Top 52 All-Time Posts and All My Columns Ranked by Popularity, as of May 23, 2014

I keep my ranking of top columns updated along the way, but it is time to update the ranking of my top blog posts. You can see my explanation of the rankings and other musings after the lists.

All Quartz Columns So Far, in Order of Popularity:

- There’s One Key Difference Between Kids Who Excel at Math and Those Who Don’t

- The Coming Transformation of Education: Degrees Won’t Matter Anymore, Skills Will

- The Hunger Games is Hardly Our Future: It’s Already Here

- The Complete Guide to Getting into an Economics PhD Program

- Why Thinking about China is the Key to a Free World

- The Case for Gay Marriage is Made in the Freedom of Religion

- How to Turn Every Child into a “Math Person”

- How Big is the Sexism Problem in Economics?

- After Crunching Reinhart and Rogoff’s Data, We Find No Evidence That High Debt Slows Growth

- The Swiss National Bank Means Business with Its Negative Rates

- The National Security Case for Raising the Gasoline Tax Right Now

- Will Narendra Modi’s Economic Reforms Put India on the Road to Being a Superpower?

- The Shakeup at the Minneapolis Fed and the Battle for the Soul of Macroeconomics

- How Increasing Retirement Saving Could Give America More Balanced Trade

- Human Grace: Gratitude is Not Simple Sentiment; It is the Motivation that Can Save the World

- Larry Summers Just Confirmed That He is Still a Heavyweight on Economic Policy

- An Economist’s Mea Culpa: I Relied on Reinhart and Rogoff

- Examining the Entrails: Is There Any Evidence for an Effect of Debt on Growth in the Reinhart and Rogoff Data?

- How to Avoid Another NASDAQ Meltdown: Slow Down Trading (to Only 20 Times Per Second)

- Odious Wealth: The Outrage is Not So Much Over Inequality but All the Dubious Ways the Rich Got Richer

- Benjamin Franklin’s Strategy to Make the US a Superpower Worked Once, Why Not Try It Again?

- America’s Big Monetary Policy Mistake: How Negative Interest Rates Could Have Stopped the Great Recession in Its Tracks

- Gather ‘round, Children, and Hear How to Heal a Wounded Economy

- Show Me the Money!

- QE or Not QE: Even Economists Needs Lessons In Quantitative Easing, Bernanke Style

- Don’t Believe Anyone Who Claims to Understand the Economics of Obamacare

- Swiss Pioneers! The Swiss as the Vanguard for Negative Interest Rates

- Radical Banking: The World Needs New Tools to Fight the Next Recession

- The Government and the Mob

- How Italy and the UK Can Stimulate Their Economies Without Further Damaging Their Credit Ratings

- Janet Yellen is Hardly a Dove: She Knows the US Economy Needs Some Unemployment

- Four More Years! The US Economy Needs a Third Term of Ben Bernanke

- Japan Should Be Trying Out a Next Generation Monetary Policy

- Why the US Needs Its Own Sovereign Wealth Fund

- One of the Biggest Threats to America’s Future Has the Easiest Fix

- Could the UK be the First Country to Adopt Electronic Money?

- Righting Rogoff on Japan’s Monetary Policy

- Optimal Monetary Policy: Could the Next Big Idea Come from the Blogosphere?

- Why You Should Care about Other People’s Children as Much as Your Own

- Get Real: Bob Shiller’s Nobel Should Help the World Improve Imperfect Financial Markets

- In Defense of Clay Christensen: Even the ‘Nicest Man Ever to Lecture’ at Harvard Can’t Innovate without Upsetting a Few People

- Actually, There Was Some Real Policy in Obama’s Speech

- Meet the Fed’s New Intellectual Powerhouse

- Read His Lips: Why Ben Bernanke Had to Set Firm Targets for the Economy

- More Muscle than QE3: With an Extra $2000 in their Pockets, Could Americans Restart the U.S. Economy?

- How Subordinating Paper Money to Electronic Money Can End Recessions and End Inflation

- That Baby Born in Bethlehem Should Inspire Society to Keep Redeeming Itself

- Three Big Questions for Larry Summers, Janet Yellen, and Anyone Else Who Wants to Head the Fed

- Judging the Nations: Wealth and Happiness Are Not Enough

- The Man in the Tank: It’s Time to Honor the Unsung Hero of Tiananmen Square

- Yes, There is an Alternative to Austerity Versus Spending: Reinvigorate America’s Nonprofits

- John Taylor is Wrong: The Fed is Not Causing Another Recession

- However Low Interest Rates Might Go, the IRS Will Never Act Like a Bank

- Why Austerity Budgets Won’t Save Your Economy

- Monetary Policy and Financial Stability

- Make No Mistake about the Taper—the Fed Wishes It Could Stimulate the Economy More

- Nationalists vs. Cosmopolitans: Social Scientists Need to Learn from Their Brexit Blunder

- Off the Rails: What the Heck is Happening to the US Economy? How to Get the Recovery Back on Track

- VAT: Help the Poor and Strengthen the Economy by Changing the Way the US Collects Tax

- Talk Ain’t Cheap: You Should Expect Overreaction When the Fed Makes a Mess of Explaining Its Plans

- Obama Could Really Help the US Economy by Pushing for More Legal Immigration

- Does Ben Bernanke Want to Replace GDP with a Happiness Index?

- How to Stabilize the Financial System and Make Money for US Taxpayers

- How the Electronic Deutsche Mark Can Save Europe

- Al Roth’s Nobel Prize is in Economics, but Doctors Can Thank Him, Too

- Italy Should Look to Ancient Rome to Reform Its Ineffective Senate

- Symbol Wanted: Maybe Europe’s Unity Doesn’t Rest on Its Currency. Joint Mission to Mars, Anyone?

Major Pieces First Appearing in Other Outlets (in Arbitrary Order)

- Slate: Governments Can and Should Beat Bitcoin at Its Own Game

- VoxEU: Happiness and Satisfaction Are Not Everything: Toward Well Being Indices Based on Stated Preferences

- Pieria: Going Off the Paper Standard

- The Costs and Benefits of Repealing the Zero Lower Bound … and Then Lowering the Long-Run Inflation Target

- The Independent: Why George Osborne Should Give Everyone in Britain a New Credit Card

Columns Rejected by Quartz Because of Their Topics

- Safe, Legal, Rare and Early (on abortion)

- The Pope and the Prophet: Letting Go (on facing old age)

Top 52 Posts on supplysideliberal.com:

- The Wall Street Journal’s Quality-Control Failure: Bret Stephens’s Misleading Use of Nominal Income in His Editorial 'Obama’s Envy Problem’ 7508

- Contra John Taylor 7390

- The True Size of Africa, Revisited 7317

- Joshua Foer on Deliberate Practice 7110

- Dr. Smith and the Asset Bubble 6735

- Daniel Coyle on Deliberate Practice 6425

- Shane Parrish on Deliberate Practice 6413

- The Medium-Run Natural Interest Rate and the Long-Run Natural Interest Rate 5961

- Scott Adams’s Finest Hour: How to Tax the Rich 4866

- Balance Sheet Monetary Policy: A Primer 4761

- Sticky Prices vs. Sticky Wages: A Debate Between Miles Kimball and Matthew Rognlie 4744

- The Logarithmic Harmony of Percent Changes and Growth Rates 4724

- What is a Supply-Side Liberal? 4684

- The Message of Mormonism for Atheists Who Want to Stay Atheists 4108

- Isaac Sorkin: Don’t Be Too Reassured by Small Short-Run Effects of the Minimum Wage 3977

- Noah Smith Joins My Debate with Paul Krugman: Debt, National Lines of Credit, and Politics 3848

- On Master’s Programs in Economics 3711

- Heroes of Science Action Figures 3013

- The Deep Magic of Money and the Deeper Magic of the Supply Side 2860

- Noah Smith: God and SuperGod 2853

- Trillions and Trillions: Getting Used to Balance Sheet Monetary Policy 2624

- You Didn’t Build That: America Edition 2583

- The Egocentric Illusion 2522

- Why I Write 2521

- Two Types of Knowledge: Human Capital and Information 2499

- Why Taxes are Bad 2471

- Noah Smith: Mom in Hell 2414

- How Conservative Mormon America Avoided the Fate of Conservative White America 2378

- How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide 2271

- No Tax Increase Without Recompense 2260

- Monetary vs. Fiscal Policy: Expansionary Monetary Policy Does Not Raise the Budget Deficit 2137

- Books on Economics 2108

- Getting the Biggest Bang for the Buck in Fiscal Policy 2098

- The Unavoidability of Faith 2060

- Teleotheism and the Purpose of Life 2029

- The Mormon View of Jesus 1951

- Why I am a Macroeconomist: Increasing Returns and Unemployment 1921

- Milton Friedman: Celebrating His 100th Birthday with Videos of Milton 1871

- The Shape of Production: Charles Cobb’s and Paul Douglas’s Boon to Economics 1841

- Electronic Money: The Powerpoint File 1831

- Three Goals for Ph.D. Courses in Economics 1803

- Let the Wrong Come to Me, For They Will Make Me More Right 1802

- John Stuart Mill’s Brief for Freedom of Speech 1766

- Inequality Aversion Utility Functions: Would $1000 Mean More to a Poorer Family than $4000 to One Twice as Rich? 1750

- On the Great Recession 1745

- Scrooge and the Ethical Case for Consumption Taxation 1723

- Government Purchases vs. Government Spending 1721

- Jobs 1695

- Kevin Hassett, Glenn Hubbard, Greg Mankiw and John Taylor Need to Answer This Post of Brad DeLong’s Point by Point 1614

- Top 10 Posts on supplysideliberal.com 1584

- Is Taxing Capital OK? 1553

- When the Government Says “You May Not Have a Job” 1529

Explanation of the rankings:

The top 52 posts on supplysideliberal.com listed above are based on Google Analytics pageviews from June 3, 2012 through around 9 pm on May 22, 2014. The number of pageviews is shown by each post. Not counting Quartz pageviews and pageviews from some forms of subscription, Google Analytics counts 504,893 pageviews during this period but, for example, 135,805 homepage views could not be categorized by post.

I have to handle my Quartz columns separately because that pageview data is proprietary. My very most popular pieces have been Quartz columns, so I list them first. I have listed them all plus a few columns in other outlets, with the ones with no data (yet) listed at the bottom. (To avoid duplication, I have disqualified companion posts to Quartz columns from the top 40 blog post list, since they eventually get recombined with the Quartz columns when I repatriate the columns. For these columns, the ranking is by pageviews at a point where things have settled down. For later posts, that is standardized to pageviews during the first 30 days when Quartz has an exclusive.)

Going forward as in the past, I plan to update the list of columns as new columns appear, but the list of posts is locked in place until the next time I do a post like this.

You might also find other posts you like in this earlier list of top posts. If you want to compare all the shifts to the last time I did the list of top blog posts, here it is. Last time, October 14, 2013, I did the top 40. In just the top 40 above, there are 15 new entrants since that last time. Conversely, 6 out of last time’s top 40 didn’t even make it into the top 52 this time.

Musings:

- Five of the top ten–1, 2, 4, 7, 8–are about education. Somewhat to my surprise, this has emerged as an important theme on my blog, as Noah Smith identified when writing about this blog.

- Four of the top ten columns are coauthored: 1 and 4 with Noah Smith, 8 with Anonymous and 9 with Yichuan Wang. It helps to have a top-notch coauthor.

- Two of the top ten–3 and 6–are relatively recent columns with a strong religious or moral tone to them. I am glad to see that my efforts to articulate religious and moral themes find an audience as well as what I have to say about economics. I actually consider 5 to be in this category as well.

- One of the top ten–9–is about Reinhart and Rogoff. Levels of interest for understanding Reinhart and Rogoff’s mistake was extraordinary.

- One thing I pay attention to is how great a reach my most popular column on negative interest rates is. I am pleased to have one at 9.

- Two of the top ten–3 and 5–touch on national security.

- There is a clear time trend in the data. Later columns and posts have an advantage over earlier columns and posts of equal quality.

- Other than “Dr. Smith and the Asset Bubble,” which is very popular because of the love many justifiably have for Noah Smith as a blogger, the top 7 blog posts all had the advantage of being flagged in very high traffic columns. The Wall Street Journal’s Quality-Control Failure: Bret Stephens’s Misleading Use of Nominal Income in His Editorial 'Obama’s Envy Problem’ and "Contra John Taylor“ were flagged by Paul Krugman, The True Size of Africa, Revisited was flagged by Tyler Cowen, and Joshua Foer on Deliberate Practice, Daniel Coyle on Deliberate Practice, and Shane Parrish on Deliberate Practice were flagged by Noah’s and my viral column There’s One Key Difference Between Kids Who Excel at Math and Those Who Don’t. Given this competition, the ones just below the top 7 that do well without such an advantage are doing impressively well–in particular, ”The Medium-Run Natural Interest Rate and the Long-Run Natural Interest Rate.“

- I am pleased at how many posts that seem especially useful for teaching and understanding policy have crept ahead of posts they used to be behind. This is associated with the fact that when I look at traffic over narrow, recent periods of time, there is a long tail of older posts people find useful that is generating most of the traffic on a typical day or week.

- The mini-bio for me on Quartz says I blog about "economics, politics and religion.” I am glad to see that my religion posts and Noah Smith’s guest religion posts (collected in my Religion Humanities and Science sub-blog) are getting some attention. Religion is represented by 8 posts in the top forty, in spots 14, 20, 23, 27, 28, 34, 35 and 36. Since the presidential election, I actually haven’t written that much about politics–other than in very close connection to policy, so I am not surprised that politics doesn’t make much of an appearance in either of the lists above. The major exception is “That Baby Born in Bethlehem Should Inspire Society to Keep Redeeming Itself.”

- I had planned to stop at the top 50 this time, I went to the top 52, because I feel number 52, When the Government Says “You May Not Have a Job”, is so important. I feel there is close enough to free disposal that I am not burdening readers too much by extending the list all the way from 40 to 52, and maybe benefitting some readers who will feel as positively as I do about these posts further down the list. And 52 is the number of weeks in a year. (Hint, hint.)

- Finally, let me say that one of the things I am most pleased by is how many people are checking out the details of my proposal to eliminate the zero lower bound in How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide and Electronic Money: The Powerpoint File.

A Sketch of Miles Kimball | drawyourprofessor.com

Here is a link to this sketch of me on drawyourprofessor.com. I am honored that one of my students would take the trouble to draw me.

Thanks to Evan Jenkins for flagging this.

“Problems don’t age well, and denial is no good.”

– Jamie Dimon, as quoted in Clutch, by Paul Sullivan, p. 135

Why I Read More Books than Economic Journal Articles

One of my economist friends asked me why it is that I read more books than economic journal articles. The question made me think. Here is the answer I came to.

First, books are on average much better written–at least the books I read. There are some journal articles that are a joy to read, but the average economics journal article is not. (In the quality of writing, reading a newspaper article or a good blog post is more like reading a book than it is like reading an economic journal article.)

Second, I think of myself as a social scientist first and an economist second, so there is a lot of ground to cover.

Third, I often find it exhausting to read a journal article because if I really dig in to understand it, I find myself either (a) figuring out how one could write the paper it should have been, if the article is not that good, or much more infrequently, (b) finding myself inspired and wanting to do half a dozen new projects because the article is so great. (And a new project inspired by a journal article is seldom something that can be completed quickly.) Because reading journal articles tempts me to rechannel my energies in many new directions when I am already spread thin, that effect from reading a journal article is much more distracting to the essential work I need to focus on than reading books is.

Evolutionary theory has the concept of frequency-dependent selection: there are some things, like left-handedness that are advantageous for survival and reproduction as long as they are reasonably rare. (In the case of left-handedness, the speculation is that if it is rare, left-handedness gave an advantage in combat because one’s opponent would have to face moves he had less experience with.) My pattern is unusual among economists who publish in economic journals with some regularity, but precisely because it is rare, I think having one more person (me) doing things the way I do is valuable.

In another context, when I was criticized for being weak in a particular dimension helpful for professional success, I thought to myself “What strengths I have don’t come for free.” I have the strengths I have in important measure because I spend a lot of time developing those strengths–something that has unavoidable tradeoffs in less time to develop certain other skills.

Actually, having that thought is something that itself came from hard-won knowledge about the malleability of intelligence from reading the kind of books that Noah Smith and I talk about in “There’s One Key Difference Between Kids Who Excel at Math and Those Who Don’t.” I tell the story in “How the Idea that Intelligence is Genetic Distorted My Life—Even Though I Worked Hard Trying to Get Smarter Anyway” of how culturally, I was brought up to believe that one simply started out smart or not. If that were true, it would mean that for those who are lucky, intellectual strengths would come largely for free. I don’t believe that any more, but it took a lot of reading to get to the view I have now–the view Noah and I lay out in “There’s One Key Difference Between Kids Who Excel at Math and Those Who Don’t."

Noah Smith: Buddha Was Wrong About Desire

In this image, the one on the elephant represents Noah Smith.

I am pleased to be able to publish another guest religion post by Noah Smith. Noah's other guest religion posts on supplysideliberal.com are

My favorite of Noah’s religion posts is still “God and SuperGod,” but Noah’s personal favorite is this one, right here. Here is Noah’s tussle with classic Buddhism:

“Sun/ Felt numb” – Nirvana

One of the central tenets of Buddhism is that tanha, or desire, leads to dukkha, or suffering. Much of Buddhism, as it was originally conceived, is about eliminating suffering, in part by eliminating desire. If you extinguish all suffering, you reach Nirvana. This idea has appealed to many in the West in recent decades, especially among those who are looking to make a break with Christianity, Judaism, and other traditional Western religions. It dovetails with the idea that consumerism is a “hedonic treadmill” - that our modern society encourages us to buy more stuff, which just makes us want more stuff. It also seems to promise a relief from the stress of capitalist competition. Wouldn’t it be great if we could just leave all these cravings behind?

No, it would not. How do I know that? Because I’ve been there. I have achieved Nirvana. And let me tell you, it was a lot more like the band than the Buddhist state of enlightenment.

I’m talking, of course, about clinical depression. Most people think of depression as a very severe sad mood, or some other form of negative emotion. But mostly, it’s not like that. Mostly, it’s a feeling of emptiness that is unlike any emotion that non-depressed people experience. But it’s not an enlightened emptiness, or a neutral, robotic emptiness - it’s an awful emptiness. Here is a pretty good (and grimly entertaining) description of what it’s like by Allie, the writer of the blog Hyperbole and a Half. Here was my briefer, less colorful attempt. Though I hadn’t read her post when I wrote mine, you’ll quickly see that we’re describing exactly the same thing. Depression, basically, is a total lack of volition and desire. And it’s the worst thing that it’s possible to experience.

Now, I’m sure Buddha didn’t intend for people to eliminate their desires by becoming clinically depressed! But he probably simply did not understand how human desire works. Now, with the help of modern science, we know a few things. For example, we’ve learned that the nucleus accumbens is responsible for many of our feelings of pleasure and happiness. But it’s also responsible for our feelings of desire! From Wikipedia:

The activation of dopamine in the nucleus accumbens is central to forming desire for something. Dopamine release in the accumbens occurs in anticipation of reward, and facilitates many kinds of approach and goal-oriented behaviors like exploration, affiliation, aggression, sexual behavior, and food hoarding. Lesions to the nucleus accumbens reduce the motivation to work for reward.

This sort of desire is exactly the “tanha” that Buddhism tells us we should get rid of. But in experiments, this kind of desire is essentially indistinguishable from pleasure:

Rats in Skinner boxes with metal electrodes implanted into their nucleus accumbens will repeatedly press a lever which activates this region, and will do so in preference over food and water, eventually dying from exhaustion.

In other words, desire is not the cause of suffering; it is the opposite of suffering. Desire is what feels good. And so it’s no surprise that stimulating the nucleus accumbens is an incredibly effective treatment for depression. Anyone who has been depressed will not be surprised in the slightest to hear that result.

The truth is, desire is good. Desire is what keeps us going in life. It’s not getting stuff that makes us happy, it's wanting stuff, hoping for stuff, dreaming of stuff - stuff like love, success, adventure, or meaning. Desire itself is the payoff!

Sure, sometimes we’re frustrated. Sometimes we get what we want, only to find out that it’s not as great as we thought. But to try to eliminate the central feature of a good human life just because of these stumbling blocks is to throw the baby out with the bathwater. These stumbling blocks are a necessary cost of leading a good human life.

So I think that the main tenet of classic Buddhism is totally wrongheaded, and reflects a deep lack of understanding of what constitutes human happiness. But like all religions - maybe more than other religions! - Buddhism is fluid, and subject to revision, interpretation, and improvement. So it pleases me to report that Soka Gakkai, a Japanese form of Buddhism, has this to say about desire:

But can such desires and attachments really be eliminated? Attachments are, after all, natural human feelings, and desires are a vital and necessary aspect of life. The desire, for example, to protect oneself and one’s loved ones has been the inspiration for a wide range of advances–from the creation of supportive social groupings to the development of housing and heating. Likewise, the desire to understand humanity’s place in the cosmos has driven the development of philosophy, literature and religious thought. Desires are integral to who we are and who we seek to become.

In this sense, the elimination of all desire is neither possible nor, in fact, desirable. Were we to completely rid ourselves of desire, we would end up undermining our individual and collective will to live.

The teachings of Nichiren thus stress the transformation, rather than the elimination, of desire. Desires and attachments are seen as fueling the quest for enlightenment.

Damn straight.

Wei Zhu: The Sharing Economy

Link to Wei Zhu’s economics blog

My Winter 2014 “Monetary and Financial Theory” class is over, but I read a flurry of excellent posts toward the end of the semester that I plan to publish as guest posts here in the coming Saturdays. Wei Zhu is one of several students in the class who have set up their own public blogs to continue blogging even now that the class is over. I think you will like his post about the Sharing Economy. (Catherine Rampell objects to calling it “sharing” in her Washington Post essay “What preschoolers can teach Silicon Valley about ‘sharing’”. I am very sympathetic to Catherine’s argument that the word “sharing” is being bent out of shape when applied to new, more convenient forms of rental, but I suspect that that moniker “sharing economy” is here to stay–at least for a few years, until it is old hat.)

What do

have in common? They are all billion-dollar ideas based on one concept: the Sharing Economy.

Like the name suggests, the Sharing Economy is “a socio-economic system built around the sharing of human and physical assets”(Wikipedia). The system sees the excess capacity in goods and services as a problem and solves it with collaborative consumption. Simply put, the Sharing Economy wants to lower your cost of living by letting you borrow a bike from you neighbor and make your trip in Puerto Rico much more enjoyable while cheaper by renting you a house in San Juan.

Jeremy Rifkin’s comments on Airbnb’s success explains a lot about the Sharing Economy:

“Airbnb owes its meteoric rise to a new phenomenon — near zero marginal cost — which is disrupting entire sectors of the global economy and giving rise to a new economic system riding alongside the conventional market. Marginal cost is the cost of producing an additional unit of a good or service once a business has its fixed costs in place, and for businesses like Airbnb, that cost is extremely low.”

The extremely low marginal cost is one of the greatest benefits of Sharing Economics. By efficiently redistributing resources among the crowd, this economy system significantly decreases the pressure of purchasing for individuals. For example, if you want to buy a vacuum machine, in the conventional market, you have to pay $200. That’s $200 per person. But with the sharing model, although the nominal price of the vacuum machine is the same, since you can share the purchase with your neighbor, the real cost becomes $200 divided by n. The more you share, the less you actually pay.

The concept is simple, but the impact can be huge.

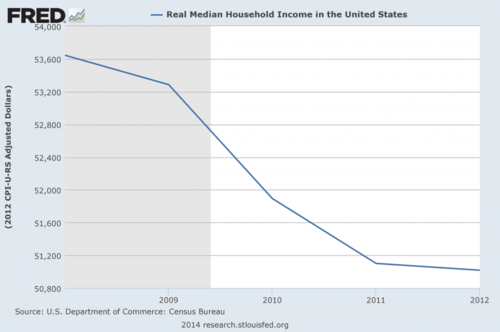

Since the beginning of the Great Recession, most households’ real income has been decreasing.

This forces average households to spend a greater portion of their income on food and other basic living expenses. People are scared of big purchases because of the financial pressure. Shared purchases, however, remove this pressure. The real expense on shareable goods is divided among several– and sometimes many–people therefore becomes much lower. With the shareable goods looking cheaper, people will be willing to pay for access to more goods.

The Sharing Economy can help people feel they have abundance despite scarce resources in a world that, despite falling birth rates, will have more people in the future than it does now. (The UN projects that, by the year of 2050, there will be 9.3 billion people in the world.) A world without resource-sharing would be relatively impoverished in that future.

One thing that may hold back the Sharing Economy, at least in the short run, is regulatory uncertainty. The Sharing Economy’s model suggests that everybody can be a service provider or property lender. This will surely introduce problems when it comes to security, licensing and the tax treatment of the Sharing Economy. But the success of Airbnb and Uber in their respective industries suggests that these regulatory issues can ultimately be overcome.

Capital Budgeting: The Powerpoint File

Writing “One of the Biggest Threats to America’s Future Has the Easiest Fix” with Noah Smith about capital budgeting inspired the seminar presentation I am giving today at the Congressional Budget Office, Here is a link to my Powerpoint file for the presentation:

It is quite technical, and is a work in progress. If you do want to brave it, I recommend that you first read "One of the Biggest Threats to America’s Future Has the Easiest Fix.“

Update: I learned today that the Congressional Budget Office put out a document on "Capital Budgeting” in 2008. I hope they now put out a new document on capital budgeting!

Sliding Doors: Hillary vs. Barack

“Sliding Doors” Wikipedia article. Please imagine in your mind’s eye a version of this poster with Barack Obama on top and Hillary Clinton on the Bottom to represent the two alternate histories: actual history and “Hillary wins in 2008.”

“Sliding Doors” is one of my wife Gail’s and my favorite movies. It explores the perennially fascinating theme of alternate histories–“what if” or “counterfactual” histories.

Although it is too early for me to attempt any serious discussion of the race to be elected president in 2016, it is not too early to rerun the what-ifs raised by the 2008 Democratic primary that came down to a hard-fought battle between Hillary Clinton and Barack Obama. Most political observers believe that Hillary would also have defeated John McCain in the general election, as Barack did, so the Democratic primary in 2008 comes closer than the general election to providing a “sliding-doors” moment when history could easily have gone either way. If I had the technical skill, I would photoshop the “Sliding Doors” poster above to have Barack on top and Hillary on the bottom, instead of blond and brunette Gwyneth Paltrow.

I would be interested in your opinion about how the world would be different if Hillary had won instead of Barack. I have two thoughts on that subject, that I am happy to have you dispute.

First, I think the 2008 Financial Crisis was baked in the cake by the time of the 2008 primaries, so whoever became president would have had to deal with the same type of economic problems, and the differences between Hillary and Barack could have been crucial. I think Hillary, having been burned on the health care reform front before, would have pursued health care reform, but would have put it as a lower priority relative to economic recovery than Barack did. As I wrote in “What Should the Historical Pattern of Slow Recoveries after Financial Crises Mean for Our Judgment of Barack Obama’s Economic Stewardship?” I think it was a mistake for Barack not to devote every ounce of his political capital to getting a bigger stimulus package for economic recovery; so at that juncture, it was a mistake to let the goal of health care reform distract from the goal of economic recovery.

In my book, to the extent a health care reform steamroller would then have been impossible, that also might have been a good thing. Given how little we know about what works in health care reform at a systemic level (see my column “Don’t Believe Anyone Who Claims to Understand the Economics of Obamacare”), I believe that Medical Reform Federalism would have been the best course, and this might have been exactly the kind of compromise eventually reached had Barack not been in the presidency to push through Obamacare. As I wrote in my post “Evan Soltas on Medical Reform Federalism–in Canada” here is what I mean by Medical Reform Federalism:

Let’s abolish the tax exemption for employer-provided health insurance, with all of the money that would have been spent on this tax exemption going instead to block grants for each state to use for its own plan to provide universal access to medical care for its residents.

Second, I think that Hillary would have helped the Syrian rebels more as President than she could as Secretary of State, which in turn would have projected enough more toughness that Vladimir Putin would not have dared to seize Crimea for Russia and Ukraine would not be facing that loss of the Crimea and possible further loss of territory right now. Supposing that is true, even greater differences between the two alternate histories I am considering (actual history and Hillary winning in 2008) are likely to open up as time goes on.

I was stimulated to think again about Hillary vs. Barack by a Washington Post article this morning by Philip Rucker and Zachary A. Goldfarb that can be found online here:

“The Clintons fight back, signaling a new phase in 2016 preparations”

Here are some memorable passages from that article:

1. Bill Clinton reveled in mocking Karl Rove for his suggestion that Hillary Clinton may have suffered brain damage from a fall in late 2012 …

Referring to Rove’s remarks, [Bill] Clinton chuckled and fired back with humor.

“First they said she faked her concussion, and now they say she’s auditioning for a part on ‘The Walking Dead,’ ” he said, referring to a television series about zombies. “If she does [have brain damage], then I must be in really tough shape because she’s still quicker than I am.”

2. Asked whether [Hillary] Clinton is still a stateswoman operating above the political fray, Republican presidential strategist Mark McKinnon wrote in an e-mail, “There is no ‘above the fray’ in politics anymore. There is only ‘the fray.’”

3. [Bill] Clinton, who has faced criticism that income inequality worsened on his watch in the 1990s, defended income growth during his term but acknowledged that the gap between the rich and the poor represents a significant problem.

“You can say, ‘Well, inequality has still increased,’ because the top 1 percent did better, but I don’t think there’s much you could do about that unless you want to start jailing people,” he said.

Colleges Should Stand Up For Freedom of Speech!

Christine Lagarde

The list of scheduled commencement speakers who have been disinvited or encouraged to withdraw because of threatened student protests keeps growing. (If the speakers were just scared of facing a ruckus, so much the worse for them, but if college or university administrators encouraged them to withdraw, that is bad business on the part of those college and university administrators.) Yesterday’s Wall Street Journal reported that Christine Lagarde, the head of the International Monetary Fund is now on this list:

- IMF’s Lagarde Won’t Speak at Smith, Part of a Growing List: Protests by Students, Faculty Have Derailed Several Commencement Addresses This Spring

If colleges were standing up for freedom of speech, they would let the speakers come and use the fact of the student protests as a chance to teach everyone there about the importance of freedom of speech both for the invited speaker and for the protestors. When colleges treat having an outwardly pleasant commencement event as more important than upholding the principle that one should have a chance to hear the major viewpoints on an issue before making a judgment about it, they betray the quest for truth that is their reason for existence.

Now, it would be possible to give more dignity to hearing all sides of an issue. For example, a college could have a selection procedure to have the most eloquent student who wants to argue against the brief of the invited speaker have some time to talk after that speaker. Any invited speaker who is unwilling to come if he or she has to face a rebuttal afterward is no great loss. But I seriously doubt that someone like Ayaan Hirsi Ali would be afraid of a debate–the Ayaan Hirsi Ali of whom Ruth Wisse wrote after Brandeis backtracked on giving her an honorary degree:

Here in the United States, the educated class thinks nothing of denying an honorary degree to a fearless Muslim woman who at peril of her life, and in the name of liberal democracy, has insisted on exposing…outrages [done in the name of Islam] to the light.

Ayaan Hirsi Ali

I think I understand where college administrators are coming from. They are worried about what will happen to alumni donations if commencements are contentious rather than being pleasant ceremonies. But that path ultimately leads to freedom of speech at official podiums only when people don’t understand enough, or care enough about an idea to object, or when the idea happens to be congenial to those who come from the most aggressive tradition of protest.

Update: Bonnie Kavoussi alerted me to this related post by Harvard Computer Science Professor Harry Lewis: “A bad day for the right to offend.”

David Beckworth: What Caused Great Recession? Household Deleveraging or ZLB? →

This is a nice treatment by David Beckworth of key issues, and gives his take on my proposal to eliminate the zero lower bound.

“I have always followed the law, but from an early age, I said I would not follow the rules.”

– Mark Stevens, businessman and business writer, as quoted in Clutch, by Paul Sullivan

Edward Jay Epstein: Was Snowden's Heist a Foreign Espionage Operation? →

The article linked above lays out the argument that Edward Snowden was simply a brilliant spy—including brilliance at public relations. Here is the key passage:

Mr. Snowden’s critics regard the whistleblowing narrative as at best incomplete, at worst fodder for the naïve. They do not believe that it explains the unprecedented size and complexity of the penetration of NSA files and records. For one thing, many of his critics have intelligence clearance. They have been privy to the results of an NSA investigation that established the chronology of the copying of 1.7 million documents that were stolen from the Signals Intelligence Center in Hawaii. The documents were taken from at least 24 supersecret compartments that stored them on computers, each of which required a password that a perpetrator had to steal or borrow, or forge an encryption key to bypass.

Once Mr. Snowden breached security at the Hawaii facility, in mid-April of 2013, he planted robotic programs called “spiders” to “scrape” specifically targeted documents. According to Gen. Dempsey, “The vast majority of those [stolen documents] were related to our military capabilities, operations, tactics, techniques and procedures.”

I must confess that my relevant expertise for judging such an argument is limited to what I have learned from TV series that attempt to portray semi-realistic spywork, such as Burn Notice, Sherlock and Elementary. (The adjective “semi-reliastic” is meant to contrast these shows with others like Alias or Chuck that intentionally portray fantastical spy work.) What Edward did would certainly have made a good plot line.

For my take on the policy issues raised by Edward Snowden’s revelations, see my column “The Government and the Mob.”

Update: I got some pushback on this post. See the discussion in the storified tweets “Edward J. Epstein, Miles Kimball, Brad Delong, Alex Bowles and Ramez Naam: Was Edward Snowden a Spy?” Ramez Naam in particular has good arguments against the idea that Edward Snowden was a spy employed by a foreign government.

John Stuart Mill on China's Technological Lost Centuries

One of the greatest of all questions in the study of economic growth is why China, which for a long time was the technological leader of humanity, fell behind Europe and its offshoots technologically.

In On Liberty, Chapter III: “Of Individuality, as One of the Elements of Well-Being,“ paragraph 17, John Stuart Mill points to the ascendance of "Custom” in the centuries immediately before he wrote as a key factor, and draws cautionary lessons about the dangers of letting Custom rule too thoroughly:

The greater part of the world has, properly speaking, no history, because the despotism of Custom is complete. This is the case over the whole East. Custom is there, in all things, the final appeal; justice and right mean conformity to custom; the argument of custom no one, unless some tyrant intoxicated with power, thinks of resisting. And we see the result. Those nations must once have had originality; they did not start out of the ground populous, lettered, and versed in many of the arts of life; they made themselves all this, and were then the greatest and most powerful nations of the world. What are they now? The subjects or dependents of tribes whose forefathers wandered in the forests when theirs had magnificent palaces and gorgeous temples, but over whom custom exercised only a divided rule with liberty and progress. A people, it appears, may be progressive for a certain length of time, and then stop: when does it stop? When it ceases to possess individuality.

We have a warning example in China—a nation of much talent, and, in some respects, even wisdom, owing to the rare good fortune of having been provided at an early period with a particularly good set of customs, the work, in some measure, of men to whom even the most enlightened European must accord, under certain limitations, the title of sages and philosophers. They are remarkable, too, in the excellence of their apparatus for impressing, as far as possible, the best wisdom they possess upon every mind in the community, and securing that those who have appropriated most of it shall occupy the posts of honour and power. Surely the people who did this have discovered the secret of human progressiveness, and must have kept themselves steadily at the head of the movement of the world. On the contrary, they have become stationary—have remained so for thousands of years; and if they are ever to be farther improved, it must be by foreigners. They have succeeded beyond all hope in what English philanthropists are so industriously working at—in making a people all alike, all governing their thoughts and conduct by the same maxims and rules; and these are the fruits. The modern régime of public opinion is, in an unorganized form, what the Chinese educational and political systems are in an organized; and unless individuality shall be able successfully to assert itself against this yoke, Europe, notwithstanding its noble antecedents and its professed Christianity, will tend to become another China.

I have often gotten in minor trouble from not following Custom. Maybe that isn’t all bad.

Fanglue Zhou: The Market for Cars in China

This is a guest post by my “Monetary and Financial Theory” student Fanglue Zhou:

China used to be considered a big market for many kinds of products. However, as China’s economy has slowed recently, its role as the biggest growth engine for the global car business depends on auto makers getting reluctant customers behind the wheel, as written in Wall Street Journal.

The automotive industry in China is quite unique as the joint ventures with foreign car makers play a very important role. Of the automobiles produced, 44.3% were local brands (including BYD, Dongfeng Motor, FAW Group, SAIC Motor, Lifan, Chang’an, Geely, Chery, Hafei, Jianghuai, Great Wall and Roewe), and the rest were produced by joint ventures with foreign car makers such as Volkswagen, General Motors, Hyundai, Nissan, Honda, Toyota, Mitsubishi etc. Most of the cars manufactured in China sold within China. Foreign automotive companies cannot sell the cars directly to China’s market, instead, they have to become joint ventures with Chinese local car makers in order to have the right to produce and sell within China.

Why is there a sales decline in China’s automotive industry given that China has just become the world’s biggest automobile market in 2013?

- Slowing economic growth. The disinflationary policy is slowing down economic growth in China. Chinese consumers’ interest in cars had shown signs of cooling along with broader economic growth.

- Auto Sales Control. A growing number of Chinese cities are controlling auto sales to fight against traffic congestion and pollution. To combat air pollution, China’s State Council, or cabinet, released a national plan in September that called for a 15 percent to 25 percent reduction in particulate matter by 2017 in the three key manufacturing regions anchored by Beijing, Shanghai and Guangzhou.

- Anti-corruption campaign. The demand for imported luxury vehicles will decline as the official frugality campaign spreads beyond the government and affect companies and individual consumers.

Nevertheless, we can still find ways out for the automotive companies:

- Young people should be the targeted consumers. Given that many of the young are paid relatively well compared to the old generation, they may today borrow to finance their housing or cars instead of saving until they have enough money to enjoy. Moreover, the good news for most of the automotive companies is that – Chinese people love brand new cars. Most of the Chinese prefer brand new cars to the second-hand because they may think it uncomfortable to use something that may have been owned by others.

- Inland cities would be promising markets. Since most of the big cities, as well as the rich costal cities, are already overwhelmed by too many cars, their local government may implement the “controlling” policy sooner or later so that the demand for cars is limited. Most of the inland cities are quite well-developed in recent years. Many well-paid job opportunities are created in these cities creating many relatively high-income people. Hence, the inland cities will be a promising market for the automotive industry in the near future.

On Freedom of Political Speech

Link to Wall Street Journal article “Political Speech Wins in Wisconsin”

My experiences with the Mormon Church’s attempts to suppress freedom of speech within the Church, using ecclesiastical power, make me very leery of allowing the heavier power of the government to fine people or throw them in jail for speech. So it seems very short-sighted to me when many commentators put concerns about money in politics ahead of concerns about maintaining the freedom of speech that fosters desperately needed information processing at the social level.

As a result, I give props to federal judge Rudolph Randa who in issuing a preliminary injunction on Tuesday ending the John Doe investigation of allies of Wisconsin Governor Scott Walker, wrote:

… the larger danger is giving government an expanded role in uprooting all forms of perceived corruption which may result in corruption of the First Amendment itself.

He also wrote:

O'Keefe and the Club obviously agree with Governor Walker’s policies … but coordinated ads in favor of those policies carry no risk of corruption because the Club’s interests are already aligned with Walker and other conservative politicians.

Concerns about corruption must never be a stalking horse for criminalizing speech that is objectionable primarily because it deeply offends one’s political sensibilities.

Is freedom of speech really important enough that we should risk an excessive role of money in politics? This is a genuine tradeoff, but our answer should be yes. It is worth sacrificing a lot for freedom of speech. To me, freedom of speech is sacred because it is necessary for seeking truth. So for over a year, every other week, I have built my Sunday religion post around a passage from John Stuart Mill's On Liberty. I hope you will read On Liberty closely along with me to see if you don’t weigh the importance of freedom of speech more highly–even relative to other very important values–after pondering John’s argument.

Notes

1. You can see all the posts based on On Liberty in my Religion, Sciences and Humanities sub-blog:

http://blog.supplysideliberal.com/tagged/religionhumanitiesscience

2. On truth as a sacred value, see the discussion on this Facebook post:

https://www.facebook.com/miles.kimball.9/posts/10202070113535257