Federal Lines of Credit’ Proposal," announced by this tweet:

New post, where I go feral on@mileskimball, discussing four issues with his “Federal Lines of Credit” policy idea.

Mike’s tweet is the only way I can get a working link to his post. This link may work at some point in the future. Here is Mike’s description of my proposal:

What’s the idea? Under normal fiscal stimulus policy in a recession, we often send people checks so that they’ll spend money and boost aggregate demand. Let’s say we are going to, as a result of this current recession, send everyone $200. Kimball writes, "What if instead of giving each taxpayer a $200 tax rebate, each taxpayer is mailed a government-issued credit card with a $2,000 line of credit?” What’s the advantage here, especially over, say, giving people $2,000? “[B]ecause taxpayers have to pay back whatever they borrow in their monthly withholding taxes, the cost to the government in the end—and therefore the ultimate addition to the national debt—should be smaller. Since the main thing holding back the size of fiscal stimulus in our current situation has been concerns about adding to the national debt, getting more stimulus per dollar added to the national debt is getting more bang for the buck.”

Mike has some praise and four Roman numerals worth of objections. I promised a detailed answer. Other than the comment threads after each post, this is only the second time I have had a serious online criticism of one of my posts, and I will try to accomplish the same sort of thing I tried to accomplish in my answer to the first serious criticism I received from Stephen Williamson: to answer the criticism point by point while at the same time making some important points worth making even aside from this dustup with Mike. The main point I want to make uses the phrases “fiscal policy” and "stabilization policy,“ which can be given the following rough-and-ready definition:

Fiscal policy: government policy on taxing and spending

Stabilization policy: loosely, recession-fighting (in times of recession) and inflation-fighting (in times of boom).

More precise definitions of stabilization policy inevitably involve the details of exactly what should be done and when, which are sometimes under dispute; this definition will serve for now. Here is the main point I want to make in this post:

Long-run fiscal policy is unavoidably political, since it involves the tradeoff between the benefits of redistribution and the benefits of low tax rates, but stabilization policy can and should be kept relatively apolitical. The politicization of stabilization policy in the last few years is an unfortunate, and fundamentally unnecessary, turn of events.

By avoiding big changes in taxes or spending, I hope my Federal Lines of Credit proposal can help to depoliticize stabilization policy.

The reason a discussion of the politicization of stabilization policy belongs in a reply to Mike Konczal is that my simple summary of his objections to my Federal Lines of Credit proposal of government-issued credit cards to stimulate the economy is that my proposal does not do enough to redistribute toward the poor. Now my views on redistribution are no secret. As I said in my first post, "What is a Supply-Side Liberal,” redistribution is good. In my post “Rich, Poor and Middle-Class,” I made a stronger statement, focusing on helping the poor, which is the important part of redistribution:

I am deeply concerned about the poor, because they are truly suffering, even with what safety net exists. Helping them is one of our highest ethical obligations.

The other type of redistribution, which is more controversial (because the redistributive benefit is smaller and the economic efficiency cost is higher) is taxing the rich in order to help the middle class. Given the fact that redistribution needs to be financed by taxes or by deficit spending, Republicans and Democrats differ substantially on how much redistribution they think should be done of either type. As a result, the political fights over long-run taxing and spending policy are often bitter. My fervent hope is to find ways to avoid having the the blood that is spilled over long-run taxing and spending policy from infecting short-run stabilization policy, which by rights should be less controversial especially in a recession, since recessions are bad for almost everyone. It is a little harder to say that inflation is bad for almost everyone, since inflation benefits debtors at the expense of creditors, but few people on either side of the political divide advocate high inflation as a way to wipe out debts, and most of the other effects of inflation higher than a few percent per year are bad for everyone.

What has made stabilization policy a political football in the last few years is the fact that the Federal Reserve is maxed out on its favorite recession-fighting tool of lowering short-term interest rates. Because currency effectively earns an interest rate of zero, no one is willing to lend money at an interest rate much below zero, so zero is about as low as the Fed can go. In my answer to the first serious criticism I received from Stephen Williamson, I argue that the Fed can still do a lot more to stimulate the economy even when the nominal interest rate is already down to zero, but the Fed has been reluctant to use unfamiliar tools to the full extent possible. And the size of the necessary changes to the Fed’s balance sheet are enough to scare many people (in a way that I argue is unwarranted in my third, and to this date, most-viewed post “Balance Sheet Monetary Policy.”) Indeed, the Fed has become a political target not only because of its sadly necessary role in saving the economy by bailing out big banks, but also because even the Fed’s half-measures have involved big enough changes in the Fed’s balance sheet to scare many people.

Besides monetary policy, the traditional remedies in stabilization policy have to do with taxing and spending. In particular, the traditional remedies for a recession other than monetary stimulus are tax cuts and spending increases. It is easy to see the problem. Since taxes and spending are also the center of the political debate about long-run policy, any use of taxes or spending to fight recessions arouses justifiable suspicion that the other side will use recession-fighting as an excuse to advance its long-run agenda: for Republicans, lowering taxes in the long run, for Democrats, increasing the amount of redistribution in the long run.

By contrast, since monetary policy does not touch on what in recent history are the core political debates about taxing and spending, for at least the 30 years from mid 1988 to mid 2008 (when the financial crisis and the Great Recession threw things for a loop) political controversies over monetary policy have been relatively esoteric–not the sorts of things that move the average voter in either party.

In crafting my Federal Lines of Credit proposal, one of my key objectives was to find a new way of fighting recessions that, like monetary policy in normal times, would be fully acceptable to both political parties. The U.S. economy and the world economy are in trouble, and it is important that politics not get in the way of what needs to be done. So I am pleased to have Mike Konczal say of my proposal “This has gotten interest across the political spectrum.” The proposal itself is described in my second post “Getting the Biggest Bang for the Buck in Fiscal Policy,” and my recent post “Bill Greider on Federal Lines of Credit: 'A New Way to Recharge the Economy’” is a good way to catch up on the discussion about Federal Lines of Credit since then.

Now let me turn to Mike’s four issues:

I. Isn’t deleveraging the issue? Is this a solution looking for a problem? From the policy description, you’d think that a big is credit access holding the economy in check.

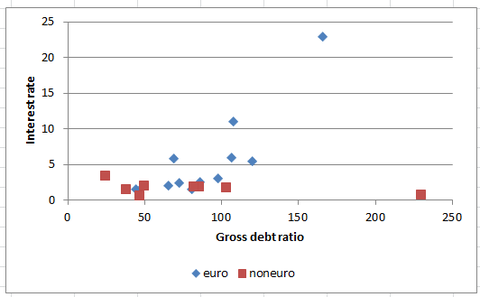

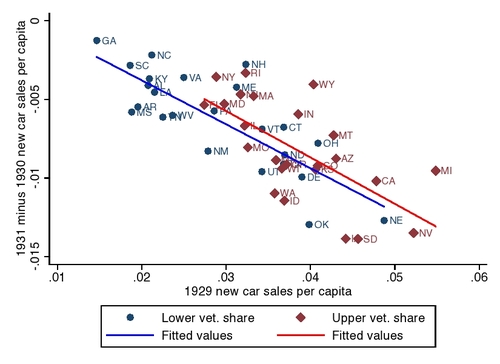

But taking a look at the latest Federal Reserve credit market growth by sector, you can see that credit demand has collapsed in this recession.

I actually think that credit access has gone down. For example it is a lot harder getting home-equity lines of credit these days than it used to be, even for those whose houses are worth a lot more than their mortgages. But Mike is right that many people are scared enough about the economy that they are trying to pay down their credit card debt. The key point here is that what makes sense from an individual point of view in time of recession–reducing household spending–makes things worse for all of us by reducing the amount of business that firms get and therefore how many workers feel they can hire. So to help out the macroeconomic situation, we want people to lean toward spending more than they otherwise would. Giving every taxpayer access to a federal line of credit at a reasonable interest rate and reasonable terms (say 6%, paid off over 10 years) would cause at least some people to spend more, which is what we want in order to stimulate the economy.

II. This policy is like giving a Rorschach test to a vigilante. No, not that vigilante. I mean the bond vigilantes.

Mike’s point here is that, although in the long-run, people will have to pay back the money they borrowed from the government on their Federal Lines of Credit, the government is out the money in the meantime, and this might add to the official deficit and national debt numbers. So if the folks in the bond market are not smart enough to look past the surface of the deficit and national debt numbers, they might cause long-term interest rates to go up. Here, my answer is simple: the folks in the bond markets are very, very smart. They know the difference between the government being out money forever (as it would be if it used a tax rebate) and the government making loans that will be repaid, say, 90% of the time. As evidence that the “bond vigilantes” look at more than the official debt to GDP ratios, take a look at this list of debt to GDP ratios. (I am using the International Monetary Fund’s numbers from this table, rounded off to the nearest percent. If there are more recent numbers, I am confident they will show the same thing.) Here are the examples that make my point:

Spain: 69%

Germany: 82%

United States: 103%

Japan: 230%

It is right to worry about the future, but currently, Spain is in trouble with the bond vigilantes, while the world is eager to lend money to Germany, the United States and Japan. (See my post “What to Do When the World Desperately Wants to Lend Us Money” about what this eagerness of the world to lend to the U.S. means for U.S. policy from a wonkish point of view that ignores political difficulties.) The reason Spain is in trouble with the bond vigilantes is that the Spanish government is seen to be on the hook for the much of the debts of Spanish banks; this bank debt that may become Spanish government debt sometime in the future does not show up in the official debt to GDP figures, but the bond vigilantes know all about it. On the other end, one reason that the bond vigilantes are still willing to lend money to Japan at low interest rates is that they know Japanese households do a lot of saving and don’t like to put their money abroad, so a lot of that saving makes its ways into Japanese government bonds, either directly or indirectly.

III. This policy will involve trying to get blood from a turnip. I very much distrust it when economists waive away bankruptcy protection. Especially for experimental, controversial debts that have never been tried in known human history.

As the paper admits, this is a machine for generating adverse selection, as the people most likely to use it are people whose credit access is cut due to the recession. High-risk users will likely transfer their balances from higher rate credit cards to their FOLC (either explicitly or implicitly over time if barred) - transferring a nice chunk of credit risk from the financial industry to taxpayers.

It’s also not clear what happens a few years later when consumers start to pay off the FOLC. Could that trigger another recession, especially if the creditor (the United States) doesn’t increase spending to compensate?

The issue isn’t whether or not the government will be able to collect these debts at some point. It has a long time-horizon, the ability to jail debtors and use bail to pay debts, the ability to seize income, old-age pensions and a wide variety of income, and the more general ability to deploy its monopoly on violence. The question is whether this will be smoother, easier, and more predictable than just collecting the money in taxes. We have a really smooth system for collecting taxes, one at least as good as whatever debt collection agencies are out there. If that is the case, there’s no reason to believe that this will satisfy the bond vigilantes or bring down our debt-to-GDP ratio in a more satisfactory way.

Mike actually raises several issues here. Let me be clear that I am not proposing jailing debtors! I am imagining something like the current system we have for student loans directly from the Federal government. These loans cannot be wiped away by bankruptcy, but no one is jailing former students who can’t pay what they owe on their student loans. When I supposed above that (including interest–I am thinking in present values) only 90% of the money would be repaid, the other 10% is money that the government ultimately gives up on trying to collect because some people can’t pay. To avoid any possible abuses, I think it would be a good idea to specify in the law authorizing Federal Lines of Credit that people’s debts under the program could never be sold to an outside collection agency: only official government employees would be allowed to make collection efforts. Worry about a political firestorm would prevent the government from doing the kinds of things the private collection agencies sometimes do. Almost all repayment would be through payroll deduction from people who are drawing a paycheck, with perhaps some repayment through small deductions from government transfers people receive when those government transfers are above a minimum level.

Is an expected loan-loss rate of 10% too much? Then it is easy to modify the program to reduce the loan-loss rate without reducing its effectiveness in recession-fighting by allowing those with higher incomes to borrow more and restricting the size of the lines of credit for those with lower incomes. For those worried about issues with Federal Lines of Credit like those Mike is raising, I strongly recommend reading my relatively accessible academic paper on the proposal: “Getting the Biggest Bang for the Buck in Fiscal Policy.” But now I am going to give you fair warning about what “relatively accessible” means by quoting the somewhat recondite way that I make this point in the paper:

One of the main factors in the level of de facto loan losses would be the extent to which the size of the lines of credit goes up with income. Despite the reduction in additional aggregate demand per headline size of the program that might be occasioned by conditioning on income, de facto loan losses would probably decline by a greater proportion, meaning that conditioning on income might improve the ratio of extra consumption to budgetary cost. Certainly, having the line of credit go up with income might reduce the level of implicit redistribution, which is a consideration I will not try to address here.

To translate, if we give rich taxpayers bigger lines of credit than poor taxpayers, we will probably get even more bang-for-the-buck from the program–in the sense that there will be more stimulus for each dollar ultimately added to the national debt after most repayment has happened.

I will confess that the only reason I didn’t make this kind of dependence of the size of the line of credit on income the benchmark version of the proposal is that I wanted to sneak in a little income redistribution into the program. But if next year we have a Republican Congress and a Republican President (now trading at a 30% probability on Intrade), stimulating the economy is important enough that it is still a very good thing to do the Federal Line of Credit program with less redistribution than I had in the benchmark version of the proposal, which gives the same-size line of credit to each taxpayer. On the other hand, if next year we have a Democratic Congress and a Democratic President (now trading at a 7.5% probability on Intrade), stimulating the economy is important enough that it is still a very good thing to do the Federal Line of Credit program with lines of credit of the same size not only for every taxpayer but also for non taxpaying adults and to let the debts be extinguished in bankruptcy. Federal Lines of Credit would still give us more bang-for-the-buck than other types of fiscal stimulus that a Democratic Congress and Democratic President might turn to, and regardless of what happens politically, the United States government does have to worry about the bond vigilantes down the road whenever it adds to the national debt in a long-run way. In what I consider the most likely case of divided government, where out of the presidency, the Senate and the House of Representatives, each party holds at least one (now trading at a 62.5% probability on Intrade if one includes the 4.5% probability of “other,” which presumably covers the case when the control of one house of congress depends on how the few independents vote), something in between–perhaps not too far from my benchmark proposal–seems to me what would be politically feasible.

In the passage I quoted from Mike labeled as his issue III, he also worries about whether the repayment of the loans would cause a recession later on. I have thought that stretching out repayment over 10 years would be enough to avoid this problem, but I view this an issue for the experts. If, as I prefer (see my post “Bill Greider on Federal Lines of Credit: 'A New Way to Recharge the Economy’”), the Federal Reserve determines many of the details of the Federal Lines of Credit Program, I trust the staff of the Federal Reserve Board and the Federal Reserve Banks to come up with a better answer on the appropriate length of time for loan repayment than either Mike or I could.

Finally, we come to Mike’s fourth and last issue, which motivated my discussion above about the value of separating long-run fiscal issues from short-run stabilization policy, so that recession-fighting doesn’t become a political football. What Mike writes to explain his fourth issue is long enough that I will intersperse some comments along the way. From here on, everything in block quotes reproduces Mike’s words.

IV.Since we’ve very quickly gotten to the idea that we’ll need to jettison legal protections under bankruptcy for this plan to work, it is important to emphasize that this policy is the opposite of social insurance.

As I said above, I am not advocating jailing debtors. I don’t see the fact that student loans are not expunged in bankruptcy as a massive social injustice that causes huge problems; if it is, it would meant that it is a travesty that the Obama administration is only proposing having private student loans wiped away by bankruptcy while leaving public student loans from the government untouched by bankruptcy. I am sure some people think that, and would not be surprised if that is Mike’s view, but I don’t think the average voter would take that view, nor do I criticize the Obama administration for not being willing to go far enough and have all student loans expunged in bankruptcy.

I don’t see a macroeconomic difference between the government borrowing 3 percent of GDP and giving it away and collecting it through taxes later versus the government borrowing 3 percent of GDP, loaning it to individuals, and collecting it later through debt collectors except in the efficiency and the distribution.

This passage is well-designed to underemphasize the fact that the way in which, say, “3 percent of GDP” is given away is redistributive. Indeed, to the extent that asking everyone to pay the same amount is regressive, giving everyone the same amount as in my benchmark proposal has to count as anti-regressive. There is no question that giving away 3 percent of GDP and collecting it later through progressive taxes would bemore redistributive. Overall, my program is fairly neutral as far as redistribution goes, though as I confessed, I snuck a little redistribution into my benchmark proposal because those with higher incomes would likely repay a bigger fraction of the borrowed money than those with higher incomes.

The distributional consequences of this proposal aren’t addressed, but they are quite radical. Normally taxes in this country are progressive. Some people call for a flat tax. This proposal would be the equivalent of the most regressive taxation, a head tax. And it also undermines the whole idea of social insurance.

Mike seems to be claiming that the Federal Lines of Credit program overall is regressive. I just don’t see this. Is the government’s student loan program regressive? Just because a program could be made more redistributive than it is, does not mean that on the whole it is regressive.

Let’s assume the poorest would be the people most likely to use this to boost or maintain their spending. I think that’s largely fair - certainly the top 10 percent are less likely to use this (they’ll prefer to use high-end credit cards that give them money back). This means that as the bottom 50 percent of Americans borrow and pay it off themselves, they would bear all the burden for macroeconomic stability through fiscal policy. Given that the top 1 percent captured 93 percent of the income growth in the first year of this recovery, that’s a pretty major transfer of wealth. One nice thing about tax policy, especially progressive tax policy, is that those who benefit the most from the economy provide more of the resources. This would be the opposite of that, especially in the context of a “"relatively-quickly-phased-in austerity program.”

Let me say quickly that my mention of “austerity” was in the European context, where paying what the bond market demands without a full-scale bailout from a reluctant Germany requires austerity. I made no mention of “austerity” for the U.S., nor do I think “austerity” will be necessary for the U.S., if we follow the kinds of proposals I recommend.

Going back up to the top of this block quote from Mike, again, saying that the bottom 50 percent of Americans “would bear all the burden for macroeconomic stability” ignores the fact that they were able to borrow and use the money when they really needed it during hard economic times. The only way in which this could be a burden is if loaning money on relatively favorable terms (again, say at 6% for 10 years) is an unkind temptation to people who have trouble stopping themselves from spending more now than they should. I worried about this, which is why I proposed that, by the time the next recession rolls around, we have National Rainy Day Accounts set up that allow people to spend in recessions or during documentable personal financial emergencies money that they have saved up previously. Now requiring someone to save money for later emergencies they might face, and encouraging them to spend some of that money in a national emergency such as a future recession may indeed be a burden. But it is hard for me to see how both proposals–letting people borrow on favorable terms from Federal Lines of Credit and requiring people to save in National Rainy Day Accounts–can be a burden. The only way that allowing people to borrow on favorable terms can be a burden is if they have trouble saving as much as they should, in which case setting up a structure to help them save will help them out. And Mike agrees that “There’s a lot to like about the proposal [Federal Lines of Credit], particularly how it could be used after a recession is over to provide high-quality government services to the under-banked or those who find financial services yet another way in which it is expensive to be poor …" On a more negative note, Mike continues as follows in the text of his fourth issue:

Efficiency is also relevant - as the economy grows, the debt-to-GDP ratio declines, making the debt easier to bear. The most likely borrowers under FOLC [sic], the bottom 50 percent, have seen stagnant or declining wages overall, especially in recessions. A growing economy would keep their wages from falling in the medium term, but this is still a problematic issue - their income is not more likely to grow to balance out the payment burdens than if we did this at a national level, like normal tax policy.

The policy also ignores social insurance’s role in macroeconomic stability, and that’s insurance against low incomes. Making sure incomes don’t fall below a certain threshold when times are tough makes good macroeconomic sense and also happens to be quite humane. This is not that. As friend-of-the-blog JW Mason said, when discussing this proposal, the FOLC [sic] is like "if your fire insurance simply consisted of a right to borrow money to rebuild your house if it burned down.”

Here again, I take Mike’s point that it would be easy to do more redistribution than the modest amount of redistribution in the Federal Lines of Credit proposal as I lay it out. But I view redistribution as the province of long-run fiscal policy (in the broadest sense). Trying to use recession-fighting as a way to also do more redistribution is a recipe for making recession-fighting a political football. If recession-fighting becomes a political football, as it has to an unfortunate extent in the last few years, the recession (or the long tail of unemployment that follows what are officially called “recessions”) wins. And bad economic times are especially hard on those at the bottom of the income distribution. So they can least afford to have recession-fighting become a political football. My hope is that Federal Lines of Credit will make it possible to stimulate the economy when necessary in a way that avoids major changes in taxing and spending that would set off alarms for one or another of the two warring parties in the political debate.