First, define the "dragdown rate" b as

b = delta + n + g

delta = depreciation rate

n = population growth rate

g = growth rate of labor augmenting technology

Note that g = [growth rate of multiplicative technology A] /(1-α), where α is capital's share.

The reason I chose "b" as the letter for the dragdown rate is that

bK = breakeven investment

bk = breakeven investment per unit of effective labor.

The rate of change of capital per unit of effective labor is

dk/dt = sy - bk,

where

s = saving rate

sy = i = investment per unit of effective labor.

In steady state,

sy* = bk*

or in logarithms,

ln(s) + ln(y*) = ln(b) + ln(k*).

The other key equation is the production function. Given Cobb-Douglas and constant returns to scale, we can write it as

ln(y) = ln(multiplicative technology) + α ln(k).

To get a growth-steady-state expression involving technology, let's separate the logarithm of technology into two pieces:

trend log technology = (1-α)gt

(a growth rate of (1-α)g for the multiplicative technology, which corresponds to a growth rate of g when thinking of it as a labor-augmenting technology; t is time)

away from trend log technology, measured in multiplicative terms = ln(A).

This is a bit of a redefinition of A from how we used A earlier. This redefinition allows us to write that in steady state,

ln(y*) = ln(A) + α ln(k*).

The trend log technology has all been used up to keep growth-steady-state output growing at the same rate as growth-steady-state capital, so that in the absence of shocks, y* (the steady-state capital to effective labor ratio) and and k* (the steady-state output to effective labor ratio), are constant.

Collecting the two key equations:

ln(s) + ln(y*) = ln(b) + ln(k*) (1)

ln(y*) = ln(A) + α ln(k*) (2)

Let's substitute in the expression for ln(y*) from Equation (2) into Equation (1)

ln(s) + ln(A) + α ln(k*) = ln(b) + ln(k*)

collect terms in ln(k*)

ln(s) + ln(A) - ln(b) = (1-α) ln(k*)

and solve for ln(k*):

ln(k*) = [1/(1-α)] {ln(A) + ln(s) - ln(b)}. (3)

Substituting from Equation (3) into Equation (2) yields this for ln(y*):

ln(y*) = ln(A) + [α/(1-α)] {ln(A) + ln(s) - ln(b)}.

Now, note that ln(A) = 1 ln(A) and that

1 + [α/(1-α)] = 1/(1-α).

Then one can see that

ln(y*) = [1/(1-α)] ln(A) + [α/(1-α)] {ln(s) - ln(b)}. (4)

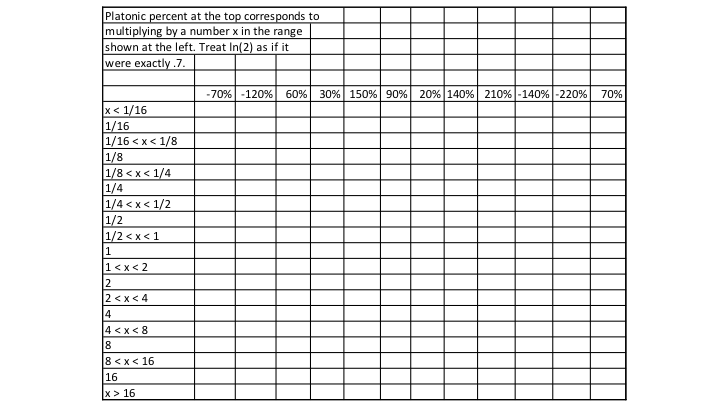

Equations (3) and (4) can be converted into Platonic percent change form as follows:

%Δk* = [1/(1-α)] {%Δln(s) + %Δln(A) - %Δln(b)} (5)

%Δy* = [1/(1-α)] %Δln(A) + [α/(1-α)] {%Δln(s) - %Δln(b)}. (6)

In words:

[1/(1-α)] = elasticity of k^* with respect to A

[1/(1-α)] = elasticity of k* with respect to s

-[1/(1-α)] = elasticity of k* with respect to b

[1/(1-α)] = elasticity of y* with respect to A

[α/(1-α)] = elasticity of y* with respect to s

- [α/(1-α)] = elasticity of y* with respect to b

This is most of what you need in order to do the exercise. The one other tricky think is that, for example, a change from b = .15 to .1515 is a 1% change in b, NOT a .15% change in b, and a change in b from .20 to .21 is a 5% change in b, NOT a 1% change in b. This is the difference between percent changes and percentage point changes that economists always have to worry about. The way to keep things straight is to realize that a percentage change (as opposed to a percentage point change) is always the change in the logarithm. In these examples,

ln(.1515) - ln(.15) = ln(.1515/.15) = ln(1.01) ≈ .01 = 1%

ln(.21) - ln(.20) = ln(.21/.20) = ln(1.05) ≈ .05 = 5%.

For b, don't think about percentage point changes (the easy but wrong way to go), think about percentage changes in the sense of the change in the natural logarithm of b. Exactly the same issue applies to the saving rate s.

I have broken this exercise into pieces. First, finding 1/(1-α) and α/(1-α) from α. Keep the answers off the screen while you do it. Alternatively, you can print out the slides of this Powerpoint file.