Inequality Is About the Poor, Not About the Rich

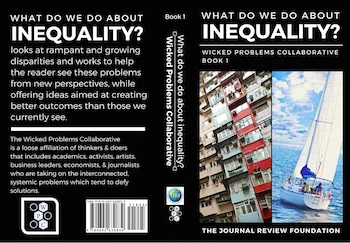

As an initiative of the “Wicked Problems Collaborative,” Chris Oesterreich put together the work of contributors for What Do We Do About Inequality? The book is now out. We would love to get some more reviews up on Amazon.

I agreed to contribute a chapter to this effort on the condition that I could post it here on my blog, too. Here it is, slightly re-edited:

One of the most basic ways to think about why inequality matters is to use the intuition that a dollar means more to a family that is desperately poor than to a family that is astoundingly rich. In the survey behind the University of Michigan’s Index of Consumer Sentiment, 90% of respondents agreed that “one thousand dollars is worth more to a poor family than to a rich family.” [1] Even more tellingly, 74% said that $1000 to a family at their own level of income would “make a bigger difference” than $4000 to a family at twice their level of income. That is, 74% of those surveyed agreed that doubling a family’s standard of living cuts the value of an extra dollar by a factor of at least 4.

The belief that the significance of a dollar declines with income even trumps favoritism toward people at one’s own income level: 66% of respondents agreed that $1000 to a family at half their level of income would “make a bigger difference” than $4000 to a family at their own level of income. That is, close to a 2/3 majority of everyone agrees that cutting income by a factor of two below their own level multiplies the value of an extra dollar by a factor of 4.

In this essay, I want to pursue the logical consequences of the idea that doubling income cuts the value of an extra dollar by at least a factor of four, while cutting income in half multiplies the value of an extra dollar by a least a factor of 4. If one accepts this idea, a little arithmetic then goes a long way toward clarifying issues of inequality. Extending this idea throughout the full range of income [2] yields something like the inverse square law for gravity, only a bit more dramatic: just as being ten times as far away from the Sun reduces the force of the Sun’s gravity by a factor of 100, being ten times richer reduces the value of an extra dollar by a factor of at least 100. And just as being ten times closer to the Sun increases the force of the Sun’s gravity by a factor of 100, being ten times poorer increases the value of an extra dollar by a factor of at least 100.

Thus, quantifying the idea that a dollar means more to a poor family than to a rich family shows that as far as financial well-being is concerned, inequality is about the poor, not about the rich. This is an important idea because a large share of the popular discussion about inequality focuses on the rich. Relative to being in the hands of a middle-income family, then, dollars in the hands of the ultra-rich are merely wasted, while dollars in the hands of the poor are supercharged in their potency for making lives better.

Before going on, let me concede first of all that the amount of wealth held by the ultra-rich is truly astonishing, and that making sure that the ultra-rich do not convert their wealth into total control of our political system is important. Documenting and studying in detail all of the ways in which the ultra-rich influence politics is crucial. But short of the ultra-rich subverting our political system, the focus of our concern about inequality should be how well we take care of the poor; whether money needed to help the poor comes from middle-income families or the rich is an important issue, but still of secondary importance to how well we take care of the poor.

In practical use, the formal social welfare measure I am advocating—which treats a dollar as 100 times as valuable in the hands of a family with one-tenth the income—gives recommendations remarkably close to John Rawls’s criterion in his famous book A Theory of Justice [3] of maximizing the prospects of the least well off. This is dramatically different from worrying about how much more the richest have than the average family. And it is very different from focusing on other common inequality measures like the Gini coefficient.

Once one focuses on the lot of the poor and desperate, many policy debates look different. Let me consider three examples: immigration policy, the minimum wage, and licensing.

In thinking about immigration policy, a case can be made that one should give the welfare of citizens a higher weight than the welfare of those who want to immigrate. For the sake of argument, let me put aside my skepticism there and accept a lower welfare weight for non-citizens than for citizens. I maintain that recognizing the fact that immigrants are human beings mandates that any ethical criterion must put some positive weight on the welfare of non-citizens. Suppose that we treated the welfare of non-citizens as worth one-hundredth as much as the welfare of citizens. The surprising arithmetic of inequality says that even given that low a welfare weight, a dollar in the hands of an immigrant family of four living on $4000 per year is still worth more than a dollar in the hands of a family of four citizens living on $40,000 per year. Given how modest the documented effects of immigrants on the welfare of citizens are, and the large benefits to immigrants of being able to immigrate, this militates in favor of a fairly open immigration policy. (I apply this reasoning further in my Quartz column “’The Hunger Games’ Is Hardly Our Future–It’s Already Here.”)

Going further, the large welfare benefits of an open immigration policy when even a small weight is put on the welfare of immigrants suggests that many political compromises are worth making if those compromises can help secure a more open immigration policy. For example, immigration is still worth a lot to immigrants even if they are excluded from social safety net benefits and from being naturalized enough to vote for many years.

Although support for raising the minimum wage is common among progressives (encouraged by cherry-picking from empirical results about the effects of minimum wages [4]), it is far from obvious that the minimum wage helps the poorest of the poor. Indeed, the US federal minimum wage causes serious problems in Puerto Rico [5], whose residents are on average much poorer than the residents of the fifty states. A minimum wage can be seen as a rule saying that if a worker cannot find a good job, he or she is not allowed to have any job at all. The best case for a worker is when he or she already has a job and the minimum wage raises pay by splitting the benefit of the employer/employee match more in favor of the worker. But as soon as a worker is out of work, looking for a new job, the minimum wage is a hindrance. It not only prevents some deals from going through, but also leads employers to search less hard for new workers, since the employer will get less benefit from an employer/employee match.

A higher minimum wage is a burden for someone who is out of work and looking for a job, but anything that makes it harder for employers to hire some workers increases the demand from those employers for other workers. For example, if the minimum wage is increased, employers who can’t hire workers at low wages anymore can increase the hours of higher-quality workers who were already above the minimum wage. Thus, while the minimum wage does not help the poorest of the poor, it can effectively help those who are one rung up on the economic ladder at the expense of the poorest of the poor.

It is important to note that to help raise the incomes of the working poor, there is an excellent alternative to raising the minimum wage: making the earned income tax credit more generous. Although for those concerned with inequality for those at the bottom of the heap, the earned income tax credit is still not generous enough, the political feasibility of moving in this direction has been shown by expansions in 1986, 1990, 1993, 2001, and 2009. Its rank on the policy wish list relative to the raising the minimum wage will make a difference for whether there are further expansions of the earned income tax credit.

I have focused on the minimum wage because it is analytically clear and frequently offered as a way to reduce inequality. But in its harm to the poorest of the poor, the minimum wage pales in comparison to the overgrowth of licensing requirements that excludes the poor from more and more jobs. Take a simple example. Suppose I am desperately poor and have minimal skills. I get the bright idea that I can cut hair. I can do it in my apartment and only need a pair of scissors, an electric clipper, and a mirror. I start earning a small but helpful amount of money. Then, the neighborhood barber gets wind of what I am doing and complains to the government, which comes to shut me down. I am told I could do a year or two of training to become a licensed barber. But I cannot afford to. In this transaction, a barber, who is probably two rungs up on the economic ladder from me, has gotten the government to put his interests first over mine. There may be a pretense that it is all for safety or quality reasons, but my customers were perfectly happy with me, fully realizing that having me cut their hair was no more dangerous than having a family member who doesn’t have as good a sense of style as I do cut their hair.

Licensing requirements, like the minimum wage, say in effect “If you can’t get a good job, you can’t have any job at all.” The rhetoric focuses on guaranteeing that jobs will be good, middle-class jobs, but cutting off worse jobs is not the way to do it—at least not if one cares about the poorest of the poor.

All of this matters because the most common trope about inequality is to point to the increasing share of income and wealth in the hands of the ultra-rich and then to recommend a policy mix heavy on measures like increasing the minimum wage that effectively take from the poor to give to the middle class, rather than taking from the rich to give to the middle class as advertised. It is the reverse—helping the poor at the expense of the middle class—that is a genuine reduction in inequality.

“But what about the rich?” The answer to that question ought to be “Let’s talk about the poor and desperate a bit longer first.” One group whose members are often desperate and often poor are the mentally ill, and those who have fallen into the grip of a serious addiction. Better funding and greater parity for mental health care make a lot of sense when the rule-of-thumb version of John Rawls’s principle of “maximizing the prospects of the least well off.” And government resources should be dramatically shifted away from trying to interdict marijuana, where the harm is likely to be relatively mild, to treating people with life-destroying addictions.

As a matter of public policy, the welfare of the rich themselves is not something we need to worry about very much, since so many other people in the marketplace stand ready to help them. But how we treat the rich is very important because of their role in the economy and in society. Many have gotten rich in ways that should not be rewarded. In those cases, it is appropriate to think of how to fix that misallocation of rewards—even after the fact, when criminal actions are involved. But for those who have gotten rich in ways that are honorable and do deserve to be rewarded, we are better advised to think hard about encouraging them to be as altruistic as possible so that they separate themselves from their money voluntarily instead of being separated from their money on pain of being thrown in jail.

In between the two extremes of fully altruistic donation, and taxation, would be a “public contribution program” in which the rich and semi-rich have the alternative of either paying additional taxes or taking that same amount of money and donating it to charities in the nonprofit sector. One of the great advantages of such a public contribution program is that because of cognitive dissonance (the attractions of thinking one is donating because one is a good person instead of because required), such a public contribution program may itself encourage the rich to become more altruistic. (This is a proposal dear to my heart. See my bibliographic post “How and Why to Expand the Nonprofit Sector as a Partial Alternative to Government: A Reader’s Guide.”)

The bottom line is that where we don’t need the rich, it may be okay to arrange things so that they are no longer rich. But in many cases, we actually do need the rich. Once we are down to the rich we actually need, the wisest course of action may be to work toward their having as good a character as possible. This is made easier by the fact that, by and large, we don’t need or want people of seriously bad character to be rich in the first place, and those of seriously bad character often became rich by a pathway that we would want to foreclose in any case. But those who are merely subject to the common motive of greed, in ordinary measure, and have done socially useful things partly in service of their personal greed, are likely to be redeemable by appealing to the common, and noble, desire of doing good in the world.

Let me end by quoting something I wrote in a July 9, 2012, blog post (“Rich, Poor and Middle-Class” on supplysideliberal.com [6]), during the thick of the presidential election campaign that year:

I am deeply concerned about the poor, because they are truly suffering, even with what safety net exists. Helping them is one of our highest ethical obligations. I am deeply concerned about the honest rich—not so much for themselves, though their welfare counts too—but because they provide goods and services that make our lives better, because they provide jobs, because they help ensure that we can get good returns for our retirement saving, and because we already depend on them so much for tax revenue. But for the middle-class, who count heavily because they make up the bulk of our society, I have a stern message. We are paying too high a price when we tax the middle class in order to give benefits to the middle-class—and taxing the rich to give benefits to the middle-class would only make things worse. The primary job of the government in relation to the middle-class has to be to help them help themselves, through education, through loans, through libertarian paternalism, and by stopping the dishonest rich from preying on the middle-class through deceit and chicanery.

Milton Friedman often talked about “Director’s Law”: the tendency of democracies to focus on the interests of the middle class even when using the rhetoric of helping the poor. Unmasking programs that serve the interests of the middle class under the pretense of the poor is a first step in working toward making things better for the poor.

Footnotes

[1] Yoshiro Tsutsui, Fumio Ohtake, and I arranged to add some questions to find out if people generally agree with that idea, and if so, how much more they thought a dollar meant to a poor family than to a rich family. Daniel Reck and Fudong Zhang helped us analyze the data.

[2] To see if it was reasonable to extend this idea throughout the income distribution, we split the sample into people in the upper half of the income distribution and those in the lower half of the income distribution. Richer people actually thought that income level makes a bigger difference to how much a dollar means: 77% of the richer half, compared to 70% of the poorer half, thought going to double their income level would cut the value of an extra dollar by at least a factor of four; 61% of the richer half, compared to 70% of the poorer half, thought going to half their income level would multiply the value of an extra dollar by at least a factor of four.

[3] John Rawls, A Theory of Justice (Cambridge, MA: Belknap Press, 1971).

[4] David Card and Alan Krueger have a famous paper (“Minimum Wages and Employment: A Case Study of the Fast Food Industry in New Jersey and Pennsylvania” [NBER Working Paper No. 4509, National Bureau of Economic Research, Cambridge, MA, October 1993, http://www.nber.org/papers/w4509]) finding that a minimum wage increase had no effect on employment (or maybe even increased employment a bit) in fast food restaurants. But a more recent paper by Daniel Aaronson, Eric French, and Isaac Sorkin (“Industry Dynamics and the Minimum Wage: A Putty-Clay Approach” [working paper, May 22, 2015, http://events.barcelonagse.eu/live/files/864-sim15-frenchpdf]) finds that non-chain restaurants actually shut down after a minimum wage increase—leaving more business for the chain restaurants that David Card and Alan Krueger were focusing on. Theoretically, the Card-Krueger result was always too good to be true, and certainly should not be relied on as a reason to favor an increase in the minimum wage.

[6] Miles Kimball, “Rich, Poor and Middle-Class,” Supply Side Liberal (blog), July 9, 2012, http://blog.supplysideliberal.com/post/26828687393/rich-poor-and-middle-class