Japan Should Be Trying Out a Next-Generation Monetary Policy

Here is a link to my 66th column on Quartz, “Japan should be trying out a next-generation monetary policy.” My working title was “Japan is wasting its time trying to raise inflation.”

Monday’s post “Is the Bank of Japan Succeeding in Its Goal of Raising Inflation?” was written in conjunction with writing this column.

Why Thinking about China is the Key to a Free World

Here is a link to my 65th column on Quartz: “An economist explains why the key to a free world lies with China.” This is my July 4th column, arriving a little early.

Update: Don’t miss the robust discussion in the comments below. I make some important clarifications there. Also, there is an interesting set of comments here on Facebook with a reply from me.

Update July 9, 2015: On the military technology dimensions, John L. Davidson tweeted a link to this interesting article on the important work on unmanned submarines.

Radical Banking: The World Needs New Tools to Fight the Next Recession

Here is a link to my 64th column on Quartz, “Radical Banking: The World Needs New Tools to Fight the Next Recession.” Among other things, this column gives a report about two amazing conferences in London about eliminating the zero lower bound.

VAT: Help the Poor and Strengthen the Economy by Changing the Way the US Collects Tax

The working title for this column was “Is a value-added tax really regressive?”

How Increasing Retirement Saving Could Give America More Balanced Trade

“TPP” stands for the “Trans-Pacific Partnership,” the free trade deal currently very much in the news. The working title for this column was “Free Trade; Balanced Trade.” I tried to reflect that and to more accurately reflect my views in the title of this post. In taking the screen shot, I consciously cut off the kicker “Whoops” at the top of the column on Quartz, since I tend to think most free trade deals are a good idea in any case. But I think they would be a better deal if we had more balanced trade–something that is possible with a surprisingly simple and interesting policy change.

In the column, I write:

Using back-of-the-envelope calculations based on the effects estimated in this research, they agreed that requiring all firms to automatically enroll all employees in a 401(k) with a default contribution rate of 8% could increase the national saving rate on the order of 2 or 3 percent of GDP.

Here is a rough idea of the kind of simple calculation that could back that claim up:

- Suppose current 401(k)’s give only one-quarter or less of the amount of saving if everyone had an 8% contribution rate–partly because many people aren’t covered at all. Then if no one opted out, the new regulation would add 6% to saving as a fraction of labor income. Multiply that by 2/3 for labor’s share, that is 4% more of GDP if no one opted out. Then the opt-out assumption is that 25% to 50% of people opt out.

However Low Interest Rates Go, The IRS Will Never Act Like a Bank

Chris has appeared before on supplysideliberal.com. For example, see

The Coming Transformation of Education: Degrees Don't Matter Anymore, Skills Do

Here is a link to my 60th column on Quartz, “Degrees don’t matter anymore, skills do.” The first part of the title of this post is my original working title.

I want to thank Steven Bogden for this crystallized idea about elite universities selling social status:

There will still be a few expensive elite colleges and universities; these schools are not just providing an education, they are selling social status, and the opportunity to rub shoulders with celebrity professors.

Swiss Pioneers! What Unpegging the Franc from the Euro Means for the US Dollar

Update, January 19, 2015: Denmark lowered its interest on reserves from -.05% to -.2%. Danmarks Nationalbank has viewed its currency peg with the euro as the heart of its monetary policy for many decades.

Thanks to Mark Fontana for letting me know in real time about the Swiss National Bank’s and Danmarks Nationalbank’s actions.

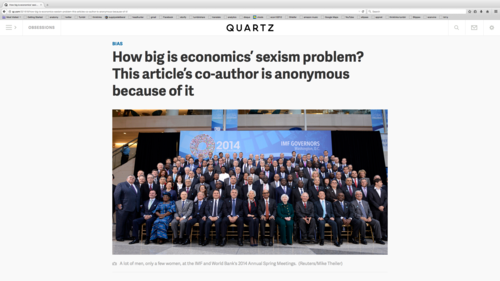

How Big is Economics' Sexism Problem? This Article's Co-Author is Anonymous Because of It

Here is a link to my 58th column on Quartz, “How big is economics’ sexism problem? This article’s co-author is anonymous because of it,” coauthored with an anonymous female economist.

Justin Wolfers has more tweets listing excellent female economists than my editor thought we could include without breaking up the flow too much. You can see them at

I also lobbied unsuccessfully for this sentence

What we mean is that female economists should be encouraged to assert their power, but male economists should find it hard or impossible to exert illegitimate, sexist power over their female colleagues.

to be changed to this more subtle take:

What we mean is that female economists should be encouraged to assert their power, but male economists should find it hard or impossible to exert illegitimate power (which gives those men an unfair advantage over women when that illegitimate power is exercised to intimidate other men into favoring them over women as well as when it is used directly against women).

But my editor thought that was overkill.

Reactions: Jeff Smith had a nice blog post reacting to the column, and Claudia Sahm had a very interesting Ello post.

In Defense of Clay Christensen: Even the ‘Nicest Man Ever to Lecture’ at Harvard Can’t Innovate without Upsetting a Few People

I wrote a version of this first as a blog post. I am delighted that my new editor at Quartz, Paul Smalera, liked it enough to publish it in Quartz. (My previous editor, Mitra Kalita, is now overseeing key aspects of Quartz’s global expansion.)

By the way, since I am blogging through Clay’s books (as I have been blogging through John Stuart Mill's On Liberty) I have a virtual sub-blog on Clay Christensen:

http://blog.supplysideliberal.com/tagged/clay

In the column, I give my take on Clay’s theory, which I think is important for economists to understand. Here is a teaser:

My views on Clay as a thinker come from reading six of Clay’s books this year …

As an economist, I found them fascinating. One of the hottest areas of economics in the last twenty years has been the border between economics and psychology. One basic idea at that intersection is that people have limitations in their ability to process information and make decisions. This idea that cognition is finite is a key issue in macroeconomics, as Noah Smith and I wrote about in “The Shakeup at the Minneapolis Fed and the Battle for the Soul of Macroeconomics—Again.” But the idea of finite cognition also matters a lot for businesses. Some decisions are hard even for people who spend their careers making those kinds of decisions, and the support of teams of experts.

Clay, in the management theory he has developed with various coauthors, identifies one key factor in how hard a decision is for a generally well-run business …

The Swiss National Bank Means Business with Its Negative Rates

This is a link to my 56th column on Quartz: “The Swiss are now at a negative interest rate due to the Russian ruble collapse.” I kept something closer to my working title as the title of this companion post, and as what I plan for the long-run title.

This column is in honor of all the amazing people I met at the Swiss National Bank.

Update December 19: Paul Krugman links to my column as a news source in his column “Switzerland and the Inflation Hawks.” The link is on the words “charging banks."

Righting Rogoff on Japan's Monetary Policy

Here is a link to my 55th column on Quartz: “Righting Rogoff on Japan’s monetary policy.”

This column is meant to back up my tweet:

Ken Rogoff is wrong when he says the BOJ’s Kuroda has done “whatever it takes” monetary policy for Japan: http://www.project-syndicate.org/commentary/japan-slow-economic-growth-by-kenneth-rogoff-2014-12…

One other note: Ken sent a nice reply to the email I sent him about my work on eliminating the zero lower bound, soon after I sent it.

Update December 19, 2014: Although the main point of my column is to emphasize the importance of putting negative paper currency interest rates in the monetary policy toolkit now rather than a decade or two from now (with particular urgency for the European Central Bank and the Bank of Japan), I know that for many readers, the reprise of the Spring 2013 media furor about Carmen Reinhart and Ken Rogoff’s work is equally salient. Personally, I believe eliminating the zero lower bound is much more important as whether debt lowers economic growth even when it doesn’t cause a debt crisis, but the issue of debt and growth does need to be addressed as well.

I had a chance to read Ken Rogoff’s and October 2013 FAQ http://scholar.harvard.edu/rogoff/publications/faq-herndon-ash-and-pollins-critique. Substantively, I think this is a good response to the Thomas Herndon, Michael Ash and Robert Pollin paper (linked there) that started the media furor in Spring 2013. But my own substantive concerns are not those. They are the concerns that Yichuan Wang and I detail in our two Quartz columns and two other posts on Reinhart and Rogoff’s work:

- http://blog.supplysideliberal.com/post/54317917221/quartz-24-after-crunching-reinhart-and-rogoffs

- http://blog.supplysideliberal.com/post/52121284524/for-sussing-out-whether-debt-affects-future

- http://blog.supplysideliberal.com/post/52849136298/instrumental-tools-for-debt-and-growth

- http://blog.supplysideliberal.com/post/55484991854/quartz-25-examining-the-entrails-is-there-any

In my view, these posts by Yichuan Wang and me are a good example of how, in Clay Christensen’s terms, the disruptive innovation of the economics blogosphere is beginning to move upscale and challenge traditional economics outlets such as working papers and journal articles.

I hope that, taken as a whole, what I write on my blog puts things in the context of the literature, and–through links–gives the kinds of references that are rightly considered important for academic work. In any case, for me the major source of the not inconsiderable number of references I have had in my academically published work come from other people telling me about work related to my own. The same thing happens online. I deeply appreciate the many links people send me in tweets and in more private communications.

Although it is natural for an individual blog post to be be much less complete than a working paper or journal article, I hope to achieve a reasonable balance between breadth and depth in this blog as a whole. And of course, the relative difficulty of putting mathematical equations in Tumblr means I will choose the working paper format once the number of equations needed to make a point exceeds a certain threshold.

To repeat, although Thomas Herndon, Michael Ash and Robert Pollin’s paper definitely piqued my interest and Yichuan’s interest and so led to our analysis of Carmen Reinhart and Ken Rogoff’s postwar data, I am critical of the substance of Carmen and Ken’s work based on my work with Yichuan, not based on the work of Thomas Herndon, Michael Ash and Robert Pollin.

In relation to our own critique of Carmen and Ken’s work, let me make three substantive points:

- Nonlinearity. In our last piece on Reinhart and Rogoff’s work, http://blog.supplysideliberal.com/post/55484991854/quartz-25-examining-the-entrails-is-there-any

- Yichuan and I look nonlinearly at how different levels of debt are related to growth beyond what one would expect from looking at past growth alone. It would be nice to have more evidence total, but on its face, the hint has a higher growth rate after controlling for past growth at a 90% debt to GDP ratio than at a 50% debt to GDP ratio. And we do suggest that what little evidence there is in the data suggests that, say, 130% debt to GDP ratio is associated with lower growth beyond what would be predicted by past growth than a 90% debt to GDP ratio, though a 130% debt to GDP ratio and a 50% debt to GDP ratio give about the same level of growth beyond what would be predicted by past growth alone. On theoretical grounds, it seems plausible to me, though far from an open-and-shut case that high enough debt levels would cause problems for economics growth. That thinking has led me to argue persistently that monetary stimulus is better than fiscal stimulus because it does not raise national debt. See for example my post “Monetary vs. Fiscal Policy: Expansionary Monetary Policy Does Not Raise the Budget Deficit.”But exactly how high that is matters a lot when people can’t be convinced of the virtues of negative interest rates so that fiscal stimulus remains an issue. I consider the nonlinear smoother result that (given what power there is in the postwar data set) the line is the same at a 130% debt to GDP ratio as at a 50% debt to GDP ratio, even after correcting for “illusory growth” on the part of Ireland and Greece as painting a considerably different picture than someone would get from reading Carmen Reinhart and Ken Rogoff’s, or Carmen Reinhart, Vincent Reinhart and Ken Rogoff’s work.

- Is controlling for past GDP growth appropriate? In my view, yes. I consider the past income growth controls important because countries that are generally messed up are likely to have both high debt and low growth. That doesn’t mean the high debt causes low growth. Most of the discussion has focused on reverse causality, but I consider the positive correlation across many dimensions of bad policy to be another big issue. I worry that the past income controls would make it hard to detect whether or not debt overhangs are followed by long-lasting low-growth periods, as Carmen, Vincent and Ken argue. But without some other way to control for the many, many other possible bad policies besides debt (which goes beyond the kind of growth accounting regressions that Ken’s FAQ document points to as strong evidence in favor of the view that debt might slow growth) this seems to me to point toward genuine empirical agnosticism about whether debt lowers growth as the right conclusion. (Theoretical arguments are a different matter.)

- Does the prewar data strongly bolster the case the debt slows growth? Here, it depends on what the question means. The prewar data were not as readily available as the postwar data, so Yichuan and I did not analyze them. And so I don’t know what they say, once subjected to the kind of empirical exercises I would like to subject them to. I would love to see an analysis like the one the Yichuan and I did on the postwar data applied to the prewar data. That said, the prewar data may answer the question of whether a given debt level lowered growth under the gold standard, or with prewar institutions that were weaker than current institutions. So I have my doubts about how much guidance it can give to policy now. Monetary policy in particular, had advanced dramatically since the pre-World War II era, even before the ongoing revolution against the paper currency standard.

Did Carmen and Ken overstate their case?

While I feel confident that Yichuan’s and my substantive critique has not been adequately addressed, I am much less confident about claims I made in

“Righting Rogoff on Japan’s monetary policy”

about how policy-makers interpreted Carmen and Ken’s work (and how they could have been expected to have interpreted it, given what was written).

Ken’s FAQ document points to the 2010 Voxeu article “Debt and Growth Revisited” as something that could have provided more balance to policy makers in interpreting Carmen (and Vincent) and Ken’s work. Because policymakers might be more likely to read a Voxeu article than an academic paper, this Voxeu piece is an important touchstone for whether Carmen and Ken overstated the strength of the empirical evidence in favor of the idea that high public debt slows down growth in the range that was relevant to policy in the last few years.

The issue I have with the Voxeu article “Debt and Growth Revisited” is that it never mentions the fact that the normal standard of establishing causality in economics is to find a good instrument, or some other source of exogeneity or quasi-exogeneity. In other words, the inherent difficulty of establishing causality in this kind of data is never mentioned. Here is how strongly Carmen and Ken suggest in their Voxeu article “Debt and Growth Revisited” that there is causal evidence despite the highly endogenous nature of the data:

Debt-to-growth: A unilateral causal pattern from growth to debt, however, does not accord with the evidence. Public debt surges are associated with a higher incidence of debt crises.9 This temporal pattern is analysed in Reinhart and Rogoff (2010b) and in the accompanying country-by-country analyses cited therein. In the current context, even a cursory reading of the recent turmoil in Greece and other European countries can be importantly traced to the adverse impacts of high levels of government debt (or potentially guaranteed debt) on county risk and economic outcomes. At a very basic level, a high public debt burden implies higher future taxes (inflation is also a tax) or lower future government spending, if the government is expected to repay its debts.

There is scant evidence to suggest that high debt has little impact on growth. Kumar and Woo (2010) highlight in their cross-country findings that debt levels have negative consequences for subsequent growth, even after controlling for other standard determinants in growth equations. For emerging markets, an older literature on the debt overhang of the 1980s frequently addresses this theme. …

… We have presented evidence – in a multi-country sample spanning about two centuries – suggesting that high levels of debt dampen growth.

I appreciate the note of uncertainty in the sentence

Perhaps soaring US debt levels will not prove to be a drag on growth in the decades to come.

But I feel that for the typical policy maker reading the Voxeu article, this note of uncertainty is largely cancelled out by the next sentence:

However, if history is any guide, that is a risky proposition and over-reliance on US exceptionalism may only prove to be one more example of the “This Time is Different” syndrome.

The phrase “if history is any guide” phrase in particular suggests that the historical evidence gives some clear guidance, and the sentence as a whole points to an interpretation of “Perhaps soaring US debt levels will not prove a drag on growth in the decades to come” as simply making a bow toward random variation around a regression line rather than expressing any uncertainty about what the causal regression line for the effect of debt on growth says before other random factors are added in.

In any case, saying “Perhaps soaring US debt levels will not prove to be a drag on growth in the decades to come” is not the same as if Carmen and Ken had said

Of course further research could overturn the suggestion we find in the evidence that high debt lowers growth, and there are always many difficulties with interpreting historical evidence of this kind.

Of course, there is always the possibility that Carmen and Ken said almost exactly that, in a forum that most policy makers would have noticed, but one that Idid not notice. (My own reading is ridiculously far from comprehensive.) If so, I would love to get a link to it. Ideally, I would like to see the main text of Ken's FAQ document collect in its main text all the details (including of course venue or outlet and date) about all the strongest caveats and cautions against overreading that Carmen, Vincent and Ken wrote about their work.

One extremely important note that the FAQ document does have is this quotation from Reinhart, Reinhart, and Rogoff (2012), “Public Debt Overhangs: Advanced-Economy Episodes since 1800.” (Journal of Economic Perspectives, 26(3)):

This paper should not be interpreted as a manifesto for rapid public debt deleveraging exclusively via fiscal austerity in an environment of high unemployment. Our review of historical experience also highlights that, apart from outcomes of full or selective default on public debt, there are other strategies to address public debt overhang, including debt restructuring and a plethora of debt conversions (voluntary and otherwise). The pathway to containing and reducing public debt will require a change that is sustained over the middle and the long term. However, the evidence, as we read it, casts doubt on the view that soaring government debt does not matter when markets (and official players, notably central banks) seem willing to absorb it at low interest rates – as is the case for now.”

This suggests to me that Paul Krugman went overboard in his criticism of Carmen and Ken–at least before he backed off somewhat. I am not up on all the details, but it is my understanding that some of Paul Krugman’s stronger criticisms against Carmen and Ken in terms of providing intellectual backing for austerity might have been better leveled against other influential economists, such as Alberto Alesina. But I would need a lot of help to know whether such criticisms were even appropriate for other influential economists such as Alberto. For the record, the current Wikipedia article on Alberto Alesina says:

In October 2009 Alesina and Silvia Ardagna published Large Changes in Fiscal Policy: Taxes Versus Spending,[3] a much-cited academic paper aimed at showing that fiscal austerity measures did not hurt economies, and actually helped their recovery. In 2010 the paper Growth in a Time of Debt by Carmen Reinhart and Kenneth Rogoff) was published and widely accepted, setting the stage for the wave of fiscal austerity that swept Europe during the Great Recession. In April 2013 some analysts at the IMF and the Roosevelt Institute found the Reinhart-Rogoff paper flawed. On June 6, 2013 U.S. economist and 2008 Nobel laureatePaul Krugman published How the Case for Austerity Has Crumbled[4] in The New York Review of Books, noting how influential these articles have been with policymakers, describing the paper by the ‘Bocconi Boys’ Alesina and Ardagna (from the name of their Italian alma mater) as “a full frontal assault on the Keynesian proposition that cutting spending in a weak economy produces further weakness”, arguing the reverse.

Thus, Wikipedia conflates Carmen and Ken’s views with those of Alberto Alesina and Silvia Ardagna.

But just as Carmen and Ken’s views should not be conflated with Alberto and Silvia’s views, neither should my views be conflated with Paul Krugman’s. Soon after Thomas Herndon, Michael Ash and Robert Pollin’s paper came out, I wrote in Quartz:

Unlike what many politicians would do in similar circumstances, Reinhart and Rogoff have been forthright in admitting their errors. (See Chris Cook’s Financial Times post, “Reinhart and Rogoff Recrunch the Numbers.”) They also used their response to put forward their best argument that correcting the errors does not change their bottom line. Given the number of bloggers arguing the opposite case—that Reinhart and Rogoff’s bottom line has been destroyed—it is actually helpful for them to make their case in what has become an adversarial situation, despite their self-justifying motivation for doing so. And though I see a self-justifying motivation, I find it credible that Reinhart and Rogoff’s original error did not arise from political motivations, since as they note in their response, of their two major claims—(1) debt hurts growth and (2) economic slumps typically last a long time after a financial crisis—the claim that debt hurts growth is congenial to Republicans, while the claim that it is normal for slumps to last a long time after a financial crisis is congenial to Democrats.

The results from the fairly straightforward data analysis that Yichuan and I did made me somewhat less sympathetic to Carmen and Ken. Nevertheless, I think they spoke and wrote in good faith. Errors of omission are a different issue, and there we all stand condemned, in a hundred different directions for each of us.

It is from the perspective that we all stand condemned for errors of omission of one type or another, that I hope my words in “Righting Rogoff on Japan’s monetary policy” are taken. I also urge you to distinguish carefully between simply reportingone side of the Spring 2013 debate about Reinhart and Rogoff’s work, and things I say on my own behalf: principally that Ken does not challenge policy-maker conventional wisdom as much as I would like to see.

Carmen and Ken literally did not have time enough to defend themselves adequately back in Spring 2013. Now that the dust has cleared, I would be glad to see them do more to tell their side of the story.

This update is my effort to make up for some of my own errors of omission when I wrote “Righting Rogoff on Japan’s monetary policy.” In particular, I thought wrestling with Ken’s FAQ document was the least I could do to give a little more voice to Carmen and Ken’s side of the story. (To the extent that you were persuaded by Thomas Herndon, Michael Ash and Robert Pollin’s paper, or were persuaded by unjustified accusations of bad faith on Carmen and Ken’s part, you should take a close look at that FAQ document.) As always for my columns, this update in the companion post will become part of the permanent record for this column 30 days or so after initial publication on Quartz, when I am contractually allowed to bring the column home to supplysideliberal.com.

The National Security Case for Raising the Gasoline Tax Right Now

In light of the title, I should point out that, from an efficiency standpoint (without regard to politics), there may no justification for phasing in a gasoline tax increase slowly. If a national security externality were like an environmental externality, that externality should ideally be reflected in the tax rate right now. But the national security externality is actually a pecuniary externality, so it would take some nontrivial reasoning to figure out whether or not there is any justification for phasing a gasoline tax in. It is an optimal taxation problem in which money in the hands of certain parties counts negatively.

Why You Should Care about Other People's Children as Much as Your Own

This column doesn’t just say we should care, it gives a plan for getting there. In particular, how we handle long-run fiscal policy can make a big difference to the level of altruism in our nation.

You can see links to all of my other Quartz columns lined up in reverse chronological order here, and in order of popularity here.

How to Turn Every Child into a "Math Person"

Here is a link to my 52d column on Quartz, “How to turn every child into a ‘math person.’”

In the companion post below, I have collected a few memories, ideas and suggestions that had to be cut out of the Quartz column to make the column flow well. I added some headings to make it clear where each bit fits in:

I spent at least as much time on math when I wasn’t supposed to be doing math as when I was: The teacher might have been talking about social studies, but I was finding the prime factorizations of all the numbers from 1 to 400 by writing “2 ×” for every other number “3 ×” for every third number, “5 ×” for every fifth number, etc.–and then repeating that process for every other even number, every third multiple of 3, every fifth multiple of 5, and so on). The prime factorizations I learned from that satisfyingly tedious task I distracted myself with in elementary school came in handy when I took my SAT’s. And to this day, the way I get a hotel room number firmly into my memory is by doing its prime factorization.

Nothing seemed like a failure: At one point I knew just enough algebra to know that doing the same thing to both side of an equation left it a true equation. So for a long time, I transformed equations endlessly with no idea at all of where I was trying to go with those equations. Later on, when I actually had a purpose in mind for what I wanted to accomplish with a bit of algebra, I was able to draw on all of that experience just wandering around in algebra-land. And because I knew what it was like to do math without having any particular objective, I was able to appreciate how important it was keep the objective clearly in mind when there was an objective.

Proofs on other topics to get kids ready for proofs in Geometry class: Many kids who do well with arithmetic and algebra have trouble with geometry class in middle school or high school. It is often very hard to understand the idea of a proof when can’t see any reason to doubt the proposition to be proved in the first place. It is much better to get kids used to the idea of a proof earlier on in a context where the proof tells them something that doesn’t seem obvious. My favorite is the proof that there are an infinite number of primes. (There is a whole page of Youtube videos to choose from on this.) And a lot of kids wonder if imaginary numbers are numbers at all. The proof that complex numbers with an imaginary components obey all the rules of arithmetic and algebra and therefore can be treated as legitimate numbers not only answers a question kids really have, but uses concepts from “The New Math” that confused many kids in the 1960’s in a way that is obviously useful.

Math resources I found useful:

- Montessori math toys

- Schaum’s Outline series

- The “Hungarian Problem Books” of challenging math problems

Resources to check out that might be good but that I don’t have any experience with:

- Khan Academy videos are at least free! Here is a set of videos about the Khan academy, including a TED talk by Salman Kahn and a “60 Minutes” segment and a talk by Bill Gates about the Khan Academy.

- Hands-on Equations for algebra

Note: if you want to advertise your tool or method for math instruction here, I encourage you to advertise it in a comment that you post in the comment box below. When I moderate the comments, I will approve comments that advertise tools or methods for math instruction like that unless I have reason to believe there is something wrong with that tool or method.

Italy Should Look to Ancient Rome to Reform Its Ineffective Senate

The idea for this column emerged during my trip to Rome, when I talked to Luigi Guiso about the economic and political situation in Italy. I wanted to thank him for all of his insights. Don’t construe that as his endorsement of my proposal, though!

Will Narendra Modi’s Economic Reforms Put India on the Road to Being a Superpower?

Here is a link to my 49th column on Quartz, “Cheer Modi On: Why you really want India to join the US and China as a superpower.” I kept my working title as the title of this companion post, since it better reflects the content of the column.

Important Note: Thirumaran makes the case in these storified tweets that Narendra Modi has been given a bad rap for his performance during the Gujarat riots in 2002.What I say in my column about that incident is based entirely on the Wall Street Journal article “Why Narendra Modi Was Banned From the U.S.” I would be glad to hear reactions to Thirumaran’s additional perspective.

Populations of the Most Populous Nations. I found the population figures in Wikipedia’s “World population” for the most populous countries very interesting.

- China: 1,364,970,000

- India: 1,245,280,000

- United States: 318,201,000

- Indonesia: 247,008,052

- Brazil: 201,032,714

- Pakistan: 186,709,000

- Nigeria: 173,615,000

- Bangladesh: 152,518,015

- Russia: 143,657,134

- Japan: 127,180,000

I hadn’t realized that the US was the third most populous nation. All of Europe, including 110,000,000 in the European part of Russia, is only listed at 742,000,000. The reason it makes sense to focus on population figures is that catch-up economic growth up to the cutting-edge level of income per capita is much easier than the economic goal of the US of pushing income per capita to levels the world has never seen before for any large nation.

I was clued into India being headed for beating out China in overall population by Thomas Piketty's Capital in the 21st Century. It is a fat enough book that I am only partway through. And I am glad I am reading it on a Kindle.

The Man in the Tank: It's Time to Honor the Unsung Hero of Tiananmen Square

Here is a link to my 48th column on Quartz “The Man in the Tank: It’s Time to Honor the Unsung Hero of Tiananmen Square.” In addition to my editor, Mitra Kalita, I want to thank my father, Edward Kimball, for excellent editorial suggestions in putting together this column.

The Tiananmen Square Massacre is an event well-deserving in its infamy of a two-day memorial. Tomorrow’s post will also remember.