The Political Perils of Not Using Deep Negative Rates When Called For

How well has what you have been doing been working for you?

People are quick to think that the political costs of deep negative rates to a central bank are substantial. But it is worth considering the political costs of not doing deep negative rates when the economic situation calls for it. Take as a case in point the failure of the Fed to do deep negative rates in 2009. Regardless of the reason for the Fed’s not doing deep negative rates in 2009, it is possible to see the consequences for the Fed’s popularity of the depth of the Great Recession and the slowness of the recovery.

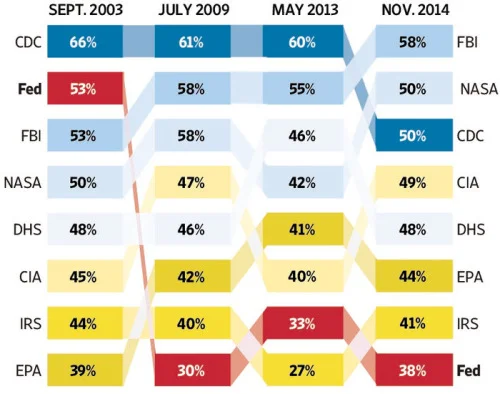

In his Wall Street Journal special report “Years of Fed Missteps Fueled Disillusion With the Economy and Washington,” Jon Hilsenrath tells the story of the Fed’s decline in popularity, and presents the following graphic:

How Americans rate federal agencies

Share of respondents who said each agency was doing either a ‘good’ or ‘excellent’ job, for the eight agencies for which consistent numbers were available

The Alternative

There is no question that the Fed’s failure to foresee the financial crisis and its role in the bailouts contributed to its decline in popularity. But consider the popularity of the Fed by 2014 in two alternative scenarios:

Scenario 1: The actual path of history in which the economy was anemic, leading to a zero rate policy through the end of 2014.

Scenario 2: An alternate history in which a vigorous negative interest rate policy met a firestorm of protest in 2009, but in which the economy recovered quickly and was on a strong footing by early 2010, allowing rates to rise back to 1% by the end of 2010 and to 2% in 2011.

In Scenario 2, the deep negative rates in 2009 would have seemed like old news even by the time of the presidential election in 2012, let alone in 2014. In the actual history, Scenario 1, low rates are still an issue during the 2016 presidential campaign, because the recovery has been so slow.

It Looks Good to Get the Job Done

At the end of my paper “Negative Interest Rate Policy as Conventional Monetary Policy” (ungated pdf download) published in the National Institute Economic Review, I discuss the politics of deep negative interest rates–not just for the United States, but also for other currency regions that needed them. My eighth and final point there is this:

Finally, the benefits of economic stabilisation should be emphasised. The Great Recession was no picnic. Deep negative interest rates throughout 2009 – somewhere in the –4 per cent to –7 per cent range – could have brought robust recovery by early to mid 2010. The output gaps the world suffered in later years were all part of the cost of the zero lower bound. These output gaps not only had large direct costs, they also distracted policymakers from attending to other important issues. For example, the later part of the Great Recession that could have been avoided by negative interest rate policy led to a relatively sterile debate in Europe between fiscal stimulus and austerity, with supply-side reform getting relatively little attention. And the later part of the Great Recession that could have been avoided by negative interest rate policy brought down many governments for whom thepolitical benefits of negative interest rate policy would have been immense. And for central banks, it looks good to get the job done.