Nick Timiraos and Andrew Tangel: In the Long Term, an Economy Can’t Expand Faster than the Combined Growth Rates of Its Working Population and Their Output Per Hour

Nick Timiraos and Andrew Tangel's Wall Street Journal article on productivity and number of workers in the US explores many of the same themes as my talk "Restoring American Growth." One of the most basic truisms in the article is the one I made into the title of this post:

In the long term, an economy can’t expand faster than the combined growth rates of its working population and their output per hour.

Let me talk about each of these in turn, as they do.

The Drift of Policy is Against Growth in Number of Workers Because It Focuses on Prohibiting People from Working for the US Economy

Nick and Andrew write:

The president is pushing some policies that work against economic growth. Relatively low birthrates and an aging population mean immigration is the source of nearly all of the work force’s net increase, so its growth rate would be even lower if legal immigration were curbed.

For the most part, economic growth is judged in terms of income per person. But there is one exception: potential military power depends in important measure on total GDP, not just GDP per person. In "Benjamin Franklin's Strategy to Make the US a Superpower Worked Once, Why Not Try It Again?" and "Why Thinking about China is the Key to a Free World," I wrote of how allowing more immigration could add greatly to the military and therefore geopolitical strength of the US. Thus, allowing more immigration is the obvious way to "Make America Great Again" in the geopolitical sense. Conversely, treating being American as a closely guarded privilege that only those born to that privilege are allowed is a path to greatly reduced American power and influence. Of course, allowing more immigration is also extremely valuable to the immigrants themselves, as I talk about in "Us and Them" and "'The Hunger Games' Is Hardly Our Future--It's Already Here." But many people have a "Keep the Riffraff Out!" attitude that trumps concern with the America's power and the well-being of people who want to join us in our fair land.

Aggregate Demand Is No Longer Scarce

Other than immigration, is there room for expanding the number of workers in the US economy? NIck and Andrew argue this is difficult:

With the unemployment rate now at 4.4% and operating at a level economists consider to be “full employment,” meaning the economy produces as many jobs as it can without spurring inflation, the labor market provides little room for the kind of economic surge that marked the 1980s.

But there is a contrary argument:

White House Budget Director Mick Mulvaney ... pointed to millions of prime-age workers who aren’t in the labor force. “If you created economic opportunity and jobs that they want, they would come back,” Mr. Mulvaney said. “So I’m not worried about the tightness of the labor supply.”

This argument should not be dismissed too quickly. It is quite similar to arguments made by Narayana Kocherlakota in our storified Twitter debate "Narayana Kocherlakota and Miles Kimball Debate the Size of the US Output Gap in January, 2016."

When Monetary Policy Keeps the Economy at the Natural Level, the Supply Side Determines What Happens

Some people think that monetary policy alone can create growth miracles. It can't; not for long. Good monetary policy can readily cut short potential disasters such as the Great Depression or Great Recession, which is in itself quite valuable, but when monetary policy has done its job, then it takes other policies to raise the growth rate of the economy in a sustainable way.

And indeed, if monetary policy is done well, the remaining story will about the supply side. In my view, one of the best ways to get people to focus on the supply side—or what is sometimes called "structural reform"—is to do monetary policy so well that the economy stays at the natural level, or very close. What would this look like? Something like this description from Nick and Andrew, only more so:

If growth advances and productivity does too, policy makers may be able to keep interest rates lower for longer because productivity growth holds down inflation. Companies can boost profit margins and hold down costs, and thus inflation, when they can produce more goods and services with fewer workers.

If, on the other hand, the administration’s policies boost demand without drawing in new workers or raising their productivity, the growth that results could be harder to sustain because it would produce inflation. The Fed would feel additional pressure to raise interest rates to prevent the economy from overheating.

The Overall Trends in Productivity Growth Are Disappointing

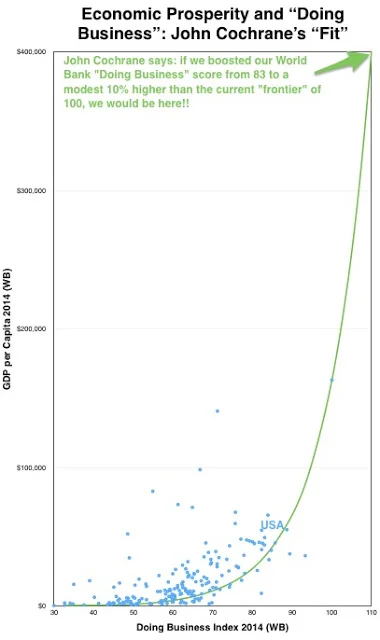

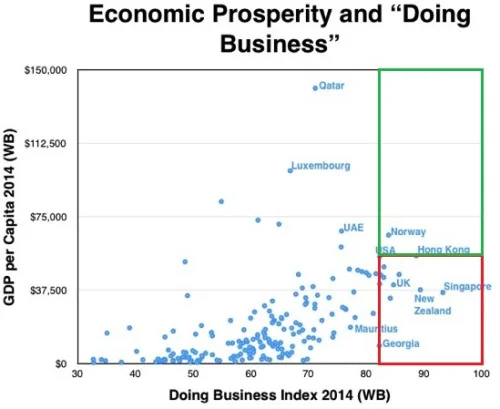

Nick and Andrew include a graph showing how the growth rate of output per work hour has declined in recent years:

I made a similar graph in the slides for my talk "Restoring American Growth." But where Nick and Andrew's graph gives credit for growth in the next 5 years and the last 5 years, my graph gives credit only for growth in the next 5 years after a given date, and so shows the decline in productivity growth after 2003 much more clearly:

A capsule history of productivity growth since World War II goes like this:

- Fast from the end of World War II in 1945 to 1973

- Slow from 1973 to 1995

- Fast from 1995 to 2003

- Slow from 2003 to the present and maybe beyond (2017+)

But to provide some perspective, however wrenching they have been politically, the "slow" growth rates from 1973 to 1995 and from 2003 to the present still represent the productivity growth rate that existed during the Industrial Revolution. The fast periods from the end of World War II in 1945 to 1973 and 1995-2003 made many people expect those productivity growth miracles to continue.

Productivity Growth Is Miserable in Construction

One of the big puzzles for productivity—one that deserves to have many more economists studying it—is why productivity growth in construction has been so miserable. Productivity growth has been quite high in manufacturing. Construction is also a seemingly straightforward physical activity involving the assembly of tangible materials. Why is its productivity growth trend so different from that of manufacturing?

Look at the difference in the productivity trends between construction ("Structures") and manufacturing (the other two):

Nick and Andrew also note the low productivity growth in construction. Here is their discussion:

Camden uses efficiencies such as prefabricated concrete building panels and roof trusses, “but there hasn’t been a huge breakthrough yet where we can lower costs dramatically,” said Mr. Campo. “You have a nail gun instead of a hammer, OK? But you still have to line it up and pull the trigger.”

Productivity in construction has contracted at a 1% annual rate since 1995, according to a study by McKinsey Global Institute, the research arm of McKinsey & Co., due in part to reliance on unskilled workers and in part to government red tape.

Joel Shine, chief executive of builder Woodside Homes Inc., visited Kyoto, Japan, to see how firms there use automation in home construction. He thinks it would take at least a decade for the innovations to become mainstream in the U.S., in part because they would require building-code changes.

State and local rules often play as big a role for his business as the federal government. Higher permitting fees, for instance, have raised construction costs in California towns. “There are a lot of places if you gave me a raw lot for free—for free!—I could not even come close to building an entry-level house,” Mr. Shine said.

I think this passage is part of the story. But I think there is more to the story of why construction productivity has gotten worse instead of better. I hope someone does more digging to find out.

Prospects for Productivity Growth Elsewhere are Unclear

There is hope that productivity growth—that is, growth in output per work hour—will pick up. But the prospects are unclear. Nick and Andrew counterpose these two views:

Some productivity optimists say gains from new technology will build in the years ahead. They see businesses incorporating a backlog of innovations in artificial intelligence, from self-driving vehicles to the processing of routine clerical work.

A paper from four growth specialists published by the Brookings Institution in March takes a dimmer view. It maintains that almost the entire shortfall in output during the recent expansion reflects long-term forces unrelated to the financial crisis and recession, including a drop in a measure of economic dynamism called “total factor productivity.” That measure reflects how efficiently labor and capital are used.

Of course, the future of technology is unavoidably difficult to know; to know enough to predict it well, we would have to know the future technology itself. I talk about that difficulty in "The Unavoidability of Faith."

What Can Be Done?

The question of what can be done is a difficult one. I know I don't have all of the answers, but I tried in my talk "Restoring American Growth" to make progress on this issue. I would be honored to have anyone reading this post listen to the video of that talk.