Libertarianism, a US Sovereign Wealth Fund, and I

In reaction to my Quartz column “Why the US Needs Its Own Sovereign Wealth Fund” (which I followed up with “Miles’s First TV Interview: A US Sovereign Wealth Fund” and “Miles Kimball, David A. Levine, Robert Waldmann and Noah Smith on the Design of a US Sovereign Wealth Fund.”), I received this question:

Question:

Chris Lindsay Advocating another government agency? The “libertarian” label that I see/hear people put on you is being tested. Heh.

Answer:

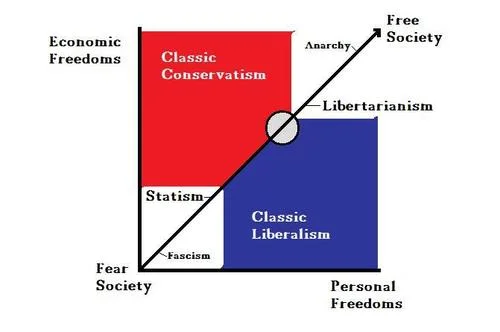

There are really two questions here: (A) “Am I a Libertarian?” and (B) “How can I square my proposal for a US Sovereign Wealth Fund with a concern for freedom and the consequences of too much government power for freedom?”

(A) Philosophically, I am much closer to being a Utilitarian than a Libertarian. Given that, how is it that I sound as much like a Libertarian as I do?

- First, I believe that people love freedom–and hate being under someone else’s thumb–so freedom should be very important to a Utilitarian. I discuss evidence for human beings’ love of liberty and hatred of oppression in my post “Judging the Nations: Wealth and Happiness are Not Enough,” which expands on my Quartz column “Obama the libertarian? Americans say they’d be happy if government got out of the way.”

- Second, I love freedom myself. I think about freedom a lot when I am writing posts. Typing in the word “freedom” in the search box at my sidebar will lead you to an interesting set of posts that back up this claim. One of the most memorable things I heard from my peers in grade school was “It’s a free country”–a statement that always had, in context, a clear practical meaning. To me “It’s a free country” means that anyone who wants to tell me to do something has the burden (sometimes easy, sometime hard) of persuading me that is what I should do.

- Third, I believe that freedom has enormous instrumental value in furthering all of our other interests. Freedom of thought fosters science. Freedom of speech fosters better government. Freedom in making economic decisions fosters prosperity.

However, the statement that freedom in making economic decisions fosters prosperity must be qualified if there is theft, deception or violence, and it must be qualified if there is serious internal conflict or a lack of understanding on the part of the decision-maker.

One area where I am not Libertarian at all is in the regulation of food and drink, where I think most of us face serious internal conflict–one part of each of us wanting to do one thing, the other part another thing. Of course, any benefits of such regulation need to be weighed against my first point–the simple fact that people love freedom and hate being under someone else’s thumb–often even when they believe it is for their own good. And the administration of rules often attracts as functionaries those who like to boss others around–something that makes an abridgment of freedom even more painful.

(B) Now, let’s judge a US Sovereign Wealth Fund against a concern for freedom. All a US Sovereign Wealth Fund does is buy risky assets, financed by the issuance of Treasury bills and Treasury bonds. (Think in terms of an initial fund of $1 Trillion, financed by the issuance of Treasury bill and Treasury bonds.) The US Sovereign Wealth Fund does not tell anyone, other than its employees, what to do. It would not have the same political pressures to undercharge customers and overpay employees (and thereby lose money) as other government enterprises. Indeed, I am much more worried that political pressure would cause the US Sovereign Wealth Fund to underpay its key employees. Rather than costing money as government spending does and thereby leading to higher taxes, a US Sovereign Wealth Fund would most likely make money for the government, and thereby allow lower taxes. Since higher taxes are a serious blow to freedom, anything likely to reduce them is–at least on that account–a plus for freedom.

Notice that a US Sovereign Wealth Fund reduces the temptation to dream up additional government spending to take advantage of the very low interest rates at which the US government can borrow. We should indeed borrow more to take advantage of low real interest rates, but we should weigh carefully whether we should be spending more or putting those borrowings to work in the asset markets.

“Fairness” to Firms. Some financial firms will dislike a US Sovereign wealth fund because it would act, in effect, as a competitor. They would say it unfair that they have to compete with an institution that can borrow at such a low rate. But which is more fair–to have all taxpayers share in some of the benefits of the rich return to risk available in asset markets, or to have a much smaller share of the population take all of the benefit through the financial firms, often costing taxpayers directly when they need bailouts? And none of this fairness discussion has anything directly to do with freedom.

Limiting the Influence of Politics on the US Sovereign Wealth Fund. I have discussed in previous posts how, in order to insulate the US Sovereign Wealth Fund from political pressures to invest in particular companies or industries, it is important that it have a level of independence comparable to (but separate from) the Federal Reserve. A board with long, staggered terms would hire and fire the portfolio managers, with a dual mandate to make a good return for taxpayers and to contribute to financial stability through a contrarian investment strategy and through having a staff with deep financial expertise.

But there is one other key issue for a US Sovereign Wealth Fund I haven’t yet addressed. To avoid backdoor regulation, it is important to have a structure that limits the influence of politics on how the shares owned by the US Sovereign Wealth Fund are voted. When I first thought of this, I was inclined to totally prohibit shareholder voting by the US Sovereign Wealth Fund. But banning all voting could hurt returns, as when it is time to vote for a takeover that would significantly raise the value of shares. So here is my proposal. The Federal Reserve System has industry input through the boards of the regional Federal Reserve banks. Suppose we created a system where pension fund managers with broadly diversified portfolios would have representation on a council that would decide on how the US Sovereign Wealth Fund’s shares were voted. They would have no other formal role in the US Sovereign Wealth Fund. With broadly diversified portfolios like the broadly diversified portfolio of the US Sovereign Wealth Fund, their interests in raising their own returns should be reasonably consistent with taxpayers’ interests in earning a higher return. The head of the US Sovereign Wealth Fund would serve on this council on the voting of shares, in order to allow some coordination with the portfolio decisions and financial stability concerns of the US Sovereign Wealth Fund, but none of the other members of the governing board of the US Sovereign Wealth Fund would serve on the council on the voting of shares.