The Supply and Demand for Paper Currency When Interest Rates Are Negative

Note: The acronym "ROERC" is pronounced in the same way as Howard Roark's last name. It stands for "Rate of Effective Return on/for/of Cash.

Why the Rate of Effective Return on Cash Curve Slopes Down

Ruchir Agarwal and I argue in our IMF working paper "Breaking Through the Zero Lower Bound" that when deep negative interest rates are needed for prompt macroeconomic stabilization, central banks should take paper currency off par. (On this point, also see "How and Why to Eliminate the Zero Lower Bound: A Reader's Guide.") But what if a central bank is legally or politically unable—or unwilling—to take paper currency off par? In our nascent paper "Implementing Deep Negative Rates"—and the Powerpoint presentation of the same name—Ruchir and I argue that a variety of measures can be taken to make an arbitrage using massive paper currency storage more difficult. We call this "the dirty approach" to dealing with the paper currency problem. Moreover, we argue that political economy forces are favorable for many of the measures in the dirty approach, whether taken by a central bank or by other arms of its government. First, versions of many of these measures are already being taken. Second, how many governments would really stand by and do nothing while private agents piled up in storage a substantial fraction of GDP in paper currency? That is, for the US, is it plausible that the government would stand by and do nothing as private agents pile up trillions and trillions of dollars worth of paper currency?

Six measures in the dirty approach to the paper currency problem (which you can see discussed on video in "Enabling Deeper Negative Rates by Managing the Side Effects of a Zero Paper Currency Interest Rate: The Video") are

- Ban Electrification of Paper Currency. That is, prohibit any money market mutual funds or similar securities that have on their asset side more than a small percentage of paper currency. Though only a partial implementation of this measure, it is an open secret I heard from multiple sources in various places around Europe and elsewhere in the world that the Swiss National Bank has been using moral suasion to discourage financial firms from offering easily traded assets backed by paper currency.

- Use the Interest on Reserves Formula to Subsidize Zero Rates for Small Household Accounts. This would reduce the motivation for households to withdraw money from the bank and store it as paper currency, helping to avoid a "death of a thousand cuts" of small-scale paper currency storage by many households that could add up to a large total quantity of storage. See "How to Handle Worries about the Effect of Negative Interest Rates on Bank Profits with Two-Tiered Interest on Reserves Policies," "Ben Bernanke: Negative Interest Rates are Better than a Higher Inflation Target," and "The Bank of Japan Renews Its Commitment to Do Whatever it Takes." No central bank has done this yet, but the reception I have had for this proposal is quite favorable. And several central banks already have quite complex tiered interest-on-reserves formulas.

- Charge Banks for Excess Paper Currency Withdrawals from the Cash Window, Allowing Them to Impose Restrictions in Turn. The Swiss National Bank and the Bank of Japan already have provisions in their tiered interest-on-reserves formulas that penalize banks for cumulative withdrawals of paper currency. This is a way of directly having negative interest rates on paper currency in the relationship between the central bank and private banks. However pass-through of paper currency to households may not currently be counted as part of those cumulative withdrawals. If it were, that would inhibit banks from giving out paper currency so freely.

- Retire Large Denomination Notes of Paper Currency. This is under serious discussion in many countries. In action, the ECB has decided to eliminate the 500-euro note.

- Ban Storage of Paper Currency as a Business. Note that, given the substantial economies of scale and what would be sunk costs in setting up a paper currency storage business, even the threat of future action banning this business can do a lot to stunt its growth.

- Put Tight Restrictions on Flows of Paper Currency Out of the Country. This is a small step from restrictions and hindrances to flows of paper currencies in and out of a country that are in place for other reasons.

I argue that these kinds of measures (and perhaps inherent obstacles in place even without these kinds of measures) make the marginal rate of effective return on paper currency decreasing in the currency-region-wide amount of paper currency being stored, as shown in the graph of the rate of effective return on cash (ROERC) curve at the top of this post. Such difficulties tend to push the rate of effective return on cash below its superficial return of zero. If any dirty hindrances to redemption of paper currency into reserves (electronic money) are added, that would add to the downward slope of the ROERC curve on the right.

On the left of the curve, the rate of effective return on cash is far above its superficial return of zero for the amount of paper currency needed to carry on high-demand illegal activities—including, notably, tax evasion. (The secrets people want most desperately to keep are typically secrets from the government, but there is some demand for cash in order to keep secrets from others.)

The Opportunity Cost of Cash Curve

The ROERC curve is the demand curve for paper currency. The supply curve for paper currency is the Opportunity Cost of Cash (OCC) curve.

To the private sector, the maximum possible potential supply quantity of paper currency is the entire monetary base. Without reducing the amount of loans, the potential supply of paper currency is the monetary base minus required reserves. But even beyond required reserves, there may be some amount of excess reserves that has value as a buffer stock and so has an implicit return beyond the interest on reserves (shown as a negative rate above, as in several countries now). If the monetary base is large, as it is now, the marginal opportunity cost for quite a bit of paper currency would be very close to the interest on reserves (IOR). But beyond some level, additional paper currency would require reducing excess reserves that have some significant value as a buffer stock, so above that level of paper currency, the opportunity cost of cash would rise above IOR.

In drawing the opportunity cost of cash curve, I am heavily influenced by having seen Ricardo Reis's Jackson Hole Presentation "Funding Quantitative Easing to Target Inflation." Ricardo argues that in the US, the value of reserves—and therefore the opportunity cost of cash—only drops to IOR after excess reserves reach about $1 trillion.

Putting the ROERC and OCC Curves Together

The Classic Zero Lower Bound Argument

The classic zero lower bound argument corresponds to a ROERC curve flat at zero once certain high-priority demands for paper currency have been satisfied:

With a ROERC curve flat at zero beyond a certain point, the interest rate won't drop below zero even if the monetary base is large and IOR is negative. Moreover, starting from that situation, increasing the monetary base will do nothing to the interest rate, which will stay at zero.

Similarly, starting from that situation, reducing IOR even further will do nothing to the interest rate:

An Effective Lower Bound Below IOR

Now, what if there is a constant storage cost of paper currency. This make the ROERC curve flat at a level below zero after a certain point. This flat ROERC curve creates an effective lower bound below zero. If the IOR is still above that effective lower bound, a cut in IOR will lower the interest rate:

As long as the effect rate of return on cash is below IOR, it is IOR, not the effective return on cash that is crucial for determining the interest rate. Indeed, assuming the monetary base is large enough that the function of marginal reserve is simply to earn IOR on them, increasing the monetary base further has no effect on the interest rate, it just increases excess reserves.

Again, because the effect return on cash is below IOR, paper currency isn't affecting things very much.

An Effective Lower Bound Above IOR

By contrast, if the effective rate of return on cash is above IOR, constant beyond a certain amount of paper currency that has already been exceeded, then both reductions in IOR and open market operations do nothing to the interest rate:

The Clean Approach: Cutting the Effective Rate of Return on Paper Currency Using a Depreciation Mechanism

Sticking for simplicity with a flat ROERC curve beyond a certain point, one can illustrate the effect of having the exchange rate for paper currency in terms of reserves gradually decline over time with a downward shift in the ROERC curve. Here the idea is to cut the paper currency interest rate (PCIR) in tandem with cutting IOR:

The PCIR or effective rate of return on cash is cut by making the exchange rate at which paper currency can be exchanged for reserves at the cash window drift downward more strongly. Obviously, doing this requires being willing to contemplate an exchange rate between paper currency and reserves that can become different from par. Being willing to take paper currency off par opens the possibility of making the effective return on paper currency a policy variable. The bulk of the links in "How and Why to Eliminate the Zero Lower Bound: A Reader's Guide" point to discussions of this approach. (On the cash window itself, see "An Underappreciated Power of a Central Bank: Determining the Relative Prices between the Various Forms of Money Under Its Jurisdiction.")

A Downward Sloping ROERC

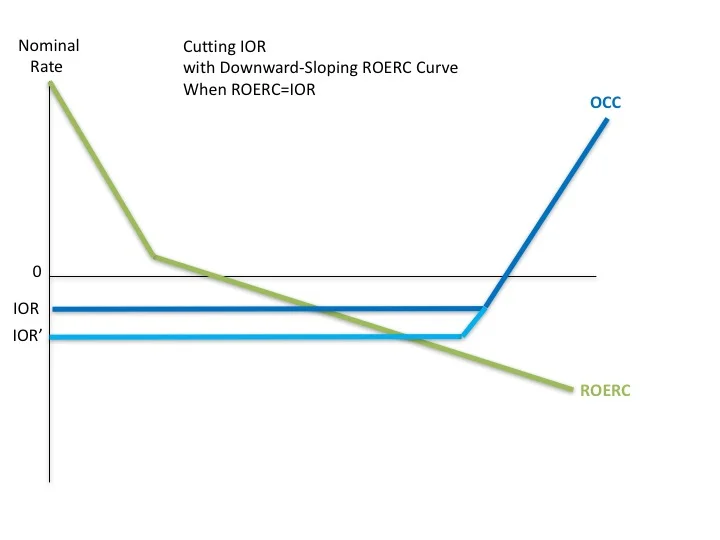

If the ROERC curve is downward sloping, for whatever reason—and the monetary base is large enough to make the opportunity cost of cash equal to IOR—reductions in IOR lower the interest rate even if the exchange rate at the central bank's cash window between paper currency and reserves is left at par:

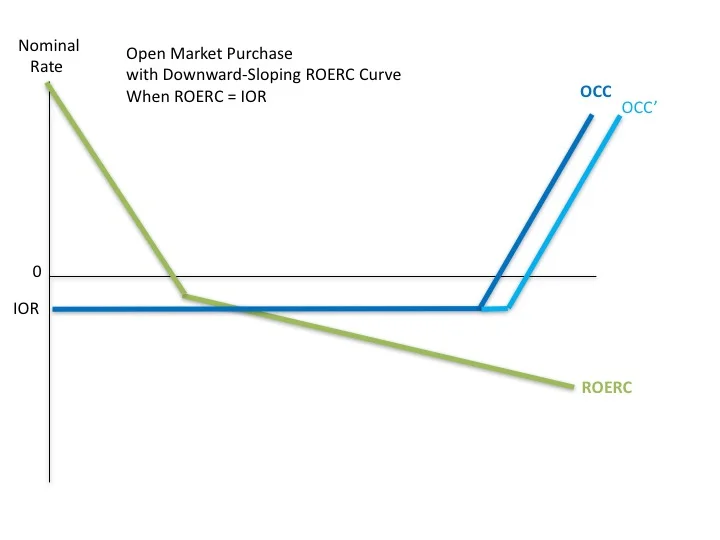

With the monetary base already large enough to make the opportunity cost of cash equal to IOR, open market purchases without any reduction in IOR do not affect the interest rate:

On the other hand, if the monetary base isn't large enough to make the opportunity cost of cash equal to IOR, reductions in IOR don't lower the interest rate, but open market purchases do: