The Great Recession and Per Capita GDP →

Although recessions in the United States are officially determined by a committee of the independent and nonpartisan National Bureau of Economic Research (NBER)–usually long after the fact–a rough-and-ready definition of a recession is the period of time when real GDP (the actual amount of goods and services produced) is falling, if it falls for a period of at least six months. This period of time when real GDP is falling is very different from the period when real GDP is “in the hole” compared to its peak, let alone the period when real GDP per person is in the hole.

For the same level of GDP,

GDP/Population goes down when Population goes up,

and Population in the United States is growing.

Americans are used to real GDP not only growing, but keeping up with the growth of population, plus a couple of percent more each year. This link shows a graph of real GDP per capita since the beginning of the Great Recession. Since at least the beginning of 2008, real GDP has been doing quite a bit worse than Americans are used to.

Catherine Mulbrandon has made a great set of graphs on her Visualizing Economics website.

Here is a graph showing the history of the logarithm of real per capita GDP in the U.S. since 1871. With the logarithm on the vertical axis, the slope of the curve shows the percentage growth rate.

Here is a graph showing the history of real per capita GDP in the U.S. since 1871. You can see what the miracle of compound growth does.

Two Types of Knowledge: Human Capital and Information

Human Capital and Information. Knowledge can be either “human capital” or “information.” The difference is the resource cost of transferring a body of knowledge from one person to another. Here is the classification scheme I have in mind:

Human capital is knowledge that is hard to transfer.

Information is knowledge that is easy to transfer.

(This is a specific technical meaning of the word “information” for economics. I use the word “information” in a more general philosophical sense in my post “Ontology and Cosmology in 14 Tweets.”) Note that a given body of knowledge can shift from one category to another when technology changes. The words of the Iliad and the Odyssey were “human capital” when the only means of transferring this knowledge was oral transmission and memorization. When printing arose, the words of the Iliad and the Odyssey became “information." (See Albert Lord's The Singer of Tales on the original oral transmission of the Iliad and the Odyssey.)

Now comes the mid-post homework problem. Read Daniel Little’s description of the knowledge of how to fix machines or my abridged version of it just below, and classify the knowledge of how to fix machines as human capital or information. Here is Daniel Little’s opening paragraph:

There is a kind of knowledge in an advanced mechanical society that doesn’t get much attention from philosophers of science and sociologists of science, but it is critical for keeping the whole thing running. I’m thinking here of the knowledge possessed by skilled technicians and fixers – the people who show up when a complicated piece of equipment starts behaving badly. You can think of elevator technicians, millwrights, aircraft maintenance specialists, network technicians, and locksmiths.

Here is Daniel’s account of the level of difficulty of transferring this knowledge, based on his conversations with a fixer of mining machinery:

I said to him, you probably run into problems that don’t have a ready solution in the handbook. He said in some amazement, "none of the problems I deal with have textbook solutions. You have to make do with what you find on the ground and nothing is routine.” I also asked about the engineering staff back in Wisconsin. “Nice guys, but they’ve never spent any time in the field and they don’t take any feedback from us about how the equipment is failing.” He referred to the redesign of a heavy machine part a few years ago. The redesign changed the geometry and the moment arm, and it’s caused problems ever since. “I tell them what’s happening, and they say it works fine on paper. Ha! The blueprints have to be changed, but nothing ever happens.”

I would trust Tim to fix the machinery in my gold mine, if I had one. And it seems that he, and thousands of others like him, have a detailed and practical kind of knowledge about the machine and its functioning in a real environment that doesn’t get captured in an engineering curriculum. It is practical knowledge: “If you run into this kind of malfunction, try replacing the thingamajig and rebalance the whatnot.” It’s also a creative problem-solving kind of knowledge: “Given lots of experience with this kind of machine and these kinds of failures, maybe we could try X.” And it appears that it is a cryptic, non-formalized kind of knowledge. The company and the mine owners depend crucially on knowledge in Tim’s head and hands that can only be reproduced by another skilled fixer being trained by Tim.

In philosophy we have a few distinctions that seem to capture some aspects of this kind of knowledge: “knowing that” versus “knowing how”, epistime versus techne, formal knowledge versus tacit knowledge. Michael Polanyi incorporated some of these distinctions into his theory of science in Personal Knowledge: Towards a Post-Critical Philosophy sixty years ago, but I’m not aware of developments since then.

As a practical matter, Polanyi’s distinction between “knowing how” (formal knowledge) and “knowing that” (tacit knowledge) is so important for the costs of transferring knowledge from one person to another that it closely parallels the distinction between human capital and information.

Pure Technology. Let me assume that your answer to the homework problem is the same as mine: knowledge of how to fix machines has a large element of human capital. This has an important consequence: “technology” as we usually think of “technology” is not just made of the easily copied “recipes” that Paul Romer talks about in his Concise Encyclopedia of Economics article “Economic Growth.”

Suppose for the purposes of economic theory, we insist on defining “pure technology” as a recipe that can be cheaply replicated. Then “technology” in the ordinary sense has an element of human capital in it as well as “pure technology,” much as “profit” in the ordinary sense has an element of return to capital in it as well as “pure profit.” The pure technology for mining would include not only

- a plan for how the machines are used and repaired, but also

- a plan for having new operators learn how to operate the machines and for having new machine repairers learn from more experienced machine repairers.

The “technology” in the ordinary sense is human capital for using and repairing the machines–that is, already embedded knowledge produced from 1, 2 and learning time.

Economic Metaknowledge. In addition to straight ideas or recipes, Paul Romer emphasizes the importance of meta-ideas:

Perhaps the most important ideas of all are meta-ideas. These are ideas about how to support the production and transmission of other ideas. The British invented patents and copyrights in the seventeenth century. North Americans invented the agricultural extension service in the nineteenth century and peer-reviewed competitive grants for basic research in the twentieth century.

There are many meaning of the prefix “meta.” Paul is using “meta” so that “meta-X” means “things in category X to foster the production and transmission of things in category X.” When another meaning of “meta-” might otherwise intrude, let’s use “economic meta-X” for this meaning. Then with the distinction between human capital and information in hand, there are at least four types of economic metaknowledge–knowledge to foster the production and transmission of knowledge:

- Meta-human-capital: human capital to foster the production and transmission of human capital. (Teaching skill is the most important example.)

- Economic meta-information: information to foster the production and transmission of information. (Many of the most important software programs are in this category: Microsoft Office, the software behind Social Media such as Tumblr, Twitter, and Facebook, TiVo’s software, the software behind the web itself…. Also, computer science and electrical engineering journals on library shelves contain some economic meta-information. In its time, a 17th Century printer’s manual would count.)

- Human capital to foster the production and transmission of ideas. (Research skill– including the skill of writing academic papers–is a good example.)

- Information to foster the production and transmission of human capital. (The contents of Daniel Willingham’s book Why Don’t Students Like School? are an excellent example that I highly recommend. He draws his suggestions for teaching from the U.S. Department of Education’s What Works Clearinghouse)

Extra Credit: Figure out how Paul Romer’s meta-ideas listed above–patents and copyrights, agricultural extension services, and peer-reviewed competitive grants–fit into this fourfold division of economic metaknowledge.

Rumsfeldian Metaknowledge. According to Colin Powell (as excerpted in the Appendix below and given more fully at this link) we can blame Donald Rumsfeld’s unchecked insubordination in disbanding the Iraqi Army for some portion of the long hard slog we faced in the War in Iraq since 2003, but Donald did coin a memorable description of another kind of metaknowledge. Here is the 21-second video, and here is the transcript:

[T]here are known knowns; there are things we know that we know.

There are known unknowns; that is to say there are things that, we now know we don’t know. But there are also unknown unknowns–there are things we do not know, we don’t know.

Metaknowledge in this sense of knowing what one knows and knowing what one doesn’t know often has great economic value, whether in daily life, business and policy making. But metaknowledge in this Rumsfeldian sense–even economically valuable Rumsfeldian metaknowledge–should be distinguished from “economic metaknowledge” as I define it above.

Appendix.Here is what Colin Powell wrote:

When we went in, we had a plan, which the president approved. We would not break up and disband the Iraqi Army. We would use the reconstituted Army with purged leadership to help us secure and maintain order throughout the country. We would dissolve the Baath Party, the ruling political party, but we would not throw every party member out on the street. In Hussein’s day, if you wanted to be a government official, a teacher, cop, or postal worker, you had to belong to the party. We were planning to eliminate top party leaders from positions of authority. But lower-level officials and workers had the education, skills, and training needed to run the country.

The plan the president had approved was not implemented. Instead, Secretary Donald Rumsfeld and Ambassador L. Paul Bremer, our man in charge in Iraq, disbanded the Army and fired Baath Party members down to teachers. We eliminated the very officials and institutions we should have been building on, and left thousands of the most highly skilled people in the country jobless and angry—prime recruits for insurgency. These actions surprised the president, National Security Adviser Condi Rice, and me, but once they had been set in motion, the president felt he had to support Secretary Rumsfeld and Ambassador Bremer.

The Litany Against Fear

Tomorrow I am going to the dentist, and in all probability will need a root canal. One thing that has been helpful to me in the past in facing the medium-sized fear appropriate to the dentist’s chair is the Bene Gesserit litany against fear, from Frank Herbert’s Science Fiction blockbuster Dune. Here it is:

I must not fear.

Fear is the mind-killer.

Fear is the little-death that brings total obliteration.

I will face my fear.

I will permit it to pass over me and through me.

And when it has gone past I will turn the inner eye to see its path.

Where the fear has gone there will be nothing.

Only I will remain.

Posts on Religion, Philosophy, Science, Literature and Culture through August 27, 2012

- Miles’s Linguistics Master’s Thesis: The Later Wittgenstein, Roman Jakobson and Charles Saunders Peirce

- Miles’s April 9, 2006 Unitarian Universalist Sermon: “UU Visions”

- Milan Kundera on the Contribution of Novels to the Liberal Imagination

- Teleotheism and the Purpose of Life

- Will Mitt’s Mormonism Make Him a Supply-Side Liberal?

- How the Mormons Became Largely Republican

- Ontology and Cosmology in 14 Tweets

- Grammar Girl: Speaking Reflexively

- Big Brother Speaks: Christian Kimball on Mitt Romney

- Should Everyone Spend Less than He or She Earns?

- The Matrix and Other Worlds: The Videos

- Isomorphismes on Enclosures

- Diana Kimball on Reading the Reader

- Persuasion

- The Egocentric Illusion

- What is a Partisan Nonpartisan Blog?

Update:

What is a Partisan Nonpartisan Blog?

I have thought for a while that I should have a post explaining the meaning of my header’s subtitle: “A Partisan Nonpartisan Blog.” Here is the interpretation:

“Partisan” means I am passionate about policy and cultural issues.

“Nonpartisan” means I don’t belong to any pre-existing “team,” whether Republican, Democratic, Libertarian, Green, etc.

My experience in blogging and tweeting during the presidential election contest between Barack Obama and Mitt Romney has clarified for me what that means in practice. In November, I will step into a voting booth and make a choice. But I don’t want advance intimations of that choice to cloud my treatment of each issue. Although I have to set priorities about what I write about, if I do write about an issue, my commitment is to try as hard as humanly possible to give you my unvarnished opinion on that issue–even if, according to an exaggerated sense of my own importance, expressing my unvarnished opinion on an issue would hurt the chances of the candidate I think I am more likely to vote for by a tiny amount. (Here, I can only barely stand to do without the word economists use for a tiny amount: “epsilon,” drawn from calculus.) If I ever waver from that commitment, I will think hard about choosing a new subtitle for my header.

If you ever think the priorities I am setting for what I write about are skewed, please use the “Ask Me Anything” button on my sidebar or make a comment to a post to nudge me toward dealing with the issues you think I should be dealing with. On issues, posing questions for me will have a big effect. But to avoid distraction from a focus on the issues, I will be slow to answer questions about which candidate I support when I think that different, reasonable weightings of the importance of various issues could lead to different candidate preferences–even for someone who has the same views on the issues that I do.

In a fractal recapitulation of the “team-loyalty versus unvarnished opinion on each issue” conflict, fidelity to the truth can sometimes hurt the overall thread of one’s argument on an issue. Here, fidelity to the truth has to come first. Let me list the legitimate excuses: (a) there is no duty to mention facts that seem to run against one’s argument that are actually unimportant and could easily be answered; (b) for clarity it is permissible to defer dealing with even important, widely-known facts until a commenter sets up the Q part of the Q&A; and (c) human language always deals in approximations, especially in short-form essays. But for a blogger who hopes to have the trust of readers, it is never OK to say something one knows to be false and misleading, even in the service of what one might think is a higher Truth. Or to make a slogan out of the wisdom of my best friend Kim Leavitt:

“We are in trouble if we let our devotion to Truth get in the way of our devotion to truth.”

All humans are fallible, so I may slip at some point. But I shudder at the thought.

Health Economics Posts through August 26, 2012

- Health Economics

- Will the Health Insurance Mandate Lead People to Take Worse Care of Their Health?

- The Paul Ryan Tweets

- Miles Kimball and Noah Smith on Balancing the Budget in the Long Run

- Tyler Cowen on My Little Brother Jordan’s Wisdom

- Victor Fuchs and Zeke Emanuel on Health Care Reform

- The OECD Compares Health Care Systems

- Jonathan Portes and Others on the Mystery of Why Americans are So Unhealthy

- Evan Soltas on Medical Reform Federalism–in Canada

- Gilbert Welch on Testing What We Think We Know in Medicine

Matthew O'Brien versus the Gold Standard →

The two graphs are the centerpiece of Matt’s post.

Ambrose Evans-Pritchard offers more interesting graphs about gold in his post “The Monetary Maginot of the Gold Standard.” Also, Robert Samuelson uses history to argue against the gold standard in “New gold standard not practical.”

Learning Through Deliberate Practice →

This link gives a taste of the kind of thing you can read in a book I highly recommend: The Talent Code: Greatness Isn’t Born, It’s Grown by Daniel Coyle. In order to learn a lot, you need to

- put in the hours and

- study effectively during those hours.

To study effectively, you need to do a lot more than “going over things” several times. You need to identify what you don’t completely understand and zero in on it to figure it out. You need to wonder how each idea relates to everything else you have learned. You need to get to the point where you can write your own exam questions and answer them, carefully thinking through what it would make sense for the instructors to test.

The human mind has a natural tendency to skitter away from things that are hard to understand. Effective study requires you to resist that tendency like a bad addiction. You need to turn toward the ideas that are hardest, not away from them.

Adam Ozimek: School Choice in the Long Run →

Many programs to help the poor create incentives not to earn too much, which discourages hard work. By contrast, improved schooling raises the incentives to work hard at a career because the range of job choices is so much greater after better schooling. So I have long thought of school reform as an ideal avenue for helping the poor. And since monopolies and near-monopolies tend to perform poorly, I have long been a passionate advocate of school choice. In “School Choice in the Long Run,” Adam Ozimek provides a subtle discussion of evidence for the benefits of school choice.

Update: In a related post, Matthew DiCarlo provides a good discussion of why attrition “Student Attrition is a Core Feature of School Choice, Not a Bug.”

The Egocentric Illusion

Link to David Foster Wallace’s Kenyon College Commencement Address (audio with subtitles)

This is one of my annual sermons to the Community Unitarian Universalists in Brighton, Michigan. I gave it on June 1, 2009. In it, I build on David Foster Wallace’s 2005 Commencement Address at Kenyon College. I also talk here about some of the practical consequences of what I have learned from my research on happiness with Bob Willis. Here is a link to an old version of our paper “Utility and Happiness” that is more accessible than the current, more technical (and unreleased) version.

I will begin this sermon with a confession. I am self-centered. But I have an excuse. The normal human brain is designed by evolution to generate the egocentric illusion: the illusion that the owner of a particular brain is the center of the universe.

This egocentric illusion is useful in many ways. In particular, learning the difference between self and non-self is a basic task of mental development, accomplished by most of us some time in infancy. Without knowing which patch of the universe we directly control and will feel pain when hurt, we would have trouble navigating in the world. This awareness of self versus non-self is accomplished by what might be described poetically as a special glow emanating from the part of one’s consciousness that keeps track of the part of universe that is “me.” Moreover, even those things one recognizes as “non-self” are seen in relation to one’s own position, both literally and metaphorically.

While useful, the egocentric illusion also causes a great deal of the grief and suffering and misbehavior that we are prone to. It can also contribute to an inordinate fear of death: one’s own personal death is a bad thing, but not quite as bad as the egocentric illusion makes it seem.

As is true for other illusions, it is good to see the egocentric illusion for what it is. David Foster Wallace spoke eloquently about the egocentric illusion at Commencement at Kenyon College a few years before his own death–in a way that just might loosen the hold of this illusion on those who hear what he had to say. Let me give an abbreviated version of his remarks and then give some of my own, sparked by his. As you will see, hearing what David Foster Wallace has to say inspires a certain bluntness about the realities we face. He began by telling this story:

There are these two young fish swimming along, and they happen to meet an older fish swimming the other way, who nods at them and says, “Morning, boys, how’s the water?” And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, “What the hell is water?”

He was making the point that we often swim in the egocentric illusion without noticing it, as fish swim in water. As he explained:

Everything in my own immediate experience supports my deep belief that I am the absolute center of the universe, the realest, most vivid and important person in existence. We rarely talk about this sort of natural, basic self-centeredness, because it’s so socially repulsive, but it’s pretty much the same for all of us, deep down. It is our default setting—hard-wired into our boards at birth….

Other people’s thoughts and feelings have to be communicated to you somehow, but your own are so immediate, urgent, real—you get the idea. But please don’t worry that I’m getting ready to preach to you about compassion or other-directedness or the so-called “virtues.” This is not a matter of virtue—it’s a matter of my choosing to do the work of somehow altering or getting free of my natural hard-wired default setting, which is to be deeply and literally self-centered, and to see and interpret everything through this lens of self.

If not for the sake of virtue, why does David Foster Wallace think we would we want to break free of the egocentric illusion? Fundamentally because if one has no other way to approach life, things will get either painful or boring or both. Here is some of what he said on that topic:

Think of the old cliché about “the mind being an excellent servant but a terrible master.” …I submit that this is what the real, no-bull value of your liberal arts education is supposed to be about: How to keep from going through your comfortable, prosperous, respectable adult life dead, unconscious, a slave to your head and to your natural default setting of being uniquely, completely, imperially alone, day in and day out.

After describing at some length the kind of thing “day in and day out” means, with all of the “boredom, routine and petty frustration” that goes into our daily lives, David Foster Wallace says this:

If you’re automatically sure that you know what reality is and who and what is really important—if you want to operate on your default setting—then you, like me, will not consider possibilities that aren’t pointless and annoying. But if you’ve really learned how to think, how to pay attention, then you will know you have other options. It will actually be within your power to experience a crowded, loud, slow, consumer-hell-type situation as not only meaningful but sacred, on fire with the same force that lit the stars—compassion, love, the sub-surface unity of things. Not that this mystical stuff’s necessarily true: The only thing that’s capital-T True is that you get to decide how you’re going to try to see it. You get to consciously decide what has meaning and what doesn’t. You get to decide what to worship…

Because here’s something else that’s true…. There is no such thing as not worshipping. Everybody worships. The only choice we get is what we worship. And an outstanding reason for choosing some sort of God or spiritual-type thing to worship—be it J.C. or Allah, be it Yahweh or the Wiccan mother-goddess or the Four Noble Truths or some infrangible set of ethical principles—is that pretty much anything else you worship will eat you alive. If you worship money and things—if they are where you tap real meaning in life—then you will never have enough… . Worship your own body and beauty and sexual allure and you will always feel ugly, and when time and age start showing, you will die a million deaths before they finally plant you… . Worship power—you will feel week and afraid, and you will need ever more power over others to keep the fear at bay. Worship your intellect, being seen as smart—you will end up feeling stupid, a fraud, always on the verge of being found out. And so on.

Look the insidious thing about these forms of worship is not that they’re evil or sinful; it is that they are unconscious. They are default settings. …. And the world will not discourage you from operating on your default settings, because the world of men and money and power hums along quite nicely on the fuel of fear and contempt and frustration and craving and the worship of self. Our own culture has harnessed these forces in way that have yielded extraordinary wealth and comfort and personal freedom. The freedom to be lords of our own tiny skull-sized kingdoms, alone at the center of all creation. This kind of freedom has much to recommend it. But of course there are all different kinds of freedom, and the kind that is most precious you will not hear much talked about in the great outside world of winning and achieving and displaying. The really important kind of freedom involves attention, and awareness and discipline, and effort, and being able truly to care about other people and sacrifice for them, over and over, in myriad petty little unsexy ways, every day. That is real freedom. The alternative is unconsciousness, the default-setting, the “rat race” –the constant gnawing sense of having had and lost some infinite thing.

…. None of this is about morality, or religion, or dogma, or big fancy questions of life after death. The capital-T Truth is about life before death. It is about making it to 30, or maybe 50 without wanting to shoot yourself in the head. It is about simple awareness—awareness of what is so real and essential, so hidden in plain sight all around us, that we have to keep reminding ourselves, over and over: “This is water, this is water.”

It is unimaginably hard to do this, to stay conscious and alive, day in and day out.

The note at the top of the online Wall Street Journal article back in September laying out this address said “Mr. Wallace, 46, died last Friday, after apparently committing suicide.” David Foster Wallace’s suicide hints at just how difficult the battle was for him. Not all battles are won. But we can still win where he ultimately lost.

When I think about what David Foster Wallace said, I see three helpful responses an awareness of our own egocentric illusion can lead us to. The first is that we can take advantage of our egocentric illusion, that focuses our consciousness on many things that are nearby and controllable, to enjoy our domestic lives even when some external things are not as we would wish. Many things bring quiet pleasure, regardless of what is going on at work or in the world at large. For example, I personally think that watching TV is underrated. The disdain of TV by many elites is out of step with the improvement in experience and the quality of what one watches that automatic time-shifting with a TiVo or other digital video recorder can bring. Moreover, in my view the quality of the best shows has increased markedly ever since the ability to sell DVD’s of good shows has enabled TV production companies to afford to produce more intelligent shows. When I say “intelligent shows” I don’t mean anything high-brow, but shows like Heroes, Lost, Alias, Kings, Buffy the Vampire Slayer, How I Met Your Mother, Dollhouse, Battlestar Galactica, Babylon 5, etc. Critics sometimes speak of long novels such as War and Peace as allowing more time for character development and buildup. But the best TV shows are like 24-hour movies, with much more time for character development and buildup than the typical 2 or 3 hour movie in the theater, and can be watched consecutively when you wait to get the DVD’s or download them.

Another kind of quiet pleasure is being in good health and free from pain. Although good health and freedom from pain are in large measure out of our control, people often don’t realize the extent to which these things are in their control. My sociologist colleague Jim House has found that there is a huge and widening difference in health at older ages between those who have a college education and those who don’t. Since I doubt it is what people learn in college itself that does this, imitating the health habits of the typical college-educated person should work for those without a college education as well. One dimension of pain that is more avoidable than many people realize is pain from tight muscles and the skeletal misalignments that tight muscles can cause. After computer work gave us both serious shoulder pain, my wife Gail and I got so much relief from seeing skilled massage therapists that she did an intensive year of training this past year to become a massage therapist herself. And I believe it is not just my own bias that I think she is a very good one.

I have been involved in academic research on happiness. The grand meaning of happiness is a life well-lived, which is a deep subject for many sermons, much religious and philosophical discussion, and difficult wrestling with unavoidable choices. But when psychologists and economists study happiness, they are working with data that tells us much more narrowly whether people have positive feelings or negative feelings. Happiness in this narrow sense of feeling happy is something well within the orbit of our individual egocentric illusion and something over which we have considerable control. Genes matter, and there is not much yet that we can do about them. Antidepressants are appropriate for some people and not for others. But there are many other controllable things known to be associated with happiness: sleep, exercise, music, time spent with friends, time spent in other enjoyable activities, meditation, and habits of clear, balanced thinking that some people learn from psychotherapists and other people learn from religious teachings—such as an attitude of gratitude. Because most of these things are time-consuming, it takes sacrifice to be happy. Ever since my psychologist colleague Norbert Schwarz pointed out that sleep contributes to happiness, I have been trying to get more sleep. But there are many other things I can’t do if I am determined to get 8 hours of sleep a night. My morning transcendental meditation also takes a chunk out of my day.

One of the interesting things about happiness that can confuse people about what it takes to be happy is that good news about anything makes people happy for a while: a short time for small items of good news, and a long time for large items of good news. Similarly, bad news about anything makes us unhappy for a while. For the most part, this fact about happiness doesn’t directly give you much leverage for feeling happier. For one thing, these doses of happiness that come with good and bad news are temporary. Also—and this is basic—most of us are already doing everything we can to bring about good news and forestall bad news for ourselves. But if you understand that good and bad news about anything affects happiness, but only temporarily, it highlights the things I listed that do have long-run effects on happiness: sleep, exercise, music, time spent with friends, time spent in other enjoyable activities, meditation and good habits of thought such as an attitude of gratitude. Also, if you pay attention to what news gives you a burst of happiness and what news gives you a burst of unhappiness, you may learn something about what you care about that will be useful to you.

While the egocentric illusion is a mostly neutral or even helpful force when we are enjoying ourselves alone or with friends who are favorably disposed toward us in an uncomplicated way, it causes us grief in the arena of social and professional competition. Think of David Foster Wallace’s examples of automatic daily misery: wanting money and things to keep up with the Jones’s, wanting beauty to look better than the competition, wanting power to be able to put others down instead of being put down oneself, wanting to be the smartest kid on the block. The trouble here is that while my egocentric illusion seems to put me at the center of the universe, the other guy’s egocentric illusion seems to put that guy at the center. So the other person will fight like tooth and nail to make sure the universe as he or she sees it is in good order by having the seeming center of his or her universe be a high point. Even if he or she is just being honest, rather than mean, he or she will have a tough time being properly impressed with me. People vary in this, but most of us have at least one person in our lives who regularly puts us down.

Like our close relatives, the chimpanzees, we are wired to respond to competition and to pecking orders. Thinking about status and rank in social groups we care about can dominate our consciousness almost as much as severe hunger, thirst or physical pain. Earlier, I gave a benign view of desire for things such as music CD’s and DVD’s of entertaining TV shows. Why is it then that the desire for things gets such a bad rap? I believe it is because many of the things we want we don’t want for the things themselves, but rather for how they contribute to, or make us feel about, our own social status and rank. My wife and I had some acquaintances whose house we only visited once, many years ago, but I still remember the expensive-looking uncomfortable chairs they had.

I have to say that social rank in itself is probably good for happiness. But all of our fretting, slaving and sacrificing of other good things for the sake of social rank can be very bad for happiness, particularly when we fail to get what we want. And those who do get the social rank they want, unless they are extraordinarily gracious, often make others feel bad.

In view of the automatic daily misery of competition whenever it is not going splendidly, the second helpful response to an awareness of the egocentric illusion is to step back and remember how little everyone else is really thinking about you anyway. There are practical consequences of where each of us fits in the social pecking order, but the burden only gets worse if we add to these practical consequences the emotional beating that we are tempted to give to ourselves over not being higher up. Remembering clearly how each person is at the center of his or her own perceived universe may not always make us feel better in a direct way, but at least the vertigo of that wild picture of overlapping universes can distract us from our pain.

The third helpful response to an awareness of the egocentric illusion is to step back from everyone’s egocentric illusion and think about the good of everyone. This may be the only response to the egocentric illusion that works in extremum. I often think about getting old and creaky and dying. I am not a fan of death. It is hard on those who die and hard on those left behind. Whatever the pain he suffered in living, David Foster Wallace did all the rest of us a grim disservice by killing himself—among other things the obvious disservice that there are books we will never be able to read because he will never write them now. More routinely, our experience is impoverished by each person we know who dies. For each of us, it makes sense to dread our own death at least as much as the collective loss of all those who would be left behind. And indeed, we should add to that the loss of our own experience of life because of our own death. But my death is not the end of the experiencing universe, as the egocentric illusion would have it. There will be people left behind to experience, to feel, to think, to build and create.

In the face of death, or serious illness that makes it hard for our daily personal experience to be positive, taking the perspective of all the other people now and in the future who do and will experience life is one of the few solaces we may be able to find. Almost all of us have the power to significantly improve the perceived life experiences of others by an amount that stacks up quite well against our ability to improved our own perceived life experiences. Sometimes what we can do for ourselves is bigger, sometimes what we can do for others is bigger, but the amount we can do for others is usually at least a big fraction of what we can do for ourselves, especially when illness or impending death limits our ability to help ourselves.

Let me end by getting personal. Up until I was 39 or 40 years old, I genuinely believed in an afterlife, and like most people assumed my afterlife would be a pleasant one. Then I decided I did not believe in God. I had always thought that an afterlife would require someone powerful to make it happen. So not believing in God meant I did not believe in an afterlife either. Realizing that most likely there was no afterlife was a big item of bad news for me. It made me less happy than I normally would have been for several years. That unhappiness caused me to think. Then and sometimes now, I tried to imagine the intelligent aliens who might be recording my consciousness digitally for later cybernetic resurrection, but I have lacked enough social support for that belief for it to be all that reassuring. What has helped me is reminding myself of the Buddhist belief that the self is an illusion. If the self is an illusion, then death is not quite as terrible, in exactly the way I have been describing. My death will be a tragedy as will yours. But neither my death nor yours will be the end of the universe, nor the end of consciousness, nor even the end of humanity. The world will go on, and what we do while we are alive can make it go on in a better or worse way. Sometimes I imagine consciousness as one light that shines through many windows. It is true that the information flows between the separate windows of consciousness are limited compared to the information flows within each window of consciousness, but that does not stop us from identifying our deeper self with consciousness itself, which does not die with my death or yours.

In summary, let us enjoy a high-quality egocentric illusion in our private lives in cooperation with our friends and loved ones, avoid getting too wrapped up in struggles between competing egocentric illusions, and cultivate a perspective that embraces all consciousness as precious, even if for no other reason than to salve our distress at knowing that my limited window of consciousness and your limited window of consciousness are both doomed to be shattered at different times within a few short years.

Note: The other two of my Unitarian-Universalist sermons that I have posted so far on this blog are “UU Visions” (which includes a brief account of my religious journey) and “Teleotheism and the Purpose of Life” (which is the best statement of my current religious beliefs).

No Tax Increase Without Recompense

The slogan “No taxation without representation” played a key role in the American Revolution. There is great wisdom in this slogan. First of all, it recognizes that taxation is necessary. Benjamin Franklin famously wrote in a 1789 letter to Jean-Baptiste Leroy

Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.

May the Constitution of the United States of America continue to long endure! And may we someday be free of death and taxes. But freedom from death and taxes will not come in my lifetime. Indeed, in his piece

“The Reality of Trying to Shrink Government,”

Larry Summers makes a persuasive case that anything like our current expectations for what government should do cannot be funded without substantial government revenue increases in the future. The reason is that one of the largest tasks our government has taken on is helping older Americans. As the ratio of older Americans to younger Americans increases that task becomes more difficult.

Japan and most nations in Europe are already ahead of us in being subject to the heavy burdens governments face from an aging population.

This is an important factor in the debt crises they face.

There is one way for America (and the other rich nations) to escape the fiscal difficulties of taking care of an aging population. That escape hatch is dramatically more open immigration, which I urge as a matter of basic ethics in “You Didn’t Build That: America Edition” and “Adam Ozimek: What ‘You Didn’t Build That’ Tells Us About Immigration.’”

But for the rest of this post, I will consider what we need to do in tax policy if American politicians, for whatever reason, stubbornly refuse to live up to the words engraved on the Statue of Liberty. In the better case of dramatically more open immigration, what I say below should still be helpful in the context of lower overall tax rates than if current quite-restrictive immigration policies continue.

The second dimension of wisdom in the slogan

“No taxation without representation”

is the idea that, if taxes are necessary, we should at least demand something in return for our taxes–something beyond the government spending itself. Members of the English parliament used the need of kings for tax revenue to establish this principle of asking for something in return for taxes using the earlier slogan “redress of grievances before supply."

Polycarp ably explains on the Straight Dope website:

The Speaker of the House of Representatives is the title for its presiding officer, as noted, by paralleling the English institution, where there was a Speaker of the House of Commons. And this name came about for historical reasons: back in the early days, when the law was the king’s commands, the Lords and Commons were convened to (1) approve taxes for the benefit of the realm, e.g., defense, the idea being taxes people had a voice in were less resented than those levied by the king alone, and (2) advise the king on the people’s needs and wants, so that he was informed on conditions throughout the realm. To ensure their concerns got listened to, they adopted a policy of "redress of grievances before supply”, i.e., “deal with our complaints before we vote you any money.” They would draft up bills of grievances outlining what was wrong and suggesting what the king might do about it, which eventually took the form of draft legislation prepared for the king to approve. (This is why a not-yet-passed law is a “bill”) The person who would bring the result of the Commons’ deliberations before the King in formal address was its presiding officer, the person who would speak to HM for it – and hence its Speaker.

In my post “Scott Adams’s Finest Hour: How to Tax the Rich,” I wrote:

…human beings want many things, including many intangibles. It is my belief that we can do much better at harnessing these other desires for the common good than we have.

In particular, if we give people something in return for their taxes that increases with the amount of taxes they pay, then their motivation to avoid taxes will not be as strong. Scott Adams himself wrote in “How to Tax the Rich” about

…how the rich can feel good while the rest of society is rifling through their pockets.

I can think of five benefits that the country could offer to the rich in return for higher taxes: time, gratitude, incentives, shared pain and power.

To encapsulate the idea that–especially if current policy is being altered–the government should give people something in return for their taxes other than just the government spending, let me propose two slogans with the same basic meaning. The formal version is

No tax increase without recompense.

The colloquial version is

No tax hike without something to like!

I hasten to say that–especially when leaving aside the benefits of the government spending itself–it would be overoptimistic to hope that the “something to like” will be enough to make those being taxed more heavily actually feel better off. The aim is to lessen the sting and lessen the motivation to avoid the tax.

It might seem utopian to think that these twin slogans could carry any weight in the political sphere. But the Republican Party–stiffened in its resolve by the amazingly effective Grover Norquist–has come surprisingly close in the last few years to enforcing a rule of no tax increases at all at the Federal level. So I do not think it unreasonable to hope to enforce a rule of “No tax increase without recompense.” On the other side, to those who think that Grover Norquist’s rule of no tax increases at all is too powerful to disobey, let me say that budget constraints are powerful things.

Holding things together in anything like the way to which we are accustomed is likely to be impossible without substantial revenue increases in the future. And any substantial need for revenue increases will hit close to home: there are not enough superrich; so a tax hike that makes a big difference on the revenue front is likely to hit the many who are moderately rich–such as economists, doctors and lawyers–not just the few who are very rich. Therefore, as a matter of self-interest, as well as out of public-spiritedness, I believe it is of great importance to come up with good proposals for tax hikes with something to like. Combining a tax increase with some kind of recompense is crucial both to avoid any hint of class warfare that could fray the social fabric and to keep tax distortions as small as possible. Here, I will make a specific proposal that is so ready to hand that many others have suggested something similar. But the details matter, and I will present my own version.

Even many economists who otherwise want to simplify the tax code have recognized the special status of the charitable deduction. Greg Mankiw wrote in the New York Times:

THERE are certain tax expenditures that I like. My personal favorite is the deduction for charitable giving. It encourages philanthropy and, thus, private rather than governmental solutions to society’s problems.

The substantive merit of the tax deduction for charitable contributions is also an important point in Matt Yglesias’s post “Tax Reform is Hard and It’s Not Just Politics.” In my proposal, I want to steer a course between partially balancing out a tax increase by expanding the current tax deduction for charitable contributions and partially balancing out a tax increase by following the proposal Tom Grey gives in his comment to “Scott Adams’s Finest Hour: How to Tax the Rich”:

How about 100% tax credits for …

donating directly to a Federal Gov'tProgram.

Thus, the rich who wantmore Social Security, donate their taxes to that cause. Or those who want more defense.

I’m pretty sure the rich would donate more taxes if they could choose where their money goes (despite the obvious ease of gov’t budget-makers just reducing the amount of other gov’t spend ).

Heck, such 100% tax credits could, and should, be available for all real taxpayers (not legal fiction corporations).

A key inspiration for my proposal is a trio of tax credits in Michigan State tax law, the public contribution credit, community foundation credit and homeless shelter/food bank credit. Although these credits are severely limited in size, up to that limit they mean that, together with the benefits of the Federal deduction, a taxpayer can get back over 70% of his or her contribution. But the set of organizations eligible for these three Michigan state tax credits is much narrower than the set of organizations eligible for the Federal tax deduction for charitable contributions. My interpretation of the intent of the law is that these three tax credits are meant to encourage people to give in ways that reduce the amount of direct government spending needed by the State of Michigan. For my proposal, let me define a “public contribution” as follows:

A public contribution is a donation to a nonprofit organization meeting high quality standards that engages in activities that (a) could be legitimate, high-priority activities of Federal or State governments and (b) can to an important extent substitute for spending these governments would otherwise be likely to do.

My proposal is to raise marginal tax rates above about $75,000 per person–or $150,000 per couple–by 10% (a dime on every extra dollar), but offer a 100% tax credit for public contributions up to the entire amount of the tax surcharge.

The reason I am not proposing a simple expansion of the current charitable deduction is that I want to make sure that the program helps ease government budget problems in a big way. (Note that, in addition to substituting to an important extent for government spending, these public contributions would crowd out some fraction of regular charitable deductions and increase government revenue in that way.) On the other side, though Tom Grey’s proposal of choosing which government program to support is great for a portion of existing taxes (as I think he intended it) I don’t think it goes far enough for a tax increase.

Now let me paint the picture of the kinds of effects I think this program of public contributions (the tax surcharge plus 100% public contribution credit up to the amount of the tax surcharge) would have:

- Many creative people, with more money to work with, would think of brilliant new ways to help the poor, as well as continuing and expanding tried-and-true ways of helping the poor.

- Scientific and medical research would be much better funded than currently.

- Foreign aid going to ordinary people, not dictators, would dramatically increase.

- It would be possible to fund better and cheaper ways to take care of older Americans in their own homes and delay any need for them to go into nursing homes.

- Needs that the government is slow in meeting could be addressed more quickly.

The substitute-for-government-spending test in the proposed law is not meant to prevent the total amount of public contributions for some things from going above what the government would do under the current system. Its purpose is simply to make it possible for the government to cut back on some types of spending to an important degree. Although religious congregations would not be directly eligible for public contributions because of the legitimate-activity-of-government test, many already have associated nonprofit organizations that could be eligible. And a large fraction of religious donations are from people who earn less than $75,000 per year. Support of arts enjoyed mainly by the rich, such as opera, might not meet the high-priority test, although the fine arts would still be eligible for the usual deduction for charitable donations. Setting the public contribution goal at 10% of annual income above $75,000 per person should be enough to ensure that nonprofit activities eligible for the public contribution credit are much better funded despite any crowding out or relabeling of existing contributions. There would probably be some reduction in funding for activities not considered important enough to qualify as public contributions–which would occasion much debate about exactly where to set the boundary between “public contributions” and regular charitable contributions–but setting priorities is not a bad thing.

On the part of the relatively high-income taxpayers who are subject to the combination of tax surcharge and 100% public contribution credit, many would look at the unchanged amount they actually pay the government in the end, after the tax credit, and not think of it as a net tax increase at all. Being required to devote 10% of income above $75,000 per person to public contributions would take some getting used to, but after a while, I think many people would have fun with it. Parents could teach their kids about their social responsibilities by discussing as a family where to devote the family’s public contributions. People might become involved in volunteer work in the same organizations to which they had directed their public contributions. There is joy in giving, and by providing a choice of which organization to give to, my hope is that the joy of giving would be only partially muted by the requirement of giving to some appropriate organization.

James Madison wrote in the Federalist # 51:

If men were angels, no government would be necessary. If angels were to govern men, neither external nor internal controls on government would be necessary.

Since we are not angels, most of us need very strong encouragement to give as much to public causes as the health of our Republic requires. Since those who govern us are not angels, it is best that many of the details be left to each of us to decide individually. To the extent possible, let’s have the government specialize in those important tasks that for one reason or another are not as emotionally rewarding for individuals to donate to and let individuals make decisions about those tasks that are.

People love freedom. Tax increases cannot help harming freedom to some extent. On the cost side, a program of public contributions like the one outlined above comes close to minimizing the harm to freedom from a tax increase. And the benefit side is substantial. In addition to the benefits of steering far away from national bankruptcy, it is hard for me not to think it would be a better world, with greater soft power than ever for the United States of America, if we adopted a program of public contributions like the one I have outlined.

For more on this idea, see "How and Why to Expand the Nonprofit Sector as a Partial Alternative to Government: A Reader’s Guide"

Matthew Yglesias on Archery and Monetary Policy →

I agree with Matt’s point. We should treat the loss from inflation being too high as no worse than the loss from inflation being too low.

Twitter Round Table on Federal Lines of Credit and Monetary Policy →

Be warned: this Twitter discussion is highly technical.

Why George Osborne Should Give Everyone in Britain a New Credit Card

The Guardian had a feature “Dear George Osborne, it’s time for Plan B say top economists: Seven leading economists on what Chancellor George Osborne should do to revive the ailing UK economy.” That inspired this post with my advice to the United Kingdom on the Independent’s blog, which I reprint here. Thanks to Ben Chu, Jonathan Portes and David Blanchflower for encouragement. (The links below open in the same window, so use the back button to get back.)

Dear Chancellor of the Exchequer,

Since I am an American citizen, it might be argued that I have no business giving advice to the government of the United Kingdom of Great Britain and Northern Ireland. But the economic troubles we face are worldwide and I believe are amenable to a common solution if any major nation will show the way with a new tool of macroeconomic stabilization that has fallen into our hands.

The basic problem is that fear is causing many households and firms in the private sector who could spend to cut back on their spending, while others who would be glad to spend more cannot get access to credit. Much of the advice from economists has been for governments to spend more. But even governments that have had good credit ratings and have made some attempt to increase spending have felt limited by the addition to national debt that would result from the amount of extra spending that might be needed to restore economic health. For example, in his excellent Atlantic article, “Obama Explained,” James Fallows wrote:

If keeping the economy growing was so central for Obama, why was the initial stimulus “only” $800 billion? “The case is quite compelling that if more fiscal and monetary expansion had been done at the beginning, things would have been better,” Lawrence Summers told me late last year. “That is my reading of the economic evidence. My understanding of the judgment of political experts is that it wasn’t feasible to do.” Rahm Emanuel told me that within a month of Obama’s election, but still another month before he took office, “the respectable range for how much stimulus you would need jumped from $400 billion to $800 billion.” In retrospect it should have been larger—but, Emanuel says, “in the Congress and the opinion pages, the line between ‘prudent’ and ‘crazy spendthrift’ was $800 billion. A dollar less, and you were a statesman. A dollar more, you were irresponsible.”

What is needed—mainly for genuine economic reasons, but also for political reasons—is a way to provide a large amount of stimulus without adding too much to the national debt. In my new academic paper “Getting the Biggest Bang for the Buck in Fiscal Policy,” and on my blog, I propose and discuss a tool for macroeconomic stabilization that can do exactly that. The proposal, which I call “National Lines of Credit,” (or “Federal Lines of Credit” in the US case) is to send government-issued credit cards to all taxpayers that have a substantial line of credit attached—say £2,000 per adult, or £4,000 pounds per couple. The interest rate would be relatively favorable, say 6%, with a 10-year repayment period so that most of the repayment would happen after the economy is back on its feet again. But the government would insist on eventual repayment, except for the very-long-term unemployed or disabled. Insisting on repayment would make the ultimate addition to the national debt small compared to the stimulus provided by these National Lines of Credit.

The paper provides many more details of how National Lines of Credit might work than I should try to include here, but I should mention that a key detail is requiring each household not only to pay down its debt, but also to build up a reserve of savings after the economy has fully recovered. That reserve of savings would be there to help deal with any more distant future crisis. Also, let me say that, depending on the exactly how they are implemented, National Lines of Credit are either distributionally neutral or tend to favor the poor; by contrast, the Bank of England has estimated that its program of buying gilts (which might also be necessary) has had immediate benefits tilted toward the wealthy.

Perhaps just as important as the stimulus provided by a program of National Lines of Credit would be the value of demonstrating that this kind of approach works, if it does, or gaining a greater understanding of the workings of the economy if it doesn’t. The best existing evidence- historical evidence based on the decision to allow World War 1 veterans in the U.S. to borrow against their veterans’ bonuses – suggests that the stimulus effect can be substantial. But the politics of many nations will require more evidence before National Lines of Credit can be implemented there. (Many nations in the Eurozone need a program of National Lines of Credit even more than the United Kingdom does.) Some nation must blaze the trail. If the United Kingdom is willing to take the risk of going first in trying out this new stimulus measure, and it works, it will not only have helped to solve its own economic troubles, it will have earned the gratitude of the world, in a small but still significant echo of the way in which it earned the gratitude of the world by standing against Hitler.

Miles Kimball is an economics professor at the University of Michigan who studies business cycles and the effects of risk on household consumption. He blogs about economics and politics at supplysideliberal.com.

Short-Run Fiscal Policy Posts through August 23, 2012

- Getting the Biggest Bang for the Buck in Fiscal Policy

- Reihan Salam: “Miles Kimball of Federal Lines of Credit”

- National Rainy Day Accounts

- Leading States in the Fiscal Two-Step

- Mark Thoma on Rainy Day Funds for States

- Thoughts on Monetary and Fiscal Policy in the Wake of the Great Recession: supplysideliberal.com’s First Month

- Dissertation Topic 1: Federal Lines of Credit (FLOC’s)

- Miles’s Presentation at the Federal Reserve Board on May 14, 2012 (pptx)

- Brad DeLong and Joshua Hausman on Federal Lines of Credit

- Reply to Mike Sax’s Question “But What About the Demand Side, as a Source of Revenue and of Jobs?”

- Bill Greider on Federal Lines of Credit: “A New Way to Recharge the Economy”

- Preventing Recession-Fighting from Becoming a Political Football

- What to Do When the World Desperately Wants to Lend Us Money

- My First Radio Interview on Federal Lines of Credit

- Mark Thoma on the Politicization of Stabilization Policy

- Gavyn Davies on the Political Debate about Economic Uncertainty

- Matt Yglesias on How the “Stimulus Bill” was About a Lot More Than Stimulus

- Joshua Hausman on Historical Evidence for What Federal Lines of Credit Would Do

Update:

19. Why George Osborne Should Give Everyone in Britain a New Credit Card

20. Twitter Round Table on Federal Lines of Credit and Monetary Policy

Joshua Hausman on Historical Evidence for What Federal Lines of Credit Would Do

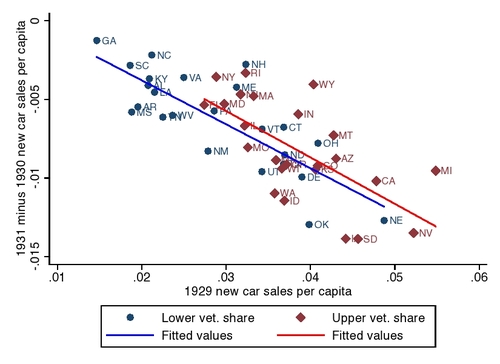

Guest blogger Joshua Hausman’s graph of the change in car sales in each state between 1930 and 1931, as a function of car sales in 1929, broken into those states with below-median fraction of veterans in the population (blue) and above-median fraction of veterans in the population (red). The fitted lines do not impose equal slopes.

The graph excludes the District of Columbia (DC), since it is a large outlier. Including DC strengthens the case for an effect of being allowed to borrow against the veteran’s bonus on auto sales: DC had a high share of veterans and was the only state to see auto sales actually increase from 1930 to 1931.

This is a guest post by Joshua Hausman. Joshua is a graduate student at Berkeley on the job market this Fall.

Perhaps the best historical analogies to Miles’s Federal Lines of Credit Proposal are 1931 and 1936 policy changes that gave World War I veterans early access to a promised 1945 bonus payment. In 1924, Congress passed a bill promising veterans large payments in 1945. When the depression came, veterans’ groups lobbied congress for immediate payment. Congress partially acquiesced in 1931, giving veterans the ability to borrow up to 50 percent of the value of their promised bonus beginning on February 27. (Prior to this, veterans could take loans of roughly 22.5 percent of their bonus.) For the typical veteran, this meant being able to borrow about $500. For comparison, in 1931 per capita personal income was $517. The loans carried an interest rate of 4.5 percent, but interest did not have to be paid annually. Rather, the amount of the loan plus interest would be deducted from what was due the veteran in 1945. In fact, the interest rate was lowered to 3.5 percent in 1932, and then forgiven entirely in 1936. But there is no reason to think that this was expected at the time.

Despite their ability to take loans, veterans continued to demand immediate cash payment of the entire, non-discounted, value of their bonus. Tens of thousands of veterans camped in Washington, DC from May to July 1932 to lobby for immediate payment. Finally, in 1936, congress granted their wish, giving veterans the choice of taking their bonus in cash or leaving it with the government where it would earn 3 percent interest until 1945. Whereas the 1931 policy change was a pure loan program, the 1936 policy had elements of both a loan and a transfer, since it gave veterans access to the same amount of cash in 1936 that they otherwise would have gotten in 1945, and since part of the 1936 bill forgave interest on earlier loans. A rough calculation suggests that of the typical bonus amount of $550 received in 1936, roughly half was an increase in veterans’ permanent income, while the other half was essentially a loan.

My ongoing work focuses on evaluating the 1936 bonus, both because it was quantitatively much larger than the 1931 loan payments, and because there is a household consumption survey and a survey of veterans themselves that makes it possible to evaluate the policy’s effects in detail. But the 1931 program is a better analogy for Miles’ Federal Line of Credit proposal. Thus in the rest of this blog post I consider what evidence there is on the 1931 program.

No single source of evidence is definitive, but several pieces of evidence suggest that loans to veterans boosted consumption in 1931. First, it is significant that veterans eagerly took advantage of the loan program. In the four months following the policy change (March to June 1931), veterans took 2.06 million loans worth an aggregate $796 million, or one percent of GDP. Since there were 3.7 million World War I veterans, these figures suggest that a majority quickly took advantage of the loan program (that is, unless many veterans took multiple loans). Given the 4.5 percent interest rate, and the lack of many attractive investment opportunities in the 1931 economy, it only made sense for veterans to take these loans to consume or to pay down high interest rate debt.

Other evidence points to veterans using some of the money on consumption rather than using it entirely to pay down debt. First, there is an uptick in department store sales amidst what is otherwise a steady downward trend. Seasonally adjusted sales rose 2.9 percent in April, the month when veterans took out the most loans. Since the proportion of veterans in the population varied significantly across states, it is also possible to relate changes in new car sales in a state to the number of veterans in the state, and thus measure the effect of the loan program. Uncovering whether or not there was such a relationship is tricky since the loan program was small compared to the other shocks hitting the economy. In particular, states with more veterans tended to be states in the west, and these states had higher car sales in 1929. In turn, states that had higher car sales in 1929 tended to see larger declines in sales during the Depression. A way to see both the relationship to 1929 sales, and the effect of veteran share is to graph the 1930-31 change in car sales per capita against the level of 1929 car sales. This is done in the figure at the top. The blue dots are states in the lower half of the veteran share distribution (i.e. states with fewer than 2.9 veterans per 100 people) and the red dots are states in the top half of the veteran share distribution. The lines are the fitted values for each set of points. The graphical evidence is hardly definitive, but it is at least consistent with the fact that conditional on pre-depression conditions, being in the top half of the veteran share distribution led to higher auto sales in 1931.

Finally, narrative sources provide some indication of what people at the time thought veterans were doing with the money. News stories are also consistent with veterans spending the money on cars. For example, the Los Angeles Times wrote on March 22, 1931: “The opinion has been ventured that the bonus readjustment would have a beneficial effect upon the motor trade and that a liberal amount of this money would find its way into the pockets of the automobile dealer. The prediction is becoming a fact to a greater extent than was at first anticipated."

Newspapers also reported veterans spending on other consumer items. The New York Times wrote on April 5, 1931: "That the payment of the soldiers’ bonus has definitely increase purchases of merchandise, particularly men’s wear, was the opinion yesterday of Julian Goldman, head of the Julian Goldman Stores, Inc., which sell goods on the instalment [sic] plan. Mr. Goldman recently returned from an extended trip through the country and reported that managers of his own stores and other merchants attributed a substantial increase in sales to the veterans spending their loan money.” The article goes on to also say that veterans were using their loans to pay back installment debt on previous clothing purchases.

2012 is not 1931 and a trial of Federal Lines of Credit today would provide much better evidence of its effects. But the 1931 experience is at least encouraging. The balance of evidence suggests that the loan program was popular and that it increased consumption relative to what it otherwise would have been. Of course, the economy still saw large absolute declines in consumption and output in 1931, since the loan program was tiny compared to the negative shocks hitting the economy.

Sources

Information on the the bonus legislation and the number and dollar amount of loans is taken from the 1931 Annual Report of the Administrator of Veterans’ Affairs, in particular, p. 42; data on seasonally adjusted department store sales are from

http://www.nber.org/databases/macrohistory/rectdata/06/m06002a.dat.

Data on veterans per capita in each state are from the 5% IPUMS sample from the 1930 Census; data on new car sales by state are from the industry trade publication Automotive Industries, data for 1929 sales is from the February 22, 1930 issue, p. 267, for 1930 from the February 28, 1931 issue p. 309, and for 1931 from the February 27, 1932 issue p. 294.

Occupy Wall Street Video →

A Principles of Macroeconomics Post

This is a great 6-minute video giving a sense of what the “Occupy Wall Street” movement and its spinoffs are all about.

For the other side, I would love to identify a video this good that is sympathetic to the “Tea Party” movement. Also, there must be good short videos about the financial crisis and the Great Recession themselves–the financial crisis and Great Recession that were the impetus for both the “Occupy Wall Street” and “Tea Party” movements.

My Ec 10 Teacher Mary O'Keeffe Reviews My Blog

Mary O'Keeffe taught my section of Ec 10 (Harvard’s full-year introduction to economics) back in the 1977-1978 school year. (Ec 10 is taught almost entirely in section, with the big lectures only icing on the cake, so she was my main instructor.) She gave me permission to reprint these thoughts that she posted on her Facebook page:

I don’t agree with everything the brilliantly eclectic Miles Kimball writes, but this piece [“Scott Adams’s Finest Hour: How to Tax the Rich”] resonates very deeply with my soul. (For those who don’t remember my earlier reference, Miles was a student in the very first intro econ class I taught at Harvard as graduate teaching fellow in the late 70s.)

He is far more nuanced and thoughtful than I would have guessed from those days–but I suppose that I too have grown more nuanced and thoughtful. I think both of us realize that there is good and bad in everything and everyone, and try to find ways to elicit the good in ourselves and others.

(Miles, who was raised a Mormon and is now a UU [Unitarian-Universalist] with a deep reverence for the good parts of his upbringing, thinks there are both good and [bad] things about his cousin Mitt Romney as well as good and bad things about President Obama. I think the same is true of everyone–some good things and some bad things–we are all flawed human beings operating in a highly imperfect world, and though I think I come down far more clearly on the side of President Obama than on the side of Mitt Romney, I think there is value in trying to understand everyone’s ideas and point of view and trying to find the best of what is within each of us.)

In short, I like this essay [“Scott Adams’s Finest Hour: How to Tax the Rich”] very much.

I am especially pleased that Mary likes my post “Scott Adams’s Finest Hour: How to Tax the Rich” yesterday since that matches my own judgment about the importance of that post compared to most of my other posts. I tweeted that it was “My most important post in a long time”–though since my blog has been in existence less than three months, “most important post in a long time” here means “best of the 62 posts after both ’You Didn’t Build That: America Edition‘ on July 24th and ’Teleotheism and the Purpose of Life' on July 25th.”

Mary wrote this addendum to her review:

Your post [“Scott Adams’s Finest Hour: How to Tax the Rich”]–by the way–reminded me of the sense of pride I feel in being part of a community of taxpayers that collectively finance public goods that exhilarate me and that I can share with the community at large.

The sudden joy of the realization one day that everyone in our community could have access to the breathtaking views from Thatcher State Park overlooking the Capital District and the bike-hike path running along the Mohawk River and the stunningly gorgeous roses in Schenectady’s Central Park Rose Garden and our great public libraries and nonprofit volunteer theater groups’ free performances in the public parks and the community spirit of all the varied denominations of churches that work together in service projects filled me with such exhilaration that I wrote this post on my own blog:

http://bedbuffalos.blogspot.com/2010/09/why-i-teach-public-finance.html