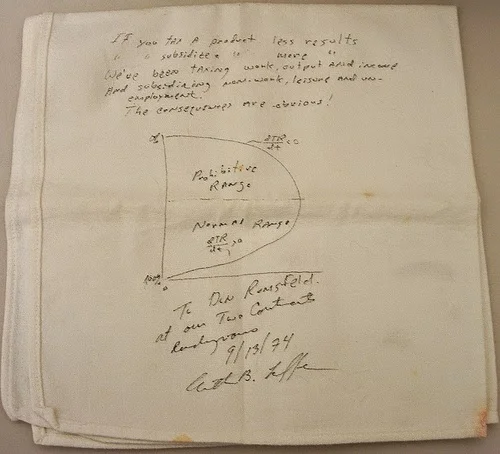

John Stuart Mill’s Laffer Curve

When Maryland tried to tax the Second Bank of the United States, Daniel Webster argued before the Supreme Court in McCulloch v. Maryland that “An unlimited power to tax involves, necessarily, a power to destroy.” The Supreme Court echoed his words, saying “That the power to tax involves the power to destroy … [is] not to be denied.” John Stuart Mill addressed the same issue in paragraph 9 of On Liberty “Chapter V: Applications,” but came to a different rule: taxation must be limited to no higher than the revenue-maximizing rate–otherwise, it is clear that the intent of the taxation is to destroy rather than to raise revenue. He wrote:

A further question is, whether the State, while it permits, should nevertheless indirectly discourage conduct which it deems contrary to the best interests of the agent; whether, for example, it should take measures to render the means of drunkenness more costly, or add to the difficulty of procuring them by limiting the number of the places of sale. On this as on most other practical questions, many distinctions require to be made. To tax stimulants for the sole purpose of making them more difficult to be obtained, is a measure differing only in degree from their entire prohibition; and would be justifiable only if that were justifiable. Every increase of cost is a prohibition, to those whose means do not come up to the augmented price; and to those who do, it is a penalty laid on them for gratifying a particular taste. Their choice of pleasures, and their mode of expending their income, after satisfying their legal and moral obligations to the State and to individuals, are their own concern, and must rest with their own judgment. These considerations may seem at first sight to condemn the selection of stimulants as special subjects of taxation for purposes of revenue. But it must be remembered that taxation for fiscal purposes is absolutely inevitable; that in most countries it is necessary that a considerable part of that taxation should be indirect; that the State, therefore, cannot help imposing penalties, which to some persons may be prohibitory, on the use of some articles of consumption. It is hence the duty of the State to consider, in the imposition of taxes, what commodities the consumers can best spare; and à fortiori, to select in preference those of which it deems the use, beyond a very moderate quantity, to be positively injurious. Taxation, therefore, of stimulants, up to the point which produces the largest amount of revenue (supposing that the State needs all the revenue which it yields) is not only admissible, but to be approved of.

Even apart from the need for revenue, it has always seemed to me that within reason taxes were a gentler way of discouraging something, more consistent with freedom than ironclad rules. The changes in defaults and framing that go by the name of libertarian paternalism or soft paternalism seem even gentler and yet more consistent with freedom.

In the arena of encouraging actions to help the environment, I personally often find social disapproval to be a more onerous, less freedom-respecting means of getting compliance than a modest tax with the same overall effectiveness (and with rebates to maintain neutrality vis a vis the income distribution) would be. It uses up a lot of air time in social interactions for people to be guilting others into green actions that could be encouraged subtly in the background of life with an appropriate Pigou tax. Maybe it is just me, but I often bridle at someone telling me directly what to do, but don’t have any psychological resistance to responding to price signals, within reason.