How and Why to Expand the Nonprofit Sector as a Partial Alternative to Government: A Reader’s Guide

The unavoidable urgency of a campaign to eliminate the zero lower bound that I wrote about in my 3d anniversary post “Beacons” has taken me away from campaigning for another proposal that is closer to the heart of what it means to be a Supply-Side Liberal: my proposal of a “public contribution program.” Once the campaign to eliminate the zero lower bound is won, I hope to devote more energy to campaigning for a public contribution program.

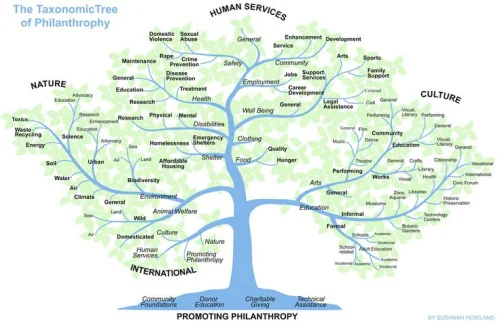

A public contribution program requires donations to charity in place of higher taxes–or if what needed to be done were less expensive–allowed tax reductions accompanied by required donations. The basic logic is that, in areas where it is possible, public goods should be provided by the nonprofit sector rather than government, with government’s role in those areas being pared back to making sure that people direct enough resources toward that provision of public goods by the nonprofit sector. Or as I wrote in The Red Banker on Supply-Side Liberalism:

… my central proposal for keeping the burden of taxation down while providing abundant public goods: a public contribution system that raises taxes rates, but lets people avoid 100% of the extra taxes by making charitable donations focused on doing things the government might otherwise have to do. …

In my book, it isn’t Supply-Side Liberalism without a serious effort to lower the burden of taxation for any given level of revenue, using everything we know about human nature.

For some time, I have hoped to have a post like this, parallel to my post “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.” What finally helped me get this done was coming across a passage from John Stuart Mill’s On Liberty discussing the nonprofit sector. That passage is the grand finale of this post.

I can think of six basic arguments for preferring nonprofit sector action to government action in many areas:

Because the nonprofit sector is more decentralized, it involves a more diverse body of key decision-makers and so can be more creative than government.

In the nonprofit sector, it is easier to sunset programs that don’t work well than in government; people can stop donating to them.

Nonprofit sector provision of public goods tends to be cheaper since wages in the nonprofit sector tend to be lower than in the private for-profit sector, while (except for the high-end of those qualified to be highly-skilled professionals) typical government wages tend to be higher than in the private for-profit sector.

Even if giving to some charity is required, giving to a charity of one’s choice is much more fun than forking over taxes to the government. Therefore, people will distort their behavior less to avoid required charitable donations than they would to avoid taxes.

Through cognitive dissonance, many who are required to give to charities will end up thinking of themselves as more altruistic and end up actually becoming more altruistic (including for many donating time as well as money to a charity). This tendency will be reinforced by discussing with friends what charity to give to. And children will be brought up surrounded by a culture of giving.

Thinking about which charity to give to will help educate people about the issues surrounding public good provision.

John Stuart Mill argues especially for 1 and 6. I would be glad to hear any other arguments. In all of this, it is important to recognize that the nonprofit sector is far from perfect. But fortunately, we have a lot of experience with government regulation of the nonprofit sector to keep things from going too far off track.

The most common argument against I have run into is that the priorities set by a democratic process are (a) better and (b) more legitimate than the priorities individuals would choose if required to give to a charitable purpose.

On the quality of priorities set by these two democratic vs. democratic mechanisms, I think the story is complex. A public contribution program is likely to increase support for scientific research and foreign aid compared to democratic decisions in the US. On the other hand, I think democratic decisions in the US now do a better job of putting the appropriate priority on national defense and aid to disadvantaged minorities. Both democratic decisions and a public contribution program would put a high priority on taking care of senior citizens. Continuing to have a substantial government budget as now plus a public contribution programs seems likely to do the best job at taking care of the full range of key public goods. Remember also that the details of regulation for the public contribution program can incorporate input from democratic decision-making. For example, perhaps opera houses that mostly serve the rich should not be eligible for public contributions. This decision of eligibility of opera houses for public contributions would be made by the usual imperfect democratic processes.

On legitimacy, I don't see why a mixed system involving some collective decision-making and some individual choice should be inherently less legitimate than a system that relies more heavily on collective decision-making.

The Core Argument

The core argument for public contribution program can be found in these three posts:

Additional Arguments

Video

Twitter Discussions

Daniel Altman and Miles Kimball: Should We Expand Government or Expand the Nonprofit Sector?

The Role of Nonprofits in Dealing with Inequality and Other Problems

Brief Appeals for Relying More Heavily on the Nonprofit Sector Relative to Government, Short Enough to Copy Out Here

The quotation from John Stuart Mill is the grand finale here. The others are from me. I give the name and link to the post they are drawn from first, then the quotation.

Speaking of decentralization, some government functions (such as taking care of the poor) might be better served if they could be decentralized to nonprofit organizations. In particular, such decentralization allows a trial and error process to work its magic as donations shift away from the least effective nonprofits to more effective nonprofits. Because people love freedom, such decentralization of certain government functions has other advantages as well, as I argue in my post “No Tax Increase Without Recompense.” In that post, I propose a way to make sure such nonprofit efforts are adequately funded.

Growing up, I was often told “You love those whom you serve.” That is a true principle of psychology. If you help someone out without too much of an ulterior motive, parts of your brain outside the localized glow of consciousness start trying to make sense of why you are being so nice. A handy explanation for your subconscious to turn to is that whoever it is means something to you. And this process of what in economists’ jargon would be called “developing a new altruistic link” works even if you know full well that it is happening. I remember when bargaining with the head of my department over the terms on which I would serve (a now completed term) as director of our Masters of Applied Economics program knowing that I had to be ready for a situation in which I would come to care about those students, even though I didn’t know them yet.

Community and religious organizations that get people involved in helping others—especially when they get people involved in helping others who are in especially bad situations—do a lot to help generate new altruistic links that make the world a fairer, more benevolent place in ways that come easily to us, psychologically, after getting over the initial hump of dealing with someone new. Strangers become friends. And our friends’ problems become our own.

Even government policy can help. Paying taxes does very little toward making us care about those who are helped from those tax revenues. But if, instead of raising taxes, we insisted that those who are comfortable contribute a substantial amount to a charity of their choice, as I advocated in my column “Yes, there is an alternative to austerity versus spending: Reinvigorate America’s nonprofits,” we would care more. And caring more, we would be likely to volunteer our time as well as giving money. And best of all, our children would see us helping other people’s children, and learn early on that loving others—even beyond our own families—is what brings us to the highest level of our own humanity.

One key to sustainably getting resources for helping the poor is to do it in a way that causes the fewest economic distortions. In addition to focusing on the right kinds of taxes, to the extent that there must be taxes, I believe that there is great potential in the kind of public contribution system that I talk about in the links in my post “The Red Banker on Supply-Side Liberalism.“ People often hate taxes, so they try to avoid them. Those efforts at tax avoidance are a social waste. So it makes sense to get many of the resources for helping the poor from public contributions that people won’t want to avoid as much as taxes, and that allow those contributing to be creative in making the world a better place. The creativity and flexibility fostered by a public contribution system are also bound to lead to technological progress in ways to help the poor.

For the record, my proposal for dealing with the long-run budget issues that are the heart of the disagreements between Republicans and Democrats is the system of “public contributions” laid out in my post “No Tax Increase Without Recompense.” This public contribution system would help make sure that the poor and afflicted are taken care of while reducing the footprint of the government in society.

[The] public contribution program will do a lot more to take care of the poor and the sick and to honor the elderly than we do now. [We] just need to be careful not to cut back on direct government programs until we are really confident that the decentralized efforts from the public contribution program are taking care of things in specific areas.

Robert Shiller, in an interview by David Wessel (see "Robert Shiller's Nobel Knowledge")

We should start preparing for a day, maybe 10 or 20 years in the future, when inequality may be much worse. We don't yet know whether it's going to be worse. We should have a contingency plan now. ...

Q: So we'd have a tax increase on wealthier people that would go into effect if some measure of inequality reached a certain point?

A: Yes. If billionaires turn into multi-billionaires, we don't let that happen. If you want to make $10 billion and spend it on yourself, we won't let you. We will take a good fraction of it, and you'll still be a billionaire, so what?

The other side of it is I think we should expand the charitable deduction, so if you make $10 billion and you want to give 90 percent of it away, you can give it away with your name on it so it enhances your prestige, but give it away and you should be able to deduct it.

Q: So we would more aggressively redistribute income from the top?

A: From selfish people at the top who don't want to give it away. You could turn into Bill Gates or an Andrew Carnegie. I think that's OK. Instead of just taxing people—saying, "We're just taking the money, and you'll go to jail if you don't turn it over"—we can find a better way.

John Stuart Mill, in paragraphs 16-19 of On Liberty “Chapter V: Applications”

I have reserved for the last place a large class of questions respecting the limits of government interference, which, though closely connected with the subject of this Essay, do not, in strictness, belong to it. These are cases in which the reasons against interference do not turn upon the principle of liberty: the question is not about restraining the actions of individuals, but about helping them: it is asked whether the government should do, or cause to be done, something for their benefit, instead of leaving it to be done by themselves, individually, or in voluntary combination.

The objections to government interference, when it is not such as to involve infringement of liberty, may be of three kinds.

The first is, when the thing to be done is likely to be better done by individuals than by the government. Speaking generally, there is no one so fit to conduct any business, or to determine how or by whom it shall be conducted, as those who are personally interested in it. This principle condemns the interferences, once so common, of the legislature, or the officers of government, with the ordinary processes of industry. But this part of the subject has been sufficiently enlarged upon by political economists, and is not particularly related to the principles of this Essay.

The second objection is more nearly allied to our subject. In many cases, though individuals may not do the particular thing so well, on the average, as the officers of government, it is nevertheless desirable that it should be done by them, rather than by the government, as a means to their own mental education—a mode of strengthening their active faculties, exercising their judgment, and giving them a familiar knowledge of the subjects with which they are thus left to deal. This is a principal, though not the sole, recommendation of jury trial (in cases not political); of free and popular local and municipal institutions; of the conduct of industrial and philanthropic enterprises by voluntary associations. These are not questions of liberty, and are connected with that subject only by remote tendencies; but they are questions of development. It belongs to a different occasion from the present to dwell on these things as parts of national education; as being, in truth, the peculiar training of a citizen, the practical part of the political education of a free people, taking them out of the narrow circle of personal and family selfishness, and accustoming them to the comprehension of joint interests, the management of joint concerns—habituating them to act from public or semi-public motives, and guide their conduct by aims which unite instead of isolating them from one another. Without these habits and powers, a free constitution can neither be worked nor preserved; as is exemplified by the too-often transitory nature of political freedom in countries where it does not rest upon a sufficient basis of local liberties. The management of purely local business by the localities, and of the great enterprises of industry by the union of those who voluntarily supply the pecuniary means, is further recommended by all the advantages which have been set forth in this Essay as belonging to individuality of development, and diversity of modes of action. Government operations tend to be everywhere alike. With individuals and voluntary associations, on the contrary, there are varied experiments, and endless diversity of experience. What the State can usefully do, is to make itself a central depository, and active circulator and diffuser, of the experience resulting from many trials. Its business is to enable each experimentalist to benefit by the experiments of others; instead of tolerating no experiments but its own.

Update: This post engendered a lively Facebook discussion, which you can see here.