Despite Constant Debate, Americans' Abortion Opinions Rarely Change →

The fact in the article linked above is an important one. I explain some of what I think is the reason behind the constancy over time in attitudes on abortion–as contrasted to attitudes toward gay marriage, which have changed rapidly–in my post “Safe, Legal, Rare and Early.”

Responding to Joseph Stiglitz on Negative Interest Rates

Link to the Wikipedia article for Joseph Stiglitz

I thought twice before I tweeted on Monday “Joe Stiglitz is making a fool of himself with his arguments against negative rates” in reaction to his April 13, 2016 Project Syndicate piece “What’s Wrong With Negative Rates?” wondering if I was being too hard on him. But then I thought to myself “I have no problem saying that I make a fool of myself with some regularity.” In particular, I often make of a fool of myself by venturing an opinion in order to see if someone can help me learn if I am wrong, and if so, why. I hope that Joe Stiglitz made a fool of himself in exactly that spirit–in which case I honor him for that.

What Joe says is complex, so it is best to proceed point by point, even if that occasions some repetition. And it helps in separating the wheat from the chaff; Joe says some things that are correct, even though his bottom line is off target–in particular his final paragraph:

Of course, even in the best of circumstances, monetary policy’s ability to restore a slumping economy to full employment may be limited. But relying on the wrong model prevents central bankers from contributing what they can – and may even make a bad situation worse.

This final paragraph is quite wrong:

- After eliminating the zero lower bound by freeing up the paper currency interest rate from its traditional value of zero, monetary policy alone has more than enough power to return an economy to the natural level of output.

- The insights from standard models should not be dismissed so quickly.

- To the extent that central bankers are making a mistake, it is not by going to negative interest rates, but by keeping the paper currency interest rate at zero, with all the attendant strains that causes.

In what follows, all block quotes that follow will be Joe Stiglitz’s words.

1. An Aggregate Demand Problem

The underlying problem – which has plagued the global economy since the crisis, but has worsened slightly – is lack of global aggregate demand.

Correct. Lack of aggregate demand is hardly the only problem of the world economy (a slower rate of technological progress than from 1995-2003 may be a bigger problem), but it is a big and pressing problem.

2. The Zero Lower Bound

Now, in response, the European Central Bank (ECB) has stepped up its stimulus, joining the Bank of Japan and a couple of other central banks in showing that the “zero lower bound” – the inability of interest rates to become negative – is a boundary only in the imagination of conventional economists.

Although the lower bound may not be at zero, a lot of the stresses and strains that are being felt from negative interest rate policy have to do with the fact that the paper currency interest rate has not yet been cut below zero to match target rates and interest rates on reserves. If the paper currency interest rates gets too far above the interest rate on reserves and the target rate, it is hard for banks to make a living on spreads in the way they are used to. In particular, it is hard for banks to lower the interest rates on checking accounts and saving accounts very far below zero without having small-scale depositors significantly raise their paper currency holdings and reduce the funds they hold in checking and savings accounts. The solution is simple: lower the paper currency interest rate, as I discuss in “If a Central Bank Cuts All of Its Interest Rates, Including the Paper Currency Interest Rate, Negative Interest Rates are a Much Fiercer Animal” and lay out in detail in two academic papers and many columns and blog posts I have collected links for in “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.”

The so-called “zero lower bound,” should be thought of as a more complex danger of massive paper currency storage and of disintermediation away from the banking system into paper currency that begins to occur when the paper currency interest rate is kept too far above the target rate and the interest rate on reserves. This danger may or may not be well described by the phrase “the zero lower bound,” but it is not a myth. Much of what Joe says in his essay is pointing out that the danger of disintermediation is not a myth. Hence the importance of lowering the paper currency interest rate along with the target rate and the interest rate on reserves.

3. Why Negative Rates Have Not Brought Full Recovery

Joe writes

And yet, in none of the economies attempting the unorthodox experiment of negative interest rates has there been a return to growth and full employment.

He has a sentence that should have followed immediately, but is several paragraphs further down:

Clearly, the idea that large corporations precisely calculate the interest rate at which they are willing to undertake investment – and that they would be willing to undertake a large number of projects if only interest rates were lowered by another 25 basis points – is absurd.

In other words, the 30 basis point cut in interest rates that the European Central Bank has made is a tiny dosage of negative rates. The effectiveness of negative interest rates has to be judged per basis point. When unhindered by a perceived zero lower bound, it is normal for a central bank in a recessionary situation to cut interest rates by 600 to 700 basis points (that is 6 or 7 percentage points). That is the kind of dosage that can be expected to get results. And go the extent that risk premia rose more during the Financial Crisis than during a normal recession, safe rates need to go enough lower to compensate for those higher risk premia.

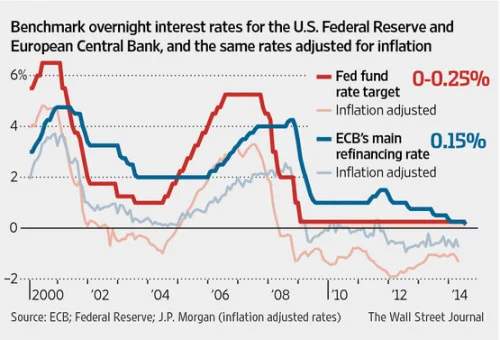

As can be seen from the graph above, the European Central Bank’s target rate was at about 4% in nominal terms at the onset of the Financial crisis. A 7 percentage point point cut would have taken the rate to -3%, which would have done a fairly good job. But a bit lower was probably appropriate given elevated risk premia. -4% in 2009 would have been an excellent policy, well within historical norms for an interest rate cut in a serious recession if one treats interest rates in the negative region on a par with interest rates in the positive region–as makes sense if one is taking the paper currency interest rate down along with other rates, so that spread between the paper currency interest rate and the target rate as small. Thinking of the norm as a 6 percentage point cut but the elevation of risk premia in this episode as 2% would have lead to the same recommendation of a -4% interest rate in 2009. But of course, after going to -4%, the European Central Bank should then have paid attention to the data about whether that was enough or not, and gone down further if need be, less if -4% was too stimulative.

Note that even without the adjustment for elevated risk premia, the rule of thumb of a 6 percentage point cut to deal with recessions leads to a real interest rate below -2% during the trough if the real interest rate starts out below 4%. For a variety of reasons detailed in Lukasz Rachel and Thomas Smith’s excellent Bank of England blog post “Drivers of long-term global interest rates – can changes in desired savings and investment explain the fall?” the real medium-run natural rate of interest has been falling over the past few decades. So a 6 percentage point cut in interest rates in a recession needs to go down to lower real interest rate than before. For example, it is not at all unreasonable to think that the real medium-run natural rate of interest rate is hovering around .5%, which means that a real interest rate of -5.5% in the trough is appropriate medicine to bring economic recovery.

Joe says correctly that -2% real interest rates haven’t done the trick:

In many economies – including Europe and the United States – real (inflation-adjusted) interest rates have been negative, sometimes as much as -2%. And yet, as real interest rates have fallen, business investment has stagnated.

Joe is also likely correct that a real interest rate of -3.5% or -4% would not be enough:

A decrease in the real interest rate – that on government bonds – to -3% or even -4% will make little or no difference.

But it is quite wrong to think that if nominal interest rate of -2%, which makes for a real interest rate of -4% at 2% inflation won’t do the trick that one should give up on negative interest rates. If one lowers the paper currency interest rate along with other rates, it is quite possible to have nominal interest rates at -4%, -5%, -6% or even -7% or lower if necessary. And that is the range standard rules of thumb suggest would be necessary–with the lower numbers in that range only necessary if there are unusual problems with the economy–which there might be.

In “Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates” I wrote: “If starting from current conditions, any country can maintain interest rates at -7% or lower for two years without overheating its economy, then I am wrong about the power of negative interest rates.” Despite all the uncertainties about what is going on with key economies in the world, I stand by that statement–with the exception of a non-market economy such as North Korea where there is no true market interest rate.

4. Will Negative Rates Make Lending Rates Increase?

Joe writes:

In some cases, the outcome has been unexpected: Some lending rates have actually increased.

The reason for raising lending rates in the wake of negative rates on reserves is presumably to increase profits for a bank that has had profits reduced by the negative interest rate on reserves. But the interest a bank earns on its lending to firms and households is enough separate from what it earns on what it lends to the central bank as reserves that if the bank can increase profits by raising its lending rates, it could probably have done that all along. The connection with negative deposit rates would then be that banks might hope governmental authorities will take pity on them, or be concerned enough about their balance sheets because of the negative rates they are paying on reserves that the governmental authorities give the banks less of a hard time about oligopolistically raising lending rates in the negative rate situation than they normally would. But this then boils down to a governmental concern about bank profits and bank balance sheets, which can be addressed in more direct and more productive ways than by allowing banks to exert more oligopoly power.

5. How to Deal with Worries about the Effects of Negative Interest Rates on Bank Balance Sheets

Joe exhibits concern about the effects of negative rates on bank balance sheets in this passage:

Negative interest rates hurt banks’ balance sheets, with the “wealth effect” on banks overwhelming the small increase in incentives to lend. Unless policymakers are careful, lending rates could increase and credit availability decline.

Since banks live on spreads, the most basic way to avoid hurting bank profits and therefore bank balance sheets is to keep spreads normal. Quantitative easing tends to squeeze key spreads and so departs from that approach. And leaving the paper currency interest rate at zero while cutting the target rate and the interest rate on reserves also departs from that approach. The way to keep things as normal as possible for banks is to lower all government-controlled interest rates in tandem. In its latest move, the European Central Bank at least lowered its lending rates along with the interest rates on reserves. That was intended to be helpful to bank profits, and it is hard to doubt that it is.

Even if the paper currency interest rate is negative, banks may have trouble explaining to small-scale, unsophisticated depositors why they need to have a negative interest rate on deposits. If banks therefore continue to give zero rates to small-scale, unsophisticated depositors, this is likely to hurt profits in a negative interest rate environment. But for the political acceptability of negative rates, it is in the interest of most central banks to support banks in continuing to give zero interest rates to small-scale, unsophisticated depositors. In “How to Handle Worries about the Effect of Negative Interest Rates on Bank Profits with Two-Tiered Interest-on-Reserves Policies,” I propose that central banks use tiers in the interest on reserves formula to effectively subsidize and incentivize banks in providing a zero interest rate to the first 1000 euros or so of average monthly balances per adult. (I discuss there how some kind of depositor identification is needed in order to avoid double-dipping.) At some cost to the seignorage that a central bank would otherwise gain from negative rates, this helps banks and shields most people (though only a small fraction of funds) from negative deposit rates.

Of course, if banks were adequately capitalized to begin with, or otherwise have robust profits (perhaps because of very strong oligopoly power, as in Sweden), there may be no need to throw money to banks to help their balance sheets, which reduces but does not eliminate the benefits of subsidizing the provision of zero interest rates to small accounts.

6. Can Negative Interest Rates Stimulate the Economy When Banks are Broken?

Joe has a passage talking generally about failed models that is a bit hard to interpret, but I think it has to do with his view that banks are central to understanding how the macroeconomy works.

It should have been apparent that most central banks’ pre-crisis models – both the formal models and the mental models that guide policymakers’ thinking – were badly wrong. None predicted the crisis; and in very few of these economies has a semblance of full employment been restored. The ECB famously raised interest rates twice in 2011, just as the euro crisis was worsening and unemployment was increasing to double-digit levels, bringing deflation ever closer.

They continued to use the old discredited models, perhaps slightly modified. In these models, the interest rate is the key policy tool, to be dialed up and down to ensure good economic performance. If a positive interest rate doesn’t suffice, then a negative interest rate should do the trick.

The evidence for that interpretation comes in this subsequent passage:

It may come as a shock to non-economists, but banks play no role in the standard economic model that monetary policymakers have used for the last couple of decades. Of course, if there were no banks, there would be no central banks, either; but cognitive dissonance has seldom shaken central bankers’ confidence in their models.

I discussed above how to address concerns about bank balance sheets. I also discussed how to deal with increased risk premia: cut the safe rate enough further to compensate for the higher risk premia–that is, to lean towards–in effect–targeting the risky rates that firms and households borrow at rather than the safe rates that a government with reasonable finances can borrow at. This works well even if the negative rates themselves have some effect on the relevant risk premia, since risk premia will not be infinite. (And indeed, the models of credit rationing to which Joe contributed with his academic work say that while a higher loan interest rate may not result in more lending because it can be associated with lower loan quality, a low enough cost of funds for the bank will reduce the amount of rationing.)

In “On the Need for Large Movements in Interest Rates to Stabilize the Economy with Monetary Policy,” I argue:

Businesses and banks sitting on idle piles of liquid assets is a telltale symptom of the zero lower bound. Breaking through the zero lower bound restores the functioning of banks. Given negative interest rates those piles of liquid assets (after perhaps earning an initial capital gain), face a low rate of return going forward if they are left in that form. So the banks have to do something. They might simply get involved in financing storage, perhaps through a wholly-owned subsidiary if they didn’t trust anyone else with those funds. And as noted above, storage of long-lived goods alone can bring recovery. But chances are the banks would begin thinking about making loans for regular forms of investment. And the subset of businesses that have their own piles of liquid assets would also begin thinking about using their own money to invest.

That is, banks look broken when their cost of funds has not been reduced enough to make the cost of funds plus an appropriate risk premium lower than the rates at which there is loan demand.

Also, while banks are important, they are far from the whole story. Note for example that when firms are sitting on large piles of safe assets, as many have been during the Great Depression, they can invest without a bank being involved at all. They don’t because the risk-adjusted return on projects looks lower to them than the zero or slightly below zero nominal rate they can earn on safe assets. Does Joe Stiglitz really believe that there is a shortage of projects that would look good compared to a safe return of -7% in nominal terms–or -9% in real terms at 2% inflation? In all likelihood there are many projects with a much better return than that, so that going as low as -7% rates would be unnecessary to get strong economic recovery.

In “Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates,” I put the importance of banks in perspective by pointing out that every type of borrower/lender relationship in which the market interest rate declines creates extra stimulus. Banks are parties to many borrower/lender relationships, but far from all. I recommend the detailed treatment in “Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates” to those who still think it is all about banks.

I don’t mean to say banks aren’t important. They are. They just aren’t the whole story. And low enough interest rates can stimulate the economy even if the channels involving banks in their canonical role as lenders to small businesses is obstructed. As I wrote in “On the Need for Large Movements in Interest Rates to Stabilize the Economy with Monetary Policy”: “At the end of the day, low enough interest rates will bring recovery one way or another. If risk premia remained high enough, recovery could come through unusual channels, but it would come.”

7. Wealth Effects

I discussed how to deal with wealth effects on banks themselves above. Joe mentions wealth effects in one other context, writing:

… older people who depend on interest income, hurt further, cut their consumption more deeply than those who benefit – rich owners of equity – increase theirs, undermining aggregate demand today.

My post “Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates” enunciates a key principle about wealth effects: because there are two parties to every borrower-lender relationship, what is a negative wealth effect to one party is a positive wealth effect to the other. And on the whole, borrowers–who tend to get a wealth effect boost from lower rates–are better spenders than lenders. So if all the wealth effects are accounted for rather than cherry-picking a wealth effect here or there, they will be in the direction of greater stimulus from lower rates. Here is the overall story about transmission mechanisms for lower rates, in the negative region as well as the positive region: In any nook or cranny of the economy where interest rates fall, whether in the positive or negative region, those lower interest rates create more aggregate demand by a substitution effect on both the borrower and lender, while other than any expansion of the economy overall, wealth effects that can be large for individual economic actors largely cancel out in the aggregate.

Regardless of how cherry-picked, it is interesting to think whether the borrow-lender relationship of senior citizens lending to big firms and their owners is an exception to the general rule that borrowers tend to be better at spending than lenders–that is that borrowers generally tend to have a higher marginal propensity to consume. It depends on whether the operating arms of the firm pay attention to lower interest rates by lowering the hurdle rate for projects. It is an important question whether firms adjust hurdle rates for investment projects when market interest rates fall, or if only the Chief Financial Officer pays attention to lower market rates (for the sake of purely financial transactions to raise the value of the firm even if the physical things the firm does are held constant).

But to address the cherry-picking, think of senior citizens who lend instead to the federal government. Lower interest rates reduce the deficit and tend to lead to more government spending fairly directly by deficit reduction rules biting less. Even though senior citizens have a high marginal propensity to consume, I think the effects of deficit numbers on government behavior make the effective marginal propensity to consume of the federal government out of a change in interest expense even higher. Those who like the idea of fiscal stimulus should be happy about this stimulus from negative interest rates–especially since the negative wealth effect is only for the relatively well-off senior citizens who are not just living on social security, but have interest income to live on on top of that.

Also, to point out another aspect of the cherry-picking (even keeping the picked cherry of “senior citizens”), think of senior citizens who are lending to companies, but hold relatively long-term bonds. If many of the bonds have roughly the same maturity as the remaining life-span of a senior citizen, the wealth effects are much reduced since the coupons are locked in. It is senior citizens who have short-term holdings that a good financial planner would warn them against who have trouble with the wealth effects from lower interest rates.

Finally, I question the idea that those near the end of their lives would have such a high consumption response to interest rates, even if they were constrained to hold only T-bills. The reason is that as the end of life approaches, the principal of the debt instruments one holds matters more and more relative to the interest. The last time I refinanced, I got a 10-year mortgage. With that short a mortgage, the need to pay off principal in such a short time means that the monthly payment was not that sensitive to the interest rate. Similarly, with, say, only 10 years left to live, the amount one can afford to take from one’s savings to spend is not that sensitive to the interest rate. One might say that uncertainty makes people act as if they had longer to live than they actually do, but that would have a big effect in reducing the marginal propensity to consume out of wealth that would tend to counterbalance any increased wealth-equivalent impact of a change in interest rates.

8. Reaching for Yield

Joe worries about the effects of lower interest rates on financial stability:

the perhaps irrational but widely documented search for yield implies that many investors will shift their portfolios toward riskier assets, exposing the economy to greater financial instability.

I owe all my readers a post with the diagram I gave my students on this, but here is its idea: lower rates boost aggregate demand a lot, reduce financial stability only a little; higher equity (capital) requirements boost financial stability a lot, reduce aggregate demand only a little. Combine the two policies: lower rates and higher equity requirements, and you get an increase in both aggregate demand and financial stability–exactly what is needed. Scale that policy up, and you can get as big an increase in both aggregate demand and a quite large increase in financial stability at the same time. These are two great policies that go well together.

Update: the May 10, 2016 post “Why Financial Stability Concerns Are Not a Reason to Shy Away from a Robust Negative Interest Rate Policy” is the promised post.

9. The Capital/Labor Ratio

Joe makes this interesting argument:

…low interest rates encourage firms to invest in more capital-intensive technologies, resulting in demand for labor falling in the longer term, even as unemployment declines in the short term.

The most basic response is that if monetary policy does its job–getting output back to the natural level–it has no further effect on long-run issues such as this. Indeed, monetary policy has no effect on the medium-run natural interest rate. So if low interest rates in the medium- to long-run are a problem, they are not the province of monetary policy. (Update: See “Mario Draghi Reminds Everyone that Central Banks Do Not Determine the Medium-Run Natural Interest Rate.”)

In this area that is not the province of monetary policy, I think there is more reason to worry about people’s ability to save for retirement in a lower interest rate environment than labor demand in a low interest rate environment. In standard models in which capital and labor are homothetic with only one type of labor, for a given technology, a higher capital/labor ratio raises medium-run labor demand. To the extent that different production methods can be thought of as all part of the same technology, the ability to switch between production methods reduces this positive effect of the capital/labor ratio on labor demand, but does not eliminate it. What is true is that in models with more than one type of labor, capital might raise the demand for some types of labor and reduce the demand for other types. It may be that the types of labor for which demand increases are much better paid than the types of labor for which demand decreases, and that the number of workers demanded goes down as demand shifts toward a few high-quality workers instead of many lower-quality workers. But the amount of this that happens as a result of interest rates is probably small compared to the amount that happens as a result of technological progress and from globalization. And to repeat, monetary policy cannot do much to either bring on or stop such trends since monetary policy has no effect on interest rates once it has done its job of getting the economy back to the natural level of output.

All of that is in the medium- to long-run. You might say “What about the short-run?” Well, the short run is the province of monetary policy, and negative interest rates are–in cases that look increasingly important–a way to get enough aggregate demand to keep labor demand at a level appropriate to any medium- to long-run situation, so that the short run is not messed up.

Note: Those interested in the share of capital income might be interested in “The Wrong Side of Cobb-Douglas: Matt Rognlie’s Smackdown of Thomas Piketty Gains Traction.”

As noted above, my bibliographic post “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide” organizes links to everything I have written about negative interest rate policy.

The Central Bank is Not Just Navigating through a Fog; It is Steering with a Delay

“The central bank is not just navigating through a fog; it is steering with a delay. The Fed reckons it takes 18 months for changes in rates to have their full impact.”

Frank Stafford on a Transmission Mechanism for Australian Monetary Policy

image source

I wish I new a lot more about different approaches to public policy in other countries. In “Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates” I wrote about the importance of the correlation between wealth effects and the marginal propensity to consume of different groups as an important part of the monetary policy transmission mechanism. My colleague Frank Stafford told me an interesting example, writing:

I have been involved with a group in Melbourne that studies the Australian housing market.

On my recent trip I just pieced together an unusual aspect of monetary policy there.

Most Australians own their own home and almost all the mortgages are ARMs.

When the Reserve Bank lowers or raises the ‘cash rate’, there is a prompt reset to the ARM mortgages, with monthly payments falling or rising, accordingly. If the cash flow burden is too difficult they take money from the home’s equity.

No doubt about the 'channel of policy’ but a rather unusual type of 'tax cut’ or 'tax increase’ on a subset of the population.

Religious Freedom as the Proving Ground for the Principles of Liberty

The principles of liberty come to the fore most strongly when one groups detests behavior that is central to the identity of another group. In my column “The Case for Gay Marriage is Made in the Freedom of Religion” I argued for the extension of our experience in guaranteeing freedom of religion to guaranteeing people the freedom to live their lives in relation to other dimensions of their belief as well:

Freedom of religion is a hard-won principle. In Europe, the wars of religion raged for over a century before the Peace of Westphalia solidified freedom of religion for rulers in 1648. Freedom of religion for ordinary citizens was much slower in coming: the Bill of Rights to the US Constitution was a huge advance in that sphere….

The reason so much blood was shed before the principle of religious freedom was established is that it’s not a principle that comes naturally to the human mind. If a behavior or belief deeply offends God or the gods, then it doesn’t seem right to tolerate it. And if a behavior or belief will bring eternal damnation down on the heads of those involved (and those they might influence), then doesn’t the solicitous kindness of tough love demand doing whatever it takes to pull them away from that behavior or belief?

… gay marriage is itself an exercise of religious freedom. As many with good marriages know from experience, marriage is one of the most powerful paths toward spiritual growth. A good spouse helps one to see the aspects of oneself that one is too blind to see, and inspires efforts to be a better person. And when two human beings know each other so well, and interact so thickly, the family they create is something new and wonderful in the world, even when there are no children in the picture. And for those who do choose to have children, but cannot bear their own biologically, adoption is a tried and true path.To those who would dispute that the freedom to marry the one person you love above all others is a matter of religious freedom, let me argue that if I am wrong that this is a matter of religious freedom, it is a freedom that should be treated in the same way. In his influential book A Theory of Justice (p. 220), John Rawls made this argument:

“This idea that arose historically with religious toleration can be extended to other instances. Thus we can suppose that the persons in the original position know that they have moral convictions although, as the veil of ignorance requires, they do not know what these convictions are. … the principles of justice can adjudicate between opposing moralities just as they regulate the claims of rival religions.”

Rawls’s point is that when something touches on a fundamental liberty—as the choice of whom to marry certainly does—people gain so much from that freedom they would not sell that freedom for anything. Imagine a time before you knew whether you would be gay or not—for many a time within actual childhood memory. Would you trade away the right to marry whom you choose for the right to prevent others from marrying whom they choose? No! Almost none of us would.

Religious liberty itself involves tricky issues. In particular, I know from my own experience as a believing Mormon during my first 40 years that for believers, religious leaders can easily have a sway over one’s thoughts and feelings that can make it hard to think straight. Freedom of religion can often mean the freedom of parents and other adults to bend children’s minds to a particular religious belief, and the freedom of religious leaders to bend the minds of adult believers. This means that children’s interests can be sacrificed to religious interests. But the alternative of putting the state in charge of children’s religious upbringing–even in a way that seems relatively neutral to those proposing it–is also problematic.

Just as there is a value to genetic diversity, there is a value to religious diversity. But some of religions key aspects are collective. So is it OK to have groups of people who are very different from other groups, but that strictly suppress individual differences within the group, as long as this strict suppression is done in a nonviolent way?

Historically, the settlement we have made for religious freedom and for other core liberties is motivated by what it took to end the wars of religion. Since groups can make war much more effectively than individuals, our notions of religious freedom give substantial deference to religious freedom at the group level–including the freedom to bend the minds of children and others in a religious group’s orbit–not just individual religious freedom. This is not a perfect settlement, but religious war was worse.

In the US, we are lucky to have a relatively stable tradition of religious liberty and Supreme Court to parse many of the trickiest issues in a way that is respected enough that whatever the decision is, does not seem to lead to much outright violence–with the single major exception of violence against abortion clinics. (On abortion, see my post “Safe, Legal, Rare and Early.”)

In the world at large, many many countries are grappling with the most basic issues of religious liberty, including having to grapple with what it takes to douse the flames of outright religious war.

So for two reasons, it is well worth reading what John Stuart Mill has to say about religious freedom in the 7th paragraph of the “Introductory” to On Liberty: religious freedom in the narrowest sense is still a struggle to be won in many places in the world, and the idea of religious freedom helps clarify the principles of liberty in general.

The likings and dislikings of society, or of some powerful portion of it, are thus the main thing which has practically determined the rules laid down for general observance, under the penalties of law or opinion. And in general, those who have been in advance of society in thought and feeling, have left this condition of things unassailed in principle, however they may have come into conflict with it in some of its details. They have occupied themselves rather in inquiring what things society ought to like or dislike, than in questioning whether its likings or dislikings should be a law to individuals. They preferred endeavouring to alter the feelings of mankind on the particular points on which they were themselves heretical, rather than make common cause in defence of freedom, with heretics generally. The only case in which the higher ground has been taken on principle and maintained with consistency, by any but an individual here and there, is that of religious belief: a case instructive in many ways, and not least so as forming a most striking instance of the fallibility of what is called the moral sense: for the odium theologicum, in a sincere bigot, is one of the most unequivocal cases of moral feeling. Those who first broke the yoke of what called itself the Universal Church, were in general as little willing to permit difference of religious opinion as that church itself. But when the heat of the conflict was over, without giving a complete victory to any party, and each church or sect was reduced to limit its hopes to retaining possession of the ground it already occupied; minorities, seeing that they had no chance of becoming majorities, were under the necessity of pleading to those whom they could not convert, for permission to differ. It is accordingly on this battle field, almost solely, that the rights of the individual against society have been asserted on broad grounds of principle, and the claim of society to exercise authority over dissentients, openly controverted. The great writers to whom the world owes what religious liberty it possesses, have mostly asserted freedom of conscience as an indefeasible right, and denied absolutely that a human being is accountable to others for his religious belief. Yet so natural to mankind is intolerance in whatever they really care about, that religious freedom has hardly anywhere been practically realized, except where religious indifference, which dislikes to have its peace disturbed by theological quarrels, has added its weight to the scale. In the minds of almost all religious persons, even in the most tolerant countries, the duty of toleration is admitted with tacit reserves. One person will bear with dissent in matters of church government, but not of dogma; another can tolerate everybody, short of a Papist or an Unitarian; another, every one who believes in revealed religion; a few extend their charity a little further, but stop at the belief in a God and in a future state. Wherever the sentiment of the majority is still genuine and intense, it is found to have abated little of its claim to be obeyed.

Negative Interest on Deposits at the National Bank of Hungary; Randy Kroszner on Negative Rates

Ever since the Bank of Japan went to negative rates, it has been hard to keep up with all of the negative interest rate news. I only learned yesterday that on March 22, 2016, the National Bank of Hungary has a -.05% rate for deposits with the central bank. That and other rumblings I have heard from Eastern Europe making me think that Eastern Europe is a priority for my travels to talk to central banks about negative interest rate policy. I hope to put together a European tour in Fall 2016, as well as an East Asian tour.

I also learned yesterday about former Federal Reserve Board Governor Randy Kroszner’s comments about negative interest rate policy. Kalyeena Markortoff reports in a March 21, 2016 article on cnbc.com:

Kroszner said that it would take a “significant negative shock that led to a threat of significant deflation” for the Fed to consider negative rates — a policy tool which has already been deployed by the likes of Japan, Switzerland, and the European Central Bank (ECB).

“I don’t see that as a likely outcome, but I never say never after what I experienced in 2006 to 2009,” Kroszner said.

“I don’t think any of us sitting around the table back at the end of 2008 thought that we’d be in 2015, 2016 (and) that we’d be debating the first (interest rate) increase and then whether we could move beyond that,” he added.

Sarah Sloat: What is Cognitive Economics? Understanding the World Through New Types of Data

I had an interesting discussion with Sarah Sloat a week or two ago about Cognitive Economics, reflected in the article “What is Cognitive Economics? Understanding the World Through New Types of Data” on inverse.com. This is quite an interesting article, but several things became garbled. Let me try to clarify and emphasize a few things:

A. Explaining Nonstandard Behavior

In the passage beginning

Historically, the first thing that a behavioral economist did was try to document the things people do when their actions look strange from the standpoint of standard economic theory

what I said was that Behavioral Economics has taken as its first task to identify behavior that seems at variance with standard economic theory. Once such behavior is identified I think it makes sense to seek explanations in the following order:

- Some deeper explanation using standard economics that was not immediately apparent.

- An explanation based on cognitive limitations or cognitive confusion.

- An explanation based on exotic preferences. By “exotic” I mean something like loss aversion or hyperbolic discounting. I don’t count altruism or caring about a wide variety of aspects of well-being (such as happiness, sense of purpose, power, etc.) as exotic preferences.

In the history of thought, many of the early influential behavioral economists reversed the order of 2 and 3.

B. The Goal of Economics

In the passage beginning

Like any scientific discipline, one of the jobs of economics is to understand how the world works

what I said was that beyond the scientific goal of understanding how the world works, economists in their role as policy advisors, have taken on the task of trying to smooth the way for people to get more of what they want.

C. Imperfect Information vs. Imperfect Information Processing

Sarah reports me as saying

That’s certainly an element. If people don’t know something — what economists call imperfect information — we now have models that are very good with dealing with that imperfect information processing.

I actually said the opposite. We now have very good models for dealing imperfect information, but our tools for dealing with imperfect information processing are still quite rudimentary–primarily because of the infinite regress problem I discuss in my paper “Cognitive Economics.” 50 years ago, economists didn’t realize how much easier it would end up being to model imperfect information than it is to model imperfect information processing. And some of the ways we do have for modeling imperfect information processing model it in a way that, from a formal mathematical point of view treats a problem of imperfect information processing quite imperfectly as if it were a problem of imperfect information. I am thinking for example of the approach of Greg Mankiw and Ricardo Reis, in which what I would describe as a failure of information processing–not going to the effort of using readily available information–is described mathematically as if it were a failure of information availability–not having the information.

D. Research with Dan Benjamin and Ori Heffetz

Where the article mentions Dan Benjamin, my coauthor Ori Heffetz should be mentioned in the same breath. Much of our joint research is described in posts in my Happiness sub-blog. I have many other cognitive economics coauthors as well–enough that I won’t try to list them all here.

E. How Cognitive Economics Can Help Save the World

There are two different directions in which I think Cognitive Economics can help to make the world a better place. The first is in helping people deal with their cognitive limitations and in taking account of people’s cognitive limitations in designing public policy–such as in the work of the Consumer Financial Protection Bureau. The second is in using subjective well-being data–data on how people feel and how they think they are doing in various aspects of their lives–to help identify previously unsuspected ways to make people’s lives better. Because a big part of politics is energizing voters to give money and to vote, politics often sets out a very narrow agenda of controversial policies. I have the hope that using subjective well-being data to zero in on what people want will be able to shine a light on changes almost everyone can agree on.

Q&A: Evidence that Financial Flows Determine the Overall Balance of Trade, Not Tariffs?

I am grateful to Greg Mankiw and Doug Irwin for permission to share this email exchange with you on the impotence of tariffs to affect the balance of trade.

Miles to Greg Mankiw:

Dear Greg,

I have always really liked your model of international finance in your Principles and your Intermediate books. You may not know this, but I wrote a blog post to try to explain it,I have always really liked the the model of international finance in your Principles and Intermediate books. I wrote a blog post, “International Finance: A Primer,” to try to explain it. I use those principles all the time in blog posts as well as in class.

My undergraduate student, August Klatt (copied above) asked this excellent question: “Is there any empirical evidence to back up the prediction that a change in tariffs has no effect on net exports under flexible exchange rates (other things being equal)?”

Greg to Miles:

Thanks, Miles, for your note and kind words.

I do not know of a relevant study to cite off the top of my head. But when I return from spring break, I will look around and let you know if I find anything.

Greg

Greg to Doug Irwin:

Hi Doug,

I was wondering if you could help me find a relevant paper or two. You seem like you might be the right person to ask (in light of your great book, Free Trade Under Fire).

A lot of standard models predict that, under flexible exchange rates, trade restrictions do not affect the trade balance (because NX=S-I and the restrictions do not directly affect S or I). Instead, the exchange rate moves so that a trade restriction reduces both imports and exports.

Do you know of any empirical studies that confirm or refute this? Obviously, this topic is relevant for Mr Trump’s proposed policies regarding China.

Doug Irwin:

Hi Greg,

I don’t know of any particular studies or papers to point you to, but theory and experience confirm it. The theory is the Lerner Symmetry Theorem, that a tax on imports is a tax on exports, so that imposing a tax on imports (to reduce imports) means that necessarily that exports will be taxed as well (resulting in a reduction in exports). The question is the mechanism by which this happens, which is obviously different under fixed and floating exchange rates.

In terms of experience, the US trade balance did not change appreciably after the imposition of the Smoot-Hawley tariff. In more recent decades, countries that have rapidly dismantled import restrictions (Chile, New Zealand) did not start running large trade deficits (although they often had fixed exchange rates and devalued or floated when they introduced their trade reforms). I don’t think China ran a large trade deficit when it unilaterally opened up its economy in the 1980s and 1990s, although as your know their current account began to balloon when you were at CEA (no causality suggested!). Another experience: I think Japan had a rough current account balance until they deregulated private capital outflows in 1980 at which point their CA surplus began to grow.

Regarding China - we do know that they retaliate immediately. Whenever Commerce and the ITC rule affirmatively on an antidumping case involving China, it is almost miraculous how China immediately finds that the United States has been dumping in their market as well.

I hope this helps a little. Let me know if you would like some elaboration.

How the Romans Made a Large Territory 'Rome'

“Edgy in a different way was the idea of the asylum, and the welcome, that Romulus gave to all comers–foreigners, criminals, and runaways–in finding citizens for his new town. There were positive aspects to this. In particular, it reflected Roman political culture’s extraordinary openness and willingness to incorporate outsiders, which set it apart from every other ancient Western society that we know. No ancient Greek city was remotely as incorporating as this; Athens in particular rigidly restricted access to citizenship. This is not a tribute to any ‘liberal’ temperament of the Romans in the modern sense of the word. They conquered broad swathes of territory in Europe and beyond, sometimes with terrible brutality; and they were often xenophobic and dismissive of people they called ‘barbarians.’ Yet, in a process unique in any pre-industrial empire, the inhabitants of those conquered territories, ‘provinces’ as Romans called them, were gradually given full Roman citizenship, and the legal rights and protections that went with it. … As one King of Macedon observed in the third century BCE, it was in this way [through inclusiveness] that ‘the Romans have enlarged their country.’”

Emily Badger: There is No Such Thing as a City that Has Run Out of Room—Especially in America →

Note: Don’t miss my related post “Density is Destiny.”

Ryan Silverman—$15 Federal Minimum Wage: Positive Intentions, Negative Results

Link to Ryan Silverman’s Linked In homepage

I am pleased to host another student guest post, this time by Ryan Silverman. This is the 10th student guest post this semester. You can see all the student guest posts from my “Monetary and Financial Theory” class at this link.

A significantly higher minimum wage in America will damage small businesses, reduce the incentive to invest in human capital, and make it harder to improve living standards.

The current federal minimum wage is $7.25 per hour. However, 29 states and the District of Columbia have set minimum wages above the federal minimum wage. Kicking off 2016, 14 states began the new year by raising their minimum wage. The nation is trending towards higher minimum wages under the rationale that all workers deserve livable wages. Many activists are fighting to raise minimum wage to $15 an hour, more than twice the current federal minimum wage.

Minimum wage jobs typically require little to no education, such as dishwashers and cashiers. The supply of minimum wage workers tends to be highly elastic, making each worker easily replaceable. It turns out that over half of minimum wage workers are between ages 16-24, many of whom are not yet financially independent.

It is clear that minimum wage jobs are not intended for those who are in dire need of funds. Minimum wage jobs are intended to provide supplemental income in return for simple labor. Higher wages should serve as an incentive for laborers to invest in various forms of human capital to make themselves more productive in the workforce. If every American could live a comfortable life providing menial labor, and skip the rigors and cost of higher education, our productivity growth as a country would slow down, if not reverse itself.

Many small businesses have already factored the current federal minimum wage into their expenses and would be unable to operate if their labor costs doubled. Any increase in the failure of small businesses would further widen the gap between upper and middle classes. Big businesses will take over the market share of struggling small businesses, creating less competition and more monopolistic behavior. Too many people act as if the set of jobs available is fixed. In the short run the set of jobs available may indeed be close to fixed, and the minimum wage may not seem to affect jobs much at all, but in the long run, the set of jobs available far from fixed. A higher wage will drive many jobs out of existence over the course of ten to twenty years.

Even for the poor that a minimum wage is intended to help, a substantial fraction of the benefits of a higher wage for those who manage to keep their jobs will be eaten up by the higher prices of goods produced in part by other minimum wage workers. For example, many people on limited incomes shop at Walmart. If Walmart has to pay higher wages, the customers at Walmart, who are themselves struggling, will have to pay higher prices.

In addition to destroying jobs over the course of ten to twenty years, a higher minimum wage might tempt many people to queue up for jobs with a high minimum wage instead of getting more training. Forgoing training is not only a limitation on the life of the individual, it also deprives society of skilled work that it needs. For example, Emergency Medical Transport professionals do important work. Their services are pivotal to saving lives and require much more education and training than a typical minimum wage worker. If the minimum wage increased while the wage of Emergency Medical Transport professionals stayed the same, there would be less incentive to gain those skills. On the other hand, if Emergency Medical Transport professional wages go up, then these crucial services become more expensive.

One must also consider the effect on the natural unemployment rate if the minimum wage increases to $15. Fewer workers will have a marginal product high enough to be employed, and more will waste time looking for jobs in scarce supply. The Congressional Budget Office predicts that if the federal minimum wage is raised to $10.10, as many as a million workers could lose their jobs.

In the long run, I predict a further wealth disparity caused by the ability of large companies and conglomerates to better weather the minimum wage hike than smaller businesses. Small businesses have substantially less operating capital to support their largest expenses of employee wages and benefits. Small businesses will encounter the most difficulties staying afloat with higher minimum wages, particularly in difficult economic times.

Raising the minimum wage might seem to many like, at worst, a relatively harmless political gesture. But for those whose marginal product is below the minimum wage, it can be a nightmare, making it hard for them to find a job. Wouldn’t it be better to let each person choose his or her own minimum wage? But of course that is exactly what happens when there is no minimum wage at all. Next best would be to choose a minimum wage carefully for each demographic group, to make sure it wasn’t too high relative to that group’s marginal product. But a uniform minimum wage is certain to shut some groups out of the labor force–those who struggle the most at finding jobs to begin with. It may be that some of those groups are made up of people who don’t desperately need a job. But if they don’t desperately need a job, they also don’t need an increase in the minimum wage either. And if they do desperately need a job, a higher minimum wage will make it harder to find one.

Tom Keen and Francine Lacqua Interview Miles Kimball on Bloomberg Radio about Negative Interest Rates and Nominal GDP Targeting →

University of Michigan’s Miles Kimball discusses negative interest rates and how it’s just an extension of positive interest rates as well as real GDP versus GDP plus inflation. He speaks with Tom Keene and Francine Lacqua on Bloomberg Surveillance.