Enkhjargal Lkhagvajav: John Taylor is Wrong—Inequality *Is* Holding Back the Recovery

Enkhjargal Lkhagvajav, who goes by “Enjar"

The students in my “Monetary and Financial Theory” course at the University of Michigan write 3 posts per week on an internal class blog. I liked Enjar’s post so much that I asked if I could publish it here as a guest post. Enjar said yes. I think you will find the analysis interesting. Here is what Enjar has to say:

Rising Inequality Explains the Weak Recovery, Not Vice Versa

In this article, I will not passionately try to convince you of the post title [in bold, just below the row of asterisks]. Instead, I will make points on how John B. Taylor’s argument on the topic fails under more scrutiny. In his article in the Wall Street Journal, titled ”The Weak Recovery Explains Rising Inequality, Not Vice Versa”, John B. Taylor makes following use of data to make his point that today’s inequality isn’t a cause of the type of recovery we are witnessing. First, he explains what the people who he is arguing against say: the slow recovery has been a result of growing inequality. He writes down their argument as follows:

“The key causal factor of the middle-out view is that a wider income distribution slows economic growth by lowering consumption demand. Saving rates rise and consumption falls if the share of income shifts toward the top, according to middle-out reasoning, because people with higher incomes tend to save more than those with lower incomes.”

And then he goes on to counteract this view by data he collected and put some make up on. He gives what his data shows:

“The data for the recovery since mid-2009 do not support this view. The 5.4% overall savings rate during this recovery is not high compared with the 8.4% average since 1960. It is relatively low compared to past recoveries, such as the 9.3% savings rate during a comparable period during the recovery in the early 1980s.”

In my curiosity, I was able to look at the data he worked on. It is data on personal saving ratio-the ratio of personal saving to disposable personal income. The following graph shows what the saving rate has been.

John Taylor is correct on that the saving rate has been averaging 5.4% since the end of the latest recession. However, when he tried to compare this rate to the 8.4% average rate since the 1960, he makes wrong comparison. Due to the general downward trend of this rate over the last decades, he shouldn’t compare this 5.4% average rate of saving during the recovery to the all time average saving rate. But if we compare the 5.4% average rate during the recovery with the average saving rate between the end of 2001 and the start of the recession, which is 3.9%, we can see that the saving rate today is higher than its pre-recession level. Therefore, we have just disproved his claim by using the same argument he tried to use. In other words, with data on how the income inequality has grown, we have further see that the saving rate also increased after the recession.

Hence, we are able to claim that the increase in inequality indeed increased the saving rate; therefore, the total consumption demand has declined, which is exactly what the people he argued against said.

One could argue that increased personal saving rate isn’t caused by the increasing inequality . It is possible that because people might be willing to save more than what it was saving before the crisis to use their saving when another crisis comes during the recovery and uncertainty. Therefore, one could say inequality isn’t playing a much role in hindering a recovery today.

However, this surge in the saving rate after any given recession has been witnessed only twice, once after 2001 and again after 2007-2009 recessions. The prior recoveries experienced the saving rate which was actually lower than its level before the crises. If we look at the average saving rate between November 1970 and November 1973, it was 12.8% which is higher than the saving rate after the recession, between April 1975 to December 1979, which is 10.8%. The same decrease in the saving rate was seen also during the early 1980′s recovery. We can see this trend of decrease in the saving rate following any recession in the above graph except for the last two recoveries. In last two recoveries, the saving rate surged and stayed at the higher level than it was before the recessions.

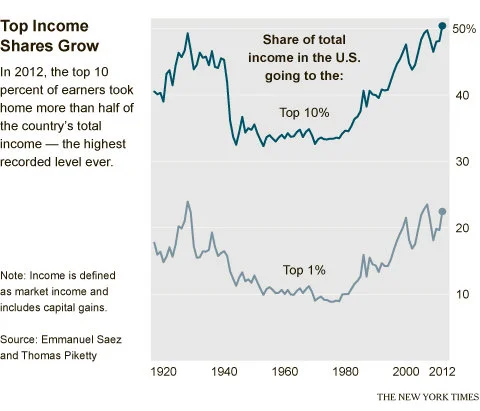

In my very first blog post, I compared the income inequality during the pre-recession periods for the Great Depression and the Great Recession and argued the recovery the economy is going through now is unhealthy one. One could agree with John Taylor on that the weak recovery is causing the widening inequality and the first problem policymakers should tackle is to boost the recovery by any means. However, the increasing inequality could be the heart of the problem, and the policymakers should prioritize equality to change the speed of the recovery. But how the inequality must be tackled should be devoted to a number of blog posts itself. I believe recent discussions and steps toward solving the inequality is a way to fasten the recovery.