From Charters of Liberty Granted by Power to Charters of Power Granted by Liberty

“IN 1792, in a short essay called ‘Charters,’ James Madison succinctly explained what he thought was the essential difference between the United States Constitution and the constitutions of every other nation in history. ‘In Europe,’ he wrote, ‘charters of liberty have been granted by power. America has set the example … of charters of power granted by liberty. This revolution in the practice of the world may, with an honest praise, be pronounced the most triumphant epoch of its history.’ The ‘charters of liberty … granted by power’ that Madison had in mind were the celebrated documents of freedom that kings and parliaments had issued throughout the ages, many still honored today: Magna Carta of 1215, the English Petition of Right of 1628, the English Bill of Rights of 1689. Documents like these had made the British constitution – unwritten though it was – the freest in the world prior to the American Revolution. A British subject enjoyed more room to express his opinions, more liberty to do as he liked with his property, more security against government intrusion, and greater religious toleration than the subject of any other monarchy in the known world. Yet for Madison and his contemporaries, that was not enough. He and his fellow patriots considered “charters of liberty … granted by power” a poor substitute for actual freedom because however noble their words, such charters were still nothing more than pledges by those in power not to invade a subject’s freedom. And because those pledges were ‘granted by power,’ they could also be revoked by the same power. If freedom was only a privilege the king gave subjects out of his own magnanimity, then freedom could also be taken away whenever the king saw fit.”

Henry George: Morality is the Heart of Economics

“Political economy is the simplest of the sciences. It is but the intellectual recognition, as related to social life, of laws which in their moral aspect men instinctively recognize, and which are embodied in the simple teachings of him whom the common people heard gladly. But, like Christianity, political economy has been warped by institutions which, denying the equality and brother-hood of man, have enlisted authority, silenced objection, and ingrained themselves in custom and habit of thought.”

Sun Balcony

↟ “Imagination will often carry us to worlds that never were, but without it we go nowhere.” — Carl Sagan; astrophysicist, awesomist.

My favorite place in NYC is of course, The Rose Center for Earth and Space. In the center of this building is an object called the “Hayden Sphere” which serves as the museum’s planetarium and Sun (Sol) replica. I always imagined what this object would look like as an actual star—in the center of everything, which inspired this Cinemagraph.

Instagram version

(Source: @deejayforte)

Sun Balcony

I love this picture. To me it looks like the observation deck from a hotel orbiting close to the Sun. – Miles

The Political Perils of Not Using Deep Negative Rates When Called For

How well has what you have been doing been working for you?

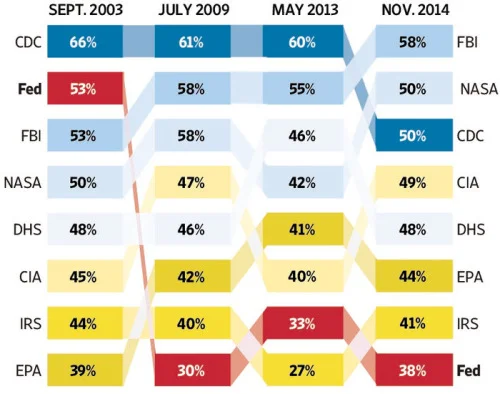

People are quick to think that the political costs of deep negative rates to a central bank are substantial. But it is worth considering the political costs of not doing deep negative rates when the economic situation calls for it. Take as a case in point the failure of the Fed to do deep negative rates in 2009. Regardless of the reason for the Fed’s not doing deep negative rates in 2009, it is possible to see the consequences for the Fed’s popularity of the depth of the Great Recession and the slowness of the recovery.

In his Wall Street Journal special report “Years of Fed Missteps Fueled Disillusion With the Economy and Washington,” Jon Hilsenrath tells the story of the Fed’s decline in popularity, and presents the following graphic:

How Americans rate federal agencies

Share of respondents who said each agency was doing either a ‘good’ or ‘excellent’ job, for the eight agencies for which consistent numbers were available

The Alternative

There is no question that the Fed’s failure to foresee the financial crisis and its role in the bailouts contributed to its decline in popularity. But consider the popularity of the Fed by 2014 in two alternative scenarios:

Scenario 1: The actual path of history in which the economy was anemic, leading to a zero rate policy through the end of 2014.

Scenario 2: An alternate history in which a vigorous negative interest rate policy met a firestorm of protest in 2009, but in which the economy recovered quickly and was on a strong footing by early 2010, allowing rates to rise back to 1% by the end of 2010 and to 2% in 2011.

In Scenario 2, the deep negative rates in 2009 would have seemed like old news even by the time of the presidential election in 2012, let alone in 2014. In the actual history, Scenario 1, low rates are still an issue during the 2016 presidential campaign, because the recovery has been so slow.

It Looks Good to Get the Job Done

At the end of my paper “Negative Interest Rate Policy as Conventional Monetary Policy” (ungated pdf download) published in the National Institute Economic Review, I discuss the politics of deep negative interest rates–not just for the United States, but also for other currency regions that needed them. My eighth and final point there is this:

Finally, the benefits of economic stabilisation should be emphasised. The Great Recession was no picnic. Deep negative interest rates throughout 2009 – somewhere in the –4 per cent to –7 per cent range – could have brought robust recovery by early to mid 2010. The output gaps the world suffered in later years were all part of the cost of the zero lower bound. These output gaps not only had large direct costs, they also distracted policymakers from attending to other important issues. For example, the later part of the Great Recession that could have been avoided by negative interest rate policy led to a relatively sterile debate in Europe between fiscal stimulus and austerity, with supply-side reform getting relatively little attention. And the later part of the Great Recession that could have been avoided by negative interest rate policy brought down many governments for whom thepolitical benefits of negative interest rate policy would have been immense. And for central banks, it looks good to get the job done.

Ryan Grim—Priceless: How The Federal Reserve Bought The Economics Profession →

I want to distance myself from the article at the link above a bit, so I don’t get in trouble myself :) Despite the title, a big share of what the article really points to is a history of stifling alternative views at the Federal Reserve Board itself, plus the usual groupthink in academia.

Dan Bobkoff and Akin Oyedele: Economists Never Imagined Negative Interest Rates Would Reach the Real World--Now They’re Rewriting Textbooks

An October 23, 2016 Business Insider article emphasizes just how far negative interest rate policy has come in the last four years since I published “How Subordinating Paper Currency to Electronic Money Can End Recessions and End Inflation” (originally titled “How paper currency is holding the US recovery back”) and started following negative interest rate discussions closely.

One of the big advances in fostering understanding of negative interest rate policy is the publication of Ken Rogoff’s book The Curse of Cash, which has a thorough discussion of the full-bore negative interest rate policy I distinguished from current negative interest rate policy in “If a Central Bank Cuts All of Its Interest Rates, Including the Paper Currency Interest Rate, Negative Interest Rates are a Much Fiercer Animal.” (See my post “Ana Swanson Interviews Ken Rogoff about The Curse of Cash” for more about the book.) Ken has been on the hustings promoting his book, and in the process greatly raising journalists’ and their readers’ understanding of negative interest rate policy. This article has some audio of Ken explaining negative interest rates.

Here is what Dan Bobkoff and Akin Oyedele write about the remarkable progress of negative interest rate practice:

The policy has evolved from radical idea to mainstream policy of postrecession governments in Europe and Asia. And in the US, Federal Reserve Board Chair Janet Yellen has said the US will not rule out using them if it needs to. …

In textbooks like Mishkin’s, a 0% interest rate was known as the “zero lower bound.” It just didn’t seem to make sense to go below that.

Now economists have to rename it. …

Today, countries with negative policy rates make up almost a quarter of global gross domestic product, according to the World Bank.

One element of Dan’s and Akin’s article deserves further discussion. They touch on the difficulty of passing through negative rates to household depositors:

“It’s very hard to obviously get depositors to accept negative interest rates for putting their money in there,” said Marc Bushallow, managing director of fixed income at Manning and Napier, which manages $35 billion in assets.

What’s much more likely is that only big banks will be forced to pay to lend money to one another. That would exempt small depositors from paying, but still have some of the stimulus effects that the central banks intend to have.

Something I emphasize in my talks to central banks is that a central bank is better off letting private banks handle much of the pass-through because the negative in regular people’s deposit and savings accounts that are likely to be a political problem a central bank represent a customer-relations problem for private banks that the private banks are likely to handle relatively carefully.

I think of negative deposit rates for small household checking and savings accounts as a big enough political problem for central banks that I have been strongly recommending to central banks that they use a tiered interest-on- reserves formula that actively subsidizes zero rates for small household checking and savings accounts. If a central bank can announce that it is trying to avoid having regular people with modest balances face negative rates in their checking or savings account, it should dramatically mitigate the political costs to a central bank of a vigorous negative interest rate policy.

I have written about subsidizing zero rates for small household accounts in a number of posts:

- How to Handle Worries about the Effect of Negative Interest Rates on Bank Profits with Two-Tiered Interest-on-Reserves Policies”

- Ben Bernanke: Negative Interest Rates are Better than a Higher Inflation Target”

- The Bank of Japan Renews Its Commitment to Do Whatever it Takes

- Why Central Banks Can Afford to Subsidize the Provision of Zero Rates to Small Household Checking and Savings Accounts

- How Negative Interest Rates Prevail in Market Equilibrium

Courage on the part of central bankers plus smart efforts to mitigate the political costs of a vigorous negative rate policy can do a great deal to advance negative interest rate policy as an element of the monetary policy toolkit. Nations that have such courageous and shrewd central bankers can then return to the Great Moderation, while maintaining low inflation targets.

Emily Badger: What Your 1st-Grade Life Says about the Rest of It →

A study over decades of young Baltimoreans offers insight into who succeeds and why.

On Consent Beginning from a Free and Equal Condition

The assertion in Article 1 of the Universal Declaration of Human Rights that “All human beings are born free and equal in dignity and rights” still sounds radical when applied to undocumented immigrants and members of small sexual minorities. To back up this assertion, it is hard to do better than John Locke in section 4 of his 2d Treatise on Government: “On Civil Government”:

To understand political power right, and derive it from its original, we must consider, what state all men are naturally in, and that is, a state of perfect freedom to order their actions, and dispose of their possessions and persons, as they think fit, within the bounds of the law of nature, without asking leave, or depending upon the will of any other man.

A state also of equality, wherein all the power and jurisdiction is reciprocal, no one having more than another; there being nothing more evident, than that creatures of the same species and rank, promiscuously born to all the same advantages of nature, and the use of the same faculties, should also be equal one amongst another without subordination or subjection, unless the lord and master of them all should, by any manifest declaration of his will, set one above another, and confer on him, by an evident and clear appointment, an undoubted right to dominion and sovereignty.

When I read this, I see an image of two human beings meeting in the middle of a trackless wilderness. They may have come from civilized territories, but that is all far away. One might be bigger and stronger than the other, and so able to take advantage of the other, but there is no good and just reason why one should rule over the other. They both deserve to be free and equal in relation to each other.

Writing when he did, it is not surprising that John Locke refers to God, but he suggests a very high burden of proof if someone claims that God has put one human being above another.

John Locke’s picture of people starting out free and equal, without any hierarchy, as we typically think of our literal neighbors next door, is very powerful. Thinking about the morality that applies between neighbors from this angle has generated some of the most persuasive Libertarian writing. I am thinking particular of Michael Huemer’s book The Problem of Political Authority: An Examination of the Right to Coerce and the Duty to Obey. My reading of that book generated several posts:

- Michael Huemer’s Libertarianism

- Michael Huemer on Moral Progress

- Michael Huemer’s Immigration Parable

- An Experiment with Equality of Outcome: The Case of Jamestown

I have thought that the starting point of being free and equal doesn’t absolutely have to point to a minimalist state. In particular, if someone would freely choose to belong to a state rather than stay in a separate, free and equal condition, then the state may be just. But there are some important considerations.

First, human beings are social creatures. It is not fair to imagine someone’s “free and equal” alternative as being alone. Rather, imagine the “free and equal” alternative as being in a highly social group of a few friends and family. Unless a state is better than that, it is not just.

Second while the provision of the basic justice of safety and protection from violence may be enough to justify the requiring a contribution to the resources necessary to provide that safety and protection if the individual would choose that protection over the state of nature even at the cost of the taxation, it seems unfair to use the surplus from the provision of protection at that cost to justify a government that goes beyond that protection. That is, think of two steps: a government that provide basic physical protection and justice at some cost. This is just getting people up to their basic rights–at a cost that someone has to bear. Then a government that goes beyond that had better provide surplus from the things that go beyond the basic provision of justice.

Let me give an example. A government might provide a commercial code and roads to make it easier to carry on commerce. If someone who doesn’t have to worry about basic security because of the minimal justice activities of a state, who was allowed to stop with those basic security benefits would still choose to join a state with that state that provided a commercial code and roads to make it easier to carry on commerce, then such a state providing infrastructure and a commercial code as well as basic physical safety might be just.

Some of these functions–such as roads–might be provided by private parties rather than by the state, but in this way of thinking about things, the state is viewed as if it were a species of private organization. As long as the people subject to it would voluntarily choose to belong to it, even when they still had basic physical security when not belonging, then the demands of the state can be seen as like those of a private club.

Looking at things this way, a basic right has to always be to leave the club if one wants to. And one should be able to continue to associate easily with others who have decided to leave the club, and even form an alternative club. Thus, from this point of view, for existing states to be just, it is crucial that there be spots on the earth where people can buy land along with the associated political rights to start a new nation on that land.

If one wants to justify redistributive taxation, there is a twist one can put on this notion that free and equal individuals would have to voluntarily want to belong to a state for that state to be just. That is to change the question to whether someone would voluntarily choose to belong to a state over remaining free and equal with all others outside a state behind a Rawlsian veil of ignorance, not knowing if one would be talented or not and therefore not knowing if one was likely to be rich or poor. I think John Locke himself was more in the spirit of asking whether one would agree after knowing one’s level of talent to belong to a society. But would-be willingness to consent if one were behind a Rawlsian veil of ignorance might count for something in the justice of a state existing.

Thinking of consent to belong to a state as compared to a free and equal state of nature, there is one very tough minimal requirement of justice that is not always noted: a state must not be dominated in attractiveness by another state that is willing to accept more members. And if State B is more attractive than State A for reasons that State A could imitate that calls into serious question the justice of State A as it is. Further, even if State B in this story doesn’t actually exist, but truly could exist in all practicality, much of the force of the argument remains.

That is, the logic of consent from the free and equal state of nature means this: a state is unjust if it is doing things in a suboptimal way that people would migrate away from to a more optimized state. The reason is that no one would consent to be part of the state doing things in a suboptimal way if they could instead be part of the state doing things the optimal way. In other words, bad public policy that is bad enough people would want to migrate away from it is not just bad, it is unjust.

One can combine this idea of a suboptimal policy being unjust because no one would consent to it if starting in a free and equal condition they could choose a similar state but with a better policy with the idea of consent from behind a Rawlsian veil of ignorance. If one would shift one’s decision of which state to be a part of from one with a policy that looks less attractive behind the veil of ignorance to one that looks more attractive behind the veil of ignorance, the justice of a state with a policy that would look less attractive behind the veil of ignorance stands in question.

John Locke’s perspective of people beginning free and equal is very refreshing in a world still filled with domineering states. The world still has a long way to go on the way to freedom.

Nate Cohn: How One 19-Year-Old Illinois Man is Distorting National Polling Averages →

The link above is to a well-done New York Times article analyzing the results highlighted on the website for the USC Daybreak Poll that has made things look so much more favorable for Donald Trump than other polls.

Let me emphasize that the underlying data for the Daybreak poll are extremely valuable. Having a panel makes it possible to answer many questions that cannot be answered well with a repeated cross-section. The problem is with the calculation for the highlighted comparison between Donald Trump and Hillary Clinton support.

The most important problem with the graph highlighted on the Daybreak Poll website is the weighting by the candidate a poll respondent claimed to have voted for in the last election. Nate Cohn is good at talking about the biases that introduces because people underreport voting for the loser. Thus, forcing the weights to make the reports of who people voted for equal to the actual shifts the weights too much toward the sort of people who might have actually voted for the loser. Many self-reported “Obama” or minor-candidate voters were really Romney voters. People who admitted voting for Romney are more Republican than the overall set of people who actually voted for Romney. So inflating the weights of people who reported voting for loser Romney up to equal the fraction of those who actually voted for Romney makes things look more favorable for Trump than they should be.

To me, the main way the data on voting in the last election should be used is in correcting for each demographic group the difference between the percent chance they said they would vote and whether they actually voted or not. It is not clear that this needs to use the self-reported voting after the fact at all; exit polls should provide good evidence on actual voting percentages by demographic group that can be compared to the probabilities people said in advance in each demographic group in this kind of data collection in 2012 (which I know was done on RAND’s American Life Panel in 2012).

Why Central Banks Can Afford to Subsidize the Provision of Zero Rates to Small Household Checking and Savings Accounts

The Bank of Thailand, which currently has a policy rate of only 1.5%, and so might need negative rates if there is a big shock to the Thai economy. Image source.

One of my key recommendations to central banks to reduce the political costs of a vigorous negative rate policy is to use the interest on reserves formula to subsidize the provision of zero interest rates to small household checking and savings accounts, as you can see in my posts “How to Handle Worries about the Effect of Negative Interest Rates on Bank Profits with Two-Tiered Interest-on-Reserves Policies” and “Ben Bernanke: Negative Interest Rates are Better than a Higher Inflation Target” and “The Bank of Japan Renews Its Commitment to Do Whatever it Takes.” (Also see “How Negative Interest Rates Prevail in Market Equilibrium” for a discussion of how the marginal rates that matter most for market equilibrium can be negative even if many inframarginal rates are zero.)

If rates become quite negative, this subsidy could become a significant cost to the central bank, since funds from private banks put into one tier of reserves would be getting a zero rate from the central bank, but after putting those funds into T-bills, the central bank could be earning a deep negative rate on those funds, say -4%. Nevertheless, I think central banks can handle the expense. This post explains why. (Talking to other economists at the Minneapolis Fed’s Monetary Policy Implementation in the Long Run Conference yesterday helped a lot in figuring this out.)

First, the transition to negative rates will create a large capital gain for the assets on the central bank’s balance sheet, while most of the central bank’s liabilities are shorter term or floating-rate liabilities and so do not go up as much in price. This includes paper currency as a liability, since in an electronic money policy that allows deep negative rates, the paper currency interest rate is a policy variable set equal to a rate close to the target rate. (See “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.”)

Second, the fact that the central bank can create money means that it cannot face a liquidity constraint as long as it is ultimately solvent. And the ultimate solvency of a central bank must be judged in the light of all future seignorage the central bank is likely to earn, ever, even if that ability to earn future seignorage is not represented by any asset that can be immediately sold.

As long as the central bank is trying to stimulate the economy, there is no problem with it creating additional money to pay all of its bills, including to pay its losses on its holdings of negative-rate Treasury bills. When it is time to tighten, any central bank that can pay interest on reserves doesn’t have to have an asset to sell in order to tighten monetary policy. Interest on reserves can be paid by newly created reserves using a central bank’s fundamental authority to create money. As long as there will be seignorage someday sufficient to mop up those extra reserves, this is a perfectly good way to tighten monetary policy.

Third, what matters for the sustainability of paying positive interest on reserves once it is time to tighten is the amount of seignorage the central bank could earn if it needed to. In an emergency, an electronic money policy allows for the possibility of seignorage from paper currency interest rates below the target rate, say by as much as 5% below.

Fourth, the markets will expect that the central bank is ultimately backed by the fiscal authority. Note that because it faces no liquidity constraints, the central bank can always wait and wait and wait for a very propitious time to beg the fiscal authority for an infusion of funds. And the markets know this. So the solvency of the central bank depends on the willingness of an exceptionally favorable fiscal authority at some future date to give it an infusion of funds. (To that exceptionally favorable fiscal authority, the central bank can argue that the deep negative rates that cost it a lot in subsidies saved the fiscal authority a lot of interest expense.)

Fifth, given whatever large present value of subsidies to support zero rates to small household borrowers a central bank has the resources for, the central bank can afford to front-load the subsidies. Deep negative rates will probably be needed only for a short time, and if necessary, an announcement that without help from the fiscal authority the cap on the amount subsidized for a zero rate in checking and savings accounts will have to be gradually reduced will probably get some help from the fiscal authority, and if not can actually be carried out.

The bottom line is that a central bank is unlikely to get into serious budget trouble from subsidizing zero rates for small household accounts even if it takes rates to a quite deep negative level.

Johannes Wieland's Discussion of "Breaking Through the Zero Lower Bound" at the Minneapolis Federal Reserve Bank's Monetary Policy Implementation Conference, October 18, 2016 (pdf download) →

For me, the highlight of this conference at the Minneapolis Fed so far has been talking to Johannes Wieland and hearing his discussion of my paper with Ruchir Agarwal, “Breaking Through the Zero Lower Bound.” (pdf download). Johannes’s slides are wonderful in their clarity.

Here are the slides for my presentation at the Minneapolis Fed (pdf download) for which Johannes was discussant.

The Transformation of Songwriting: From Melody-and-Lyrics to Track-and-Hook

“By the mid-2000s the track-and-hook approach to songwriting—in which a track maker/producer, who is responsible for the beats, the chord progression, and the instrumentation, collaborates with a hook writer/topliner, who writes the melodies—had become the standard method by which popular songs are written. The method was invented by reggae producers in Jamaica, who made one “riddim” (rhythm) track and invited ten or more aspiring singers to record a song over it. From Jamaica the technique spread to New York and was employed in early hip-hop. The Swedes at Cheiron industrialized it. Today, track-and-hook has become the pillar and post of popular song. It has largely replaced the melody-and-lyrics approach to songwriting that was the working method in the Brill Building and Tin Pan Alley eras, wherein one writer sits at the piano, trying chords and singing possible melodies, while the other sketches the story and the rhymes.”

The Consequences of Overly Strong Incentives: Wells Fargo, Baseball Baptisms, and Academic Advancement

This recent news about Wells Fargo (see for example Wells Fargo Warned Workers Against Sham Accounts, but ‘They Needed a Paycheck’) shows how overly strong incentives can cause people to cheat–especially if some of the higher-ups are OK with the cheating. Similar problems have occurred when teacher’s careers depend critically on student test scores.

Even in a religious context, the same danger of overly strong incentives leading to cheating in the sense of low-quality production can be a problem. In particular, the recent news about Wells Fargo reminded me of the “Baseball Baptism” era in Mormon proselyting when young men were acceptance Mormon baptism primarily because it was a requirement for belonging to a sports team. In the words of Michael Quinn in the article linked above:

… disadvantaged children and teen-agers may be eager to be dunked under water as the only requirement for a free trip to the beach or for membership in a sports club sponsored by a church.

Why would missionaries pursue such a course when people accepting baptism on such terms are unlikely to remain participating members of the Mormon Church for long? Here is Michael Quinn’s answer:

In the I-It relationship, performing baptisms is also a means for the missionary to gain something earthly. The missionary may want the praise of family and Church leaders for adding converts to the faith. Some missionaries use convert as a way to gain the personal “testimony” of the gospel that was absent in their pre-mission experience. The missionary may seek a sense of self-worth through baptizing others. Missionaries may believe that their eternal glory grows with each new convert. They may think that God’s love for them increases with each person they bring into his kingdom. The missionary may expect that performing more baptisms will increase the chances of advancement in Church office. The missionary may enjoy the “rush of competing with other missionaries to see who can baptize the most persons or which mission can "out-baptize” the other missions of the world. And-again in the main subject of this essay-Church leaders may put such intense pressures of reward or disfavor on a missionary’s baptismal numbers that young missionaries will do anything–anything–to satisfy those demands. In all of the above examples of I-It missionary work, potential converts and actual converts are only objects to fulfill the various goals of a missionary That is true whether a missionary’s I-It emphasis results in a single baptism or in thousands.

In “The Message of Mormonism for Atheists Who Want to Stay Atheists” I emphasized the motive of advancement in rank–a motive whose strength is hard to understand without a little more background:

While on a mission, missionaries are urged to work even harder to “get a testimony”—subjective spiritual experiences that will convince them the Mormon Church is true. In addition, they are motivated to work hard by a system of promotions in rank no doubt devised by one of the many middle-aged businessmen who take three years off from a regular job to serve as a “Mission President”–the head of a group of 150 or so young missionaries in a particular region. Mormon missionaries always travel in twos, so they can keep each other from getting into trouble–and in other countries to make sure that one of them has been there long enough to be able to speak the language reasonably well. A missionary starts out as a junior companion. It is a big day when a missionary finally makes it to being a senior companion. Later on, the missionary can hope to be promoted to District leader over three to seven other missionaries, to a Zone leader over, say, nineteen, and maybe even to being an assistant to the Mission President. It is hard to communicate how much we as missionaries cared about those promotions. And of course, there could be demotions in the form of being exiled to a remote district where it was especially hard to make converts.

The Mission Presidents, who, as I mentioned, often have business experience, also devise many other motivational strategies akin to those in the world of sales.

I greatly admire Michael Quinn as a historian who has done so much to illuminate Mormon history–even against the wishes of Mormon church leaders. I heard him present his work on the Baseball Baptism Era at a Sunstone Symposium. (Sunstone is an independent magazine about Mormonism that many Mormon church leaders wish didn’t exist. The Sunstone organization also puts on conferences.) I told of a phenomenon similar to Baseball Baptisms that occurred in the Tokyo South Mission of the Mormon Church while I was a missionary in the neighboring, but much more sedate Tokyo North Mission from 1979-1981. Here is how Michael Quinn wrote that up:

Was the baseball baptism era an unparalleled aberration in Mormon experience? Not from what a number of more recent LDS missionaries have told me. Most of the “well-known salesmanship techniques” remained in the missionary lessons and program. …

Early in 1980, a mission president in Japan used lavish dinners and other rewards as “incentives” for missionaries to reach baptism goals. The mission abbreviated the lesson-plan so that missionaries spent no more than an hour with “investigators” before baptizing them. This program was “encouraged by the general authority who was acting as an area president without counselors.” Presidency counselor Gordon B. Hinckley asked missionaries about these developments just before the dedication of the Tokyo temple that October. He ended the program by reinstituting the requirement for persons to attend at least one LDS meeting before baptism.

I was Gordon B. Hinckley’s main missionary informant about this, since when my grandfather Spencer W. Kimball–then the head of the Mormon Church–came to dedicate the new Tokyo Temple, I was invited (along with my missionary companion–we always did everything in pairs) to spend a few days away from my regular missionary duties to accompany him and my grandmother Camilla Eyring Kimball. That also put me in close contact with Gordon B. Hinckley. I remember Gordon Hinckley’s talk to the missionaries saying that conversion involved not only believing the doctrine of Mormonism but also “a decision to throw in their lot with us.” In addition imposing the requirement of attending at least one church meeting before baptism, Gordon B. Hinckley urged that “investigators” read his brief history of the Mormon Church: Truth Restored.

Even after that, at the time my 2-year missionary service was over, things baptisms of a sort were still coming thick and fast in the Tokyo South mission. My brother Jordan came to meet me and I had the chance to tour Japan a bit. One of the things we did was to visit a classmate of mine from Harvard who was serving in the Tokyo South mission. I saw the makeshift baptismal font set up in a missionary apartment. I got a copy of their very abbreviated lesson plan and heard about how they often represented baptism as part of joining a cool club.

During my mission, I was a bit envious of the much better statistics we heard about from the Tokyo South mission. But in retrospect, I was very grateful that I had a Mission President with more integrity than that: Michael Roberts.

The Moral of the Story:

I no longer believe in the supernatural or in Mormonism, but the lessons of the Baseball Baptism Era apply to many areas of life: in a large organization, there is a limit to how strong incentives providing extrinsic motivation can be without causing widespread cheating (in the sense of low-quality production that seems to answer the quantitative goals but does not truly meet the underlying goals very well). For economists and businesspeople who are trained to believe in incentives, this is a sad message, but an important one.

Formal competitions sometimes keep cheating down by extremely intensive monitoring. But monitoring as intensive as, say the referees on the field in a sports arena, along with all the watching fans scrutinizing things, can be expensive and not always easy to adapt to routine production.

The rewards for publishing journal articles are large enough to cause a certain amount of cheating even though the quality of articles can be monitored relatively thoroughly. Sometimes the cheating is in claiming data that doesn’t exist. Sometimes it is in mischaracterizing the statistical results–especially not mentioning all the failed experiments. Sometimes it is in saying something that sounds good but is misleading. Given all the many ways to cheat a little or a lot in the academic arena, we should be careful about judging our fellow academics on grounds that are too narrowly quantitative. A judgement about someone’s academic integrity and whether they are really trying to advance knowledge and make the world a better place should always be formed along with the counting of the beans (an apt metaphor for the counting of journal articles someone has published). It is possible for a bad person to have a brilliant scientific insight that one should take very seriously and build on. But a bad person who has done some good science needs to be watched very closely in case they slip in bad science along with the good.

On the other hand, someone who, with integrity is working hard to do the best that she or he can to advance knowledge and make the world a better place by applying knowledge should feel good about that even if her or his number of beans doesn’t add up to the same magnificent-looking pile as some others. Although occasionally, something wrong is like sand in an oyster and causes many other researchers to generate pearls of wisdom in reaction, in general, it is much better to have a short Curriculum Vitae with one scientific result that is right than a long Curriculum Vitae with one scientific result that is right and ninety-nine other misleading bits of supposed science.

Henry George on How Statistical Identification Problems Increase the Importance of Theory

“Thus the facts we must use and the principles we must apply are common facts that are known to all and principles that are recognized in every-day life. Starting from premises as to which there can be no dispute, we have only to be careful as to our steps in order to reach conclusions of which we may feel sure. We cannot experiment with communities as the chemist can with material substances, or as the physiologist can with animals. Nor can we find nations so alike in all other respects that we can safely attribute any difference in their conditions to the presence or absence of a single cause without first assuring ourselves of the tendency of that cause. But the imagination puts at our command a method of investigating economic problems which is within certain limits hardly less useful than actual experiment. We may test the working of known principles by mentally separating, combining or eliminating conditions.”

Henry George, Protection or Free Trade.