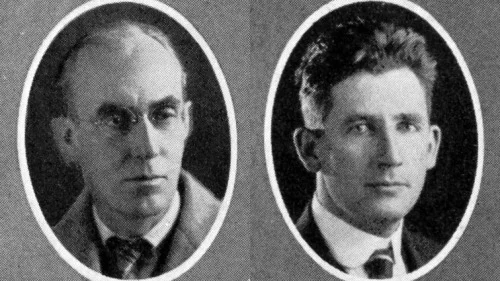

A very famous economist, Knut Wicksell, had used this equation before, but it was the work of Charles Cobb and Paul Douglas that gave this equation currency in economics. Because of their work, Paul Samuelson–a towering giant of economics–and his fellow Nobel laureate Robert Solow, picked up on this functional form. (Paul Samuelson did more than any other single person to transform economics from a subject with many words and a little mathematics, to a subject dominated by mathematics.)

In the equation, the letter A represents the level of technology, which will be a constant in this post. (If you want to think more about technology, you might be interested in my post “Two Types of Knowledge: Human Capital and Information.”) The Greek letter alpha, which looks like a fish (α), represents a number between 0 and 1 that shows how important physical capital, K–such as machines, factories or office buildings–is in producing output, Y. The complementary expression (1-α) represents a number between 0 and 1 that shows how important labor, L, is in producing output, Y. For now, think of α as being 1/3 and (1-α) as being 2/3:

As long at the production function has constant returns to scale so that doubling both capital and labor would double output as here, the formal names for α and 1-α are

- α = the elasticity of output with respect to capital

- 1-α = the elasticity of output with respect to labor.

What Makes Cobb-Douglas Functions So Great. The Cobb-Douglas function has a key property that both makes it convenient in theoretical models and makes it relatively easy to judge when it is the right functional form to model real-world situations: the constant-share property. My goal in this post is to explain what the constant-share property is and why it holds, using the logarithmic percent change tools I laid out in my post “The Logarithmic Harmony of Percent Changes and Growth Rates.” If any of the math below seems hard or unclear, please try reading that post and then coming back to this one.

The Logarithmic Form of the Cobb-Douglas Equation. By taking the natural logarithm of both sides of the defining equation for the Cobb-Douglas production function above, that equation can be rewritten this way:

log(Y) = log(A) + α log(K) + (1-α) log(L)

This is an equation that holds all the time, as long as the production engineers and other organizers of production are doing a good job. If two things are equal all the time, then changes in those two things must also be equal. Thus,

Δ log(Y) = Δ log(A) + Δ {α log(K)} + Δ {(1-α) log(L)}.

Remember that, for now, α= 1/3. The change in 1/3 of log(K) is 1/3 of the change in log(K). Also, the change in 2/3 of log(L) is 2/3 of the change in log(L). And quite generally, constants can be moved in front of the change operator Δ in equations. (Δ is also called a “difference operator” or “first difference operator.”) So

Δ log(Y) = Δ log(A) + α Δ log(K) + (1-α) Δ log(L).

As defined in “The Logarithmic Harmony of Percent Changes and Growth Rates,”the change in the logarithm of X is the Platonic percent change in X. In that statement X can be anything, including Y, A, K or L. So as long as we interpret %Δ in the Platonic way,

%ΔY = %ΔA + α %ΔK + (1-α) %ΔL

is an exact equation, given the assumption of a Cobb-Douglas production function.

Percent Changes of Sums: An Approximation. Now let me turn to an approximate equation, but one that is very close to being exact for small changes. Economists call small changes marginal changes, so what I am about to do is marginal analysis. (By the way, the name of Tyler Cowen and Alex Tabarrok’s popular blog Marginal Revolutionis a pun on the “Marginal Revolution” in economics in the 19th century when many economists realized that focusing on small changes added a great deal of analytic power.)

For small changes,

%Δ (X+Z) ≈ [X/(X+Z)] %ΔX + [Z/(X+Z)] %ΔZ,

where X and Z can be anything. (Those of you who know differential calculus can see where this approximation comes from by showing that d log(X+Z) = [X/(X+Z)] d log(X) + [Z/(X+Z)] d log(Z)], which says that the approximation gets extremely good when the changes are very small. But as long as you are willing to trust me on this approximate equation for percent changes of sums, you won’t need any calculus to understand the rest of this post.)

The ratios X/(X+Z) and Z/(X+Z) are very important. Think of X/(X+Z) as the fraction of X+Z accounted for by X; and think of Z/(X+Z) as the fraction of X+Z accounted for by Z. Economists use this terminology:

- X/(X+Z) is the “share of X in X+Z.”

- Z/(X+Z) is the “share of Z in X+Z."

By the way they are defined, the shares of X and Z in X+Z add up to 1.

The main reason the rule for the percent changes of sums is only an approximation is that the shares of X and Z don’t stay fixed at their starting values. The shares of X and Z change as X and Z change. Indeed, if one changed X and Z gradually (avoiding any point where X+Z=0), the approximate rule for the percent change of sums would have to hold exactly for some pair of values of the shares of X and Z passed through along the way.

The Cost Shares of Capital and Labor. Remember that in the approximate rule for the Platonic percent change of sums, X and Z can be anything. In thinking about the production decision of firms, it is especially useful to think of X as the amount of money that a firm spends on capital and Z as the amount of money the firm spends on labor. If we write R for the price of capital (the "Rental price” of capital) and W for the price of labor (the “Wage” of labor), this yields

For the issues at hand, it doesn’t matter whether the amount R that it costs to rent a machine or an office and the amount W it costs to hire an hour of labor is real (adjusted for inflation) or nominal. It does matter, though, that nothing the firm can do will change R or W. The kind of analysis done here would work if what the firm does affects R and W, but the results, including the constant-share property, would be altered. I am going to analyze the case when the firm cannot affect R and W–that is, I am assuming the firm faces competitive markets for physical capital and labor. Substituting RK in for X and WL in for Z, the approximate equation for percent changes of sums becomes

%Δ (RK+WL) ≈ [RK/(RK+WL)] %Δ(RK) + [WL/(RK+WL)] %Δ(WL)

Economically, this approximate equation is important because RK+WL is the total cost of production. RK+WL is the total cost because the only costs are total rentals for capital RK and total wages WL. In this approximate equation

- s_K = share_K = RK/(RK+WL) is the cost share of capital (the share of the cost of capital rentals in total cost.)

- s_L = share_L = WL/(RK+WL) is the cost share of labor (the share of the cost of the wages of labor in total cost.)

The two shares always add up to 1 (as can be confirmed with a little algebra), so

s_L = 1 - s_K.

Using this notation for the shares, the approximation for the percent change of total costs is

%Δ (RK+WL) ≈ {s_K} %Δ(RK) + {s_L} %Δ(WL).

The Product Rule for Percent Changes. In order to expand the approximation above, I am going to need the rule for percent changes of products. Let me spell out the rule, along with its justification twice, using RK and WL as examples:

%Δ (RK) = Δ log(RK) = Δ {log( R ) + log(K)} = Δ log( R ) + Δ log(K) = %ΔR + %ΔK

%Δ (WL) = Δ log(WL) = Δ {log(W) + log(L)} = Δ log(W) + Δ log(L) = %ΔW + %ΔL

These equations, reflecting the rule for percent changes of products, hold exactly for Platonic percent changes. Aside from the definition of Platonic percent changes as the change in the natural logarithm, what I need to back up these equations is the fact that the change in one thing plus another, say log( R ) + log(K), is equal to the change in one plus the change in the other, so that Δ {log( R ) + log(K)} = Δ log( R ) + Δ log(K). Using the product rule,

%Δ (RK+WL) ≈ {s_K} (%ΔR + %ΔK) + {s_L} (%ΔW+ %ΔL).

Cost-Minimization. Let’s focus now on the firm’s aim of producing a given amount of output Y at least cost. We can think of the firm exploring different values of capital K and labor L that produce the same amount of output Y. An important reason to focus on changes that keep the amount of output the same is that it sidesteps the whole question of how much control the firm has over how much it sells, and what the costs and benefits are of changing the amount it sells. Therefore, focusing on different values of capital and labor that produce the same amount of output yields results that apply to many different possible selling situations (=marketing situations=industrial organization situations=competitive situations) a firm may be in. That is, I am going to rely on the firm facing a simple situation for buying the time of capital and labor, but I am going to try not to make too many assumptions about the details of the firm’s selling, marketing, industrial organization, and competitive situation. (The biggest way I can think of in which a firm’s competitive situation could mess things up for me is if a firm needs to own a large factory to scare off potential rivals, or a small one to reassure its competitors it won’t start a price war. I am going to assume that the firm I am talking about is only renting capital, so that it has no power to credibly signal its intentions with its capital stock.)

The Isoquant. Economists call changes in capital and labor that keep output the same “moving along an isoquant,” since an “isoquant” is the set of points implying the same (“iso”) quantity (“quant”). To keep the amount of output the same, both sides of the percent change version of the Cobb-Douglas equation should be zero:

0 = %ΔY = %ΔA + α %ΔK + (1-α) %ΔL

Since I am treating the level of technology as constant in this post, %ΔA=0. So the equation defining how the Platonic percent changes of capital and labor behave along the isoquant is

0 = α %ΔK + (1-α) %ΔL.

Equivalently,

%ΔL = -[α/(1-α)] %ΔK.

With the realistic value of α=1/3, this would boil down to %ΔL = -.5 %ΔK. So in that case, %ΔK= 1% (a 1 % increase in capital) and %ΔL = -.5 % (a one-half percent decrease in labor) would be a movement along the isoquant–an adjustment in the quantities of capital and labor that would leave output unchanged.

Moving Toward the Least-Cost Way of Producing Output. To find the least-cost or cost-minimizing way of producing output, think of what happens to costs as the firm changes capital and labor in a way that leaves output unchanged. This is a matter of transforming the approximation for the percent change of total costs by

- replacing %ΔR and %ΔW with 0, since nothing the firm does changes the rental price of capital or the wage of labor that it faces;

- replacing %ΔL with -[α/(1-α)] %ΔK in the approximate equation for the percent change of total costs; and

- replacing s_L with 1-s_K.

After Step 1, the result is

%Δ (RK+WL) ≈ {s_K} %ΔK + {s_L} %ΔL.

After doing Step 2 as well,

%Δ (RK+WL) ≈ {s_K} %ΔK - {s_L} {[α/(1-α)] %ΔK}.

Then after Step 3, and collecting terms,

%Δ (RK+WL) ≈ {s_K - (1-s_K) [α/(1-α)]} %ΔK

= { [s_K/(1-s_K)] - [α/(1-α)] } [(1-s_K) %ΔK].

Notice that since the

1-s_K = s_L = the cost share of labor

is positive, the sign of (1-s_K) %ΔK is the same as the sign of %ΔK. To make costs go down (that is, to make %Δ (RK+WL) < 0), the firm should follow this operating rule:

1. Substitute capital for labor (making %ΔK > 0)

if [s_K/(1-s_K)] - [α/(1-α)] < 0.

2. Substitute labor for capital (making %ΔK < 0)

if [s_K/(1-s_K)] - [α/(1-α)] > 0.

Thus, the key question is whether s_K/(1-s_K) is bigger or smaller than α/(1-α). If it is smaller, the firm should substitute capital for labor. If s_K/(1-s_K) is bigger, the firm should do the opposite: substitute labor for capital. Note that the function X/(1-X) is an increasing function, as can be seen from the graph below: