Balance Sheet Monetary Policy: A Primer

This is the First Post in the Monetary Policy Thread

In my first post, “What is a Supply-Side Liberal,” I promised to show that there is no shortage of powerful tools to revive both the U.S. economy and the world economy. In my second post, I started to fulfill that promise by proposing “federal lines of credit” as a way of stimulating consumption without adding much to the national debt. Federal lines of credit represent a policy somewhere between traditional fiscal policy and traditional monetary policy. In this post, I turn to monetary policy proper. Many of the currently most controversial issues about monetary policy revolve around principles that are easy to misunderstand, especially in unfamiliar situations like the current economic situation. So I need to explain these principles carefully. Trust me, even though they may seem basic, I will need these principles in the form I am laying them out in order to untangle the knots of current controversies in this and later posts.

To increase aggregate demand by monetary policy, my version of the basic principle is already known to devotees of Noahpinion.com, my brilliantly creative student Noah Smith’s blog. In “What I Learned in Econ Grad School, Part 2,” Noah reports me as saying that to stimulate an economy like Japan’s anytime in the last 20 years, or the U.S. or Europe now, the procedure to follow is “Print money and buy stuff!” Let me modify that a little to this:

WHEN BELOW NATURAL OUTPUT: PRINT MONEY AND BUY ASSETS!

Each part of this slogan is important:

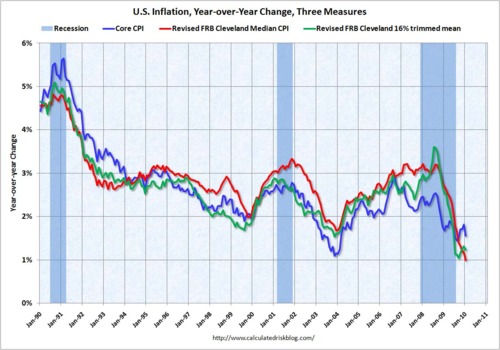

“WHEN BELOW NATURAL OUTPUT” means that aggregate demand needs to be reined in to keep it in line with the “natural level of output” just as often as it needs to be stimulated. The “natural level of output” is the level of output at which core inflation will be steady. Above the natural level of output, core inflation rises. Below the natural level of output, core inflation falls. This can be seen in the graph below which shows recessions by shading and core inflation by the blue line. Note that the graph stops at the beginning of 2010. (Thanks to Alexander Wolman for pointing this out.) I will put off any attempt to parse the current situation until another post. Let me say only that the current situation is a little hard to read, but the European debt crisis could easily make things worse, and lead to a situation in which additional stimulus is clearly called for.

“PRINT MONEY" means that the Federal Reserve System creates dollars as a bookkeeping entry to buy the assets from someone. The right to create dollars out of nothing is the source of the Fed’s power. Whoever sold the assets then has dollars that didn’t exist before. That person who has the new electronic money then has the right to ask the Federal Reserve System for the type of green pieces of paper in our pockets that say "Federal Reserve Notes” on them. Because banks are required to keep a certain fraction of any deposit as green pieces of paper in their vault or have the electronic equivalent in an account with the Fed as a reserve requirement, the amount of money created by the Fed matters. Money created directly by the Fed is called high-powered money and is closely related to what are called Federal funds. The interest rate paid by banks for the high-powered money they need is called the Federal funds rate.

Let me mention one more thing. What everyone else calls “the interest rate,” economists call the “nominal interest rate” to distinguish it from the “real interest rate” which is a concept much more beloved by economists (including me) than the lowly concept of the nominal interest rate. But in the context of monetary policy right now, the nominal interest rate is getting its time in the limelight because a nominal interest rate of zero is the rate of interest earned by the green pieces of paper we are so fond of.

Not too long after Lehman Brothers went bankrupt in September, 2008 the Fed brought the Federal funds rate down very close to zero. How did it do this? As a matter of supply and demand, in the short run at least, the more high-powered money the Fed creates, the less banks will pay in interest to have the high-powered money they are required to have. So the Federal funds rate falls when the Fed “prints” or electronically creates money. But there is a limit. Even if a bank doesn’t need the green pieces of paper to meet its reserve requirement, these green pieces of paper buried in the backyard or stuffed in a mattress, or left in a vault–or the electronic equivalents floating around in the Federal Reserve Systems piece of cyberspace–earn an interest rate of zero. So no one will lend the green pieces of paper at a rate lower than zero. So when the Fed funds rate gets down to zero, any extra high-powered money the Fed creates just piles up in bank vaults or in cyberspace. The banks won’t lend to each other at an interest rate (more than a tiny bit) lower than zero and they won’t lend to companies or families at a rate lower than zero because the banks can earn zero by just keeping the green pieces of paper in their vaults. This principle is called thezero lower bound on the nominal interest rate.

So, interestingly enough, once the nominal Fed funds rate is zero, the level of the money supply doesn’t matter very much any more! The reason is that money sitting in a bank vault doing nothing (which is exactly where a lot of it will sit and what it will do if the nominal interest rate is zero) doesn’t have much effect on the economy. The one way the level of the money supply does matter is that if the nominal Fed funds rate ever rises significantly above zero again, that money could wake up and overstimulate the economy if the Fed doesn’t vacuum it up by sellingassets to get back the money and annihilate it at that point. But the Fed is perfectly capable of doing that if the economy recovers. Also, as an alternative to selling assets to get the money back and annihilate it, the Fed now has the power to pay banks more than a zero nominal interest rate on the electronic high-powered money if the Fed chooses, so that banks would want to leave the high-powered money dormant and the money would not wake up.

The key point for current controversies is that money will not overstimulate the economy and cause inflation if it is sleeping in bankvaults, which is exactly what it will be doing if the Fed funds rate is zero.So the only reason to fear a large supply of high-powered money in the current situation is if you don’t trust the Fed to realize that when the economy is recovering it needs to vacuum up the high-powered money, or raise the interest rate it pays on high-powered money to keep that money asleep. Alan Blinder made this point in an excellent Wall Street Journal piece “In Defense of Ben Bernanke” a while back. He wrote:

To create the fearsome inflation rates envisioned by the more extreme critics, the Fed would have to be incredibly incompetent, which it is not.

So if a larger money supply doesn’t do much when the Fed funds rate is already zero, how does the Fed stimulate the economy after that point? The answer is in the last part of the slogan: "BUY ASSETS!“ Whenever the Fed buys any asset, its price goes up. You can think of it as the Fed adding to the demand for the asset or subtracting from the supply of the asset in private hands. Either way, when the Fed buys an asset, its price goes up.

What then? One of the most useful facts in all of Finance comes into play. For assets, a higher price is basically the same thing as a lower interest rate. This is easiest to see for a relatively simple asset such as a Treasury bill. When first sold, a Treasury bill is a promise by the U.S. Treasury to pay $10,000 three months from now. To make things easy, let me do some arithmetic with very high interest rates. First, suppose that you could buy the Treasury bill for $5,000. Then in three months you would be able to turn $5,000 into $10,000. So in three months you earned an extra $5,000 or 100% of the $5,000 you started with. Now, suppose the price of the Treasury bill went up, so you had to pay $8,000. Then in three months you would be able to turn $8,000 into $10,000. So in three months you earned $2,000 or 25% of the $8,000 you started with. The increase in the price of the Treasury bill from $5,000 to $8,000 reduced the three-month interest rate on Treasury bills from 100% to 25%. (The annual compounded interest rates would be much bigger.)

So any time the Fed buys an asset, it pushes up its price, which lowers its interest rate. Normally, what the Fed buys when it prints money is Treasury bills. But the Treasury bill rate is so strongly affected by the Fed funds rate that the Treasury bill rate would have gone down because the Fed funds rate went down anyway. So the fact that buying Treasury bills raises their price and therefore lowers their interest rate a little beyond what would happen as a result of the decline in the Fed funds rate alone is only a footnote for monetary policy. What is more, by the time the Fed funds rate is close to zero, the Treasury bill rate is also close to zero as well. So buying Treasury bills doesn’t provide any way around the zero lower bound on the nominal interest rate. To get an interest rate lower than zero on a Treasury bill, you would have to pay more than $10,000 now for a promise of $10,000 in three months. And no one is going to pay, say, $10,010 now for a promise of $10,000 in three months since anyone can get $10,000 in three months at a cost of only $10,000 now, simply by burying the $10,000 for three months.

But when the Fed buys other assets that have interest rates that are not so closely tied to the Fed funds rate, the fact that buying the asset raises its price and lowers its interest rate becomes very important. As long as any asset has a nominal interest rate above zero, buying that asset will raise its price and lower its interest rate. And there are a lot of assets in the world. Once the Fed buys these assets the values get written on a document called the Fed’s balance sheet. So when the Fed is changing interest rates through the ”BUY ASSETS!“ part of the slogan rather than through the ”PRINT MONEY" part of the slogan, it is balance sheet monetary policy. The Fed may be both printing money and buying assets, but if the nominal Fed funds rate is zero, it will only be the buying of the assets and putting them on its balance sheet that will be affecting interest rates, not the printing of the money.

To give one more example, in September 2011, the Fed did something more complicated: something called “Operation Twist”. Operation Twist involved a combination of selling Treasury bills and other short-term Treasuries to get money to buy long-term (6-30 year) Treasury bonds. Since the interest rate on Treasury bills was already pressed fairly hard up against the zero lower bound, lessening the pressure a little still left the interest rate on Treasury bills close to zero. But the long-term Treasury bonds had interest rates quite a ways above zero, and buying them pushed up their prices and lowered their interest rates.

All interest rates matter for the economy, so lowering almost any interest rate will stimulate the economy. And all interest rates affect all other interest rates, so lowering any interest rate tends to lower all other interest rates, at least a little bit. So the last key question for this post is “What are the limits on the Fed’s ability to lower interest rates by buying assets and raising their prices?” And here I mean technical limits, aside from any political considerations–and for now, aside from the legal limits on what the Fed is allowed to buy (more on that later). Also, since I am hoping that careful (and repeated) explanations of how all of this works can reassure people, I am also leaving aside any effects that come from people misunderstanding and getting scared by, say a large money supply–even when most of the money is asleep and the Fed is waiting to pounce on it and take care of it when the money wakes up.

Since the Fed can print as much money as it needs to buy assets, even trillions upon trillions of dollars if need be, there are only two technical limitations to the Fed’s ability to lower the interest rates on assets by buying them and raising their prices:

- lf the nominal interest rate on the asset gets down to zero, the Fed can’t go any further on that asset. It has to find some other asset that has a nominal interest rate above zero to buy.

- It is logically possible that sellers might sell all of a particular asset to the Fed before its interest rate gets down to zero. Then it has to find some other asset to buy that it doesn’t already have all of. Notice that this only happens when people don’t feel they really need that particular asset very badly, otherwise they wouldn’t sell it to the Fed so cheaply. So nothing bad happens as a result of the Fed buying all of an asset that people are willing to let go of that easily. (Remember that an interest rate above zero has to be associated with a lower price than what the asset would have at an interest rate equal to zero.)

What if the Fed bought all of the assets in the world other than money and the economy still didn’t have enough stimulus? Then companies would create additional assets to sell to the Fed, which would amount to the Fed making loans at a slightly more favorable interest rate than companies had been getting before. This would stimulate the economy more.

What if all the assets in the world got down to a zero nominal interest rate and the economy still didn’t have enough stimulus? Then, and only then, we would be in deep, deep trouble on the aggregate demand front from which there would be no escape through monetary policy. But we are far, far away from that situation. Simple economic models studied by economists often have this happen because they have so few types of assets in them, but the real world has a huge number of different types of assets, some with nominal interest rates that are still very far from zero.

Let me end by reminding you of the "WHEN BELOW NATURAL OUTPUT“ part of the slogan. Just because the Fed has the power to create a huge amount of additional aggregate demand doesn’t mean that this is a good idea. What we need is just the right a amount of extra aggregate demand. Suppose that because of the European debt crisis we do end up clearly needing a moderate amount of additional stimulus sometime in the near future. With the stimulative effects of printing money out of commission at the zero nominal interest rate, it might take a huge amount of asset buying (much more than the Fed has done already) to get the moderate amount of extra aggregate demand it will take to get output up to its natural level. But what’s wrong with that? As long as the Fed stands ready to pounce on the extra money it creates to buy the assets when that money wakes up, there is no serious problem with doing a huge amount of asset buying to get a moderate amount of extra aggregate demand. I am not claiming there is no risk to doing this, since we are new to serious use of balance sheet monetary policy, and all new things carry some risk. But there is also risk in not stimulating the economy if it needs stimulus.