Reducing the Importance of Cash: Sweden and South Korea

Although deep negative interest rates are straightforward to handle even when a currency region uses paper currency intensively, the needed changes in paper currency policy are likely to be seen as less upsetting to people when cash usage is low. Thus, even when the time has not yet come for more dramatic changes in paper currency policy, it is useful for public policy to encourage the replacement of cash by other means of transactions.

Some countries are much further along in reducing cash usage than others. The article above points in particular to Scandinavian countries and South Korea. Two quotations:

- Globally, Scandinavian countries are leading the charge towards cashless societies. More than half of Sweden’s 1,600 bank branches neither hold cash nor take cash deposits.

- South Korea is already one of the least cash-dependent nations in the world. It has among the highest rates of credit card ownership — about 1.9 per citizen — and only about 20 per cent of Korean payments are made using paper money, according to the BoK.

In Sweden, cash usage is low and declining–so much so that I could point out that it made no sense in Sweden to let the “tail wag the dog” by letting paper currency get in the way of otherwise optimal interest rate policy.

There are three key factors in the decline in cash usage in Sweden. First, some time back, Sweden stopped subsidizing cash usage. There is only one place in Sweden for banks to get cash from the central bank: at a cash window near Arlanda airport near Stockholm. Carting cash to or from anywhere else in the country must be paid for by someone other than an arm of the government.

Second, Swedish kronor are not that useful for international crime. Finland provides an interesting natural experiment. Until it joined the euro zone, cash usage was declining in Finland, paralleling what was happening in Sweden. But since Finland joined the euro zone, cash withdrawals have increased greatly. Why? The Finnish markka was not very useful in international crime. The euro is.

Third, electronic forms of payment are advancing quickly in Sweden. For example, the mobile app Swish now makes it very easy for people in Sweden to transfer funds to anyone else with the app on their phone.

It is not necessary to eliminate paper currency entirely to make deep negative interest rates possible. But it makes things easier both politically and practically if cash usage is already seen of as something of only marginal importance.

Update: JP Koning points out another big factor in the decline in cash usage in Sweden, which he lays out in his post “Thoughts on Rogoff’s ‘Curse of Cash'”:

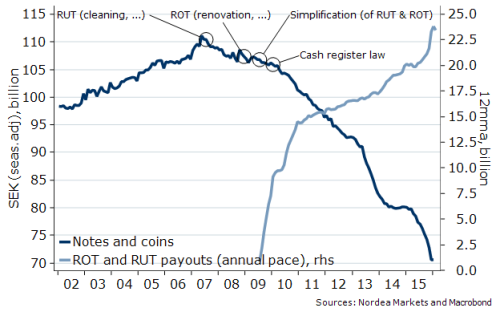

As discussed in this excellent post by Martin Enlund, the Swedes implemented a tax deduction in 2007 for the purchase of household-related services such as the hiring of gardeners, nannies, cooks, and cleaners. This initial deduction, called RUT-avdrag, was extended in 2008 to include labour costs for repairing and expanding homes and apartments, this second deduction called ROT-avdrag.

Enlund’s chart shows how the decline in krona outstanding closely coincides with the timing of the introduction of RUT and ROT:

Prior to the enactment of the RUT and ROT deductions, a large share of Swedish home-related purchases would have been conducted in cash in order to avoid taxes, but with households anxious to claim their tax credits, many of these transactions would have been pulled into the open. Note the rise in RUT and ROT payments on Enlund’s chart, for instance. Calleman reports that the number of customers using registered domestic service companies rose from 92,000 in 2008 to 537,600 in 2013. Since the implementation of RUT and ROT, Swedish opinions on paying for undeclared work have changed dramatically. In 2006, 17% said it was completely wrong to to hire undeclared labour. In 2012, 47% felt it was completely wrong.

In passing, let me say that giving some kind of tax break or at least tax exemption for services provided at a low wage rate is also good for helping those near the bottom of the income distribution. It accords with many people’s intuitive notions of fairness. And it is helpful for efficiency as well–helping to make sure that ad hoc opportunities for gains from trade are not missed. And given the option of evading taxes by using cash, trying to tax such low-wage services may not in fact provide enough tax revenue to make current policies of trying to tax such services worth the bad side effects.