Kathryn Schultz: Consumer Debt in the Short Run and in the Long Run

This is a guest post from Kathryn Schultz, one of the students in my “Monetary and Financial Theory” class at the University of Michigan.

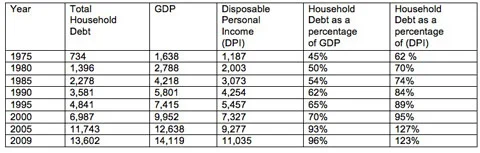

Everyone has had that one credit card bill that they’ve opened up and cringed at the amount due. But how can such small purchases add up so quickly in only a month? Most people don’t realize just how much money they are spending when they use a credit card to buy their purchases. However, most of the debt in our country comes from consumer spending. Since consumer spending drives the economy and fuels nearly 70% of U.S. GDP, it is important for consumers to be in a sound financial position. If consumers become overburdened with debt, they will not be able to drive economic growth. The table below shows the total amount of household debt, total nominal GDP, total nominal disposable personal income, and the ratio of household debt to both GDP and disposable personal income; all the numbers are in billions of dollars:

As you can see, over the past 30 years, U.S. consumers have increased both total household debt and the percentage of that debt relative to overall GDP and DPI. At some level, the total amount of debt can become so large that it can force consumers to slow their spending and thus begin to negatively affect the health of the economy. This is why in times of a recession, governments try to encourage consumer spending by lowering taxes and lowering interest rates. When consumers slow down their purchases, business’ profits are lowered which eventually lead to lay-offs; worsening the downward spiral. The more debt that is held, the less money is available to be put away in savings and reinvested in the economy.

After 2009, consumer debt began to slowly decline for the next few years. Recently however, since the beginning of 2013, Americans have been taking on debt at a rate not seen since the country spiraled into the Great Recession. Consumer debt increased in just the fourth quarter of 2013 by $241 billion, the largest quarter to quarter increase since 2007. Below is a graph of the quarter to quarter household debt balance since 2003 and its composition:

This total debt balance was a combination of Americans boosting credit card balances, increasing borrowing to buy more homes and cars, and taking on more student debt. Balances on credit card accounts alone increased $11 billion during the fourth quarter, making it the third largest source of household indebtedness. Only the mortgage and student loan debt markets were larger.

You would have thought that after the chaos of the recession, we would have become better at keeping track of our debt. However, data shows otherwise. According to a survey released by Bankrate.com, 28% of Americans have more credit card debt today than they have in a savings fund. This means that over a quarter of Americans wouldn’t be able to pay off their debt even if they used their entire savings! But, despite consumers’ savings records, banks are loosening up their credit card limits to levels not seen since the recession. This easy access to credit along with low interest rates during boom years is what brings Americans to take on record levels of debt. This does not mean that we are on the road to a second recession however. Americans’ increase in household debt could actually have to do with increased consumer confidence in the economy as it relatively improves. Higher spending leads to more jobs and higher incomes, which ultimately leads to higher consumer spending. For consumers with extra money in their wallets, taking on more debt may not seem so risky. And, as we know, consumer spending puts the economy on a positive track.

So can this notion that “Americans are spending way too much” be curbed and should it be? Financial advisers offer several tips on how to stop spending so much money and get back on track financially. Two of these tips include tracking your cash flow and tapping into your feelings to restrain your urge to spend. There is a difference between needing something and wanting something, and budgeting helps you to see areas where you may be overspending. Therapist Nancy Irwin says that overspending tends to be a coping mechanism. “You need to find the underlying issue that is trying to be fixed by overspending and learn how to deal with it in a healthy manner. There is nothing wrong with keeping up with the latest trends or being indulgent from time to time, as long as the intent is in the right place.” There is a fine line between spurring growth and digging the nation deeper into an economic sinkhole if too many houses are burdened with debt. Before you hand over your credit card, you need to think twice. You should ask yourself what need you are trying to fulfill and if you are going to be able to pay it off when the bill comes in the mail.