Zhi Ying Lin: Why Are People So Upset About Uber’s Surge Pricing—And Should They Be?

Link to Zhi Ying Lin’s Linked In homepage

I am pleased to host another student guest post, this time by Zhi Ying Lin. This is the 7th student guest post this semester. You can see all the student guest posts from my “Monetary and Financial Theory” class at this link.

People should not be upset about Uber’s surge pricing as it creates market efficiency. Uber though, should improve its model by representing some of the variation in pricing as a discount and creating a loyalty program to reduce passengers’ dissatisfaction.

There has been an outrage against Uber for charging its passengers more than the normal rate on busy days. On this past New Year’s Eve, many passengers posted their receipts from Uber on social media websites to complain about the “ridiculously” inflated fare. There were some riders who paid more than $200 for a 20-minute ride, but Matthew Lindsay from Canada, probably paid the highest price of all - $800 for a 60-minute ride.

This happened because Uber adopts surge pricing as its core business strategy. This model uses an algorithm that calculates the fare multiplier based on the supply and demand for rides. When the demand exceeds the supply in a particular area, the base fare gets multiplied to attract more driver-partners.

People feel upset about surge pricing because they treat the base fare as a reference point. So, when there is a price surge, they feel that they get ripped off because to them, the base fare is the price that they “should” be paying. After all, most traditional taxis and buses have fixed pricing schemes with predetermined prices regardless of time. Why should Uber surge its prices during peak hours?

First, it ensures adequate supply of driver-partners on busy days. As we all know, it is always hard to hail a cab on rainy days or during peak hours because drivers, who are limited to a 20% wage hike, face very little incentive to drive. Like Princeton economist Henry Farber put it, some drivers stop driving simply because it is less pleasant to drive in the rain, and there is no additional benefit in continuing to drive.

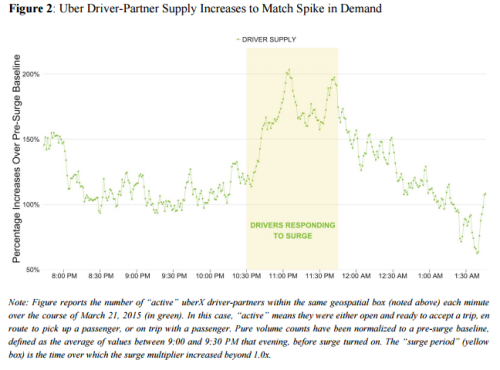

To increase driver’s incentives, Uber allows surge pricing, which essentially removes the price cap. Though this strategy is still not perfect, Uber’s economists managed to prove that there is a high correlation between surge pricing and a rise in driver-partners supply.

In addition, due to a technical glitch, they managed to demonstrate the negative effects of not having surge pricing on busy days. Findings show that as fares dropped to normal, completion rates fell dramatically and waiting times increased.

Besides increasing the supply of driver-partners, surge pricing also helps to control the demand for rides. It makes sure that those who value the service more are able to secure rides. Though some people might argue that surge pricing is a form of price gouging, it creates much-needed incentives for people to think harder about what they really need. This means that those who really, really need a ride–and are willing to pay the surge prices–will always be able to get a ride.

Given the benefits of surge pricing, it would be great if Uber could find a way to reduce customer discontent about surge pricing, rather than abandon surge pricing. One way to do this would be represent some of the variation in prices as a discount, rather than a premium. As mentioned earlier, riders treat the base fare as a reference point, so prices that are higher than the reference point are considered as losses, while prices below that seem like gains. As suggested by this paper, Uber could charge its passengers inflated prices during peak hours and give large discounts during off-peak hours, with the reference price somewhere in between. When the higher regular price becomes the reference point, passengers will not feel the losses that they experience under the current system. They will feel like they gain something from the discounted prices on regular days. The right level for the reference price between the minimum and maximum prices can be chosen by the kind of experimentation that an online platform like Uber is well set up to do. Of course, Uber should do this in the context of educating customers about the benefits of having a price that adjusts to equate supply and demand in real time.

Another, complementary approach that can be combined with an intermediate reference price is for Uber to give loyalty points to frequent app users that can be used to pay for surge pricing. Customers who have enough loyalty points might then even experience the surge prices as a gain, since they can feel satisfaction that they accumulated enough loyalty points to pay for the surge pricing. Customers who don’t have enough loyalty points to pay for the above-reference part of the price will at least then have hope that they can have enough loyalty points to pay for surge prices in the future. This can help to shift a part of the responsibility in a customer’s mind from the company to the customer her- or himself. It also has the usual benefits of loyalty points–the encouragement to use the app more frequently. Isn’t it great to kill two birds with one stone?

The economic argument for surge pricing is strong: bring out more drivers when they are needed and help make sure those who need a ride most can still get one, even during peak times. The problem is customer dissatisfaction with surge pricing, due to the principle of loss-aversion and notions of fairness that fail to take these benefits of surge pricing into account. So Uber should keep its surge pricing, but raise the reference price so that sometimes the price variation looks like a discount, and let customers pay for the part of surge prices above the reference price with loyalty points. Making surge pricing work better psychologically can preserve the benefits of real-time price variation to match supply and demand.