David Farnum: The Real (Estate) Cost of Student Debt

Many economic effects are complex. In the 6th student guest post this semester, David Farnum points out one of the more subtle costs of student debt:

The increase in student loans has lead students to increasingly make sub-optimal real estate investment and are forced to take relatively more expensive rentals.

The sentence above is actually an example of the requirement that my writing teaching assistant Adam Larson and I recently instituted that students write an explicit thesis statement at the top of their posts, in accordance with my dictum in “On Having a Thesis”

The thesis statement does not always have to actually appear in your post or essay, but it needs to exist and you need to know what it is.

Here is David’s argument for that thesis:

While the repayment of principal and interest on student loans themselves can be expensive, one of the hidden expenses is the opportunity cost of having this student debt amount, namely sub-optimal investment choices. One area of investment choices that are distorted due to accumulating student debt is in the real estate market: increased debt levels force recent graduates to forgo purchasing real estate assets. This impacts them on two fronts, first it limits their portfolio exposure to potentially lucrative investment returns and causes them to pay for relatively more expensive rentals.

As pointed out in A Random Walk Down Wall Street, an investment into hard real estate assets such as houses can provide excellent returns into a well diversified portfolio. Burton Malkiel explains:

As long as the world’s population continues to grow, the demand for real estate will be among the most dependable inflation hedges available. Although the calculation is tricky, it appears that the long-run returns on residential real estate have been quite generous…In sum, real estate has proved to be a good investment providing generous returns and excellent inflation-hedging characteristics.

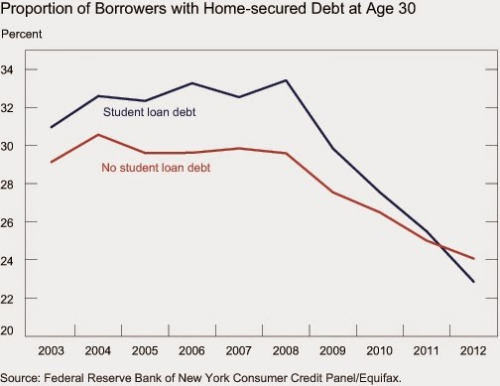

It makes sense that recent graduates would want to invest into such an asset class to better ensure they are able to take advantage of the long run returns that Malkiel describes. However, as more and more students are graduating with expanding college debt levels, they are increasingly unable to afford the purchase of a house. A 2013 post by Liberty Street Economistson the New York Fed blog analyzed the impact of student loans on home ownership. They explain their findings from the graph (below):

By 2012, the homeownership rate for student debtors was almost 2 percentage points lower than that of nonstudent debtors. Now, for the first time in at least ten years, thirty-year-olds with no history of student loans are more likely to have home-secured debt that those with a history of student loans.

In the past, those aged 30 with college debt were more likely to purchase a home due to their greater propensity to acquire higher paying jobs and thus be able to afford home ownership. However, this relationship has changed starting in 2012, possibly due to the higher overall levels of debt precluding mortgage approvals and reducing already debt burdened individuals ability to make home payments. The advent of this increasing proportion of students with debt and higher overall debt levels has been a contributing factor in the fall of home ownership, potentially leaving a large portion of recent graduates investment portfolios underexposed to the real estate sectors.

Not only are debt-burdened students under-investing in home ownership, they face increased relative prices for renting. A WSJ article entitled A Tough Time for Renters, outlines the rapid rise in rental prices:

The cost to rent an apartment jumped in 2014 for the fifth consecutive year as strong demand and short supply left vacancies at historically low levels. Nationwide, apartment rents rose an average 3.6% last year…the average monthly lease rate to $1,124.38, the highest since Reis started tracking the market in 1980.

A calculator provided by the New York Times allows one to compare the relative costs of renting vs home ownership based on a variety of input factors. Using the settings given, the equivalent home price to the national average monthly lease rate would be roughly $311,000. Given this is higher than the $199,600 national median sales price of existing homes, clearly the cost of renting currently greatly outpaced the cost of purchasing a home nationally.

However, the national data can skew the renting data, as rental rates will be especially high in areas of high populations such as large cities. Using a similar process to the NYT, online residential real estate company Trulia estimates the percentage difference in the cost of renting vs. buying a house in populous metropolitan areas. Their interactive map indicates that even in heavy populated areas, the cost of home is significantly less than that of renting, including a 21% difference in New York and Los Angeles, a 29% difference in Boston, and a 42% difference in Chicago.

All else being equal, this relative cost increase should tip the scales toward home ownership; however, as discussed above, the increased student debt levels have precluded individuals from home ownership. Not only are they missing out on the investment opportunity of real estate, they are throwing away relatively more money into the rental market.