John L. Davidson on the Decline of the Quality of Information Processing in Lending

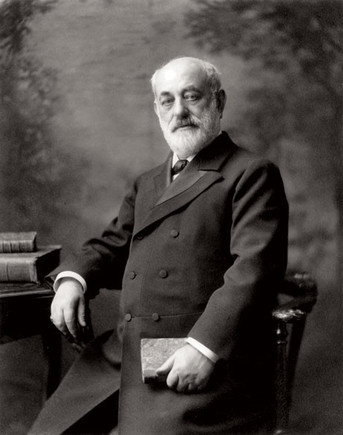

Marcus Goldman, founder of Goldman Sachs

My friend John Davidson sees information as the central issue for the economy. In this guest post, he argues that one of our big supply-side problems is the decline in the quality of human-brain information-processing behind lending decisions.

Noah Smith argues that “Something Big Happened in the Early 70s.”

You and others have your macro theories and I am Keynesian, but I have told everyone until I am blue in the face that short-run stimulus is not enough and events bear me out.

This country is broken because community and commercial banking is broken by risk aversion, undercapitalization, and mis-regulation. We need to return to community bankers being almost merchant bankers.

I also have no regard for economists in the Koch orbit as they are political operatives and nothing but crony capitalism at its worst, so I will start with a real life model.

It is really simple to see a lot of what is wrong in America if one just reads the second chapter of Goldman Sachs: The Culture of Success.while at the same time, watch Copper on Netflicks (which is set in NYC at the time Goldman Sachs was formed).

For more than a few hours, contemplate an economic world in which Goldman was operating as he walked those streets in NYC in 1870 in his Top Hat and Frock coat. He could see, hear, taste commerce all around. The imagination can paint an easy word picture of the streets of New York and Chicago. By contrast, you see, hear, or taste nothing on a trading floor.

Goldman first lent on signature, not collateral. That is the world we need, in America, today. People who have skin in the game (Nassim N.Taleb just taught this lesson on Twitter about the losses at Harvard by Larry Summers)living on their wits, making loans on the street, door to door.

Banking has it backwards, today, lending on collateral and never on signature, worrying about collateral not character.

And, consider the agglomeration economies of information. Look at the network that was in Goldman’s mind. He probably knew 10,000 people first hand and 100,000 second hand. He was the model for my original thinking on information. A partner, with skin the game, walking the street looking to make loans: now that is a node of a powerful information network that made our great cities work.

Sorry for tone but feel strongly about this.