Noah Smith, Miles Kimball and Claudia Sahm on Math in Economics →

Short and sweet & sour.

A Partisan Nonpartisan Blog: Cutting Through Confusion Since 2012

Short and sweet & sour.

My University of Michigan colleague Jeff Smith had these wise words to add to what Noah and I said on how to get into an economics PhD program. Jeff kindly gave me permission to reprint his advice here as a guest post:

I am generally in agreement with what Miles and Noah have to say, but would add or alter a few bits:

1. By all means do not just focus on the top five or 10 or 15 programs. The poster child here is probably Amitabh Chandra (now at the Kennedy School), whose doctorate is from Kentucky. On my very first visit to Kentucky back in my assistant professor days, I was assigned to meet with Amitabh and told to talk him out of staying at Kentucky for his doctorate. I failed, but his career seems to have turned out fine anyway. The reason it turned out fine is that the faculty at Kentucky, who already knew Amitabh as a stellar undergraduate, treated him like a colleague throughout his doctoral studies. He got a lot more attention and opportunity than he would have at a top program. Example number two is my colleague Martha Bailey, whose doctorate is from Vanderbilt. What Amitabh and Martha have in common is a lot of internal drive, which you need to make this strategy work because there is less external pressure from peers and faculty outside the top departments.

2. You should take more than just one statistics course. If your college offers an upper econometrics track for undergraduates (many do, and Michigan will soon) take the whole thing. If an upper track is not available, be sure you do what you can and think about taking some courses in the statistics department as well.

3. Learn to program if you do not already know. Pretty much any reasonable programming language will do. Once you have learned one, others (including statistical packages like Stata or Matlab) are much easier to learn.

4. I think there can be more value in doing an MA first than Miles and Noah. This is particularly true if your undergraduate record is a bit weak and/or if you are unsure you really want to do a doctorate. The trick is then picking the correct MA program. Many are aimed at mid-career people adding a credential and not at people thinking about a doctorate. I recommend in particular the programs at UBC and Toronto. They have the added bonus of plugging you into a somewhat different network and letting you experience life in another country (assuming you are not Canadian).

5. It is harder to get someone to hire you as a research assistant, even at a zero money wage, than Miles and Noah suggest. The time cost to the professor is really large of having a research assistant. Paying that time cost for someone who turns out not to produce - it happens! - is something faculty really try hard to avoid. So if you want to do this, it is probably best to first make a good impression in a class, or in someone else’s class who is willing to write an email of introduction for you to the person you want to work for.

6. Think about taking, or at least auditing, first-year graduate courses at your undergraduate institution. I did this at Washington, taking Gene Silberberg’s excellent first quarter of graduate micro.

7. Getting a doctorate at a biz school with an economics group is at least as good as a straight-up economics program. It is easier to get in and you will likely have more financial aid and a nicer place to work. The same holds for some policy school doctoral programs.

Wu-wei: action through inaction

The image of self-control, both in popular culture and in economics, is of a kind of action. But psychologists Justin Hepler and Dolores Albarracín report that priming people with extraneous inaction words helped them resist temptation, while extraneous action words made it harder for them to resist temptation. (See the news article by Rick Nauert, “Is Unconscious Self-Control Possible?”) This sounds like Taoist wisdom to me: the key Taoist concept of wu-wei is “action through inaction.”

In his book How Music Works, David Byrne argues for the traditional economic principle “De gustibus, non est disputandum”–tastes are not to be disputed. But eminent economist John Maynard Keynes departed from that principle in the arts. Here is what David Byrne says about Keynes, on pages 279 and 280:

Outside of his work as an economist, Lord Keynes was involved in an organization called the Council for the Encouragement of Music and the Arts (CEMA), a government arts-funding agency that later morphed into the Arts Council of Great Britain. It was established during World War II to help preserve British culture. Keynes, however, didn’t much like popular culture–so some things were deemed outside the provenance of the agency’s mission. Keynes “was not the man for wandering minstrels and amateur theatricals,” observed Kenneth Clark, the director of London’s National Gallery, and later the host of the popular television series Civilisation. Mary Glasgow, Keynes’s longtime assistant, concurred: “It was standards that mattered, and the preservation of serious professional enterprise, not obscure concerts in village halls.”

If we subscribe to the nineteenth-century view that professionally made classical music is good for you and good for the ordinary man, then it follows that supporting it financially is more like funding a public-health measure than underwriting entertainment. The funding of “quality” work is then inevitable, because it’s for the good of all–even though we won’t all get to see it. The votes came in, and the amateurs lost by a landslide. (The Arts Council did, however, modify their brief after Keynes’s death.) There seemed to be no way, meanwhile, to teach folks how to develop their own talent–one was either born with it or not. Hazlitt, Keynes, and their ilk seem to discount any knock-on effects of benefits that amateur music-making might have. In their way of thinking, we should be happy consumers, content to simply stand back and admire the glorious efforts of the appointed geniuses. How Keynes’s friends like Virginia Woolf, or his wife, the ballerina Lydia Lopokova, learned their own skills is not explained.

Let me mention one thing to watch out for if (to bolster the argument that high-frequency trading adds to liqiuidity) someone brings to the table empirical evidence on the effect of high-frequency trading bid/ask spreads: front running by the market makers can raise trading costs too. The extra trading costs from the front running of high-frequency trading should be added to the usual bid/ask spread; just because a trading cost is less visible than bid/ask spreads doesn’t mean it doesn’t count.

The Lone Ranger and Tonto (original story, movie, movie review)

I am not drawn to Libertarianism as it is usually argued (see my post “Libertarianism, a US Sovereign Wealth Fund, and I”), but I am drawn to Michael Huemer’s version of Libertarianism. I am not sure that he has the right practical solution for achieving the ethical ideals he champions, but the ethical ideals themselves must be taken very seriously. I want you to see some of the force of his argument. I actually find his arguments most powerful as applied in particular areas of concern, as you can see in my post “Michael Huemer’s Immigration Parable.” I plan to post more of Michael’s “applications” in the future.

My own very brief summary of Michael’s argument is that it is only OK for the government to do what the Lone Ranger (along with Tonto and any number of other colleagues) could ethically do. But let me give you Michael’s own summary of his argument, with two passages from his book The Problem of Political Authority: An Examination of the Right to Coerce and the Duty to Obey:

Libertarianism is a minimal government (or, in extreme cases, no government) philosophy, according to which the government should do no more than protect the rights of individuals. Essentially, libertarians advocate the political conclusions defended in this chapter. But this position is very controversial in political philosophy. Many readers will wonder if we are really forced to it. Surely, to arrive at these radical conclusions, I must have made some extreme and highly controversial assumptions along the way, assumptions that most readers should feel free to reject.

Libertarian authors have indeed frequently relied upon controversial assumption. Ayn Rand, for example, thought that capitalism could only be defended by appeal to ethical egoism, the theory that the right action for anyone in any circumstance is always the most selfish action. Robert Nozick is widely read as basing his libertarianism on an absolutist conception of individual rights, according to which an individual’s property rights and rights to be free from coercion can never be outweighed by any social consequences. Jan Narveson relies on a metaethical theory according to which the correct moral principles are determined by a hypothetical social contract. Because of the controversial nature of these ethical or metaethical theories, most readers find the libertarian arguments based on them easy to reject.

I have appealed to nothing so controversial in my own reasoning. I reject the foundations for libertarianism mentioned in the preceding paragraph. I reject egoism, since I believe that individuals have substantial obligations to take into account the interests of others. I reject ethical absolutism, since I believe an individual’s rights may be overridden by sufficiently important needs of others. And I reject all forms of social contract theory, for reasons discussed in Chapters 2 and 3.

The foundation of my libertarianism is much more modest: common sense morality. At first glance, it may seem paradoxical that such radical political conclusions could stem from anything labeled ‘common sense.’ I do not, of course, lay claim to common sense political views. I claim that revisionary political views emerge out of common sense moral views. As I see it, libertarian political philosophy rests on three broad ideas:

- A nonagression principle in interpersonal ethics. Roughly, this is the idea that individuals should not attack, kill, steal from, or defraud one another and, in general, that individuals should not coerce one another, apart from a few special circumstances.

- A recognition of the coercive nature of government. When the state promulgates a law, the law is generally backed up by a threat of punishment, which is supported by credible threats of physical punishment, which is supported by credible threats of physical force directed against those who would disobey the law.

- A skepticism of political authority. The upshot of this skepticism is, roughly, that the state may not do what it would be wrong for any nongovernmental person or organization to do. [pp. 176-177]

I have therefore focused on defending skepticism about authority by addressing the most interesting and important theories of authority. In defending this skepticism, I have, again, relied upon no particularly controversial ethical assumptions. I have considered the factors that are said to confer authority on the state and found that in each case, either those factors are not actually present (as in the case of consent-based accounts of authority) or those factors simply do not suffice to confer the sort of authority claimed by the state. The latter point is established by the fact that a nongovernmental agent to whom those factors applied would generally not be ascribed anything like political authority. I have suggested that the best explanation for the inclination to ascribe authority to the state lies in a collection of nonrational biases that would operate whether or not there were any legitimate authority. Most people never pause to question the notion of political authority, but once it is examined, the idea of a group of people with a special right to command everyone else fairly dissolves. [p. 178]

For financial stability, along with Anat Admati, Martin Hellwig and others, I strongly advocate the simple idea of requiring banks and other financial firms to be financed by at least 50% equity on the liability side of their balance sheets.

… despite all of the efforts of bankers and the rest of the financial industry to obscure the issues, it all comes down to making sure banks are taking risks with their own money—that is, funds provided by stockholders—rather than with taxpayers’ or depositors’ money. For that purpose, there is no good substitute to requiring that a large share of the funds banks and other financial firms work with come from stockholders.

In particular, the basic problem with convertible capital, bail-ins, and so on is that they all require a decision–either drawn out an painful, or sudden and painful–to force those who have theoretically accepted a risk to actually take a loss. By contrast, equity holders take losses and make gains continually, without everything hingeing on a decision to make some group take the loss. The automatic nature of taking equity losses and getting equity gains is both an advantage in itself and tends to make these capital gains and losses more continuous and less sudden than for convertible capital and “debt” in bail-ins. The discretion that typically exists for convertible capital and bail-ins is much worse than monetary policy discretion, because the decision makers in those cases can’t help being highly conscious of which specific groups are losing money from their decision. By contrast, for monetary policy the decision makers have many other plausible ways they might be looking at things besides the distributional perspective.

For getting the flavor of the problems with convertible capital, in particular, I liked this article on “Coco Hurdles” by Cetier the First on the Capital Issues website so much that I asked and received Cetier’s permission to reprint it here. (Note: The pen-name Cetier the First is from the Basel abbreviation for Common Equity Tier 1, or CETier 1–this is basically shares, not convertible capital.)

There is a vibrant debate going on regarding convertible capital or coco’s, see for example this recent paper from the U.S. treasury.

On first sight a coco looks great. In going concern there is a tax advantage for the issuer. And when the issuer’s viability starts deteriorating, cocos may help lower the probability of default. Once a bank is in real trouble, a coco can be used to minimize the loss in default. Conversion should also dilute the owners, a punishment that should deter moral hazard behavior.

However, in practice, cocos are a mess. I will explain.

All discussions on cocos start out praising them for their virtuous properties: they are good for financial stability; they limit the probability of default and the loss given default. The general idea is that the coco converts when the bank hits some predetermined trigger, e.g. a BIS ratio of 9%. When conversion takes place, the reckless owners are punished by way of dilution, and the bank does not have to access the market for new capital. The bank stays in business and can carry on as if nothing ever happened.

In practice there are hurdles that make cocos punitively unattractive. But before digging into these hurdles, let me first define a coco as any security that may be written off (partially or in full), in some cases combined with a form of compensation. This compensation can be in the form of shares or in the form of a claim on future reserves of the bank.

Coco hurdles:

Despite the theoretical virtues of coco’s, in practice these virtues may be virtual.

Note: Anat Admati tweets

Re difficult pricing issues, see also http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2018478 … discontinuous tax treatment complicates too

and also agrees with my claim that bail-in-able debt has similar issues.

Update: John Aziz writes this addendum to his post “Obama Talks Bubble Avoidance”:

Miles Kimball on Twitter points me toward Anat Admati’s suggestion of implementing bank capital requirements to make bubbles less damaging. This is a very fair suggestion, because it is a stabiliser that does not lean on the idea of eliminating bubbles, but the idea of limiting their impact. Obviously, rules can be gamed, but if implemented properly it could systematically limit the size of bubbles, by cutting off the fuel of leverage.

This is another milestone for me, to have the column I wrote with Noah Smith, “The Complete Guide to Getting Into an Economics Ph.D. Program” appear in the Atlantic as well as on Quartz. (They are both owned by the Atlantic Co., but are different websites.) As you can see, the Atlantic layout and picture is different. For comparison, here is the layout and picture on Quartz:

John Stuart Mill couldn’t do hypertext, but I can do it for him. John gave the second chapter of On Liberty the title "Of the Liberty of Thought and Discussion.“ Here is how he sums up his argument at the end of the chapter, with links to the posts where I give his more detailed arguments:

We have now recognised the necessity to the mental well-being of mankind (on which all their other well-being depends) of freedom of opinion, and freedom of the expression of opinion, on four distinct grounds; which we will now briefly recapitulate.First, if any opinion is compelled to silence, that opinion may, for aught we can certainly know, be true. To deny this is to assume our own infallibility. (See ”John Stuart Mill on the Adversary System,“ ”John Stuart Mill on the Protection of ‘Noble Lies’ from Criticism“ and ”Should Troubling Arguments Be Kept Away from Those Who Might Be Unduly Swayed by Them?“)Secondly, though the silenced opinion be an error, it may, and very commonly does, contain a portion of truth; and since the general or prevailing opinion on any subject is rarely or never the whole truth, it is only by the collision of adverse opinions that the remainder of the truth has any chance of being supplied. (See ”A Remedy for the One-Sidedness of the Human Mind“ and ”Why Progressives and Conservatives Need Each Other.“)Thirdly, even if the received opinion be not only true, but the whole truth; unless it is suffered to be, and actually is, vigorously and earnestly contested, it will, by most of those who receive it, be held in the manner of a prejudice, with little comprehension or feeling of its rational grounds. (See ”Let the Wrong Come to Me, For They Will Make Me More Right“ and "In Praise of Trolls.”)And not only this, but, fourthly, the meaning of the doctrine itself will be in danger of being lost, or enfeebled, and deprived of its vital effect on the character and conduct: the dogma becoming a mere formal profession, inefficacious for good, but cumbering the ground, and preventing the growth of any real and heartfelt conviction, from reason or personal experience. (See “How Freedom of Speech for Falsehood Keeps the Truth Alive.”)

Update, October 19, 2019: Richard Reeves and Jonathan Haidt have created an abridged version of this second chapter of On Liberty to make it’s still timely message more accessible to college students:

Update, October 31, 2019: You might be interested in John Danaher’s layout of John Stuart Mill’s argument for freedom of speech.

On my trip to Tokyo in June, 2013 to teach about the Economics of Risk and Time at Keio University and to gives seminars about electronic money at the Bank of Japan, Keio University and the Ministry of Finance, Masao Ogaki gave me an intriguing account of how famous Manga author Osamu Tezuka achieved some of the subjective effect of a motion picture with a stationary manga page. He kindly agreed to write up a paragraph for supplysideliberal.com. Here is what Masao has to say:

My son, who grew up in the United States, loves to read Manga in Japanese but does not read Manga translated into English. I asked why, and he explained to me that eye-movements are important for Manga. I got interested in this and searched for internet articles. An article, http://shuhosato.mangareborn.jp/blog/?p=59, explains that this technique is called “visual guidance,” which has been used to create a rhythm and sometimes an illusion of motion. I am not an expert, but think that the first Manga artist who started to use this technique was Osamu Tezuka in 1940s. He started to use complicated layouts that calculate and guide the reader’s eye-movements of reading sentences and watching pictures.

Because the way the illusion of motion is created depends on habits of how one’s eyes scan a page, the technique would have to be adapted to work for comics or manga in English. I am hoping will try to achieve this affect in a way that works for native English readers, or even better, that someone has already.

Personally, I would rather read Noah’s blog than any other blog in cyberspace. That brilliant style shows through here; I think I managed not to spoil things too much in this column.

In case you are curious, let me say a little about the financial costs and benefits of an economics PhD. At Michigan and other top places, PhD students are fully funded. Here, that means that the first year’s tuition and costs are covered (including a stipend for your living expenses). In years 2 through 5 (which is enough time to finish your PhD if you work hard to stay on track), as long as you are in good standing in the program, the costs of a PhD are just the work you do as a teaching assistant. So there are no out-of-pocket costs as long as you finish within five years, which is tough but doable if you work hard to stay on track. Tuition is relatively low in year 6 (and 7) if you can’t finish in 5 years. Plus, graduate students in economics who have had that much teaching experience often find they can make about as much money by tutoring struggling undergraduates as they could have by being a teaching assistant.

When a school can’t manage full funding, the first place it adds a charge is in charging the bottom-half of the applicant pool for the first year, when a student can’t realistically teach because the courses the grad students are taking are too heavy. That might add up to a one-time expense of $40,000 or so in tuition, plus living expenses.

On pay, the market price for a brand-new assistant professor at a top department seems to be at least $115,000 for 9 months, with the opportunity to earn more during the summer months. If you don’t quite make it to that level, University of Michigan PhD’s I have asked seem to get at least $80,000 starting salary, and Louis Johnston tweets that below-top liberal arts colleges pay a starting salary in the $55,000 to $60,000 range. But remember that all of these numbers are for 9-month salaries that allow for the possibility (though not the regularity) of earning more in the summer. Government jobs tend to pay 12-month salaries that are about 12/9 of 9-month academic salaries at a comparable level.

There is definitely the possibility of being paid very well in academic economics, though not as well as the upside potential if you go to Wall Street. For example, with summer pay included, quite a few of the full economics professors at the University of Michigan make more than $250,000 a year. (Because we are at a state university, our salaries are public.)

The bottom line is that the financial returns are good enough that you should have no hesitation begging or borrowing to finance your Economics PhD. (Please don’t steal to finance it.)

What about the costs of the extra year it might take to study math the way we recommend? If you have been developing self-discipline like a champion, but are short on money and summers aren’t enough, you could spend a gap year right after high school just studying math, living in your parents’ house at very low cost; most colleges will let you defer admission for a year after they have let you in.

I liked this comment that Kevin C. Smith (an MD) sent to Quartz:

Great advice!

I almost flunked Grade 8 because my math was so bad [back in the day they would flunk you for that, at least in Alberta.]

I wound up heading for medicine. A friend who was a few years ahead of me warned: “You’ll never make it if you are not good at math!”

I hired a math tutor in August [before University started], and did every question at the end of every chapter in every one of my text books. I couldcall my tutor when I got stuck [God bless her, wherever she is in the world today!] Math got to be fun after a while [like being really good at solving puzzles.]

You might add to you list of suggestions: hire a tutor do all the questions in all your textbooks

Long story short, I won the Gold Medal for Science, and have found that a really good grasp of math has helped my enjoyment of the world and of my work a lot.

Note: The segment doesn’t really start until a little after the 2 minute mark.

The Talent Code on Amazon.

Video trailer for The Talent Code.

This post is part of my series on deliberate practice (also called deep practice or purposeful practice), which I consider very important for understanding education and human capital accumulation more broadly.

In the last few years, I have often taught an introductory macroeconomics class. Both at the beginning of the semester, and whenever a student comes to me puzzled that they have done worse-than-expected on an exam, I recommend that they read the book The Talent Code. What I hope they get from the book is a sense of what it means to study in a deep way, rather than just “going over the material.” In case students don’t read the book, I have had teams of students from an honors section of the class give a presentation on the book to the entire class of about 250 students. I strongly recommend this

which they generously gave me permission to post. I had the audience vote on this and presentations about 5 other books. This was voted best of all 6 presentations. I agreed with the audience’s assessment. (The other books were

Here is the essence of the 3 key slides in Hrishikesh’s and Madeline’s Powerpoint file:

Deep Practice

Chunk it up

- Absorb–get involved with practice: imitation

- Break it into chunks–organize practice into smaller pieces

- Slow it down–take time to practice correctly

Repeat

Learn to feel it

Self-Learning Connection

Master Coaching

- Having someone inspire you to keep working can be effective

- However, your greatest coach is yourself

Ignition

- Make yourself passionate about learning

- Find your own source of ignition

Deep Practice

- Absorb–study deeply, not necessarily a lot

- Break it into chunks–all-nighters are less effect than spreading it out

- Slow it down–take time to make sure you are learning

- Repeat–practice makes perfect!

in the text above, I bolded a thought that got a particularly strong audience reaction: the greater effectiveness of spreading study out over time, instead of concentrating it in one all-nighter.

Here is a link to my 28th column on Quartz “Benjamin Franklin’s strategy to make the US a superpower worked once, why not try it again?”

Update: Steve Sailer has an interesting post pointing out the importance of birth rates, as well as the immigration rates I emphasize in the column. In order to keep an open mind, before reading Steve Sailer’s post, I recommend reading my post “John Stuart Mill’s Argument Against Political Correctness.” In his post Steve also points out that Ben Franklin favored English immigration over German immigration.

Ezra and Evan’s Flag. I was very pleased to see Ezra Klein and Evan Soltas flag the column, and intrigued by the way they boiled it down:

KIMBALL: The Ben Franklin strategy to a U.S. renaissance. “The reason China’s economic rise matters for US grand strategy is that China has a much larger population than the United States…An excellent answer is to do everything possible to foster long-run growth of per capita GDP in the US. At a minimum, this includes radical reform of our system of K-12 education, removing the barriers state governments put in the way of people getting jobs, and dramatically stepped-up support for scientific research…The key to maintaining America’s preeminence in the world is to return to Ben Franklin’s visionary grand strategy of making many more of the world’s people into Americans.” Miles Kimball in Quartz.

The Mormon Church’s Conference Center

Reading Noah Smith’s incisive post “Conservative White America, You Need a New Grand Strategy,” my main reaction is that American Mormons, while predominantly white, and just as conservative in many dimensions, do much better than Noah’s description of Conservative White America in general. So Mormonism might provide clues to the new grand strategy Noah calls for for Conservative White America. Let me pursue that idea in the spirit of the grand research project I recommended in my post “Godless Religion” of trying to figure out how to get the non-supernatural benefits of religion without requiring supernatural beliefs (a research project saw Ari Schulman questions in his Wall Street Journal op-ed “Does Faith Make You Healthier?”).

I do not have all of the sociological facts at my fingertips, but let me give my impressions on each of the issues Noah raises for Conservative White America, subject to correction by readers who do have the sociological facts at their fingertips. (Lest I seem to be cheerleading too much for Mormonism in what follows, let me remind readers that I personally disagree with Mormonism’s supernaturalism, authoritarianism, patriarchy and opposition to gay marriage, and maintain the very different theology of Teleotheism.)

Here are Noah’s concerns about Conservative White America and my reactions:

1. First, Conservative White America has failing families. Divorce rates are highest in the “Bible Belt” states where Conservative White America is strongest. While professional whites (who are often liberals) have reversed the trend toward higher divorce, working-class whites are essentially abandoning marriage. While conservatives would claim that this trend is due to the spread of liberal, secular values, the reverse is true; Bible Belters get married more often and earlier than their Northeastern cousins. They just get divorced a lot. Those conservative values are shoving white people, especially working-class white people, into unhappy marriages that cannot last in the modern world.

Miles:

With a strong prohibition on premarital sex and its approaches, and social encouragement for marriage as soon as at least the male has served a proselyting mission, Mormons tend to marry young. But after accounting for the inevitable effects of age at marriage, it is my impression that Mormon divorce rates are relatively low. On the supernaturalist side, the notion that with “eternal marriage,” a marriage lasts even into the afterlife may encourage investment in the marriage relationship. In addition, weekly Mormon teaching focuses heavily on trying to help Mormons have a loyal and rewarding marriages and family life.

2. Next, Conservative White America has failing health. Of course, this is true of all of the United States, and American blacks and Hispanics fare worse than American whites on most health measures. But white Europeans significantly defeat their American cousins on most health outcomes, while Americans pay much more and enjoy much more uncertain access to care. This is due mainly to the success of conservatives in blocking the implementation of universal health care (a case of all America having problems due to CWA policy triumphs). Some small part of it may also have to do with the effect of suburban sprawl and lightly regulated corporate food (loaded with sugar and/or fat) on obesity rates. Additionally, suburban and rural drug use may be rising, even as urban drug use has fallen steadily. And white teens are more likely than black or Hispanic teens to abuse drugs. These trends do not bode well for the health of Red America.

Miles:

Mormon prohibitions on alcohol and tobacco–and according to many Mormons, all caffeinated beverages–have direct good effects on health, and also make it possible for rebellious souls to express their rebellion with alcohol, tobacco or even caffeinated beverages, instead of through illegal drugs. The scourge of obesity does not spare Mormons, but overall, Mormons on average live much longer than most other American groups.

3. Add to that failing economic mobility. Much is made of the economic dynamism of Red states like Texas (well, mainly Texas). But white Americans experience the least economic mobility in the South, the most conservative region. And upward mobility for whites seems to be lowest in regions with heavy sprawl.

Miles:

Although relatively large Mormon family sizes quickly dilute inherited wealth, Mormons are relatively well educated and have standards of honesty and diligence that make them relatively attractive employees for a given level of education. Academically skilled and religiously faithful Mormon teenagers can get a heavily subsidized college education at Brigham Young University, which is comparable in quality to many top state universities but with lower tuition, regardless of state of residence. Mormon congregations also provide a source of good educational and career advice for young people. And casual conversation in Mormon country often turns to career and even entrepreneurial ideas to get ahead enough financially to support a relatively large family.

4. Conservative White America, like the rest of America, also has failing economic performance. Sure, rich people - who have done pretty well over the past 13 years of stagnating incomes - tend to be conservative. But the vast majority of conservative white voters are not rich, and have seen their incomes fall along with the rest.

Miles:

Utah’s economy, where Mormons predominate, has been doing very well compared to the national economy for quite some time. It isn’t just the long-run trend for Utah that is positive. Visiting Provo and Salt Lake City in Utah regularly over the last few years I have seen no signs at all of effects of the Great Recession.

5. And to some degree, Conservative White America also has failing social lives. Studies show that suburban residents are less satisfied with their neighborhoods than urban residents, with loneliness and social isolation probably to blame. Other research has shown that urban design has a big influence on social connection. It’s just really hard to meet people in the spread-out, isolated non-cities into which conservatives would have us move - and into which much of white America has moved over the past sixty years. Gone are the days of small-town America where everyone knew their neighbors. In the modern suburbs, you are stuck in a box with nobody and nothing.

Miles:

Mormon congregations insure that any Mormon who is religiously involved will have an extensive social network. It is very hard to be socially isolated as a Mormon, even for those who would like a little more social isolation. Part of the genius of Mormonism is the way a Mormon congregation functions as an ersatz small town, where everyone knows everyone else. But unlike an actual small town, Mormons can move across the country and immediately be integrated into another ersatz small town.

6. Now finally we get to Conservative White America's failing electoral clout. The poor performance of the GOP cannot, as some hopeful conservatives have claimed, be ascribed to “missing white voters”. Whites for whom race defines politics - i.e. most of the current Republican base - have shut themselves out of future political coalitions. They could have followed the example of liberal whites, who allied with minorities, including poorer minorities (blacks, Hispanics) and richer minorities (Asians), and thus will have a big say in shaping America’s future policies. Meanwhile, stuck in permanent racial panic mode, all Conservative White America can do is pull their veto levers - the filibuster, etc. - to gum up the machinery of American politics and slow the inevitable.

Miles:

Mormons are still a small minority, so great electoral clout is not to be expected. But despite Mitt Romney’s liabilities as a presidential candidate, Mormons can feel gratified by having passed the milestone of having had their own major party nominee. Even if Mitt doesn’t run again (far from a bygone conclusion), in John Huntsman, the Mormons have a credible candidate should the Republicans lose too many presidential elections due to overly extreme nominees and become willing to nominate someone who (so far) appears relatively moderate.

Where Does Conservative White America Go Wrong?

Noah makes the following strategic judgment for Conservative White America:

The five big pieces of Conservative White America’s Grand Strategy that I think need reevaluation are:

1. “White flight” to suburbs and exurbs

2. Rigid and inflexible “family values"

3. Hostility toward immigrants and minorities

4. Excessive distrust of the government

5. Distrust of education, science, and intellectualism

Miles:

White Flight.

Mormons were never thick on the ground in areas that had many African-Americans, so "white flight” has not been a big phenomenon for them in the first place. Although racism is not absent among Mormons, most Mormons I know are so embarrassed by Mormonism’s history of having denied the Mormon priesthood to blacks before 1978 that they try extra hard to have good race relations and to have positive attitudes toward African-Americans.

Family Values.

Mormons have what Noah would call “rigid and inflexible ‘family values’” but, I think, manage to implement them better. One reason Mormons can implement family values better is that they have high church leaders spelling out the ramifications of those family values in relatively sensible ways, given the overall family-values commitments. Popular culture alone tends to result in a worse version of “family values.”

Immigration.

Mormonism’s eagerness to make the whole world into Mormons spills over into a positive attitude toward immigration. If they want people to come into the Mormon Church and become Mormons, why shouldn’t they want people to come into America and become Americans? Moreover, a large fraction of Mormons serve proselyting missions in other countries in their late teens and early twenties. That not only fosters positive attitudes toward people in other countries (and for languages other than English), but also creates personal ties to non-Americans who would like to become Americans. In its official statements, the Mormon Church is remarkably pro-immigration relative to the Republican norm.

Government.

Mormons are negative about government, but positive about the Mormon Church, which has the capacity to take on all the functions of a government–as it did when the Mormon settlers first arrived in Utah. Thus, Mormonism is not at all prey to radical individualism. Collective action is fine, it is just that government is not seen as the best form of collective action. You can see a notion of collective action inspired by the insights I have gained from my Mormon background in my posts “No Tax Increase Without Recompense” and “Yes, There is an Alternative to Austerity vs. Spending: Reinvigorate America’s Nonprofits.” Science, Education and Intellectualism. Overall, Mormonism distrusts education, science and intellectualism only where education, science and intellectualism cause people to stop believing in Mormonism. The Mormon Church has realized that, in practice, science is not the main enemy of supernaturalist religion, Postmodernism is. (There is a post to come on that topic.)

One advantage Mormonism has in its relationship with science is that its founder, Joseph Smith, fully incorporated early 19th century science into Mormonism. Because Joseph Smith was murdered by a mob in 1844, he did not live to see the publication of Darwin's The Origin of Species, and so could not fully incorporated evolution into Mormonism, so Mormonism has a testy relationship with Darwinism, but BYU professors are allowed to teach Darwinian evolution.

Mormonism lauds its scientists, as long as they continue believing in Mormonism. And it has many believing scientists that it can point to, among them my great uncle, the renowned (but not quite nobel-laureate) chemist Henry Eyring.

Summing Up

To me, it seems that Mormons have avoided the major problems faced by the bulk of Conservative White America. It is worth thinking about why. In that effort, this post barely scratches the surface. I would love to see a broader discussion of this question.

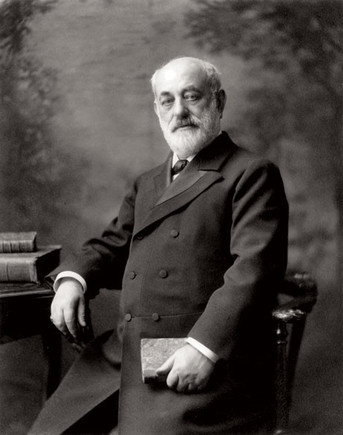

Marcus Goldman, founder of Goldman Sachs

My friend John Davidson sees information as the central issue for the economy. In this guest post, he argues that one of our big supply-side problems is the decline in the quality of human-brain information-processing behind lending decisions.

Noah Smith argues that “Something Big Happened in the Early 70s.”

You and others have your macro theories and I am Keynesian, but I have told everyone until I am blue in the face that short-run stimulus is not enough and events bear me out.

This country is broken because community and commercial banking is broken by risk aversion, undercapitalization, and mis-regulation. We need to return to community bankers being almost merchant bankers.

I also have no regard for economists in the Koch orbit as they are political operatives and nothing but crony capitalism at its worst, so I will start with a real life model.

It is really simple to see a lot of what is wrong in America if one just reads the second chapter of Goldman Sachs: The Culture of Success.while at the same time, watch Copper on Netflicks (which is set in NYC at the time Goldman Sachs was formed).

For more than a few hours, contemplate an economic world in which Goldman was operating as he walked those streets in NYC in 1870 in his Top Hat and Frock coat. He could see, hear, taste commerce all around. The imagination can paint an easy word picture of the streets of New York and Chicago. By contrast, you see, hear, or taste nothing on a trading floor.

Goldman first lent on signature, not collateral. That is the world we need, in America, today. People who have skin in the game (Nassim N.Taleb just taught this lesson on Twitter about the losses at Harvard by Larry Summers)living on their wits, making loans on the street, door to door.

Banking has it backwards, today, lending on collateral and never on signature, worrying about collateral not character.

And, consider the agglomeration economies of information. Look at the network that was in Goldman’s mind. He probably knew 10,000 people first hand and 100,000 second hand. He was the model for my original thinking on information. A partner, with skin the game, walking the street looking to make loans: now that is a node of a powerful information network that made our great cities work.

Sorry for tone but feel strongly about this.

Here is the full text of my 26th Quartz column, “The US government’s spying is straight out of the mob’s playbook,” now brought home to supplysideliberal.com. It was first published on July 4, 2013. Links to all my other columns can be found here. My preferred title above better represents my broader theme: what governments need to do to foster economic growth.

I pitched this column to my editors as an Independence Day column. I am proud of our American experiment: attempting government of the people, by the people, and for the people. This column is about the principles behind that American experiment, from an economic perspective.

If you want to mirror the content of this post on another site, that is possible for a limited time if you read the legal notice at this link and include both a link to the original Quartz column and the following copyright notice:

© July 4, 2013: Miles Kimball, as first published on Quartz. Used by permission according to a temporary nonexclusive license expiring June 30, 2014. All rights reserved.

Reading Ben Zimmer’s “How to talk like Whitey Bulger: Mobster lingo gets its day in court“ in the International Herald Tribune provided by the hotel during my recent stay in Tokyo reminded me of my litany of the basics the government must provide to make anything close to market efficiency possible:

Let me give two examples of what I have written in this vein. The first is from “So You Want to Save the World“:

If someone’s overall objective is evil or self-serving, the only way what they do will have a good effect on the world is if all their attempts to get their way by harming others are forestalled by careful social engineering. It is exactly such social engineering to prevent people from stealing, deceiving, or threatening violence that yields the good results from free markets that Adam Smith talks about in The Wealth of Nations—the book that got modern economics off the ground.

The second is from ”Leveling Up: Making the Transition from Poor Country to Rich Country“:

The entry levels in the quest to become a rich country are the hardest. The basic problem is that any government strong enough to stop people from stealing from each other, deceiving each other, and threatening each other with violence, is itself strong enough to steal, deceive, and threaten with violence. Designing strong but limited government that will prevent theft, deceit, and threats of violence, without perpetrating theft, deceit, and threats of violence at a horrific level is quite a difficult trick that most countries throughout history have not managed to perform.

“How to talk like Whitey Bulger: Mobster lingo gets its day in court“ describes the example I have in mind when I write about “threats of violence”:

Charging “rent” is extorting money from business owners under the threat of violence.

I have thought about whether I should include actual violence in the list, but decided that, with only a few exceptions, the motivations for violence boil down to either theft or being able to provide some credibility for one’s threats of violence.

Deception covers a wide range of destructive activities. The idea that the free market requires tolerance of corporate deception is itself a big lie. Even routine secrets have a measure of deception to them, and as Sissela Bok demonstrates in her book Secrets: On the Ethics of Concealment and Revelation, the ethical justification for keeping secrets is much trickier than many people think.

Blackmail presents an interesting case that doesn’t quite fit my litany: the threat to reveal deception is used to distort the deceiver’s behavior. But there is an element of deception in such a revelation, since the selective revelation of one person’s secrets and not the secrets of others makes the person whose secret is revealed look much worse than if all secrets were revealed. I think I would fare very well if the day ever came that Jesus predicted when he said:

For there is nothing hidden that will not be disclosed, and nothing concealed that will not be known or brought out into the open. (Luke 8:17)

But I have no doubt that if someone revealed all of my secrets, while everyone else got to keep theirs, I could be made to look very bad.

The possibility that threats of selective revelation of secrets could be used by members of the government to blackmail others—or to deceive the public about the relative merits of different individuals—is the most serious concern raised by government spying. That is why I join Max Frankel in advocating that government spying be overseen not by judges in their spare time, but by a dedicated court whose judges can develop special expertise, with lawyers who have high-level security clearance given the task of representing the interests of those whose communications are being monitored, whether directly or indirectly. Frankel said it this way in his New York Times editorial ”Where did our ‘inalienable rights’ go?“:

Despite the predilections of federal judges to defer to the executive branch, I think in the long run we have no choice but to entrust our freedom to them. But the secret world of intelligence demands its own special, permanent court, like the United States Tax Court, whose members are confirmed by the Senate for terms that allow them to become real experts in the subject. Such a court should inform the public about the nature of its cases and its record of approvals and denials. Most important, it should summon special attorneys to test the government’s secret evidence in every case, so that a full court hears a genuine adversarial debate before intruding on a citizen’s civil rights. That, too, might cost a little time in some crisis. There’s no escaping the fact that freedom is expensive.

If modern technology makes it harder to keep secrets in general, I think that is all to the good. People usually behave better when they believe that their actions could become known. (See for example this TedEducation talk by Jeff Hancock, “The Future of Lying,” which reports evidence that people are more honest online than offline.) Those overthrowing tyrants may benefit from secrecy in putting together their revolutions, but tyrants need secrecy even more. So a general decline in the ability to keep secrets is likely to be a net plus even there.

Above, I pointed out the fundamental problem of political economy:

… any government strong enough to stop people from stealing from each other, deceiving each other, and threatening each other with violence, is itself strong enough to steal, deceive, and threaten with violence.

Although it pains me to say so, the literature on economic growth (see for example Pranab Bardhan’s Journal of Economic Literature survey article ”Corruption and Development: A Review of the Issues“) argues that centralized corruption by a strong but evil state can yield better economic outcomes than decentralized corruption by many local mob bosses or warlords. Nevertheless, I believe the elimination of tyrants and the progress of democracy throughout the world will be one of the most important contributors to human welfare in the coming decades. May those of us who enjoy the blessings of democracy be willing to make the sacrifices that could be necessary to help others enjoy that blessing. And may all nations add to democracy all of the other restraints on government necessary to make government our servant rather than our master.

Here is a link to Yichuan Wang’s excellent Quartz article “How China’s poorest regions are going to save its growth rate”–Required reading for anyone who wants to understand the future of China.