Wei Zhu: The Sharing Economy

Link to Wei Zhu’s economics blog

My Winter 2014 “Monetary and Financial Theory” class is over, but I read a flurry of excellent posts toward the end of the semester that I plan to publish as guest posts here in the coming Saturdays. Wei Zhu is one of several students in the class who have set up their own public blogs to continue blogging even now that the class is over. I think you will like his post about the Sharing Economy. (Catherine Rampell objects to calling it “sharing” in her Washington Post essay “What preschoolers can teach Silicon Valley about ‘sharing’”. I am very sympathetic to Catherine’s argument that the word “sharing” is being bent out of shape when applied to new, more convenient forms of rental, but I suspect that that moniker “sharing economy” is here to stay–at least for a few years, until it is old hat.)

What do

have in common? They are all billion-dollar ideas based on one concept: the Sharing Economy.

Like the name suggests, the Sharing Economy is “a socio-economic system built around the sharing of human and physical assets”(Wikipedia). The system sees the excess capacity in goods and services as a problem and solves it with collaborative consumption. Simply put, the Sharing Economy wants to lower your cost of living by letting you borrow a bike from you neighbor and make your trip in Puerto Rico much more enjoyable while cheaper by renting you a house in San Juan.

Jeremy Rifkin’s comments on Airbnb’s success explains a lot about the Sharing Economy:

“Airbnb owes its meteoric rise to a new phenomenon — near zero marginal cost — which is disrupting entire sectors of the global economy and giving rise to a new economic system riding alongside the conventional market. Marginal cost is the cost of producing an additional unit of a good or service once a business has its fixed costs in place, and for businesses like Airbnb, that cost is extremely low.”

The extremely low marginal cost is one of the greatest benefits of Sharing Economics. By efficiently redistributing resources among the crowd, this economy system significantly decreases the pressure of purchasing for individuals. For example, if you want to buy a vacuum machine, in the conventional market, you have to pay $200. That’s $200 per person. But with the sharing model, although the nominal price of the vacuum machine is the same, since you can share the purchase with your neighbor, the real cost becomes $200 divided by n. The more you share, the less you actually pay.

The concept is simple, but the impact can be huge.

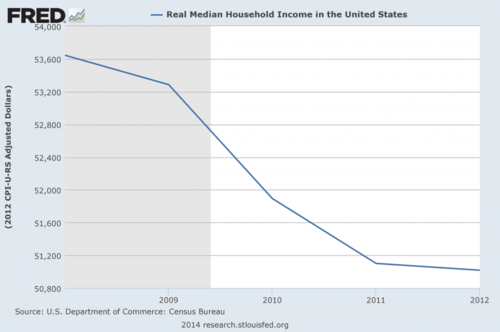

Since the beginning of the Great Recession, most households’ real income has been decreasing.

This forces average households to spend a greater portion of their income on food and other basic living expenses. People are scared of big purchases because of the financial pressure. Shared purchases, however, remove this pressure. The real expense on shareable goods is divided among several– and sometimes many–people therefore becomes much lower. With the shareable goods looking cheaper, people will be willing to pay for access to more goods.

The Sharing Economy can help people feel they have abundance despite scarce resources in a world that, despite falling birth rates, will have more people in the future than it does now. (The UN projects that, by the year of 2050, there will be 9.3 billion people in the world.) A world without resource-sharing would be relatively impoverished in that future.

One thing that may hold back the Sharing Economy, at least in the short run, is regulatory uncertainty. The Sharing Economy’s model suggests that everybody can be a service provider or property lender. This will surely introduce problems when it comes to security, licensing and the tax treatment of the Sharing Economy. But the success of Airbnb and Uber in their respective industries suggests that these regulatory issues can ultimately be overcome.