Taehyun Nam: South Korea on the Road to a Cashless Society

Link to Taehyun Nam’s Linked In homepage

I am pleased to host another student guest post, this time by Taehyun Nam. This is the 4th student guest post this semester. You can see all the student guest posts from my “Monetary and Financial Theory” class at this link.

Taehyun discusses South Korea’s goal to get to a “cashless society.” I want to emphasize that although abolishing cash might be a good idea, it is not necessary to abolish cash to eliminate the zero lower bound. My proposal for eliminating the zero lower bound would keep cash in the picture, but move cash further from the center of the monetary system. Abolishing cash is a separate decision from eliminating the zero lower bound.

The South Korean government should not falter becoming a cashless society that opens the underground economy, solves the circulation problem, prevents crimes, and provides more monetary policy options.

Bill Gross from Janus Capital once said, “The cashless society which appears over the horizon may come sooner than the demise of the penny.” My home country, South Korea, is no exception. Cash in Korea is slowly losing its presence and getting replaced by credit/debit cards. The Bank of Korea has recently announced its plan to become a “cashless society.”

According to the Bank of Korea’s survey with 2,500 Koreans with age of 19 or older in last August and September, Koreans are gradually carrying less cash. On average, they had $61.29 cash in their wallets. Senior citizens in their 50s carried $70.40 per person, whereas people in their 20s had only $41.41 cash per person in their wallets. In fact, even the seniors are now using debit cards more. In recent five years, the number of payment in debit card by people with age of 50s and 60s increased by four times, while the ratio of payment in cash plunged from 51% in the mid 2000s to 17% today. Moreover, 90.2% and 96.1% of survey participants carried credit and debit cards, respectively.

As cash is losing its popularity as a payment method, the government plans to eliminate coin by 2020 and achieve the “cashless society” afterwards. My first initial reaction to this news was, “Dr. Miles Kimball [professor for my Monetary and Financial Theory class] will be thrilled with this news!” On the contrary, the general public in Korea ranted.

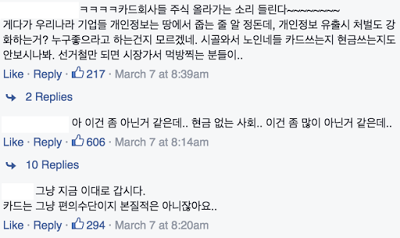

<Tirade of the General Public in Korea>

Screen Shot of Comments on the Related Article on Facebook

Comment #1: It’s obvious that the stock prices of credit card companies would skyrocket. Korean companies have low respects for privacy. Seems like Korean politicians do not even know whether seniors use cards or cash. - 217 Likes

Comment #2: This is unacceptable… Cashless society… This is totally unacceptable. - 606 Likes

#3: Why would they bother to change? Cards are for convenience. They are not essential. - 294 Likes

Such outrageous reactions are understandable. I also see some downsides of the cashless society, what I call them “5Cs”:

- Confusion in the society and negative reaction from the public.

- Card payment’s and fintech’s unfamiliarities to senior citizens.

- Card transaction fee issue.

- Concerns over security and privacy in Korea.

- Contingency plan to temporary malfunctions of electronic money system is nonexistent.

With these pitfalls, however, I still argue that the Korean society should become cashless. The economic benefits are hard to be ignored.

1. Open the underground economy

Becoming cashless will legalize the underground loan market and prevent the related transactions of billions of dollars without proper tax payments. Moreover, because electronic transactions are tractable in the cashless society, significantly less number of people would get involved in illegal prostitutions. On average, each prostitute has approximately 5 clients per night, and some even have 20. In the cashless society, there will be less illegal cash transactions without proper tax payments in the prostitution market. Instead, the customers in this market will rather consume and invest on legal activities. In fact, McKinsey report says, “The cashless society will cut costs equivalent to between 0.1 and 1.1 percent of GDP.” The data present that countries with below 50% rate of payment in cash have the shadow economy taking only 12% of gross domestic product (GDP). In contrast, those with over 80% rate of payment in cash have the underground economy taking 32% of GDP. Therefore, by becoming cashless, not only the South Korean government can collect more tax, but also the Korean economy would be stimulated by higher consumptions and investments.

2. Solve the currency circulation problem

Since 2009, the Bank of Korea has issued 2.2 billion papers of 50,000-won notes (50,000 Korean Won = $42.04, as of March 14th 2016). However, 1.2 billion of them has not been returned yet. The total amount of currency not in circulation was near $310 billion in 2009, but it more than doubled to $718 billion in 2015. Once the society transitions into the cashless society, people will be forced to bring their slush funds out and make more consumptions and/or investments. Again, the government can assemble more tax and boost the economy.

<Currency Circulation Problem in South Korea>

3. Prevent crimes & Allow more monetary policy options

Many crimes involved with cash will dwindle considerably in the cashless society. These include tax evasion, violence or plunder over cash, tax evasion, and bribery. In addition, electronic money enables countries to adopt negative interest rates in order to spur the economic activities. Such monetary policy is not feasible in a cash society, as people might put their cash in their safes. More information about negative interest rates policy with electronic money could be found in Dr. Kimball’s blog post “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.”