Many people have the intuition that even if paper currency were out of the picture, other things that pay a zero interest rate would still create a zero lower bound, so that an attempt to take the target rate into deep negative territory would fail. Among them is one of the greatest economics bloggers of them all: John Cochrane. In his Grumpy Economist post “Cancel Currency?” he writes:

Suppose we have substantially negative interest rates – -5% or -10%, say, and lasting a while. But there is no currency. How else can you ensure yourself a zero riskless nominal return?

Here are the ones I can think of:

- Prepay taxes. The IRS allows you to pay as much as you want now, against future taxes.

- Gift cards. At a negative 10% rate, I can invest in about $10,000 of Peets’ coffee cards alone. There is now apparently a hot secondary market in gift cards, so large values and resale could take off.

- Likewise, stored value cards, subway cards, stamps. Subway cards are anonymous so you could resell them.

- Prepay bills. Send $10,000 to the gas company, electric company, phone company.

- Prepay rent or mortgage payments.

- Businesses: prepay suppliers and leases. Prepay wages, or at least pre-fund benefits that workers must stay employed to earn.

My brother Chris and I answer this argument in “However Low Interest Rates Might Go, the IRS Will Never Act Like a Bank.” The set of things that can create a zero lower bound can be narrowed down considerably by the two key principles we explain there:

- Giving a zero interest rate when market interest rates are in deep negative territory (say -5%) is a money-losing proposition. Private firms are unlikely to continue very long in providing such an above-market interest rate to individuals wanting to store money with them.

- Anything that can vary in price cannot create a zero lower bound: negative interest rates will either cause its price to go up enough that expected depreciation gives it a negative expected return, or potential price variation will make its return risky enough it is clear there is no risk-free arbitrage to be had. This rules out things such as gold or foreign assets from creating a zero lower bound, unless a credibly fixed exchange rate or an established price of gold is in play.

What is left? The only other category I can see are opportunities to lend to a government within the central bank’s currency zone at a fixed interest rate. But even there, there is another logical proviso on what can create a zero lower bound. I explain in “How to Keep a Zero Interest Rate on Reserves from Creating a Zero Lower Bound”:

[3.]… a zero interest rate that only applies to a limited quantity of funds does not create a zero lower bound. The reason that our current paper currency policy creates a zero lower bound is that under current policy banks can withdraw an unlimited quantity of paper currencyand redeposit it later on at par. By contrast, within-year prepayment of taxes is possible but practically limited to the amount of the tax liability. (Between tax years a typically nonzero interest rate based on the market yield of short-term U.S. obligations applies.)

Thus, other than paper currency:

IRS interest rates between tax years are set by the Secretary of the Treasury in line with market short-term rates, such as the Treasury bill rate. They are no stickier than the Secretary of the Treasury wants them to be. It is true that a sufficiently determined Secretary of the Treasury could probably thwart a Fed move to negative interest rates by offering convenient saving at a zero interest rate through the tax system. But I don’t think the Fed would be likely to go to deep negative rates in any case without some degree of tacit backing from the Executive Branch. (I do think that with the Executive Branch’s tacit backing, the Fed might go to deep negative rates despite complaints in Congress if it thought that was necessary for the economy.)

Finally, suppose I am wrong about the willingness of private firms to lose money by continuing to offer a zero interest rate when many market rates have gone substantially negative. In “Banking at the IRS,” John Cochrane argues that private interest rates are sticky at zero. There is still a limit to how much a firm can allow individuals to store at an above-market zero interest rate without going bankrupt, and in practice, the quantity limit of how much value a firm will allow people to store at a zero interest rate is much tighter than that.

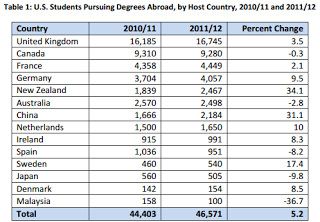

Let’s get more concrete about the sheer magnitude of the task of finding zero interest ways of storing one’s money when the central bank is bidding up the price–and therefore down the interest rate–of Treasury bills as far as it can before investors sell over the whole stock of Treasury bills. To make the calculations easier, let me imagine that before going to negative rates, that a central bank has done enough quantitative easing that most of the national debt in private hands is in the form of short-term Treasury bills that have a negative rate. In that case, the net debt-to-GDP ratio (based on government debt in private hands) puts a floor on how much in funds private individuals will be trying to shift into zero interest rate opportunities. Actually, to this should be added the paper currency to GDP ratio too, since under my proposal, paper currency carries a negative rate of return because of its gradual depreciation against electronic money. (It is only because paper currency would have a negative rate of return under my proposed policy that the discussion in this post even arises.) Here are a few interesting net debt/GDP ratios rounded to the nearest full percent as of the latest update of the Wikipedia article “List of countries by public debt” in 2012. I doubt many of these numbers have gone down since then:

- Australia: 17%

- Austria: 51%

- Belgium: 106%

- Canada: 37%

- Denmark: 8%

- Finland: -51%

- France: 84%

- Germany: 57%

- Greece: 155%

- Ireland: 102%

- Israel: 70%

- Italy: 103%

- Japan: 134%

- Netherland: 32%

- Norway: -166%

- Portugal: 112%

- Spain: 72%

- Sweden: -18%

- Switzerland: 28%

- United Kingdom: 83%

- United States: 88%

Certainly, in the eurozone, Japan, the United Kingdom, the US and Canada, the task of finding zero interest rate opportunities for all the funds that start out in government debt is daunting. Countries like Norway that have a substantial sovereign wealth fund show that the amount of money the public holds in government bills and bonds–surely a positive number–can be larger than the government debt with assets netted out–in Norway’s case, a negative number. So the net debt to GDP ratios above are only the start of how much people might face a negative interest rate in that they are trying to escape.

The biggest single opportunity for getting a zero interest rate when rates in general are negative is typically tax system. I suspect that most countries have much less wiggle room for playing with the timing of tax payments than the US. For example, the rules for the timing of paying VAT taxes probably don’t have the same kind of wiggle room. And even in the US, the wiggle room on the timing of payments is probably much greater for households than for firms. In the US, tax revenue as a percentage of GDP is something like 27%. But shifting tax payments from being paid each month as the income comes in to being paid on January 1, say, only shifts that 27% forward by 6.5 months on average, since some of the payments are already early in the year. Or for those who pay quarterly, things might be shifted forward by 7.5 months. (7.5/12) * 27% is less than 17%. (This is composed of up to 27% of GDP at a zero interest rate at the beginning of the year, and much less at a zero interest rate toward the end of the year.)

That limit of 17% of annual GDP (averaged over the year) that can get a zero interest rate is far short of the 88% that individuals and firms in the US and abroad will want to find in zero US interest rates. Along the lines of “How to Handle Worries about the Effect of Negative Interest Rates on Bank Profits with Two-Tiered Interest-on-Reserves Policies,” throw in bank account assets amounting to 4% of annual GDP in individual bank accounts exempted from a negative interest rate supported by subsidies through the interest on reserves formula. (The effective subsidy needed is not 4% of GDP, but the absolute value of the interest rate times 4% of a year’s GDP, say |-4%| per year times 4% of yearly GDP, or .16% of GDP on a flow basis.) Beyond the bank accounts subsidized to have a zero interest rate, then throw in a generous several percent of annual GDP worth of prepayment opportunities that the private sector will allow, and still those now holding government debt will fall far short of finding enough zero interest opportunities to shift their liquid assets into. When I say that is generous, remember that the flow that can be prepaid needs to be multiplied by the length of time it can be prepaid to get the stock of wealth that can be shielded from zero interest rates. Other than prepayment of mortgages–which is already a big issue even at positive interest rates–most opportunities to prepay are limited to about 90 days, which is much lass than in the tax system.

Even with substantial opportunities to get a zero interest rate, if individuals and firms have liquid assets left over that can’t get a zero interest rate, then the key market rates can go into deep negative territory as the central bank bids up the price of Treasury bills so that, say it costs $10,100 to buy a promise from the Treasury of $10,000 three months from now: a -4% annual yield.

So far, central banks that have gone to negative interest rates have done so tentatively. Still, interesting adjustments are beginning to happen. Here is a passage from Tommy Stubbington’s December 8, 2015 Wall Street Journal article “Less Than Zero: Living With Negative Interest Rates”:

Danish companies pay taxes early to rid themselves of cash. At one small Swiss bank, customer deposits will shrink by an eighth of a percent a year.

But it isn’t all bad. Some Danes with floating-rate mortgages are discovering that their banks are paying them every month to borrow, instead of charging interest on their home loans. …

… other peculiar consequences are sprouting. In Denmark, thousands of homeowners have ended up with negative-interest mortgages. Instead of paying the bank principal plus interest each month, they pay principal minus interest.

“Hopefully, it’s a temporary phenomenon,” said Soren Holm, chief financial officer at Nykredit, Denmark’s biggest mortgage lender by volume. Mr. Holm said the administration of negative rates has gone smoothly, but he isn’t trumpeting the fact that some borrowers get paid. “We wouldn’t use it as a marketing tool,” he said.

Negative rates have cost Danish banks more than 1 billion kroner ($145 million) this year, according to a lobbying group for Denmark’s banking sector.

“It’s the banks that are paying for this,” said Erik Gadeberg, managing director for capital markets at Jyske Bank. If it worsens, Jyske might charge smaller corporate depositors, he said, then maybe ordinary customers. “One way or another, we would have to pass it on to the market,” Mr. Gadeberg said.

In Switzerland, one bank already has. In October, Alternative Bank Schweiz, a tiny lender, sent letters to customers with some bad news: They were going to be charged for keeping money in their accounts.

The Swiss central bank has a deposit rate of minus 0.75%, and Martin Rohner, chief executive of ABS, decided enough was enough. The costs were eating up the firm’s entire profit, he said. He set a rate of minus 0.125% on all accounts.