The Volcker Shock

"October 6, 1979, was a chilly Saturday in Washington. The coming Monday was a government holiday, Columbus Day, and much of official Washington had scattered for the long weekend. Many of those who remained, along with the news media, were keeping an eye on Pope John Paul II, who was paying the first-ever papal visit to the White House to meet with President Carter; he would lead an open-air mass at the foot of the US Capitol the following day. With almost everyone’s attention elsewhere, it was a good day for a secret meeting at the Federal Reserve. ...

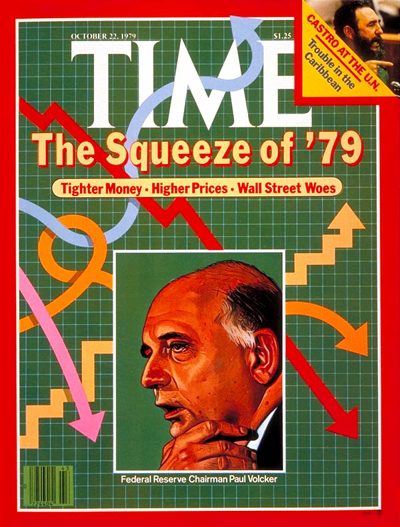

After a full day of discussion, the central bankers agreed on a plan. As Chairman Paul Volcker told reporters at an unusual press conference that night, the Federal Reserve would stop trying to stabilize prices by adjusting short-term interest rates. Instead, it would target the total amount of reserves held by the thousands of banks in the Federal Reserve system. 'By emphasizing the supply of reserves and constraining the growth of the money supply through the reserve mechanism, we think we can get firmer control over the growth in money supply in a shorter period of time,' Volcker intoned. Not one in a thousand Americans could explain what that meant. But the message got through to Wall Street, where traders dissect every word of every utterance by every Fed official. Adding up banks’ nonborrowed reserves was one of many ways to measure the nation’s money supply. By making reserves its main gauge, the Federal Reserve, like the Bank of England four months earlier, was embracing monetarism.

Neither Volcker nor any other policymaker at the US central bank was a committed believer in mechanically regulating the money supply as the monetarists counseled. Their responsibility, as all of them saw it, was to receive a stream of data and anecdotal reports, evaluate them to assess the state of the economy, and then adjust monetary policy accordingly. The October 6 announcement, known forever after as the 'Volcker shock,' seemed to eliminate the Fed’s discretion to make those month-to-month adjustments. Henceforth the central bank would be bound by an ironclad rule governing how fast the money supply should grow.

But that was not really Volcker’s intention. By appearing to put monetary policy on autopilot, the Fed was trying to sweep away two political obstacles to its goal of lowering inflation. It hoped to blunt the ceaseless attacks of its most vociferous critics, the influential monetarist economists and their allies at places like The Wall Street Journal, who harped constantly on the Fed’s erratic policies. If perchance their Fed-bashing turned to praise, perhaps the financial markets would believe that inflation would be coming down. If that occurred, interest rates would fall, and lower interest rates on mortgages and business loans might in fact help bring inflation down. The Fed also hoped its new stance would shield it from the political assaults that were sure to come. Quelling inflation, which was running at a 12 percent rate, previously experienced only when wartime price controls were removed, seemed likely to require much higher interest rates than the United States had ever known.

If the Fed openly made interest rates the target of its policy, announcing that it was raising short-term rates to 15 or 20 percent, then auto dealers, construction workers, and corporate executives would cry foul and enraged members of Congress might strip the central bank of its independence. If, however, high interest rates were merely the byproduct of its much-praised shift to the monetary policy rules the monetarists were demanding, the Fed would have some protection from its critics. As Volcker put it to his colleagues at that Saturday meeting, 'It’s an easier political sale.'”

—Marc Levinson, An Extraordinary Time: The End of the Postwar Boom and the Return of the Ordinary Economy, chapter 13.