Israel Diego: Inflation Expectations of the Well-Educated and Not-So-Well-Educated

Israel Diego is a student in my “Monetary and Financial Theory” class. Here he reports on some interesting research he did. This is the 18th student guest post this semester. You can see the rest here.

Following up from a previous blog post, I made an effort to contrast Michigan’s survey of inflation expectations, the Survey of Professional Forecasters (SPF), and a RW no-change forecast, all forecasting one-year ahead, and I was unable to conclude beyond a reasonable doubt which forecast model would be the best for predicting inflation, however this post revisits this ideology by considering differing levels of income and education of the Michigan survey participants.

As we consider a consumer’s level of income and education, what should we expect to happen to their predictive power of inflation? Some intuition would tell us that as a consumer’s level of income rises, she may have a higher propensity to save relative to consumers with lower income, because she will have more excess funds at her disposal. Naturally, she may invest these funds, and hold a portfolio comprised of stocks, bonds, and other securities, in order to grow her nest egg for retirement, or set money aside to cushion against economic downturns. Thus it would be important for her to frequently keep track of the inflation rate, to make sure that her investment is not eroded by price increases.

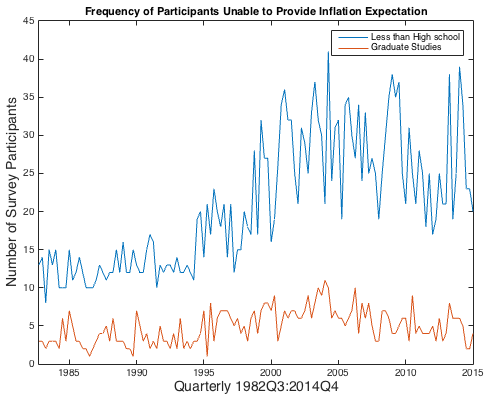

Given education, it is plausible that higher education on average leads to higher income for the consumer, so inflation expectations would improve based on the theory I motivated above. However we can also infer that more educated consumers are more likely to read the newspaper and be more informed about fluctuations in the inflation rate, a claim made by Christopher Carroll. Lastly it may be the case that less educated consumers fail to muster up an estimate for the inflation rate, relative to higher educated consumers, as uneducated consumers would rather not predict the inflation rate, for fear of embarrassingly overshooting the actual rate. To test this claim, we can sum up the number of survey participants according to their income group, from the Michigan Survey, who did not know what to say when asked about their inflation expectation. We see there is evidence that indeed people with lower education were not able to provide an answer more frequently than individuals with a graduate degree. This is looking at the far ends of the education spectrum, but the relationship holds nonetheless, as we increase education, people less frequently fail to give an answer for their inflation prediction. Interestingly it seems that consumers with less than a high school education know less, on average, about inflation now than they did back in the 80s.

My claims above would have no ‘oomph’ to them if I didn’t back them up with any evidence. So are we right in assuming that higher education and income lead to better inflation predictions? Intuitively yes, and I provide evidence that this is actually the case.

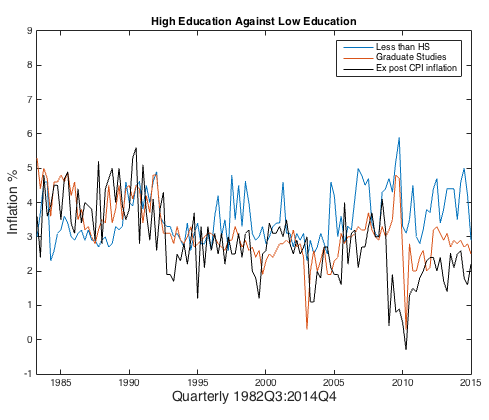

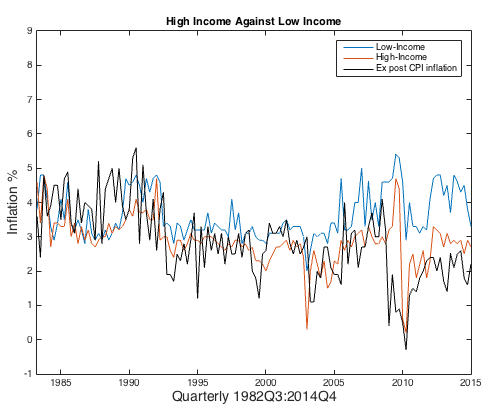

Let’s take different education and income subgroups, using the Michigan Survey one more time, and lets take the median inflation expectation at each quarter for each subgroup. I choose the median over mean expectations because, this measure is more robust against outliers in the data, and the differences between income and education subgroups are more stark when I use the mean. Finally lets compare each subgroup against one another and see how well they do in comparison at predicting the median-CPI in our experiment. (Reason for this specific inflation measure is explained on last week’s blog). I also use the same Diebold-Mariano test used on my previous post, to test for statistical significance of predictive superiority amongst subgroups. The time period I analyze is 1982-2014, because 1981Q3 is when the SPF began.

Here is a graph comparing graduate level education vs less than high school, and the top 25% income group against the bottom 25%. What we see is that higher education and income tend to move more closely with the Median-CPI. One thing to note is that inflation expectations for low education and income groups are higher than their counterparts on average for most of the time period analyzed (1982-2014), which provides further intuition that lower educated and poorer consumers not only fail to predict the inflation better than their counter parts, but constantly over predict the rate.

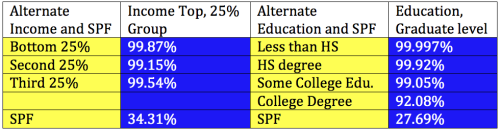

So let’s look at the results! Below I report values for income, as the probability that the highest income group performs better than the alternative income groups. Likewise for education, I display the probability that those with graduate level education do better than their counterparts. Finally we put the highest education and income groups against the SPF, and settle the forecasting battle once and for all. In all of the following results, we should interpret them as probabilities in repeated trials.

The above table demonstrates that survey participants grouped in the top 25% bracket, consistently beat their counterparts with about 99% probability. However when the predictions of the top income group were tested against those from the SPF, there was only a 34.31% probability that the high income group would predict better. Similarly, there is large evidence that the group with graduate school education beats every other education group’s predictions with a 99% probability, except for those with a college Bachelor’s degree, but still beating them with a 92.08% probability. The high education group also lost miserably to the SPF, with a probably of fairing better than the SPF of 27.69%. We get very similar, statistically significant results, when we compare the alternative income groups against a lower levels of income and education against the lowest income and education levels. From this we gain two conclusions:

- As income and education increase, predictive ability for inflation increases unambiguously.

- There is no subgroup from the Michigan survey that can predict the inflation better than the SPF.

One final note: I find out conclusively that the SPF can do better than all income groups, although the top 25% group comes closest to the SPF. This result would satisfy the claim in the beginning of the post that those with higher incomes may have a higher predisposition to know the inflation rate because they would be more likely to have an investment portfolio, and it is only those in the top 25% income bracket are able to make predictions somewhat as close to the SPF’s. This claim would be consistent with the fact that about half of Americans hold any assets, hence only individuals in the highest income groups would have any interest in the inflation rate.