Gauti Eggertsson, Ragnar Juelsrud and Ella Getz Wold: Are Negative Nominal Interest Rates Expansionary?

Link to the NBER page for this paper. For an ungated version, use this link.

It is great to see people doing formal modeling of negative interest rate policy. And it is especially good to see work of this type by a team including Gauti Eggertsson, whose research I wrote so highly of in my post "Pro Gauti Eggertsson." I wish I knew Gauti's coauthors, Ragnar Juelsrud and Ella Getz Wold better. Since this was originally posted, I have corresponded with them. Ragnar sent me this link to an ungated version of the paper.

One of the most remarkable things about this paper is that instead of saying that the lower bound on interest rates is inevitable it explicitly bills itself as showing why the lower bound on interest rates needs to be removed. On pages 5 and 6, Gauti, Ragnar and Ella write this:

There is a older literature however, dating at least back to the work of Silvio Gesell more than a hundred years ago (Gesell, 1916), which contemplates more radical monetary policy regime changes than we do here. This literature has been rapidly growing in recent years. In our model, the storage cost of money, and hence the lower bound, is treated as fixed. However, policy reforms can potentially alter the lower bound or even remove it completely. An example of such policies is a direct tax on paper currency, as proposed first by Gesell and discussed in detail by Goodfriend (2000) and Buiter and Panigirtzoglou (2003). This scheme directly affects the storage cost of money, and thereby the lower bound on deposits which we derive in our model. Another possibility is abolishing paper currency altogether. This policy is discussed, among others, in Agarwal and Kimball (2015), Rogoff (2017c) and Rogoff (2017a), who also suggest more elaborate policy regimes to circumvent the ZLB. An example of such a regime is creating a system in which paper currency and electronic currency trade at different exchange rates. The results presented here should not be considered as rebuffing any of these ideas. Rather, we are simply pointing out that under the current institutional framework, empirical evidence and a stylized variation of the standard New Keynesian model do not seem to support the idea that a negative interest rate policy is an effective tool to stimulate aggregate demand. This should, in fact, be read as a motivation to study further more radical proposals such as those presented by Gesell over a century ago and more recently in the work of authors such as Goodfriend (2000), Buiter and Panigirtzoglou (2003), Rogoff (2017c) and Agarwal and Kimball (2015). In the discussion section we comment upon how our model can be extended to explore further some of these ideas, which we consider to be natural extensions.

Gauti, Ragnar and Ella return to this theme on page 33, near the end of the main body of the working paper:

In our model exercise, the storage cost of money was held fix. However, one could allow the storage cost of money - and therefore the lower bound on the deposit rate - to depend on policy. One way of making negative negative rates be expansionary, which is consistent with our account, is if the government takes actions to increase the cost of holding paper money. There are several ways in which this can be done. The oldest example is a tax on currency, as outlined by Gesell (1916). Gesell’s idea would show up as a direct reduction in the bound on the deposit rate in our model, thus giving the central bank more room to lower the interest rate on reserves - and the funding costs of banks. Another possibility is to ban higher denomination bills, a proposal discussed in among others Rogoff (2017c). To the extent that this would increase the storage cost of money, this too, should reduce the bound on the banks deposit rate. An even more radical idea, which would require some extensions to our model, is to let the reserve currency and the paper currency trade at different values. This proposal would imply an exchange rate between electronic money and paper money, and is discussed in Agarwal and Kimball (2015), Rogoff (2017a) and Rogoff (2017b). A key pillar of the proposal – but perhaps also a challenge to implementability – is that it is the reserve currency which is the economy wide unit of account by which taxes are paid, and accordingly what matters for firm price setting. If such an institutional arrangement is achieved, then there is nothing that prevents a negative interest rate on the reserve currency while cash in circulation would be traded at a different price, given by an arbitrage condition. We do not attempt to incorporate this extension to our model, but note that it seems relatively straightforward, and has the potential of solving the ZLB problem. Indeed, the take-away from the paper should not be that negative nominal rate are always non-expansionary, simply that they are predicted to be so under the current institutional arrangement. This gives all the more reason to contemplate departures from the current framework, such as those mentioned briefly here and discussed in detail by the given authors.

My post that most directly expresses this point is "If a Central Bank Cuts All of Its Interest Rates, Including the Paper Currency Interest Rate, Negative Interest Rates are a Much Fiercer Animal"

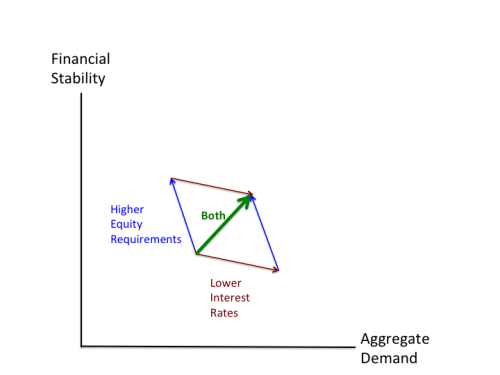

Putting their model in the context of my post "The Supply and Demand for Paper Currency When Interest Rates Are Negative," they are treating the case of a Rate of Effective Return on Cash (ROERC) curve that is flat after a certain point. I argue in my post that is not the only plausible case. There are several other ways in which their model simplifies away from issues I have stressed on my blog:

1. Gauti, Ragnar and Ella deemphasize transmission mechanisms that do not involve banks, which I argue in three key posts are quite important:

- Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates

- Responding to Joseph Stiglitz on Negative Interest Rates

- Negative Rates and the Fiscal Theory of the Price Level

However, even though there are transmission mechanisms that go around banks, causing problems for the banking system could easily be seen as an unacceptable side effect. I make this point in "What is the Effective Lower Bound on Interest Rates Made Of?"

2. In a way Gauti, Ragnar and Ella are very clear about, their model leaves out the subsidies that central banks pursuing negative interest rates can provide to private banks. Here is a key passage from pages 36 and 37:

Our model exercise focuses exclusively on the impact of negative policy rates39. Other monetary policy measures which occurred over the same time period are not taken into account. This is perhaps especially important to note in the case of the ECB, which implemented its targeted longer-term refinancing operations (TLTROs) simultaneously with lowering the policy rate below zero. Under the TLTRO program, banks can borrow from the ECB at attractive conditions. Both the loan amount and the interest rate are tied to the banks’ loan provision to households and firms. The borrowing rate can potentially be as low as the interest rate on the deposit facility, which is currently -0.40 percent40. Such a subsidy to bank lending is likely to affect both bank interest rates and bank profits, and could potentially explain why lending rates in the Euro Area have fallen more than in other places once the policy rate turned negative.

I have emphasized the importance of central bank subsidies to private banks in several posts:

- How to Handle Worries about the Effect of Negative Interest Rates on Bank Profits with Two-Tiered Interest on Reserves Policies

- Ben Bernanke: Negative Interest Rates are Better than a Higher Inflation Target

- The Bank of Japan Renews Its Commitment to Do Whatever It Takes

- Why Central Banks Can Afford to Subsidize the Provision of Zero Rates to Small Household Checking and Savings Accounts

3. In Gauti, Ragnar and Ella's model, if private banks tried to have negative rates on checking or savings accounts, all of their customers would turn to paper currency storage. But that is not the only possible interpretation of why they did not lower their checking and savings account rates below zero in negative interest rate companies. Thinking that even 5% of their customers would jump ship to another bank if they went first to negative checking and saving account rates would be enough to make these checking and saving account rates quite sticky at zero. But if the central bank took its target rate and interest on reserves into deeper negative territory, banks might lower their checking and saving account rates despite this fear. And if other banks followed suit, they might not lose as many customers as they feared.

In other words, isn't the first fear the fear of customers jumping to another bank if checking and saving account rates are reduced below zero, not paper currency storage? This would generate a stickiness that could be overcome in the way paper currency storage with a linear effective return of -.01 % annually cannot be overcome (without changing paper currency policy).

4. In line with much of the literature modeling monetary policy, Gauti, Ragnar and Ella do not have investment in the model. This makes their facsimile of the Great Recession in the model deficient. For what I consider a better model of the Great Recession, see "On the Great Recession."

Conclusion. I look forward to more articles doing formal models on negative interest rate policy. I wrote about paper that Gauti, Ragnar and Ella mention in "Markus Brunnermeier and Yann Koby's "Reversal Interest Rate." Matthew Rognlie has also written a nice paper in this genre: “What lower bound? Monetary policy with negative interest rates."

I anticipate writing something in this genre myself at some point in the future. Right now my priorities in writing academic papers on negative interest rate policy are writing a second policy-focused paper with Ruchir Agarwal and a paper with Peter Conti-Brown on the law relevant to negative interest rate policies in the US.