The Deep Magic of Money and the Deeper Magic of the Supply Side

Introduction

I will assume that you have either read The Lion, the Witch and the Wardrobe, seen the movie, or don’t intend to do either. So I won’t worry about spoiling the story for you. C.S. Lewis’s fantasy is set in the world of Narnia. WikiNarnia explains the laws of nature in Narnia that drive the plot of The Lion, the Witch and the Wardrobe:

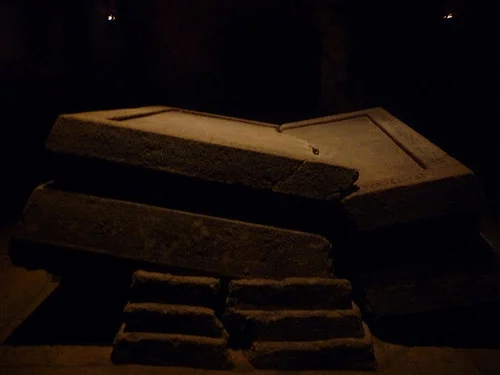

The Deep Magic was a set of laws placed into Narnia by the Emperor-beyond-the-Sea at the time of its creation. It was written on the Stone Table, the firestones on the Secret Hill and the sceptre of the Emperor-beyond-the-Sea.

This law stated that the White Witch Jadis was entitled to kill every traitor. If someone denied her this right then all of Narnia would be overturned and perish in fire and water.

Unknown to Jadis, a deeper magic from before the start of Time existed which said that if a willing victim who had comitted no treachery was killed in a traitor’s stead, the Stone Table would crack and Death would start working backwards.

Like the Deep Magic and the Deeper Magic in Narnia, in macroeconomics, money is the Deep Magic and the supply side is the Deeper Magic. In the short run, money rules the roost. In the long run, pretty much, only the supply side matters. In this post, I want to trace out what happens when a strong monetary stimulus is used to increase output and reduce unemployment. In the short run, output will go up, but in the long run, output will return to what it was.

The Deep Magic of Money

Let me start by explaining why money is the Deep Magic of macroeconomics. There are many people in the world today who think it is hard making output go up, and that we need to resort to massive deficit spending by the government spending to stimulate the economy or from tax cuts meant to stimulate the economy. But as I explained in an earlier post, Balance Sheet Monetary Policy: A Primer, there are few limits to the power of money to make output go up in the short run.

Money as a Hot Potato when the Short-Term Safe Interest Rate is Above Zero. When short-term safe interest rates such as the Treasury bill rate or the federal funds rate at which banks lend to each other overnight are positive, almost all economists agree that money is very powerful. Suppose the Federal Reserve (“the Fed”) or some other central bank prints money to buy assets. In this context, when I say “money” I mean currency (in the U.S., green pieces of paper with pictures of dead presidents on them) or the electronic equivalent of currency–what economists sometimes call “high-powered money.” (When the Fed creates the electronic equivalent of currency, it isn’t physically “printing” money but it might as well be.) The Fed requires banks to hold a certain amount of high-powered money in reserve for every dollar of deposits they hold. Any high-powered money that a bank holds beyond that is not needed to meet the reserve requirement and is usually not a good deal because it earns an interest rate of zero (unless the Fed decides to pay more than that for the electronic equivalent of currency held in an account with the Fed). So inside the banking system, reserves beyond those that are required–called “excess reserves”–are usually a hot potato. Also, outside the banking system, at an interest rate of zero, high-powered money is normally a “hot potato” that households and firms other than banks try to spend relatively quickly, since every minute they hold high-powered money they are losing out on higher interest rates they could earn on other assets, such as Treasury bills. I say “relatively” quickly because there is some convenience to currency. So if the Fed prints high-powered money to buy assets, that hot potato money stimulates spending until until people and firms wind up with enough deposits in bank accounts that most of the high-powered money is used up meeting banks’ requirements to hold reserves against deposits, while the rest is in people’s pockets or the equivalent for convenience.

What Happens at the Zero Lower Bound on the Nominal Interest Rate. Many things change when short-term, safe interest rates such as the federal funds rate or the Treasury bill rate get very low, near zero. Then high-powered money is no longer a hot potato, either inside or outside the banking system. Banks and firms and households become willing to keep large piles of high-powered money–piles doing nothing (something even many non-economists have remarked upon lately). In the U.S. extremely low interest rates are a relatively new thing, but Japan has had extremely low interest rates for a long time; in Japan, it is not unusual for people to have thick wads of 10,000-yen notes (worth about $100 each) in their wallets. There are economists who believe that when short-term safe interest rates are essentially zero so that high-powered money is no longer a hot potato that money has lost its magic. Not so. Printing money to buy assets has two effects: one from the printing of the money, the other from the buying of the assets. That effect can be important, depending on what asset the Fed is buying.

Normally, the Fed likes to buy Treasury bills when it prints money. But buying Treasury bills really does lose its magic after a while. Interest rates on Treasury bills falling to zero is equivalent to people being willing to pay a full $10,000 for the promise of receiving $10,000 three months later. (You can see that the interest rate is then zero, since you don’t get any more dollars back than what you put in. If you paid less than $10,000 at first, then you would be getting more dollars back at the end than what you put in, so you would be earning some interest.) No one is willing to pay much more than $10,000 for the promise of $10,000 in three months, since other than the cost of storage, one can always get $10,000 in three months just by finding a very good hiding place for $10,000 in currency. So when the interest rate on Treasury bills has fallen to zero, it is not only impossible to push that interest rate significantly below zero, in what turns out to be the same thing, it is impossible to push the price of a Treasury bill that pays $10,000 in three months significantly above $10,000.

Fortunately, there are many other assets in the world to buy other than Treasury bills. Unfortunately, the Fed only has the legal authority to buy a few types of assets. It can buy long-term U.S. Treasury bonds. It can buy mortgage-backed assets from Fannie Mae and Freddie Mac–which are companies that were created by the government to make it easier for people to buy houses. (They used to be somewhat separate from the government, despite being created by the government, but the government had to fully take them over in the recent financial crisis.) The Fed can buy bonds issued by cities and states. It can also buy bonds issued by other countries (as long as the bonds are reasonably safe), but usually doesn’t, since other countries would have strong opinions about that. A key thing the Fed does not feel it is allowed to do is to buy packages of corporate stocks and bonds. Still, with the menu of assets the Fed clearly is allowed to buy, it can have a big effect on the economy, even when short-term, safe interest rates are basically zero.

If the Fed buys packages of mortgages, it pushes up the price of those mortgage-backed assets. When the price of mortgage-backed assets is high, financial firms become more eager to lend money for mortgages, even though they remain somewhat cautious because they (or others who serve as cautionary tales) were burned by mortgages that went sour as part of the financial crisis. If financial firms become eager to lend against houses, more people will be able to refinance and spend the money they get or that they save from lower monthly house payments, and some may even build a new house.

If the Fed buys long-term Treasury bonds, that pushes up their price, making them more expensive. Some firms and households who had intended by buy Treasury bonds will now find them too pricey as a way to get a fixed payoff in the future. With Treasury bonds too pricey, they will look for ways to get payoffs in the future that are not so pricey now. They may hold onto their hats and buy corporate bonds or even corporate stock, despite the risk. That makes it easier for companies to raise money by selling additional stocks and bonds. Up to a point it also pushes up the price of stocks and bonds, so that people looking at their brokerage accounts or their retirement accounts feel richer and may spend more. If you don’t believe me, just watch how joyous the stock market seems every time the Fed surprises people by announcing that it will buy more long-term Treasury bonds than people expected–or how disappointed the stock market seems every time the Fed surprises people by announcing that it won’t buy as many long-term Treasury bonds as people had expected.

The Cost of the Limited Range of Assets the Fed is Allowed to Buy. It is true that at some point the legal limits on what the Fed is allowed to buy will put a brake on how much the Fed can stimulate the economy. But that does not deny the power of money to raise the price of assets and stimulate the economy, it only means that when we don’t allow newly created money to be used to buy a wide range of assets, then money is hobbled. Aside from the effect limits on what the Fed can buy have on the ability of money to stimulate the economy, those limits also affect the cost of what the Fed does. If the Fed is only allowed to buy a narrow range of assets, it will have to push the price of each of those assets up a lot to get the desired effect, and then when it sells them again to avoid the economy overheating, it may lose money from the roundtrip of buying high (when it pushed the price up by buying) and selling low (when it later pulls the price down by selling). This is a bigger problem the lower the interest rate on a given type of asset is to begin with. It is also a bigger problem the longer-term an asset is. So risky assets that have higher interest rates to begin with–and perhaps, especially, risky short-term assets–are better in that regard.

Summarizing the Deep Magic of Money. The bottom line is that in the short run, money has deep magic that can stimulate the economy as much as desired. Right now, the power of money is as about as circumscribed as it ever is, and yet it still has its magic. And yet, I claim, as almost all other economists claim, that in the long run, the supply side will win out. Not only will the supply side win out in the long run, but in the long run, money has virtually no power to affect anything important–unless continual, rampant printing of money drives the economy into the disaster of hyperinflation, or a serious shortage of money causes prices to fall in a long-lasting bout of deflation. (The fact that, short of hyperinflation or deflation, money has virtually no power to affect anything important in the long run is called monetary superneutrality.) How can money have so much power in the short run and so little in the long run?

The Deeper Magic of the Supply Side

The answer to how money can have so much power in the short run and so little in the long run is that the supply side will bend in many ways in the short run, but will always bounce back.

Price Above Marginal Cost Makes Output Demand-Determined in the Short Run. To begin with, the most basic way in which the supply side is accomodating in the short run is that if a firm has–for some period of time–fixed a price above the cost to produce an extra unit of its good or service (the marginal cost), then it is eager to sell its good or service to any extra customer who walks in the door. And firms will, in general, set their prices at least a little above what it normally costs to produce an extra unit as long as they can do so without losing all of their existing customers. Here is why. Thinking in long-run terms, if the firm sets its price equal to marginal cost, then it doesn’t earn anything from the last few customers. So losing that customer by raising the price a little is no harm. And raising the price a little means that all of the customers who don’t bolt will now be paying more–more that will go into the firm’s pocket. Raising the price too high puts that extra pocket money in jeopardy, so the firm won’t raise prices too high, but it will raise the price at least some above marginal cost as long as it doesn’t lose all of its customers by doing so. To summarize, if firms do fix prices for some length of time as opposed to changing them all the time, they are likely to set those prices above what it normally costs to produce an extra unit of the good or service they sell. And if price is above marginal cost, then given a temporarily fixed price, the amount by which price is above marginal cost is what the firm gets on net when an extra customer walks in the door. For example, produce a widget for a marginal cost of $6, sell it for $10, and take home $4 as extra profits.

So firms who won’t lose every last customer by raising their price will set price above marginal cost, and then will typically be eager to sell to an extra customer during the period when their price is fixed. I say “typically” because if enough new customers walked in the door, then marginal cost might increase enough above normal to exceed the fixed price. Then the firm would lose money by selling further units, and it will make up an excuse to tell customers about why it won’t sell more. The usual excuse is “we have run out”–which is a polite way of saying that they could do more, for a high enough price, but won’t for the price they have actually set. But since the firm will set price some distance above marginal cost to begin with, there is some buffer in which marginal cost can increase without going above the price. And anywhere in that buffer zone, the firm will still be eager to serve additional customers.

How Extra Output is Produced in the Short Run. How does the firm actually produce extra units in the short run? Here it is more interesting to broaden the scope to the whole economy. (Much of what follows is drawn from a paper I teamed up with Susanto Basu and John Fernald to write: “Are Technology Improvements Contractionary?”–a paper that has to consider what happens as a result of changes in demand before it can begin to address what happens with a supply-side change in technology.) When the amount customers are spending increases, so that firms need to produce more to serve that extra quantity demanded, the firms may, at the end of the day hire additional employees. But that is usually a last resort. There are many other ways to increase output short of hiring a new employee. Here are three avenues to increase production even before hiring new workers:

- ask existing employees to stay longer and work more hours in a week and take fewer vacations;

- ask existing employees to work harder while they are at work–to be more focused while at their stations or their desks, and to spend less time away from their work at the water cooler;

- delay maintenance of the factory, training, and other activities that can help the firm’s productivity in the long run, but don’t help produce the output the customer needs today.

The Workweek of Capital. One thing that doesn’t have time to contribute much to output when demand goes up is new machines and factories. It is simply hard to add new machines and factories fast enough to contribute that big a percentage of the increase in output. But people working longer hours with the same number of machines and factories don’t necessarily have to crowd around the limited number of machines and workspaces, since those machines and workspaces were often unused after hours anyway. So when the workers work longer, so do their machines and workspaces. Even when new workers are added, they can often be added in a new shift at a time when the machines and workspaces had been unused. So the fact that it is hard to quickly add extra factories and machines is not as big a limitation to output in the short run as one might think. Of course using machines and workspaces around the clock has costs. Extra wear and tear is one cost, but probably a bigger cost is having to pay people extra to be willing to work at the inconvenient hours of a second or third shift. (Note that paying an inexperienced worker working at night the same as a more experienced worker during the day is also paying extra beyond what the inexperienced worker would be worth for production if he or she were working during the day.)

Reallocation of Labor. At the economy-wide level another contribution to higher GDP in a boom is that in a boom the amount of work done tends to increase most in those sectors of the economy where a 1% increase in inputs leads to considerably more than a 1% increase in output–that is, in sectors such as the automobile sector where there are strong economies of scale (also called increasing returns to scale). These tend to also be sectors in which the price of output, and therefore the marginal value of output, is the furthest above the marginal cost of output. So when more work is done in those sectors, it adds a lot of valuable output that adds a lot to GDP–a lot more than if extra work by that same person were done in another sector where the price (and therefore the marginal value) of output is not as far above marginal cost.

Okun’s Law. When firms are finally driven to hiring additional workers, this still doesn’t reduce the number of “unemployed” workers by an equal amount, for the simple reason that, when firms are hiring, more people decide it is a good time to look for a job, and go from being “out of the labor force” (not looking for work) to “in the labor force and unemployed” (looking for work but haven’t found it yet). So in addition to all the ways that firms can increase output without hiring extra workers, the fact that hiring extra workers causes more worker to look for work also makes it hard to make the unemployment rate go down. So hard, in fact, that the current estimates for what is called “Okun’s Law” (after the economist Arthur Okun) say that it typically takes 2% higher output to make the unemployment rate 1 percentage point lower. (Note that a typical constant-returns to scale production function would say that 2% higher output would require 3% higher labor input. Thus, if 2% higher output came simply from hiring extra workers for a constant returns to scale production function, then the unemployment rate would go down almost 3%. So the details of how firms manage to produce more output matter a lot.)

The Supply Side in the Short Run and in the Long Run. That is the story of the short run. Extra money increases the amount that firms and households want to spend. Firms accommodate that extra desire to spend because price is above marginal cost. They actually produce the extra output by a combination of hiring extra workers and asking existing workers to work longer and harder, in a way that often takes advantage of economies of scale. Firms also may focus their productive efforts more on immediately salable output. They deal with a relatively fixed number of workspaces and machines by keeping the factory or office in operation more hours of the week.

The thing to notice is that both the ways in which the firms accommodate extra demand and their motivation for doing so rely on things that won’t last forever. Workers may work longer and harder without complaint for a while, but sooner or later they will start to grumble about the long hours and the pace of work, and maybe begin looking for another job. Of course, they may not even have to look for another job, since with a booming economy, a job may come looking for them. So even a boss who is too dense to realize all along the strain he or she is putting workers through, will eventually realize the cost of those extra hours and effort as wages get driven up labor market competition. What is more, the boss will eventually get around to raising the firm’s prices in line with this increased marginal cost as the “shadow wage” of the extra strain on workers goes up (something smart bosses will pay attention to) and ultimately the actual wage goes up (which will catch the attention of even dense bosses).

As prices rise throughout the economy, another force kicks in: workers will realize they are working hard for a paycheck that doesn’t stretch as far anymore, and start to wonder “Is it worth spending so many long, hard, late hours at work?” Even when the workers’ answer is still “On balance, yes,” because the answer is no longer “YES!” they will not jump to the boss’s orders with the same speed anymore, which will make the boss see the workers as less productive, and therefore see a higher marginal cost of output. All of this speeds the increase in prices even more, and speeds the return of hours worked and intensity of work to a normal pace. The temporary bending of the supply side toward greater production will be undone. There are things that permanently affect the supply side, but short of a monetary disaster, money is not one of those things. Short of a monetary disaster, and leaving aside tiny effects, money only matters in the short run. Economists call this monetary superneutrality and say that money only matters in the short run by saying the words the long-run aggregate supply curve is vertical.

Three Codas: Inflation Magic, Sticky vs. Flexible Prices, and Federal Lines of Credit

Is There Any Direct Magic by which Money Causes Inflation? A crucial aspect of the story above is that money only causes a general increase in prices–inflation–by increasing output and leading to all the measures discussed above to produce more output. Some economists think that printing money can cause inflation even if it doesn’t lead to an increase in output. Money has magic, but not that kind of magic.

Let me discuss the two closest things I can think of to money having some direct magic that could raise inflation even without an increase in output.

- First, to some extent, inflation can be a self-fulfilling prophecy. If firms believe that prices will be higher in the future, those who have gotten around to changing prices will set higher prices now. So if firms believed that printing money could cause inflation without increasing output, then to some extent it would. But I see no evidence that many firms believe this. They know how hard it is for them to raise prices in their own industry when demand is low.

- Printing money to buy assets drives up the prices of assets in general, as financial investors look for assets that are still reasonably priced to buy, bringing up their prices as well. Many commodities, such as oil, copper, and even cattle, have an asset-like quality because they can be used either now or later. (And copper–and depending on the use, cattle–can be used both now and later.) When the Fed pushes up the prices of assets, it pushes up what people are willing to pay now for a payout down the road. That pushes up the price of oil, copper, and cattle now. This looks like inflation, but it is not a general increase in prices, but an increase in commodity prices relative to other prices in the economy. When the economy cools down (often, unlike the story above, because the Fed sells assets to mop up money and cool down an overheated economy), all of these increases in commodity prices go in reverse, and the roundtrip effect on the overall price level from the rise and fall of commodity prices along the way is modest.

Sticky Prices vs. Flexible Prices. Some prices are relatively flexible and quick to change, while others are fixed for a relatively long period of time. (I don’t emphasize wages being fixed for often as much as a year at a time, since a smart boss should realize that in a long-term relationship, a high level of strain on workers, which can come on quickly, leads to extra costs even if the actual wage changes only slowly.) Prices are especially flexible and quick to change for the long-lasting commodities I discussed above, and for relatively unprocessed food such as bananas and orange juice. (In relatively unprocessed food, most of the cost is from the ingredients and bringing the food to the customer rather than the processing. And it is hard to differentiate one’s product from the competition’s product, so the price can’t be pushed very far above marginal cost.) Another interesting area where prices are very flexible is in air travel, where ticket prices can change dramatically from one week to the next. By contrast, prices are fixed for relatively long periods of time for most services. (My wife Gail is a massage therapist. I know that massage therapists think long and hard before they raise prices on their clients, and warn their clients long in advance about any price increase. In an even more extreme example, it is not uncommon for psychotherapists to keep their price fixed for a given client during the whole period of treatment, even if it lasts for years.) The prices of manufactured goods are in-between in their degree of flexibility.

When demand is high so that the economy booms, flexible prices move up quickly, while sticky prices move up only slowly. But when the economy cools down, the flexible prices can easily reverse course, while the sticky prices have momentum. (Greg Mankiw and Ricardo Reis explain one mechanism behind this momentum in their paper “Sticky Information Versus Sticky Prices: A Proposal to Replace the New Keynesian Phillips Curve”: firms’ sense of the rate of inflation–often based on old news–feeds into their price-setting. In this account, inflation feeds on past inflation that affects that sense of what the rate of inflation is.) So, perhaps counterintuitively, it is inflation in sticky prices that is the most worrisome. The Fed is right to focus its worries about inflation on what is happening to the sticky prices. In the news, this is described as focusing on “core inflation”–the overall rate of price increases for goods other than oil and food.

The existence of a mix of flexible and sticky prices in the economy is important for macroeconomic models, since it means that higher aggregate demand will have some immediate effect on prices (because of the flexible prices), but the effect on the overall price level will still be limited (because of the sticky prices). Economists often describe this as the “short-run aggregate supply curve” sloping upward–as opposed to being vertical, as it would be if all prices were flexible, or horizontal, as it would be if all prices were sticky. The existence of a mix of flexible and sticky prices is also important because it means that this “short-run aggregate supply curve” can shift when flexible prices change for reasons other than the level of aggregate demand. (Unfortunately, the most obvious reason the “short-run aggregate supply curve” might shift is because of a war in the Middle East that raises the price of oil in a way that is not do to the level of aggregate demand.)

Federal Lines of Credit. I have focused on monetary policy in this post, arguing that traditional fiscal stimulus–government spending or tax cuts meant to stimulate the economy in the short run–is inferior because it adds so much to the national debt. But there is one type of fiscal policy that adds relatively little to the national debt, as I discuss in my post “Getting the Biggest Bang for the Buck in Fiscal Policy.” The “Federal Lines of Credit” I propose in that post are a type of fiscal policy that is similar in some ways to monetary policy, since Federal Lines of Credit involve the government making loans to households. Federal Lines of Credit, like money, have deep magic, but in the long run their effects on output will also be countered by the deeper magic of the supply side.