After Crunching Reinhart and Rogoff's Data, We Found No Evidence That High Debt Slows Growth

Here is a link to my 24th column on Quartz, “After crunching Reinhart and Rogoff’s data, we’ve concluded that high debt does not slow growth,” coauthored with Yichuan Wang. The title chosen by our editor is too strong, but not so much so that I objected to it; the title of this post is more accurate.

Yichuan only recently finished his first year at the University of Michigan. Yichuan’s blog is Synthenomics. You can see Yichuan on Twitter here. Let me say already that from reading Yichuan’s blog and working with him on this column, I know enough to strongly recommend Yichuan for admission to any Ph.D. program in economics in the world. He should finish has bachelor’s degree first, though.

I genuinely went into our analysis expecting to find evidence that high debt does cause low growth, though of course, to a much smaller extent than low growth causes high debt. I was fully prepared to argue (first to Yichuan and then to the world) that even a statistically insignificant negative effect of debt on growth that was plausibly causal had to be taken seriously from a Bayesian perspective. Our analysis set out the minimal hurdles I felt had to be jumped over to convince me that there was some solid evidence that high debt causes low growth. A key jump was not completed. That shifted my views.

I hope others will try to replicate our findings. That should let me rest easier.

From a theoretical point of view, I am especially intrigued by the possibility that any effect on growth from refinancing difficulties might depend on a country’s debt to GDP ratio compared to that of other countries. What I find remarkable is that despite the likely negative effect of debt on growth from refinancing difficulties, we found no overall negative effect of debt on growth. It is as if there is some other, positive effect of debt on growth to the extent a country’s relative debt position stays the same. Besides the obvious, but uncommonly realized, possibility of very wisely deployed deficit spending, I can think of two intriguing mechanisms that could generate such an effect. First, from a supply-side point of view, lower tax rates now could make growth look higher now, perhaps at the expense of growth at some future date when taxes have to be raised to pay off the debt, with interest. Second, government debt increases the supply of liquid (and often relatively safe) assets in the economy that can serve as good collateral. Any such effect could be achieved without creating a need for higher future taxes or lower future spending by investing the money raised in corporate stocks and bonds through a sovereign wealth fund.

I have thought a little about why borrowing in a currency one can print unilaterally makes such a difference to the reactions of the bond market to debt. One might think that the danger of repudiating the implied real debt repayment promises by inflation would mean the risks to bondholders for debt in one’s own currency would be almost the same as for debt in a foreign currency or a shared currency like the euro. But it is one thing to fear actual disappointing real repayment spread over some time and another thing to have to fear that the fear of other bondholders will cause a sudden inability of a government to make the next payment at all.

Note: Brad Delong writes:

Miles Kimball and Yichuan Wang confirm Arin Dube: Guest Post: Reinhart/Rogoff and Growth in a Time Before Debt | Next New Deal:

As I tweeted,

- .@delong undersells our results. I would have read Arin Dube’s results alone as saying high debt *does* slow growth.

- *Of course* low growth causes debt in a big way. But we need to know if high debt causes low growth, too. No ev it does!

In tweeting this, I mean, if I were convinced Arin Dube’s left graph were causal, the left graph seems to suggest that higher debt causes low growth in a very important way, though of course not in as big a way as slow growth causes higher debt. If it were causal, the left graph suggests it is the first 30% on the debt to GDP ratio that has the biggest effect on growth, not any 90% threshold. Yichuan and I are saying that the seeming effect of the first 30% on the debt to GDP ratio could be due in important measure to the effect of growth on debt, plus some serial correlation in growth rates. The nonlinearity could come from the fact that it takes quite high growth rates to keep a country from have some significant amounts of debt–as indicated by Arin Dube’s right graph, which is more likely to be primarily causal.

By the way, I should say that Yichuan and I had seen the Rortybomb piece on Arin Dube’s analysis, but we were not satisfied with it. But I want to give credit for this as a starting place for Yichuan and me in our thinking.

Brad Delong’s Reply: Thanks to Brad DeLong for posting the note above as part of his post “DeLong Smackdown Watch: Miles Kimball Says That Kimball and Wang is Much Stronger than Dube.”

Brad replies:

From my perspective, I tend to say that of course high debt causes low growth–if high debt makes people fearful, and leads to low equity valuations and high interest rates. The question is: what happens in the case of high debt when it comes accompanied by low interest rates and high equity values, whether on its own or via financial repression?

Thus I find Kimball and Wang’s results a little too strong on the high-debt-doesn’t-matter side for me to be entirely comfortable…

My Thoughts about What Brad Says in the Quote Just Above: As I noted above, my reaction is to what we Yichuan and I found is similar to Brad’s. There must be a negative effective of debt on growth through the bond vigilante channel, as Yichuan and I emphasize in our interpretation. For example, in our final paragraph, Yichuan and I write:

…other than the danger from bond market vigilantes, we find no persuasive evidence from Reinhart and Rogoff’s data set to worry about anything but the higher future taxes or lower future spending needed to pay for that long-term debt.

The surprise is the pattern that when countries around the world shifted toward higher debt than would be predicted by past growth, that later growth turned out to be somewhat higher than after countries around the world shifted to lower debt. It may be possible to explain why that evidence from trends in the average level of debt around the world over time should be dismissed, but if not, we should try to understand those time series patterns. It is hard to get definitive answers from the relatively small amount of evidence in macroeconomic time series, or even macroeconomic panels across countries, but given the importance of the issues, I think it is worth pondering the meaning of what limited evidence there is from trends in the average level of debt around the world over time. That is particularly true since in the current crisis, many people have, recommended precisely the kind of worldwide increase deficit spending–and therefore debt levels–that this limited evidence speaks to.

I am perfectly comfortable with the idea that the evidence from trends in the average level of debt around the world over time is limited enough so theoretical reasoning that shifts our priors could overwhelm the signal from the data. But I want to see that theoretical reasoning. And I would like to get reactions to my theoretical speculations above, about (1) supply-side benefits of lower taxes that reverse in sign in the future when the debt is paid for and (2) liquidity effects of government debt (which may also have a price later because of financial cycle dynamics).

Matt Yglesias’s Reaction: On MoneyBox, you can see Matthew Yglesias’s piece “After Running the Numbers Carefully There’s No Evidence that High Debt Levels Cause Slow Growth.” As I tweeted:

Don’t miss this excellent piece by @mattyglesias about my column with @yichuanw on debt and growth. Matt gets it.

In the preamble of my post bringing the full text of “An Economist’s Mea Culpa: I Relied on Reihnart and Rogoff” home to supplysideliberal.com, I write:

In terms of what Carmen Reinhart and Ken Rogoff should have done that they didn’t do, “Be very careful to double-check for mistakes” is obvious. But on consideration, I also felt dismayed that they didn’t do a bit more analysis on their data early on to make a rudimentary attempt to answer the question of causality. I wouldn’t have said it quite as strongly as Matthew Yglesias, but the sentiment is basically the same.

Paul Krugman’s Reaction: On his blog, Paul Krugman characterized our findings this way:

There is pretty good evidence that the relationship is not, in fact, causal, that low growth mainly causes high debt rather than the other way around.

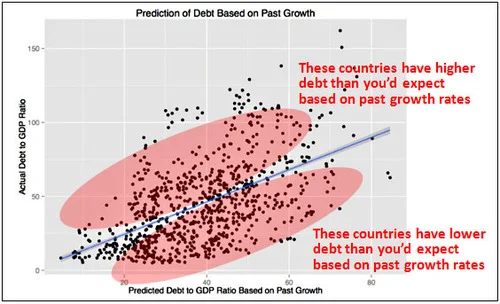

Kevin Drum’s Reaction: On the Mother Jones blog, Kevin Drum gives a good take on our findings in his post “Debt Doesn’t Cause Low Growth. Low Growth Causes Low Growth.” He notices that we are not fans of debt. I like his version of one of our graphs:

Mark Gongloff’s Reaction: On Huffington Post, Mark Gongloff’s “Reinhart and Rogoff’s Pro-Austerity Research Now Even More Thoroughly Debunked by Studies” writes:

…University of Michigan economics professor Miles Kimball and University of Michigan undergraduate student Yichuan Wang write that they have crunched Reinhart and Rogoff’s data and found “not even a shred of evidence” that high debt levels lead to slower economic growth.

And a new paper by University of Massachusetts professor Arindrajit Dube finds evidence that Reinhart and Rogoff had the relationship between growth and debt backwards: Slow growth appears to cause higher debt, if anything….

This contradicts the conclusion of Reinhart and Rogoff’s 2010 paper, “Growth in a Time of Debt,” which has been used to justify austerity programs around the world. In that paper, and in many other papers, op-ed pieces and congressional testimony over the years, Reinhart And Rogoff have warned that high debt slows down growth, making it a huge problem to be dealt with immediately. The human costs of this error have been enormous….

At the same time, they have tried to distance themselves a bit from the chicken-and-egg problem of whether debt causes slow growth, or vice-versa. “The frontier question for research is the issue of causality,” [Reinhart and Rogoff] said in their lengthy New York Times piece responding to Herndon. It looks like they should have thought a little harder about that frontier question three years ago.

There is an accompanying video by Zach Carter.

Paul Andrews Raises the Issue of Selection Bias: The most important response to our column that I have seen so far is Paul Andrews’s post “None the Wiser After Reinhart, Rogoff, et al.” This is the kind of response we were hoping for when we wrote “We look forward to further evidence and further thinking on the effects of debt.” Paul trenchantly points out the potential importance of selection bias:

What has not been highlighted though is that the Reinhart and Rogoff correlation as it stands now is potentially massively understated. Why? Due to selection bias, and the lack of a proper treatment of the nastiest effects of high debt: debt defaults and currency crises.

The Reinhart and Rogoff correlation is potentially artificially low due to selection bias. The core of their study focuses on 20 or so of the most healthy economies the world has ever seen. A random sampling of all economies would produce a more realistic correlation. Even this would entail a significant selection bias as there is likely to be a high correlation between countries who default on their debt and countries who fail to keep proper statistics.

Furthermore Reinhart and Rogoff’s study does not contain adjustments for debt defaults or currency crises. Any examples of debt defaults just show in the data as reductions in debt. So, if a country ran up massive debt, could’t pay it back, and defaulted, no problem! Debt goes to a lower figure, the ruinous effects of the run-up in debt is ignored. Any low growth ensuing from the default doesn’t look like it was caused by debt, because the debt no longer exists!

I think this issue needs to be taken very seriously. It would be a great public service for someone to put together the needed data set.

Note that Paul Andrews views are in line with our interpretation of our findings. Let me repeat our interpretation, with added emphasis:

…other than the danger from bond market vigilantes, we find no persuasive evidence from Reinhart and Rogoff’s data set to worry about anything but the higher future taxes or lower future spending needed to pay for that long-term debt.

Of course, it is disruptive to have a national bankruptcy. And nationalbankruptcies are more likely to happen at high levels of debt than low levels of debt (though other things matter as well, such as the efficiency of a nation’s tax system). And the fear by bondholders of a national bankruptcy can raise interest rates on government bonds in a way that can be very costly for a country. The key question for which the existing Reinhart and Rogoff data set is reasonably appropriate is the question of whether an advanced country has anything to fear from debt even if, for that particular country, no one ever seriously doubts that country will continue to pay on its debts.