Henry George: That Those Who Advocate Any Extension of Freedom Choose to Go No Further than Suits Their Own Special Purpose is No Reason Why Freedom Itself Should Be Distrusted.

“When we consider that [labor] is the producer of all wealth, is it not evident that the impoverishment and dependence of [labor] are abnormal conditions resulting from restrictions and usurpations, and that instead of accepting protection, what [labor] should demand is freedom? That those who advocate any extension of freedom choose to go no further than suits their own special purpose is no reason why freedom itself should be distrusted. For years it was held that the assertion of our Declaration of Independence that all men are created equal and endowed by their Creator with unalienable rights, applied only to white men. But this in nowise vitiated the principle. Nor does it vitiate the principle that it is still held to apply only to political rights. And so, that freedom of trade has been advocated by those who have no sympathy with [labor] should not prejudice us against it. Can the road to the industrial emancipation of the masses be any other than that of freedom?”

Henry George, Protection or Free Trade.

Note: Henry George idiosyncratically substituted “endeavored” wherever “labor” would normally appear, going so far as to use “eendeavoredate” in place of “elaborate,” for example. I have reversed this for clarity.

John Locke Looks for a Better Way than Believing in the Divine Right of Kings or Power to the Strong

Wikipedia article on John Locke

Having finished blogging my way through John Stuart Mill’s “On Liberty” (see John Stuart Mill’s Defense of Freedom), I wanted to turn to John Locke’s 2d Treatise on Government: “On Civil Government.” One of the many reasons John Locke’s 2d Treatise on Government is important is that the Framers of the Constitution of the United States and those who ratified it were so well versed in John Locke’s 2d Treatise of Government. Thus, anyone attempting to determine the original public meaning of the Constitution of the United States, should be as well versed in this work as folks back in the 18th century were.

In Chapter I (“The Introduction”) of the 2d Treatise of Government “On Civil Government,” John Locke summarizes his argument of his 1st Treatise of Government demolishing an argument for the divine right of Kings, and sets the stage for what follows, writing:

It having been shewn in the foregoing discourse,

- That Adam had not, either by natural right of fatherhood, or by positive donation from God, any such authority over his children, or dominion over the world, as is pretended:

- That if he had, his heirs, yet, had no right to it:

- That if his heirs had, there being no law of nature nor positive law of God that determines which is the right heir in all cases that may arise, the right of succession, and consequently of bearing rule, could not have been certainly determined:

- That if even that had been determined, yet the knowledge of which is the eldest line of Adam’s posterity, being so long since utterly lost, that in the races of mankind and families of the world, there remains not to one above another, the least pretence to be the eldest house, and to have the right of inheritance:

All these premises having, as I think, been clearly made out, it is impossible that the rulers now on earth should make any benefit, or derive any the least shadow of authority from that, which is held to be the fountain of all power, Adam’s private dominion and paternal jurisdiction; so that he that will not give just occasion to think that all government in the world is the product only of force and violence, and that men live together by no other rules but that of beasts, where the strongest carries it, and so lay a foundation for perpetual disorder and mischief, tumult, sedition and rebellion, (things that the followers of that hypothesis so loudly cry out against) must of necessity find out another rise of government, another original of political power, and another way of designing and knowing the persons that have it, than what Sir Robert Filmer hath taught us.

After taking down the divine right of kings, John Locke sets out his goal of finding some basis for government other than power to the strong. In disagreeing with both the divine right of kings and power to the strong, John Lock is unwilling to say that because things are a certain way, that they should be that way.

In my view, asking how things should be, without too much deference to how they are now, is the secret of progress. Of course, one should pay some respect to the principle well taught in economics that there might be a good reason for the way things are. But it is the height of folly to think that things are never the way they are for a bad reason.

Let me try to make this point sharply. Speaking without mercy, any time there is any technological progress it means that in retrospect something was being done stupidly before. Any time one learns anything, it reveals one’s ignorance before. And any time a society is made more just, it reveals in high relief the injustice of what went before.

But in each case, what many only see in retrospect, someone had to see in advance, when it wasn’t so easy to see: a better way to make widgets, a new insight, or an injustice to be righted.

When I took the Landmark Education “Curriculum for Living,” they had a special definition of an insight for personal growth: “Something that occurs to you as bad news about yourself.” The bad news that something is amiss has to be allowed in before there is much hope of making things better.

What is painful in personal growth is less painful when doing research, since there an insight might be bad news about someone else’s research that one can hope to right with one’s own research. Still, there is usually some pain in seeing things askew, even if the chance to right them can advance one’s own career. It is much better to have everyone do things well than to have people do things badly so that one can shine by doing them better.

Economists are trained to tear apart a presentation intellectually to find what is wrong and can be criticized. This is very useful training. But I wish they spent at least an equal amount of effort tearing apart social reality intellectually to find what is wrong and can be criticized. That is the beginning of the path toward making things better.

The tools of economic analysis are powerful, and can often be used productively to find ways to move the world in a good direction. Of course, those tools can also be used for to help find ways to help some people at the expense of many others. (For an example, see “Us and Them.”) Or the tools of economic analysis can be used as part of a game that has no immediate effect for good or ill on the wider world, but sharpens the wits of economists for a later time when some of the participants in that game do turn toward trying to make the world a better place or trying to help some people at the expense of many others.

“Two Treatises of Government” was published anonymously by John Locke in 1689. It was only a hundred years later, in 1789, that it fully bore fruit in the Constitution of the United States. This a good example of the principle I set out in “That Baby Born in Bethlehem Should Inspire Society to Keep Redeeming Itself”:

… the fact that the young will soon replace us gives rise to an important strategic principle: however hard it may seem to change misguided institutions and policies, all it takes to succeed in such an effort is to durably convince the young that there is a better way.

Many, many things stay the same until suddenly, one day, they are different. Ideas of how to make things better and patience in putting those ideas forward are two keys to bringing change in the right direction. In my view, John Locke made the world a better place. May we also do so.

Jingoism in Cahoots with Protectionism

“Protection, moreover, has always found an effective ally in those national prejudices and hatreds which are in part the cause and in part the result of the wars that have made the annals of mankind a record of bloodshed and devastation—prejudices and hatreds which have everywhere been the means by which the masses have been induced to use their own power for their own enslavement.”

The Bank of Japan Renews Its Commitment to Do Whatever It Takes

Link to Wikipedia article on Haruhiko Kuroda

I am not impressed by a target of zero for 10-year Japanese government bonds as stimulative measure, when they have been trading at negative rates. Fortunately, I think this is simply a sign that the Bank of Japan is continuing to search for new tools. And, as you can see from “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide,” there are tools available that are much more powerful than anything the Bank of Japan has used so far.

In particular, one of the most powerful tools the Bank of Japan has not yet tried is a negative paper currency interest rate through a gradually increasing discount on paper currency obtained from the cash window of the Bank of Japan (and a corresponding gradually increasing discount in what is credited to a bank’s reserve account when paper currency is deposited). A negative paper currency interest rate in turn makes it possible to cut other short-term interest rates much further.

Watching the Bank of Japan’s actions over the last few years and talking to its chief, Governor Haruhiko Kuroda, at Jackson Hole, left me confident about the Bank of Japan’s willingness to try new tools. What I wondered is whether the Bank of Japan would declare that it was already close to the natural rate of unemployment, and so didn’t need to do much more. My view is that after 20 years of slump, the Bank of Japan needed to risk overshooting its inflation target in order to find out both what its natural level of output really is, and to find out what it takes to permanently raise inflation to 2%, as it has decided it wants to do. In its September 21, 2016 statement, the Bank of Japan declares that it has come around to that point of view–better to risk overshooting than to undershoot:

The Bank will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds the price stability target of 2 percent and stays above the target in a stable manner. Meanwhile, the pace of increase in the monetary base may fluctuate in the short run under market operations which aim at controlling the yield curve. With the Bank maintaining this stance, the ratio of the monetary base to nominal GDP in Japan is expected to exceed 100 percent (about 500 trillion yen) in slightly over one year (at present, about 80 percent in Japan compared with about 20 percent in the United States and the euro area).

The Bank will make policy adjustments as appropriate, taking account of developments in economic activity and prices as well as financial conditions, with a view to maintaining the momentum toward achieving the price stability target of 2 percent.

I think it is this stated willingness to overshoot, not the introduction of an explicit yield-curve targeting, is what caused the yen to depreciate on the Bank of Japan’s September 21 announcement.

The other key section of the the September 21, 2016 statement is the section labelled “Possible options for additional easing”:

With regard to possible options for additional easing, the Bank can cut the short-term policy interest rate and the target level of a long-term interest rate, which are two key benchmark rates for yield curve control. It is also possible for the Bank to expand asset 5 purchases as has been the case since the introduction of QQE. Moreover, if the situation warrants it, an acceleration of expansion of the monetary base may also be an option.

Note the specific mention of lower short-term rates as an option.

Beyond the policy of a gradually increasing discount on paper currency obtained from the cash window of the Bank of Japan to make it possible to lower short-term rates without inducing massive paper currency storage, the most important complementary policy is one to make negative rates more acceptable politically: a shift in the details of the interest on reserves formula to explicitly link the amount of funds on which banks can earn an above-market interest rate to their provision of zero rates to small household accounts. The government retail bank represented by Postal Savings should also be part of this program, just as if it were a private bank (although its subsidy could come from another arm of the government rather than from the interest-on-reserves formula). Here is how it works, as I detailed in my post “Ben Bernanke: Negative Interest Rates are Better than a Higher Inflation Target”:

I have advocated arranging part of the multi-tier interest on reserves formula to kill two birds with one stone: not only support bank profits but also subsidize zero interest rates in small household accounts at the same time–the provision of which is an important part of the drag on bank profits as it is now. I think being able to tell the public that no one with a modest household account would face negative rates in their checking or saving account would help nip in the bud some of the political cost to central banks.

To avoid misunderstanding, it is worth spelling out a little more this idea of using a tiered interest on reserves formula to subsidize provision of zero interest in small household checking and savings accounts. To make it manageable, I would make the reporting by banks entirely voluntary. The banks need to get their customers to sign a form (maybe online) designating that bank as their primary bank and giving an ID number (like a social security number) to avoid double-dipping. In addition to shielding most people from negative rates in their checking and savings accounts, this policy also has the advantage of setting down a marker so that it is easier for banks to explain, say, that amounts above $1500 average monthly balance in an individual checking+saving accounts or a $3000 average monthly balance in joint couple checking+saving accounts would be subject to negative interest rates. That is, the policy is designed to avoid pass-through of negative rates to small household accounts but encourage pass-through to large household accounts, in a way that reduces the strain on bank profits.

Finally, in Japan, I would tie the ability of banks to get an above-market rate on a portion of their reserves to their passing along the discount on paper currency to their customers when their customers withdraw paper currency, so that regular people would get the benefit of that discount, too.

With the combination of a negative paper currency interest rate induced by a gradually increasing discount on paper currency obtained from the cash window of the central bank, and effective subsidies to support zero rates on small household accounts to make negative rates in general more acceptable, the Bank of Japan would have as much firepower it needs to achieve its goals.

Given how little we understand about economies that have been in a 20-year slump, I applaud the objective the Bank of Japan has now announced of continuing to stimulate the Japanese economy until the signs of the Japanese economy being above the natural level of output become absolutely unmistakable by inflation going above 2%. In the case of Japan, the economic risk from doing too little is much greater than the risk from doing too much.

Note: I will be going to the Bank of Japan to deliver this message personally in a few days. I have seminars scheduled at the Bank of Japan on September 27 and October 7. You can see the regularly updated itinerary for all of my travels to promote the inclusion of full-bore negative interest rate policies in the monetary policy toolkit in my post Electronic Money: The Powerpoint File.

Ben Bernanke: Maybe the Fed Should Keep Its Balance Sheet Large →

This is a good summary of some of the most important papers at Jackson Hole this year. The description at the top of Ben’s blog post is accurate: “Ben Bernanke sees merit in the case for keeping the Fed’s balance sheet large instead of shrinking it, as is the current plan.” Having listened to the same talks, I see the same merit.

You can see Ylan Q. Mui’s reaction to this blog post of Ben’s in her Wonkblog post “The Federal Reserve confronts a possibility it never expected: No exit.”

Negative Rates and the Fiscal Theory of the Price Level

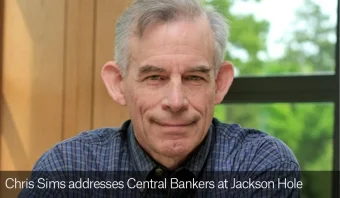

I was very pleased to be invited to the Jackson Hole monetary policy conference this past August. One of the highlights of the conference was Chris Sims’s lunchtime talk on the first main day of the conference, “Fiscal Policy, Monetary Policy and Central Bank Independence.” The fiscal theory of the price level is something I have been confused about for a long time. Chris Sims interpreted it from a remarkable simple point of view–a point of view very close in its logic to the way I analyze the transmission mechanism for interest rates cuts–including going to a negative interest rate or a deeper negative rate–in my posts

- Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates

- Responding to Joseph Stiglitz on Negative Interest Rates.

I confirmed my interpretation of what Chris was saying in a question I posed in the Q&A right after his talk. I still may have it wrong, but here is what I understood.

Why Lower Rates Increase Aggregate Demand and Higher Rates Reduce Aggregate Demand

Suppose real interest rates go down. Adding up spending from both sides of almost every borrower-lender relationship in which rates go down, aggregate demand should increase because:

- The negative shock to effective wealth of the lender is matched by an equal and opposite shock to the effective wealth of the borrower. This is the “Principle of Countervailing Wealth Effects” I discuss in the posts listed above. Long-term fixed rates can mute the shock to the effective wealth of both sides, but absent a big change in the inflation rate will still typically lead the borrower to feel better off with the change in rates and the lender to feel worse off in terms of annuity equivalents (whatever the asset values on paper).

- In almost all cases, the marginal propensity to consume is higher for the borrower than for the lender, so that adding up the effects on borrower and lender, the wealth effects add up to an increase in spending. The particular marginal propensity to consume (MPC) that matters is the marginal propensity to consume of the borrower out of reductions in interest expenses and the marginal propensity to consume of the lender out of interest earnings.

- In addition to the wealth effects on the non-interest spending of the borrower and lender, there is a substitution effect on both borrower and lender toward spending more now simply because spending now is relatively cheaper compared to spending later when the interest rate is lower. (For the lender alone, the wealth effect may easily overwhelm the substitution effect, so that the lender may spend less when interest rates go down, but for the borrower and lender combined the wealth effect and substitution effect both go in the same direction given 1 and 2: toward more non-interest spending when the rate goes down.)

What if interest rates go up? Then, adding up spending from both sides of almost every borrower-lender relationship in which rates go up, aggregate demand should decrease because:

- The positive shock to the effective wealth of the lender is matched by an equal and opposite shock to the effective wealth of the borrower–the “Principle of Countervailing Wealth Effects.” Long-term fixed rates can mute the shock to the effective wealth of both sides, but absent a big change in the inflation rate will still typically lead the lender to feel better off with the change in rates and the borrower to feel worse off in terms of annuity equivalents (whatever the asset values on paper).

- In almost all cases, the marginal propensity to consume is higher for the borrower than for the lender, so that adding up the effects on borrower and lender, the wealth effects add up to a reduction in spending. The particular MPC that matters is the marginal propensity to consume of the borrower out of reductions in interest expenses and the MPC of the lender out of interest earnings.

- In addition to the wealth effects on the non-interest spending of the borrower and lender, there is a substitution effect on both borrower and lender toward spending less now simply because spending now is relatively more expensive compared to spending later when the interest rate is higher. (For the lender alone, the wealth effect may easily overwhelm the substitution effect, so that the lender may spend more when interest rates go up, but for the borrower and lender combined the wealth effect and substitution effect both go in the same direction given 1 and 2: toward less non-interest spending when the rate goes up.)

The Fiscal Theory of the Price Level Points to the Exception

The Fiscal Theory of the Price Level comes into play when there is an exception to the rule that the borrower has a higher marginal propensity to consume than the lender. This has happened historically along the path to hyperinflations. The key borrower-lender relationship for understanding hyperinflations is the one in which the government is the borrower and bond-holders are the lenders. If inflation and interest rates are changing rapidly the wealth effects on both sides of the borrower-lender relationship in which the government is the borrower can have extra complexities, but the Principle of Countervailing Wealth Effects still applies: any effective gain in wealth to the government is an effective loss in wealth to the bond-holders and any effective loss in wealth to the government is an effective gain in wealth to the bond-holders.

One possible issue is if there is an unexpected increase in inflation that reduces even the annuity equivalent of long-term government bonds, so that the higher inflation increases aggregate demand through a higher government propensity to consume out of that inflation windfall than the reduction in spending to those who have had the annuity equivalent of their bonds eroded by inflation.

Another possible issue is related to the one envisioned in Thomas Sargent and Neil Wallace’s “Some Unpleasant Monetarist Arithmetic.” Suppose government borrowing is short-term and that the markets demand inflation compensation according to the Fisher equation, and that the central bank pushes up the real interest rate as inflation goes up. If the government reduces non-interest spending more than the bond-holders raise their spending as its real interest costs go up, then the situation is stable. But if the government keeps its non-interest spending roughly the same (financing the rising deficit out of additional borrowing), then any increase in bond-holder spending will result in an increase in aggregate demand. Unless aggregate demand goes down as a result of the effect of rising real rates on other borrower-lender relationships, the situation will be unstable. That instability can easily lead to hyperinflation.

Failure of Stabilization with a Lower Bound on Rates

Now consider the opposite situation from a hyperinflation. Suppose the economy starts with aggregate demand below what would keep the economy at the natural level of output. Interest rate cuts should raise aggregate demand according to the logic his post begins with. But if interest rate cuts are stopped short by a lower bound on rates, there may still be a deficiency in aggregate demand. And the markets, knowing that balance may not be reachable given the lower bound on rates, will not have future expectations that are as stabilizing as one would hope.

How Eliminating the Zero Lower Bound Leads to Stability

As long as rates can go as far down as needed, the logic of countervailing wealth effects–with borrowers having a higher MPC than lenders–ensures that aggregate demand will eventually rise to equal the natural level of output. Expectations of this will exert a stabilizing influence. The only potential problem is if important borrowers have lower marginal propensities to consume than the lenders on the other side of that borrower-lender relationship. The most plausible case of such a failure would be the government as borrower. But even a government in the grip of austerity because of a concern about budget deficits and national debt, is likely to have a relatively high marginal propensity to consume out of interest savings because those interest savings are manifested as a lower budget deficit–as conventionally measured–than the government would otherwise face. That is, is it really plausible that even a government in the grip of an austerity policy would spend less on non-interest items than it otherwise would because its interest expenses went down? That doesn’t seem plausible to me. Whatever reduction in non-interest spending the austerity approach lead to in itself, a low enough interest rate should reduce interest expenses enough that the government should begin spending more on non-interest items. I would be surprised if it isn’t close to 1 for 1 (MPC = 100%) in an environment where many people will be pushing the government to spend more, and for austerity proponents, pointing to a high budget deficit is one of the few effective ways of pushing back on that pressure to spend more.

How, in the Event, the Stabilization Mechanisms Need Not Be So Fiscal After All

The confidence that a low enough interest rate would bring forth enough additional aggregate demand to equal the natural level of output, plus the confidence that the central bank can and will lower the interest rate as much as necessary (having eliminated the zero lower bound) will make the economy stable. And part of that confidence may be knowing that in extremis the interest rate mechanisms described above would lead to more government spending on non-interest items as the central bank cut rates. But that does not mean that (given the initial recessionary situation) equilibrium would, in fact, be restored by a large increase in government spending on non-interest items. Knowing that the economy would return to the natural level of output, investment would be more robust. And even if there is still a big deficiency of aggregate demand, interest rate cuts raise aggregate demand through all the other borrower-lender relationships as well–many of them relationships in which the government is not involved. So it is quite possible for aggregate demand to be restored to equilibrium with the natural level of output with a relatively modest response of government spending on non-interest items as interest rates drop. Indeed, it is quite possible for the direct effect of an austerity policy to exceed the effect of interest rate cuts on government spending on non-interest items, so that government spending on non-interest items remains below normal during the recovery. Aggregate demand doesn’t have to come from the government. Interest rate cuts will guarantee that it comes from somewhere–unless the whole thing is destabilized by implausible expectations of an implausibly low government marginal propensity to consume out of interest rate savings.

Why There Is an Asymmetry Between Hyperinflation and Stabilization in the Absence of a Lower Bound on Interest Rates

Because cutting non-interest spending can be very difficult, it can and does happen that a government sometimes does have a low marginal propensity to cut non-interest spending as interest expense increases. But in a serious recession when there will be clamoring for more spending from all sides, there is nothing likely to stand in the way of even a quite austere government increasing government spending on non-interest items somewhat relative to what spending on non-interest items would have been had interest expenses been higher. On the other side of the transaction, the typical MPC of government bond-holders is quite low. And there are many, many other borrower-lender relationships in which borrowers unquestionably have a higher MPC than the lenders on the other side of the transaction. Finally, all of that leaves out the substitution effect, which can be quite powerful in raising aggregate demand in response to interest rate cuts, once one is comparing it to the sum of wealth effects for the borrowers and lenders on both sides of a transaction rather than to the wealth effect for only the lenders.

Conclusion

Anyone who forgets to think about borrowers will never understand the transmission mechanism through which interest rates affect the economy. Thinking about borrowers as well as lenders shows just how powerful cutting rates can be in stabilizing the economy once the lower bound on interest rates has been eliminated.

Gwynn Guilford: The Epic Battle Between Clinton and Trump is a Modern Day Morality Play

I am an admirer of Jonathan Haidt’s theory of moral intutions, laid out in his book The Righteous Mind. I applied it a while back to the measurement of national well-being in “Judging the Nations: Wealth and Happiness Are Not Enough.” Gwynn Guilford applied it in a trenchant July 31, 2016 Quartz column “The epic battle between Clinton and Trump is a modern day morality play” that is worth revisiting now that Labor Day is past and the general election campaign has begun in earnest.

Here are some key passages in Gwynn’s column:

1. Hunkered down in their ideological corners, Clinton and Trump could have been talking about two wholly different countries.

And in a way, they were. Their convention themes described visions of the American moral order that light up the brains of different types of voters, appealing to discrete layers of the US electorate. Both candidates went for intensity over breadth. However, of the two, Trump exhibited a much deeper and more strategic understanding of human nature, as he had throughout the primaries.

2. In his book, Righteous Mind, Haidt shows how our responses to political debate are almost pure intuition; quick-firing moral reflexes that our brains overlay with rationales after the fact.

The other vital insight involves what Haidt describes as six types of intuitions—or, as he calls them, moral foundations: care/harm, fairness/cheating, liberty/tyranny, loyalty/betrayal, authority/subversion, and sanctity/degradation. These combine to form the unconscious attitudes that animate each of us, to form our sense of morality.

This doesn’t tend to happen in a vacuum; different swaths of American society construct morality with radically different proportions of these. Urban liberal communities that thrive on commerce tend to respond strongly to only the first two of these, care/harm and fairness/cheating (and, to some extent, liberty/tyranny). Democratic voters, therefore, generally prioritize openness and tolerance and tend to be suspicious of authority. Conservative morality, which stems more from agrarian roots, typically engages all of the moral foundations, but with a heavy emphasis on the latter three of loyalty/betrayal, authority/subversion, and sanctity/degradation.

3. [Clinton] championed equality—protecting people’s “rights” got 12 specific mentions—pushing down hard on the “fairness” moral foundation.

4. Clinton also played to the other biggie of liberal morality, caring for the suffering, oppressed, and downtrodden.

5. [Clinton] showed a deference to authority in praising the military, the president and vice president, and police officers. (Convention speakers like Khizr Khan, the father of a slain Muslim US solider, bolstered this theme even more.)

6. Though pundits largely expected Trump to use the convention to broaden his appeal to voters, the event was instead a sweeping tableau of America’s descent into immorality. Each night was themed around Trump’s campaign slogan, “Make America great again” (subbing in “safe,” “work,” “first,” and “one” for “great”). Throughout the convention, Trump proxies railed against Clinton’s supposed betrayal of America in her handling of the Benghazi embassy attack, while the tragic deaths of people killed by unauthorized immigrants was cited to illustrate the mortal threats citizens now face. Another pet theme was how the undermining of police by subversive groups (the implication, usually, being Black Lives Matter activists) is letting crime and chaos flourish. Meanwhile, political correctness forbids reasonable people from criticizing the ethnic and religious groups who are killing Americans. Tolerance has made America unsafe, unpatriotic, and (obviously) un-great.

7. As many have observed, the facts backing up Trump’s narratives are pretty thin on the ground. However, to people whose sense of morality is grounded heavily in respect for authority and loyalty to a certain in-group, Trump’s diagnosis makes intuitive sense. Anyone baffled that Trump’s supporters ignore the spuriousness of his arguments are very likely people whose moral configurations don’t incline them to favor authority and loyalty much in the first place.

Gwynn goes on to speculate about strategies that might help Hillary Clinton by tapping into a wider range of moral intuitions.

As a Utilitarian, my own moral intuitions center around the care/harm axis. But whatever one’s own primary intuitions, anyone who wants to use persuasion to help make the world a better place needs to understand and appeal to the full range of moral intuitions. As I wrote in “Nationalists vs. Cosmopolitans: Social Scientists Need to Learn from Their Brexit Blunder,” it is clear that many people do not have this understanding. Reading The Righteous Mindis a good start. Then follow that up by reading George Lakoff’s Moral Politics, where George Lakoff argues that the leftwing has a “nurturant parent” morality while conservatives have a “strict father” morality. (If the phrase “strict father” sounds bad to you, you probably don’t lean toward a strict father morality.)

On the care/harm axis that is primary for me, with loyalty to all of humanity rather than only a subset of humanity, the welfare of immigrants seems to me a central concern. As I tweeted yesterday,

Preventing people from escaping poverty by preventing them from immigrating to the US is one of the cruelest things we do.

But in the interests of more open immigration, I have on various occasions also appealed to

- Fairness: “The Hunger Games” Is Hardly Our Future–It’s Already Here

- Authority: You Didn’t Build That: America Edition

- Anti-Tyranny: Benjamin Franklin’s Strategy to Make the US a Superpower Worked Once, Why Not Try It Again?

- Sanctity: Keep the Riffraff Out!

In any worthy cause–and if ever there were a worthy cause, this is one–it is important to make arguments that speak to all parts of the brain. We sell short the things we believe in if we do not try to make that kind of well-rounded argument for them.

Henry George on How the Civil War Led to High, Persistent Tariffs

“Nor could protection have reached its present height in the United States but for the civil war. While attention was concentrated on the struggle and mothers were sending their sons to the battle-field, the interests that sought protection took advantage of the patriotism that was ready for any sacrifice to secure protective taxes such as had never before been dreamed of—taxes which they have ever since managed to keep in force, and even in many cases to increase.”

Ben Bernanke: Negative Interest Rates are Better than a Higher Inflation Target

It is clear from Ben Bernanke’s September 13, 2016 blog post, that his answer to his title, “Does a higher inflation target beat negative interest rates?” is “No.” This is not a ringing endorsement of negative rates by Ben, but it is a recognition of the importance of negative rates as part of the monetary policy toolkit. And Ben is quite forthright in naming names of other central bankers he thinks have too negative a view of negative rates.

Ben links to my paper with Ruchir Agarwal, “Breaking Through the Zero Lower Bound” in this passage:

… it is not clear that an inflation target as high as 4 percent would be politically tenable and hence credible in the U.S. or other advanced economies, whereas arguably feasible institutional changes, some as simple as eliminating or restricting the issuance of large-denomination currency, could expand the scope for negative rates.

Ben also says this in a footnote:

[3] The Fed could also encourage banks (or provide incentives for them) to pass on the negative rates to market-sensitive investors rather than retail depositors, as described here by Miles Kimball, a negative-rates proponent. For more on Miles’ overall argument, see here.

Let me expand on that footnote. I have advocated arranging part of the multi-tier interest on reserves formula to kill two birds with one stone: not only support bank profits but also subsidize zero interest rates in small household accounts at the same time–the provision of which is an important part of the drag on bank profits as it is now. I think being able to tell the public that no one with a modest household account would face negative rates in their checking or saving account would help nip in the bud some of the political cost to central banks.

To avoid misunderstanding, it is worth spelling out a little more this idea of using a tiered interest on reserves formula to subsidize provision of zero interest in small household checking and savings accounts. To make it manageable, I would make the reporting by banks entirely voluntary. The banks need to get their customers to sign a form (maybe online) designating that bank as their primary bank and giving an ID number (like a social security number) to avoid double-dipping. In addition to shielding most people from negative rates in their checking and savings accounts, this policy also has the advantage of setting down a marker so that it is easier for banks to explain, say, that amounts above $1500 average monthly balance in an individual checking+saving accounts or a $3000 average monthly balance in joint couple checking+saving accounts would be subject to negative interest rates. That is, the policy is designed to avoid pass-through of negative rates to small household accounts but encourage pass-through to large household accounts, in a way that reduces the strain on bank profits.

Comparison to Ben’s March 2016 Post and a December 2015 Interview of Ben by Ezra Klein

Ben also had an earlier March 18, 2016 post about negative interest rates: “What tools does the Fed have left? Part 1: Negative interest rates.” Reading the two posts back to back, it is clear that Ben has warmed up to negative interest rates in the six months from March 2016 to September 2016. Nevertheless, even back in March, Ben leavened his skepticism about negative rates with these two passages:

1. The idea of negative interest rates strikes many people as odd. Economists are less put off by it, perhaps because they are used to dealing with “real” (or inflation-adjusted) interest rates, which are often negative. Since the real interest rate is the sticker-price (nominal) interest rate minus inflation, it’s negative whenever inflation exceeds the nominal rate. Figure 1 shows the real fed funds rate from 1954 to the present, with gray bars marking recessions.[3] As you can see, the real fed funds rate has been negative fairly often, including most of the period since 2009. (It reached a low of -3.8 percent in September 2011.) Many of these negative spells occurred during periods of recession; this is no accident, since during recessions the Fed typically lowers interest rates, both real and nominal, in an effort to spur recovery.

2. The anxiety about negative interest rates seen recently in the media and in markets seems to me to be overdone. Logically, when short-term rates have been cut to zero, modestly negative rates seem a natural continuation; there is no clear discontinuity in the economic and financial effects of, say, a 0.1 percent interest rate and a -0.1 percent rate. Moreover, a negative interest rate on bank reserves does not imply that the most economically relevant rates, like mortgage rates or corporate borrowing rates, would be negative; in the US, they almost certainly would not be.

It is also clear that Ben Bernanke has warmed up to my proposals specifically, if you compare what he wrote in his most recent September 13, 2016 blog post to what he said in part of a December 15, 2015 interview I transcribed in my post “Ezra Klein Interviews Ben Bernanke about Miles Kimball’s Proposal to Eliminate the Zero Lower Bound.”

Though Ben Bernanke is quite cautious about negative rates, I count him now as an ally in the effort to bring them fully into the monetary policy toolkit, with the actual use of negative interest rate tools remaining a very weighty decision.

Larry Summers: How to Pursue Greater Infrastructure Investment →

This is an excellent discussion of the issues.

David Beckworth—The Balance Sheet Recession That Never Happened: Australia

I am grateful for permission from David Beckworth to mirror his post as a guest post here. Here is what David wrote:

Probably the most common explanation for the Great Recession is the “balance-sheet” recession view. It says households took on took on too much debt during the boom years and were forced to deleverage once home prices began to tank. The resulting drop in aggregate spending from this deleveraging ushered in the Great Recession. The sharp contraction was therefore inevitable. But is this right? Readers of this blog know that I am skeptical of this view. I think it is incomplete and misses a deeper, more important story. Before getting into it, let’s visit a place that according to the balance sheet view of recessions should have had a recession in 2008 but did not.

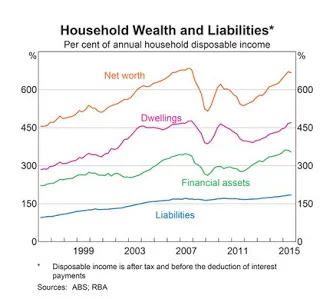

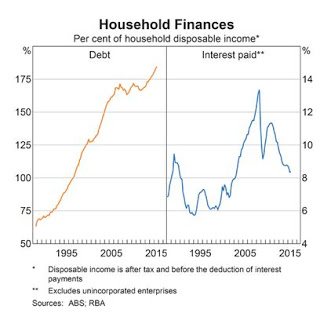

That place is Australia. It too had a housing boom and debt “bubble”. It too had a housing correction in 2008 that affected household balance sheets. This can be seen in the figures at the top of this post.

Despite the balance sheet pains of 2008, Australia never had a Great Recession. In fact, it sailed through this period as one the few countries to experience solid growth. And, as Scott Sumner notes, it was also buffeted by a collapse in commodity exports during this time. If any country should have experienced a sharp recession in 2008 it should have been Australia.

So why did Australia’s balance sheet recession never happen? The answer is that the Reserve Bank of Australia (RBA), unlike the Fed, got out in front of the 2008 crisis. It cut rates early and signaled an expansionary future path for monetary policy. It also helped that the policy rate in Australia was at 7.25 percent when it began to cut interest rates. This meant the central bank could do a lot of interest rate cutting before hitting the zero lower bound (ZLB). So between being more aggressive than the Fed and having more room to work, the RBA staved off the Great Recession.

This experience in Australia speaks to why the balance sheet recession view miss the deeper, more important problem behind depressions: the ZLB. Unlike the RBA, the Fed was slow to act in 2008 and that allowed the market-clearing or “natural” interest rate to fall below the ZLB. Had the Fed acted sooner or had it been able to keep up with the decline in the natural interest rate once it passed the ZLB, the Great Recession may not have been so great (See Peter Ireland’s paper for more on this point).

Here is how I made this point in my review of Atif Mian and Amir Sufi’s book, House of Debt, in the National Review:

Why should the decline in debtors’ spending necessarily cause a recession?

Recall that for every debtor there is a creditor. That is, for every debtor who is cutting back on spending to pay down his debt, there is a creditor receiving more funds. The creditors could in principle provide an increase in spending to offset the decrease in debtors’ spending. But in the recent crisis, they did not. Instead, households and non-financial firms that were creditors increased their holdings of safe, liquid assets. This increased the demand for money. This problem was exacerbated by the actions of banks and other financial firms. When a debtor paid down a loan owed to a bank, both loans and deposits fell. Since there were fewer new loans being made during this time, there was a net decline in deposits [and thus] in the money supply. This decline can be seen in broad money measures such as the Divisia M4 measure. These developments—increase in money demand and a decrease in money supply—imply that an excess money-demand problem was at work during the crisis.

The problem, then, is as much about the excess demand for money by creditors as it is about the deleveraging of debtors. Why did creditors increase their money holdings rather than provide more spending to offset the debtors? …Mian and Sufi do briefly bring up a potential answer: the zero percent lower bound (ZLB) on nominal interest rates.

The ZLB is a floor beneath which interest rates cannot go. This is because creditors would rather hold money at zero percent than lend it out at a negative interest rate. This creates a big problem, because market clearing depends on interest rates’ adjusting to reflect changes in the economy. In a depressed economy, firms sitting on cash would start investing their funds in tools, machines, and factories if interest rates fell low enough to make the expected return on such investments exceed the expected return to holding money. Even if the weak economy means the expected return to holding capital is low, falling interest rates at some point would still make it more profitable to invest in capital than to hold money. Similarly, households holding large amounts of money assets would start spending more if the return on holding money fell low enough to make household spending worthwhile. This is a natural market-healing process that occurs all the time. It breaks down when there is an increase in precautionary saving and a decrease in credit demand large enough to push interest rates to zero percent. If interest rates need to adjust below zero percent to spur creditors into providing the offsetting spending, this process will be thwarted by the ZLB.

It is the ZLB problem, then, rather than the debt deleveraging, that is the deeper reason for the Great Recession.

Australia never hit the ZLB. That is why it avoided the Great Recession. If we want to avoid future Great Recessions we need to find better ways to avoid or work around the ZLB.

John Stuart Mill’s Defense of Freedom

I have finished blogging my way through John Stuart Mill’s On Liberty. I circled around to blog my way through the “Introductory” chapter last:

Chapter I: John Stuart Mill’s Introduction to a Defense of Freedom

- John Stuart Mill on the Historical Origins of Liberty

- Do Democratic Governments Express the Will of the People?

- Democratic Injustice

- Social Liberty

- John Stuart Mill on the Sources of Prejudice About What Other People Should Do

- Religious Freedom as the Proving Ground for the Principles of Liberty

- Beyond Pro-Government and Anti-Government

- The Complexity of Liberty: How Equality Enters into a Good Definition of Liberty

- John Stuart Mill on Benevolent Dictators

- John Stuart Mill on Sins of Omission

- John Stuart Mill’s Roadmap for Freedom

- Democracy is Not Freedom

- John Stuart Mill on Running Other People’s Lives

- John Stuart Mill–The Great Temptation: Telling Others What to Do

- John Stuart Mill on the Need to Make the Argument for Freedom of Speech

These posts collect links for blog posts based on paragraphs in the other chapters:

Chapter II: John Stuart Mill’s Brief for Freedom of Speech

Chapter III: John Stuart Mill’s Brief for Individuality

Chapter IV: John Stuart Mill’s Brief for the Limits of the Authority of Society over the Individual

Chapter V: John Stuart Mill Applies the Principles of Liberty

I also have a few miscellaneous posts from when I first started writing posts inspired by On Liberty: